Trust Revocable Agreement For Dummies

Description

How to fill out Florida Living Trust For Husband And Wife With No Children?

Working with legal paperwork and operations could be a time-consuming addition to your entire day. Trust Revocable Agreement For Dummies and forms like it typically require you to search for them and navigate how you can complete them correctly. As a result, whether you are taking care of economic, legal, or individual matters, using a extensive and hassle-free web library of forms on hand will significantly help.

US Legal Forms is the best web platform of legal templates, boasting more than 85,000 state-specific forms and numerous tools to assist you to complete your paperwork quickly. Discover the library of appropriate papers available to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered at any moment for downloading. Protect your papers managing operations with a top-notch services that allows you to prepare any form within minutes with no additional or hidden cost. Simply log in to the profile, find Trust Revocable Agreement For Dummies and acquire it right away from the My Forms tab. You can also access formerly downloaded forms.

Could it be your first time using US Legal Forms? Register and set up up a free account in a few minutes and you will get access to the form library and Trust Revocable Agreement For Dummies. Then, adhere to the steps below to complete your form:

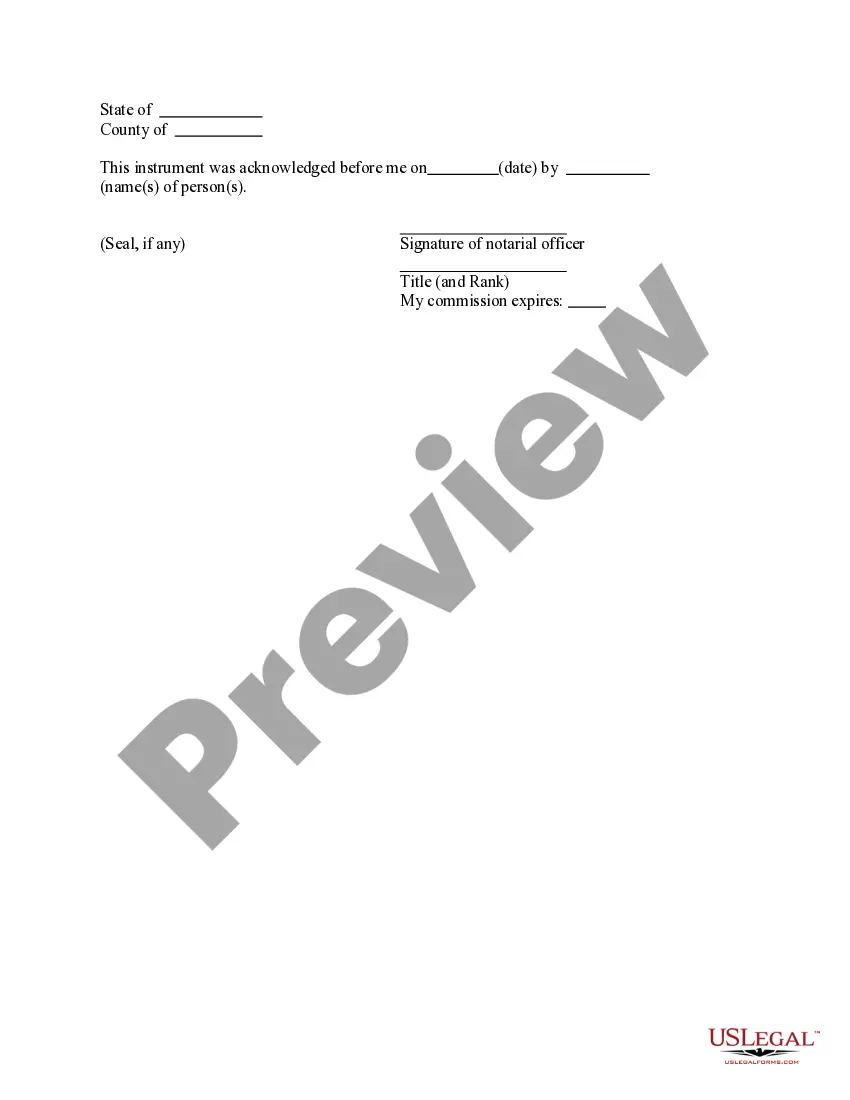

- Make sure you have discovered the proper form by using the Review feature and looking at the form description.

- Select Buy Now once ready, and select the monthly subscription plan that suits you.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of experience helping consumers manage their legal paperwork. Get the form you want today and enhance any operation without breaking a sweat.

Form popularity

FAQ

However, revocable living trusts can be expensive, don't have direct tax benefits, and don't protect against creditors. Carefully weigh these pros and cons against your situation before deciding to set up a revocable living trust. A financial advisor can help you create an estate plan for your family's needs and goals.

How do trusts work? A trust is a fiduciary1 relationship in which one party (the Grantor) gives a second party2 (the Trustee) the right to hold title to property or assets for the benefit of a third party (the Beneficiary). The trustee, in turn, explains the terms and conditions of the trust to the beneficiary.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

A revocable trust is a trust whereby provisions can be altered or canceled depending on the wishes of the grantor or the originator of the trust. During the life of the trust, income earned is distributed to the grantor, and only after death does property transfer to the beneficiaries of the trust.