Trust Revocable Agreement For Child

Description

How to fill out Florida Living Trust For Husband And Wife With No Children?

Dealing with legal papers and procedures might be a time-consuming addition to the day. Trust Revocable Agreement For Child and forms like it typically require you to search for them and understand how to complete them appropriately. Consequently, regardless if you are taking care of financial, legal, or personal matters, using a thorough and practical online library of forms on hand will significantly help.

US Legal Forms is the best online platform of legal templates, featuring more than 85,000 state-specific forms and a variety of tools to help you complete your papers effortlessly. Discover the library of appropriate papers available with just one click.

US Legal Forms gives you state- and county-specific forms offered at any time for downloading. Shield your papers administration processes with a high quality support that allows you to make any form within a few minutes with no extra or hidden fees. Simply log in to your profile, locate Trust Revocable Agreement For Child and acquire it right away from the My Forms tab. You may also gain access to previously saved forms.

Is it the first time making use of US Legal Forms? Sign up and set up up a free account in a few minutes and you’ll have access to the form library and Trust Revocable Agreement For Child. Then, adhere to the steps below to complete your form:

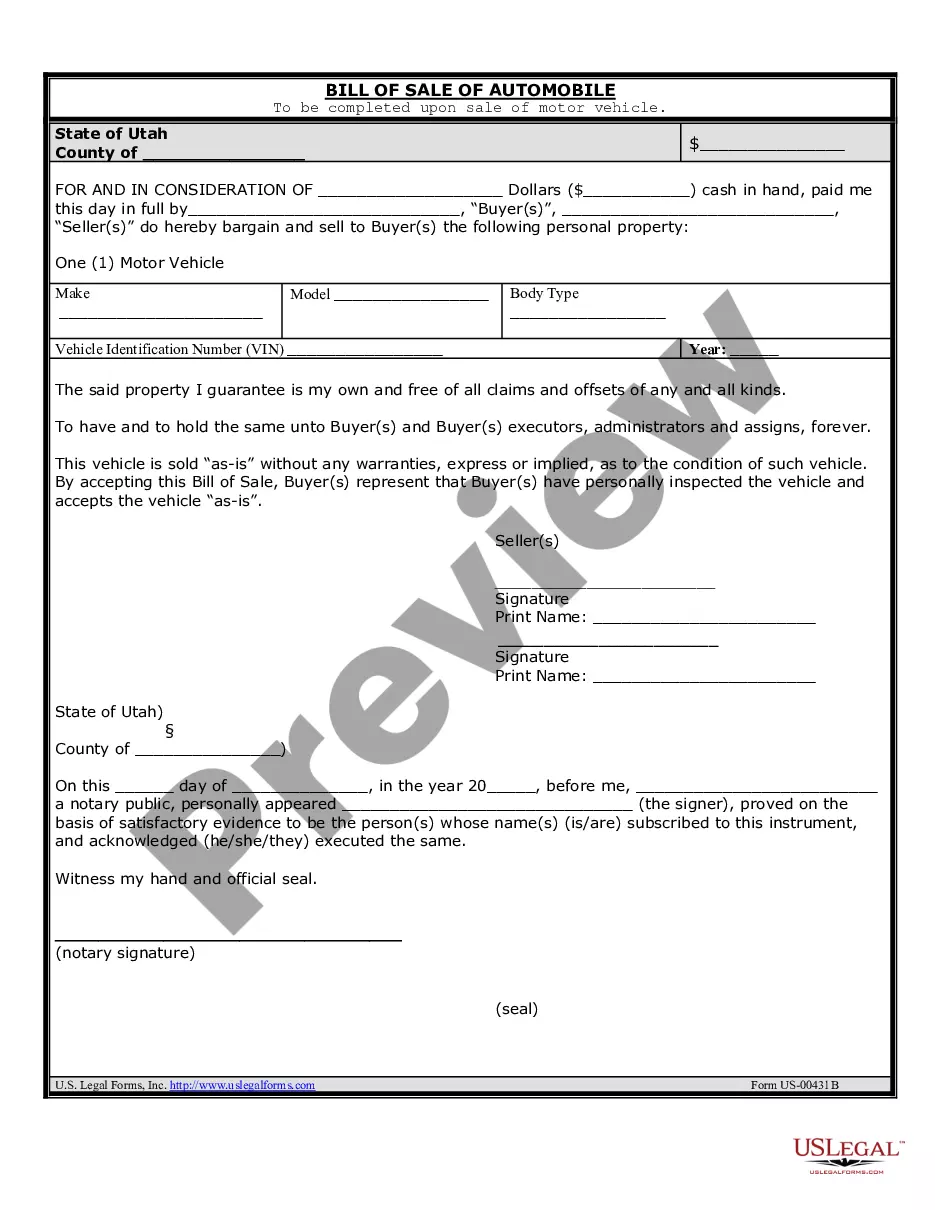

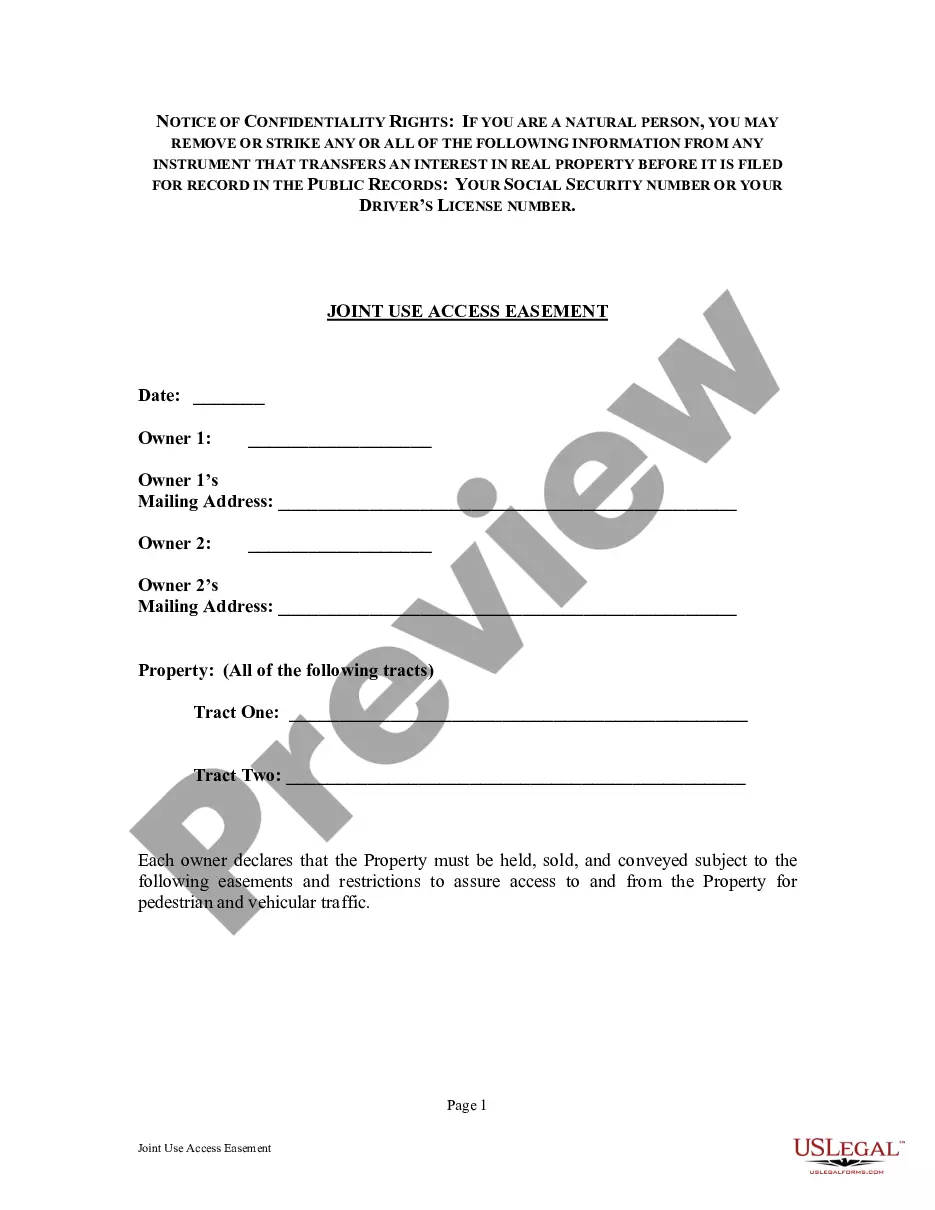

- Ensure you have the proper form using the Review option and reading the form description.

- Choose Buy Now once ready, and select the monthly subscription plan that fits your needs.

- Select Download then complete, eSign, and print the form.

US Legal Forms has 25 years of experience supporting users handle their legal papers. Discover the form you need right now and streamline any operation without breaking a sweat.

Form popularity

FAQ

Most trusts are named after the Trust Creators and also include the date the trust was created. Examples are ?John and Jane Smith Revocable Trust dated 1/1/20?; or ?Smith Family Trust dated 1/1/20?; or ?John W. Smith and Jane A. Smith Revocable Family Trust dated 1/1/20?.

Consider a lifetime trust. The trustee would have discretion to distribute money, but the child would never have a right to demand chunks of cash. This is the best approach if you are concerned that a child has creditors or may divorce in the future.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

However, revocable living trusts can be expensive, don't have direct tax benefits, and don't protect against creditors. Carefully weigh these pros and cons against your situation before deciding to set up a revocable living trust. A financial advisor can help you create an estate plan for your family's needs and goals.