Real Estate Closing Statement Template With Example

Description

How to fill out Florida Closing Statement?

Legal paperwork administration can be intimidating, even for the most seasoned experts.

If you're looking for a Real Estate Closing Statement Template With Example but lack the time to search for the correct and updated version, the task can be overwhelming.

US Legal Forms caters to all your needs, from personal to business documents, all in one convenient location.

Utilize advanced tools to complete and manage your Real Estate Closing Statement Template With Example.

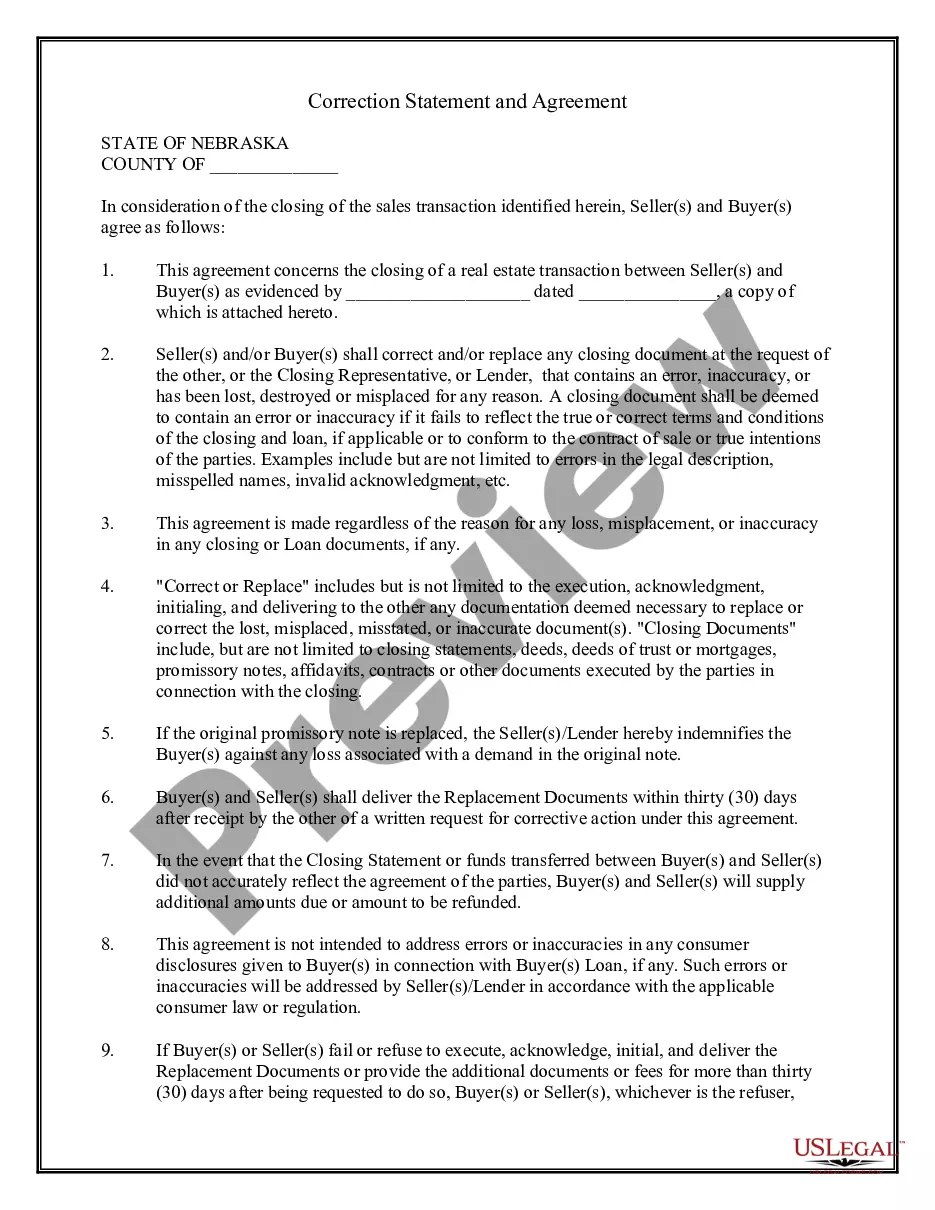

After downloading the desired form, follow these steps to proceed: Confirm that this is the correct form by previewing and reviewing its details.

- Access a library of articles, guides, and handbooks relevant to your circumstances and needs.

- Save time and effort searching for the documents you require, and use US Legal Forms' enhanced search and Preview tool to locate and obtain the Real Estate Closing Statement Template With Example.

- If you have a subscription, Log In to your US Legal Forms account, search for the required form, and obtain it.

- Check the My documents tab to review the documents you've previously downloaded and organize your folders as needed.

- For first-time users of US Legal Forms, create an account to enjoy unrestricted access to all platform features.

- A comprehensive online form repository can revolutionize the way you manage these matters.

- US Legal Forms is a prominent provider in the online legal forms sector, boasting over 85,000 state-specific legal forms available at any time.

- With US Legal Forms, you can access various forms tailored to specific states or regions.

Form popularity

FAQ

To obtain a closing statement, you typically need to contact your real estate agent, mortgage lender, or title company involved in your transaction. They can provide you with the final document that outlines all financial details. Additionally, using a real estate closing statement template with example available on US Legal Forms can simplify the process, giving you a clear framework to understand what to expect. This can make obtaining your closing statement much more efficient.

Strong closing statements clearly outline all financial obligations and ensure transparency between parties involved in the transaction. They often include precise figures for closing costs, taxes, and any adjustments. By providing a clear picture of what each party owes, these statements help reduce confusion. You can refer to a real estate closing statement template with example available on US Legal Forms for guidance on crafting an effective statement.

The 3 day rule for closing refers to the requirement that lenders must provide borrowers with a closing disclosure at least three business days before the closing date. This ensures that borrowers have ample time to review the terms and costs associated with their mortgage. Understanding this rule is essential for buyers, as it helps them avoid any last-minute surprises. For a smoother experience, consider using a real estate closing statement template with example from US Legal Forms.

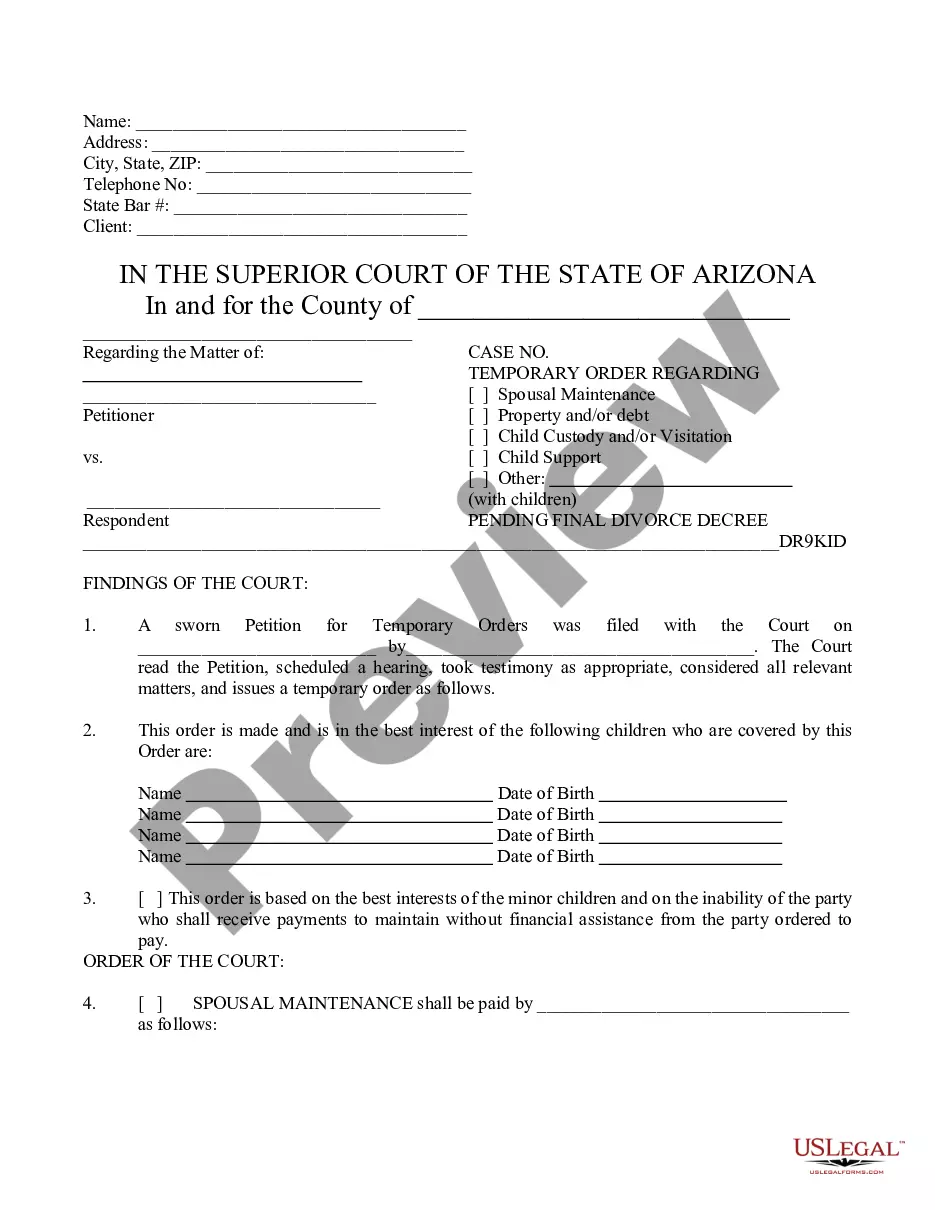

As the home buyer your must provide the following documents: Agreement of Purchase and Sale. Property Insurance. Title (how will the title be taken) Home Inspection report. Name of Mortgage lender. Personal information (identification and date of birth) Closing funds.

The closing statement includes information related to the cost of buying or selling a home. The form can also include details of the property itself. What's included on your closing statement can depend on whether you're the buyer or the seller. Property details.

The closing statement is the attorney's final statement to the jury before deliberation begins. The attorney reiterates the important arguments, summarizes what the evidence has and has not shown, and requests jury to consider the evidence and apply the law in his or her client's favor.

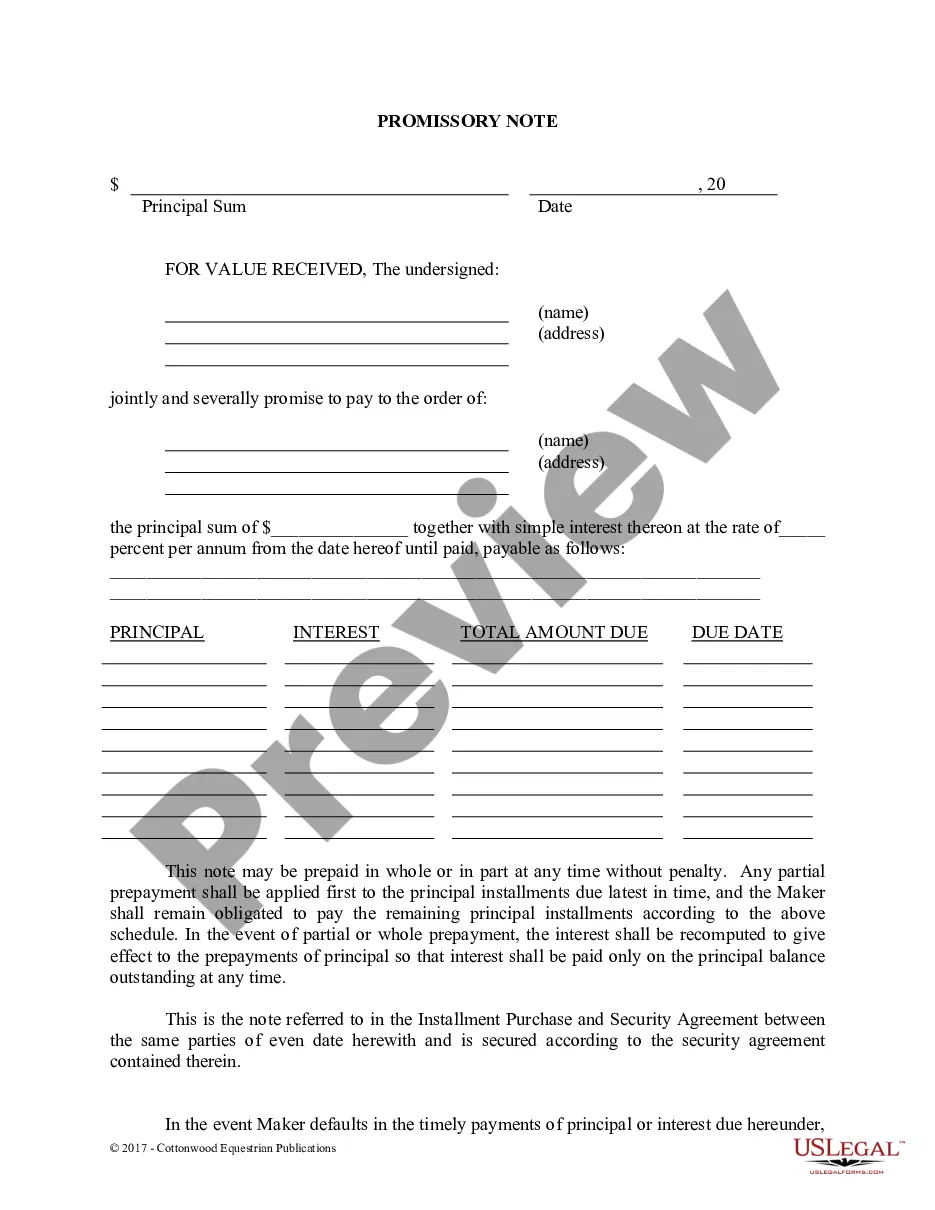

The closing statement typically lists fees in two columns, one detailing the buyer's expenses and one detailing the seller's expenses. The amount of cash the buyer must give the seller has its own entry at the bottom of the document.

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).