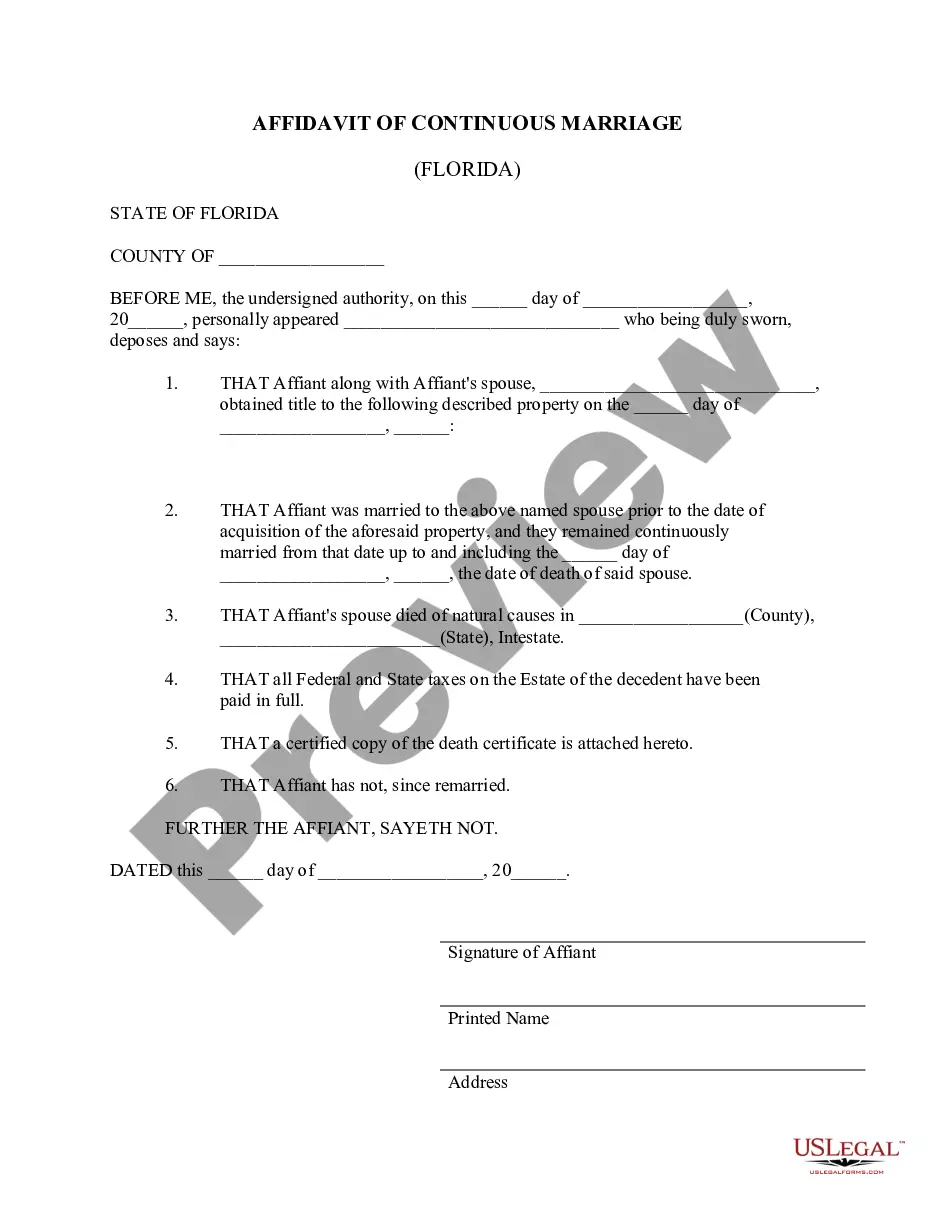

This form is an Affidavit of Continuous Marriage for use when acting to remove deceased spouse form land title. This deed complies with all state statutory laws.

Affidavit Of Continuous Marriage Florida Withholding Tax

Description

How to fill out Florida Affidavit Of Continuous Marriage - Deceased Spouse?

Individuals frequently link legal documents with something intricate that only an expert can manage.

In a certain way, it's accurate, as formulating the Affidavit Of Continuous Marriage Florida Withholding Tax requires a comprehensive grasp of subject standards, encompassing state and local laws.

However, with US Legal Forms, the process has become more straightforward: an extensive collection of ready-to-use legal documents pertinent to state laws is gathered in a single online directory and is accessible to all.

Make the payment for your subscription through PayPal or a credit card. Choose the file format you prefer and click Download. You can print your document or upload it to an online editor for quicker completion. Each template in our collection is reusable: once purchased, they remain stored in your profile for easy access whenever necessary via the My documents tab. Explore the numerous advantages of utilizing the US Legal Forms platform. Register today!

- US Legal Forms offers over 85k updated forms categorized by state and area of application, enabling you to search for the Affidavit Of Continuous Marriage Florida Withholding Tax or any other specific template in mere minutes.

- Existing users with an active subscription should Log In to their accounts and select Download to obtain the form.

- New users to the site must initially create an account and subscribe before downloading any documents.

- To retrieve the Affidavit Of Continuous Marriage Florida Withholding Tax, follow these instructions.

- Examine the content on the page carefully to ensure it meets your requirements.

- Review the form description or inspect it using the Preview feature.

- If the prior sample does not meet your criteria, search for another using the Search bar above.

- Once you locate the appropriate Affidavit Of Continuous Marriage Florida Withholding Tax, click Buy Now.

- Select the subscription plan that aligns with your preferences and financial considerations.

- Create an account or sign in to advance to the payment screen.

Form popularity

FAQ

A: A Continuous Marriage Affidavit (a/k/a CMA) is an affidavit that states that the property was acquired by the owners during their marriage (as tenants by the entirety) and the owners remained married (continuously) through the date of sale or the passing (date of death) of one of the spouses.

Mandatory disclosure requires each party in a family matter to provide the other party with certain financial information and documents. These documents must be served on the other party within 45 days of service of the initial petition or supplemental petition for modification on the respondent.

Form DR-312 should be filed with the clerk of the court and duly recorded in the public records of the county or counties where the decedent owned property. If you have any questions, or need assistance, call Taxpayer Services at 850-488-6800, Monday through Friday, excluding holidays.

In the state of Florida, there is actually a Mandatory Disclosure Rule. This rule requires that both parties in a family law case provide specific and certain documentation to the other party. This is so each are fully informed about the financial situation or circumstances of the opposing party.

Under Florida Statutes Section 732.102, if a person dies without a valid will (intestate), the surviving spouse is entitled to receive: 1. the entire probate estate if: a. the decedent has no descendants or b. all descendants are also descendants of the surviving spouse; 2.