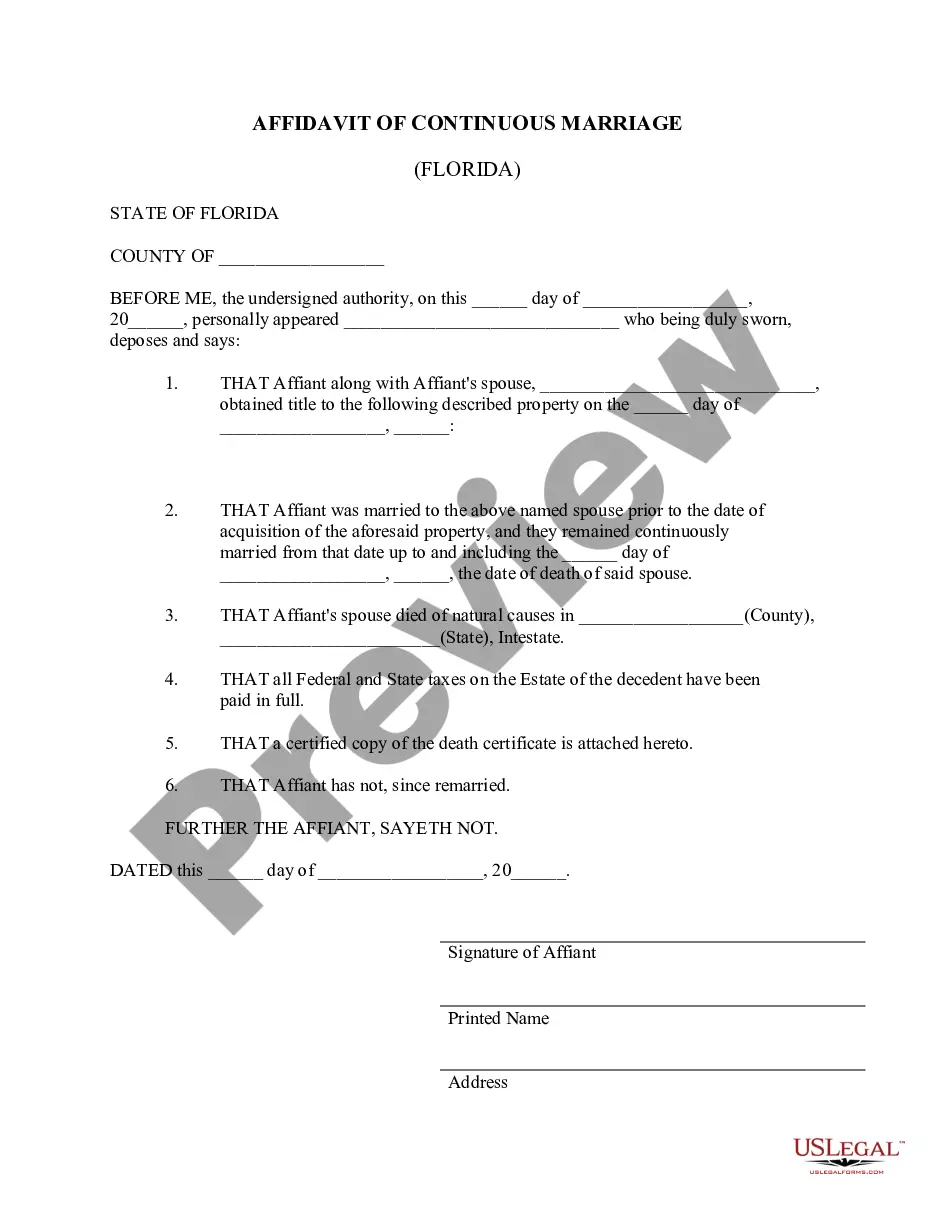

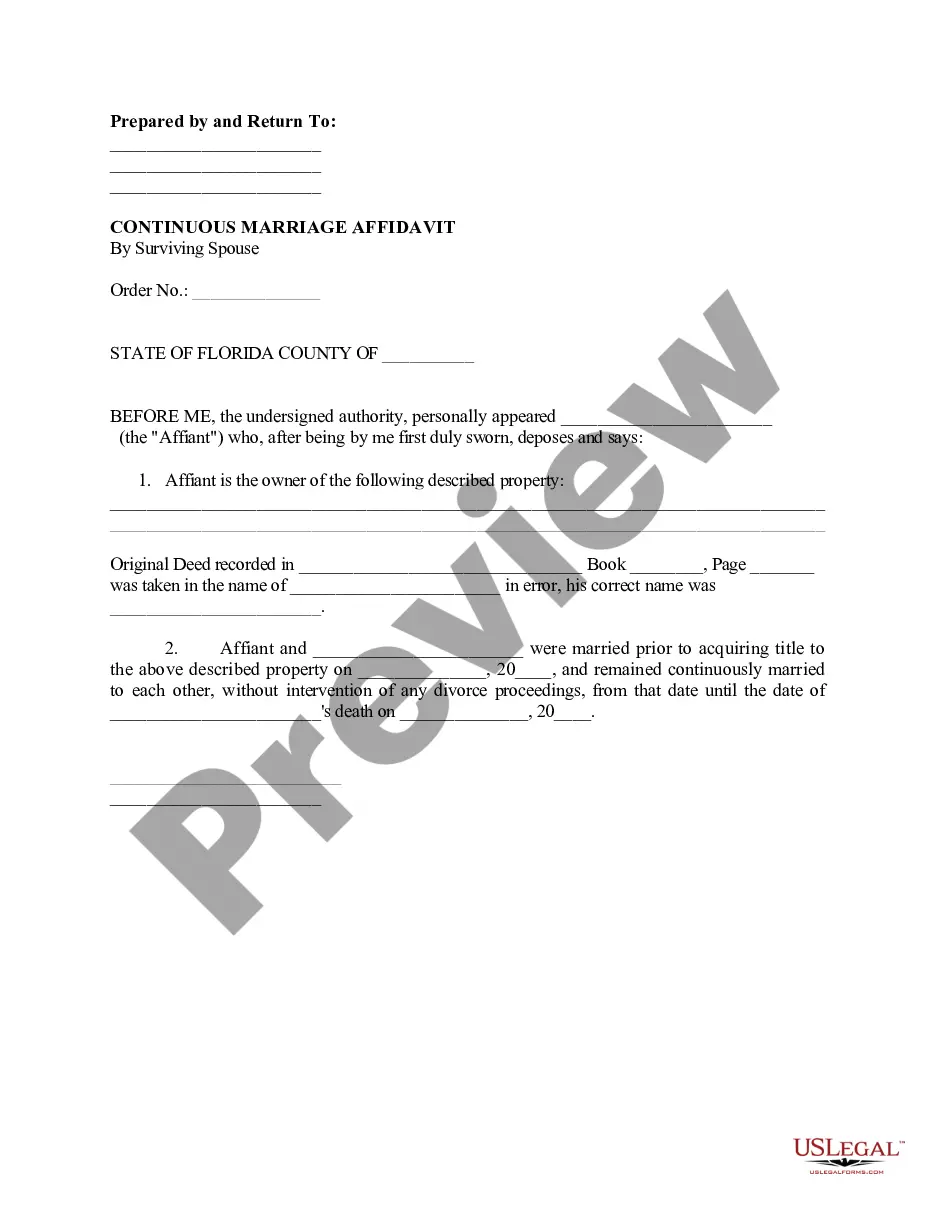

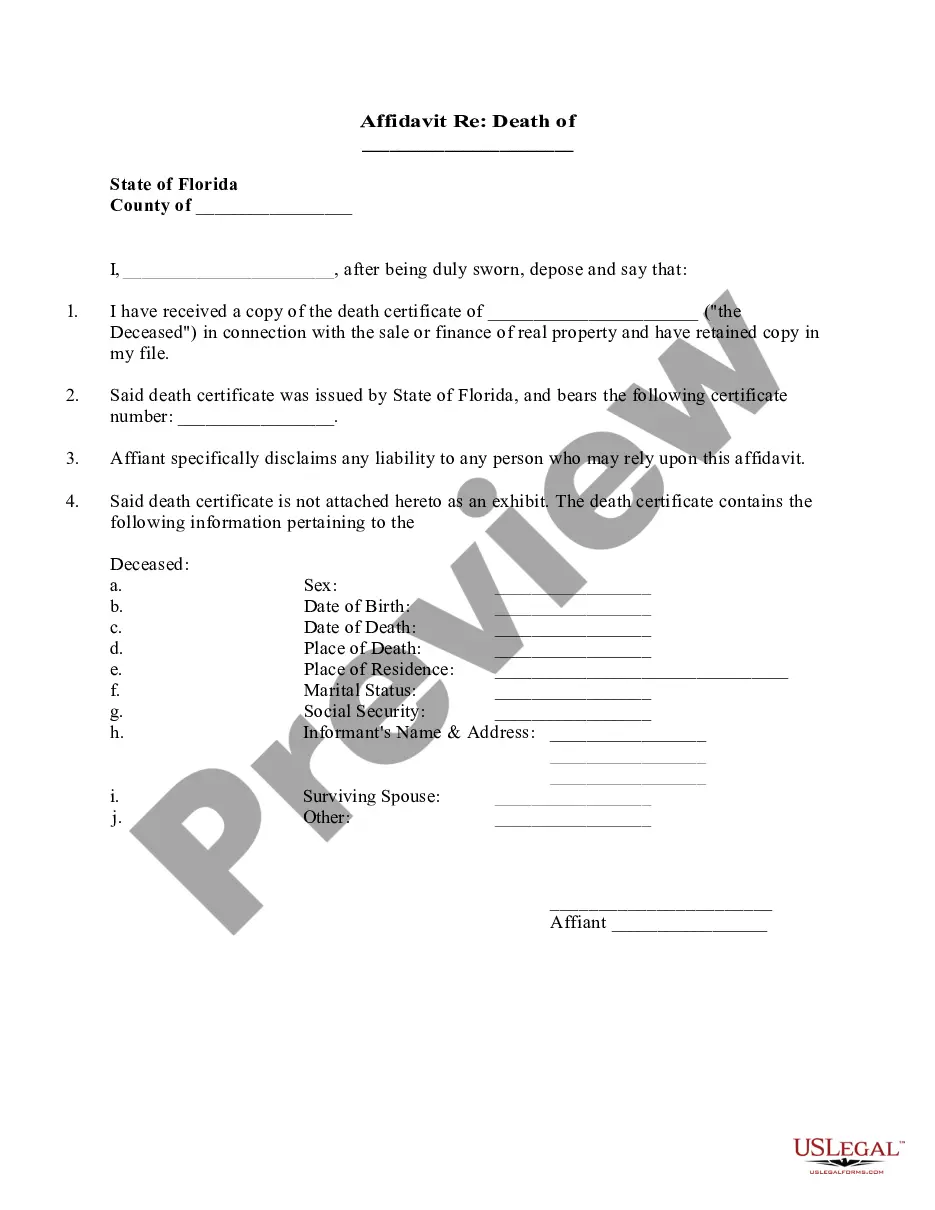

Affidavit Of Continuous Marriage Florida Form With No Will

Description

How to fill out Florida Affidavit Of Continuous Marriage - Deceased Spouse?

Regardless of whether it is for professional reasons or personal affairs, every individual must confront legal circumstances at some point in their lives.

Completing legal documents requires meticulous attention, starting with selecting the appropriate form template.

Once downloaded, you can complete the form using editing software or print it out to fill it in by hand. With a comprehensive US Legal Forms catalog available, there's no need to waste time searching for the right template online. Use the library's simple navigation to find the correct template for any situation.

- For instance, if you choose an incorrect version of an Affidavit Of Continuous Marriage Florida Form With No Will, it will be rejected once submitted.

- Thus, it is vital to have a reliable source of legal documents like US Legal Forms.

- If you need to obtain an Affidavit Of Continuous Marriage Florida Form With No Will template, adhere to these straightforward steps.

- Utilize the search bar or browse the catalog to locate the necessary template.

- Review the form’s details to confirm it aligns with your circumstances, jurisdiction, and area.

- Click on the form’s preview to examine it.

- If it is not the correct form, return to the search tool to find the Affidavit Of Continuous Marriage Florida Form With No Will template you require.

- Acquire the template if it fulfills your criteria.

- If you possess a US Legal Forms account, simply click Log in to access templates you have saved in My documents.

- If you do not have an account, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your payment method: credit card or PayPal.

- Select the document format you prefer and download the Affidavit Of Continuous Marriage Florida Form With No Will.

Form popularity

FAQ

The notice instructs the garnishee to withhold up to 25 percent of your take home wages. In addition, for garnishments on non-tax debt collected by OAA, a minimum wage exemption applies. This means that you must make over a certain amount before the garnishee can withhold and send payments to OAA.

Can my bank account or salary be garnished without a court proceeding? Usually not. In most cases a creditor must win a judgment against you and get a court order before it can garnish your wages, in ance with state and federal law.

Basically, all retirement income, social security, disiability income, etc. is exempt. Check out the complete list here. But if your income is not exempt, then to put a stop to a wage garnishment, you must contact the debt collector and/or attorney for the debt collector and arrange a STIPULATED AGREEMENT.

Filling Out the Garnishment Forms The form should be typed or neatly printed in ink. Fill in the case caption (plaintiff, defendant, and case number) on all the forms. Indicate who the garnishment is being served on. ... The date of judgment must be filled in, and can be found on your notice of entry of judgment.

In other words, if you owe money to a person or company, they can obtain a court order directing your bank/credit union to take money out of your account to pay off your debt. If this happens, you cannot use that money in your account.

Bank accounts solely for government benefits Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans' benefits.

Limits on Wage Garnishment in Oregon Oregon law protects (exempts) the greater of 75% of your disposable earnings or (effective through December 31, 2021): $254 per week. $509 per two-week period. $545 per half-month period, and.

Wage Garnishment in Oregon? To garnish your wages in Oregon, the debt collector has to have a judgment. They can then send a writ of garnishment to your employer. Your payroll department has to fill out paperwork to tell them how often you get paid and the date of your next pay day.

There are five states that prohibit bank account garnishment when the bank account contains only a small amount of money: South Carolina, Maryland, North Dakota, New York, and New Hampshire. In addition, North Carolina, South Carolina, Pennsylvania, and Texas all prohibit wage garnishments for consumer debts.

Under Oregon Garnishment Laws, the amount they can take is usually limited to 25% of your net pay. We handle situations like this every day. They can't take your entire paycheck and they may have to give back some of the money they took from your account.