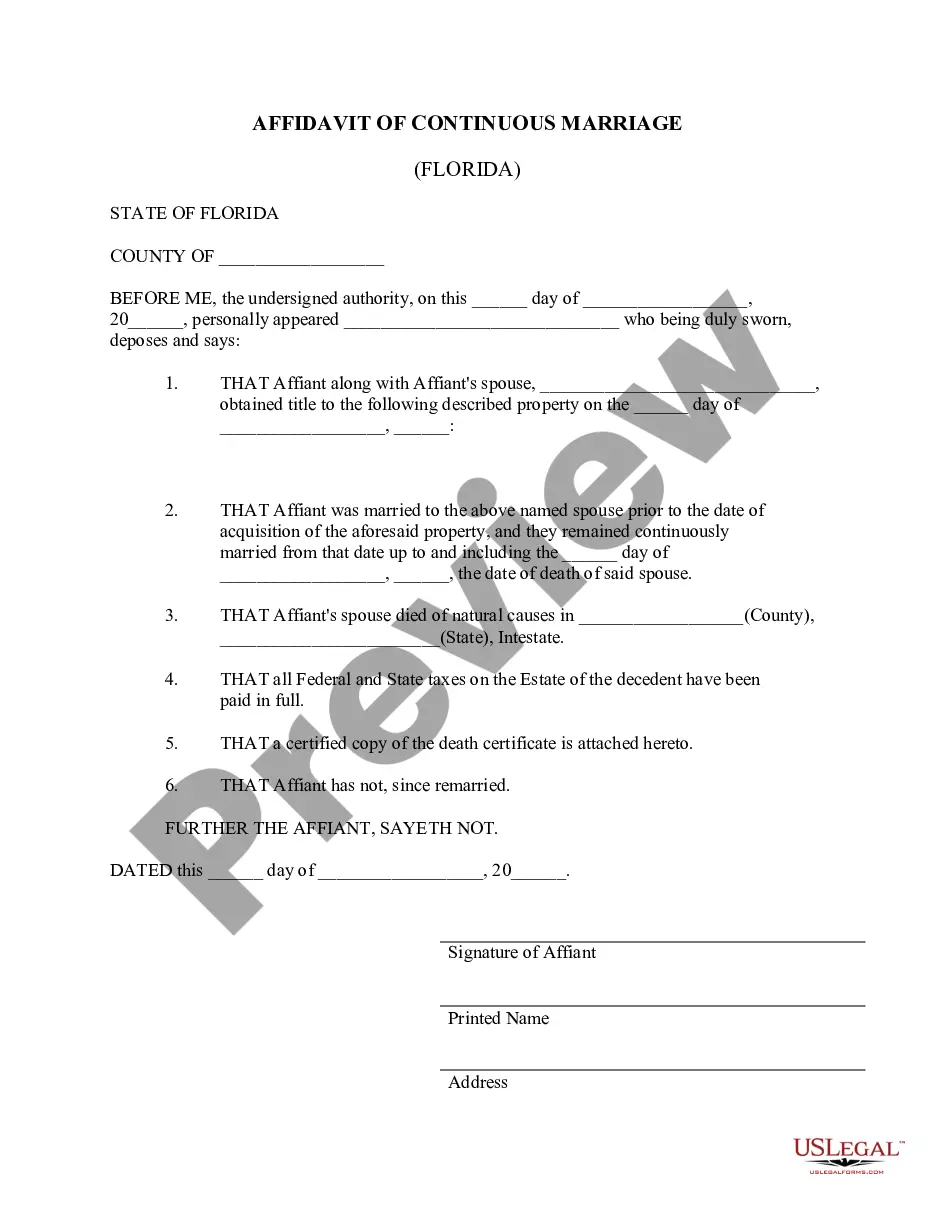

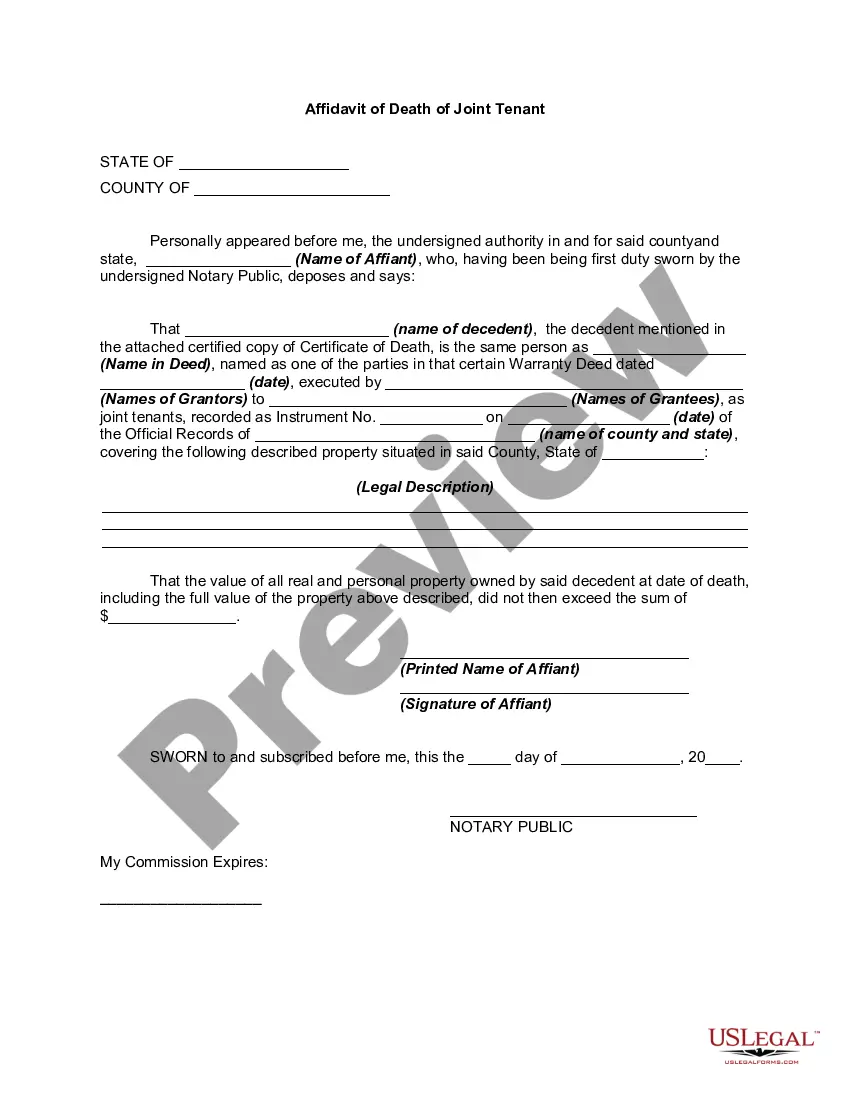

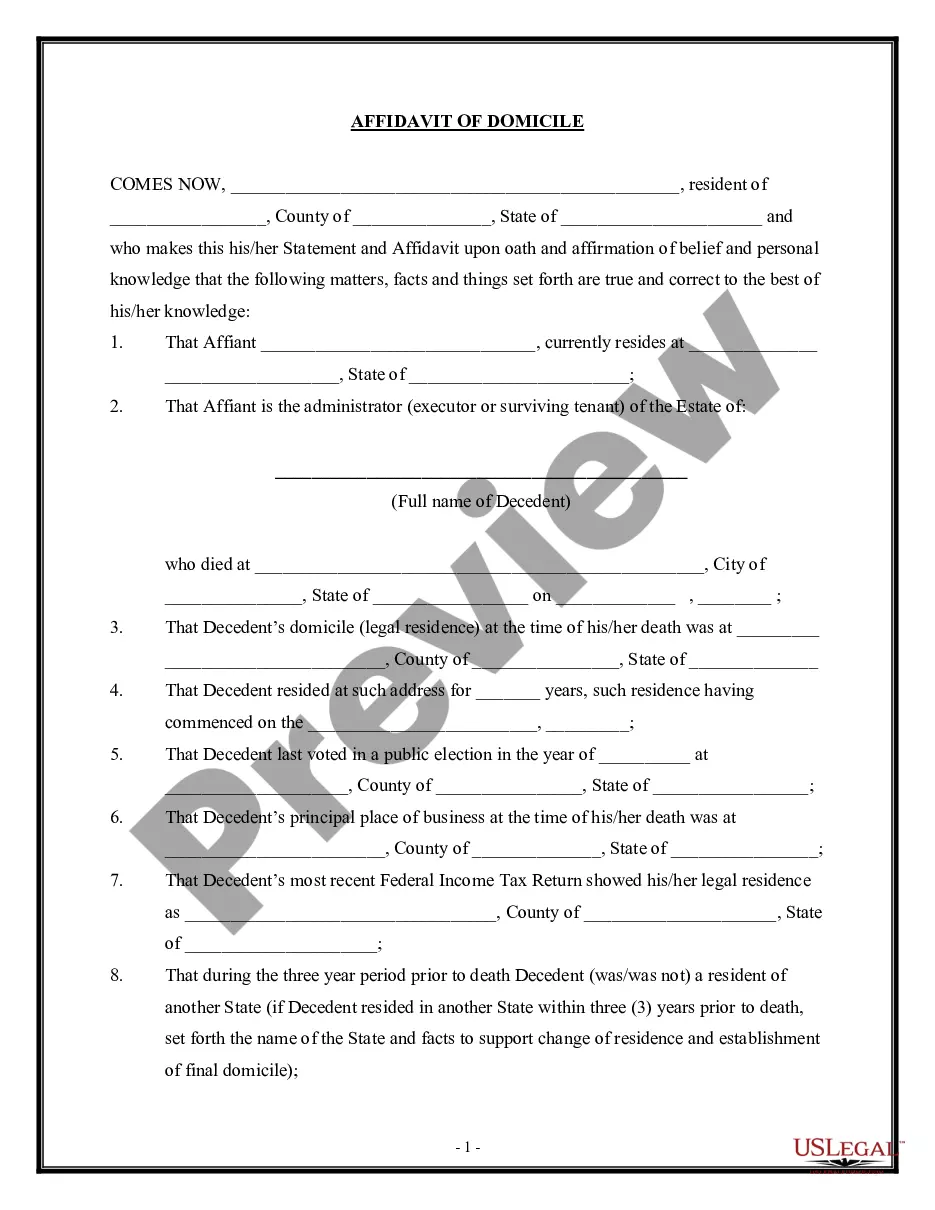

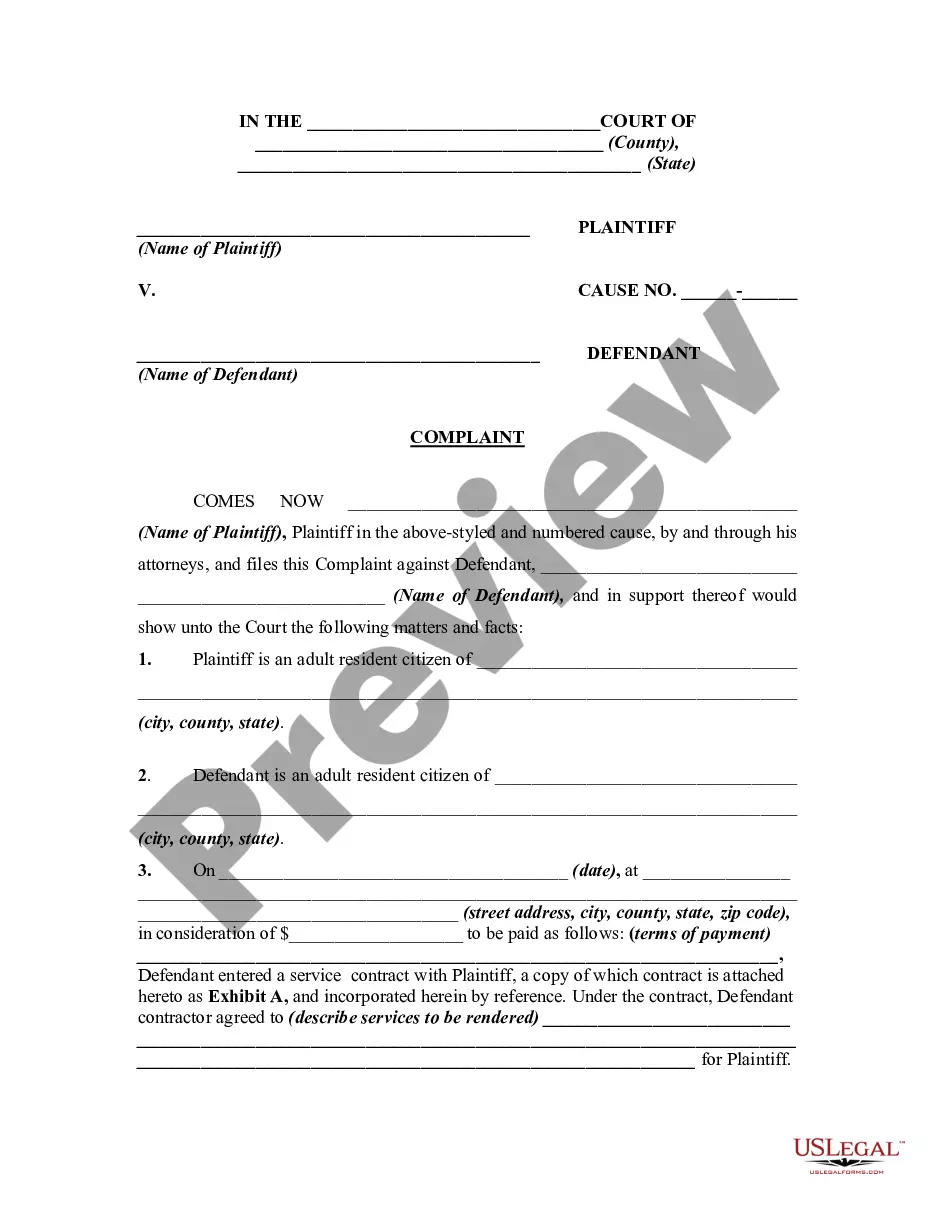

This form is an Affidavit of Continuous Marriage for use when acting to remove deceased spouse form land title. This deed complies with all state statutory laws.

Affidavit Of Continuous Marriage Florida Form For Deceased

Description

How to fill out Florida Affidavit Of Continuous Marriage - Deceased Spouse?

Whether for commercial reasons or for individual issues, everyone inevitably encounters legal circumstances at some point in life.

Completing legal documents demands meticulous attention, starting from selecting the correct form template.

With a comprehensive US Legal Forms collection available, you do not need to waste time searching for the correct template online. Take advantage of the directory’s straightforward navigation to find the suitable form for any situation.

- Acquire the template you need by using the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your case, jurisdiction, and location.

- Select the form’s preview to examine it.

- If it is the incorrect document, return to the search feature to locate the Affidavit Of Continuous Marriage Florida Form For Deceased template you require.

- Download the file when it fits your specifications.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you may purchase the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the file format you desire and download the Affidavit Of Continuous Marriage Florida Form For Deceased.

- Once downloaded, you can complete the form using editing software or print it out to finish it manually.

Form popularity

FAQ

A company that fails to file an annual report will be administratively dissolved or revoked. To reinstate, an administratively dissolved company must file ALL overdue annual reports as well as an Application for Reinstatement, which carries a $100 fee.

Purpose of Schedule OR-21 An upper-tier PTE that is a member of an electing PTE will also use Form OR-21 to pass its share of the lower-tier entity's distributive proceeds, addition, and tax credit through to the upper-tier PTE's individual owners. Form OR-21 is filed on a calendar-year basis only.

Generally, single-member LLCs will be taxed as sole proprietorship. This means that you will report your company's profits on a Schedule C form and submit this form with your personal tax return. You will also need to pay self-employment taxes on your net income.

Download forms from the Oregon Department of Revenue website or request paper forms be mailed to you. Order forms by calling 1-800-356-4222. The IRS provides 1040 forms and instructions and schedules 1-3 for the library to distribute.

Penalties: No late fee. Your entity status becomes 'inactive' in public records. Your business can be dissolved or revoked at 45 days late.

How much does an LLC in Oregon cost per year? All Oregon LLCs need to pay $100 per year for the Oregon Annual Report fee. These state fees are paid to the Secretary of State. And this is the only state-required annual fee.

Oregon requires all corporations, LLCs, nonprofits, LPs, and LLPs to file an Oregon Annual Report each year.