Life Tenant In Will

Description

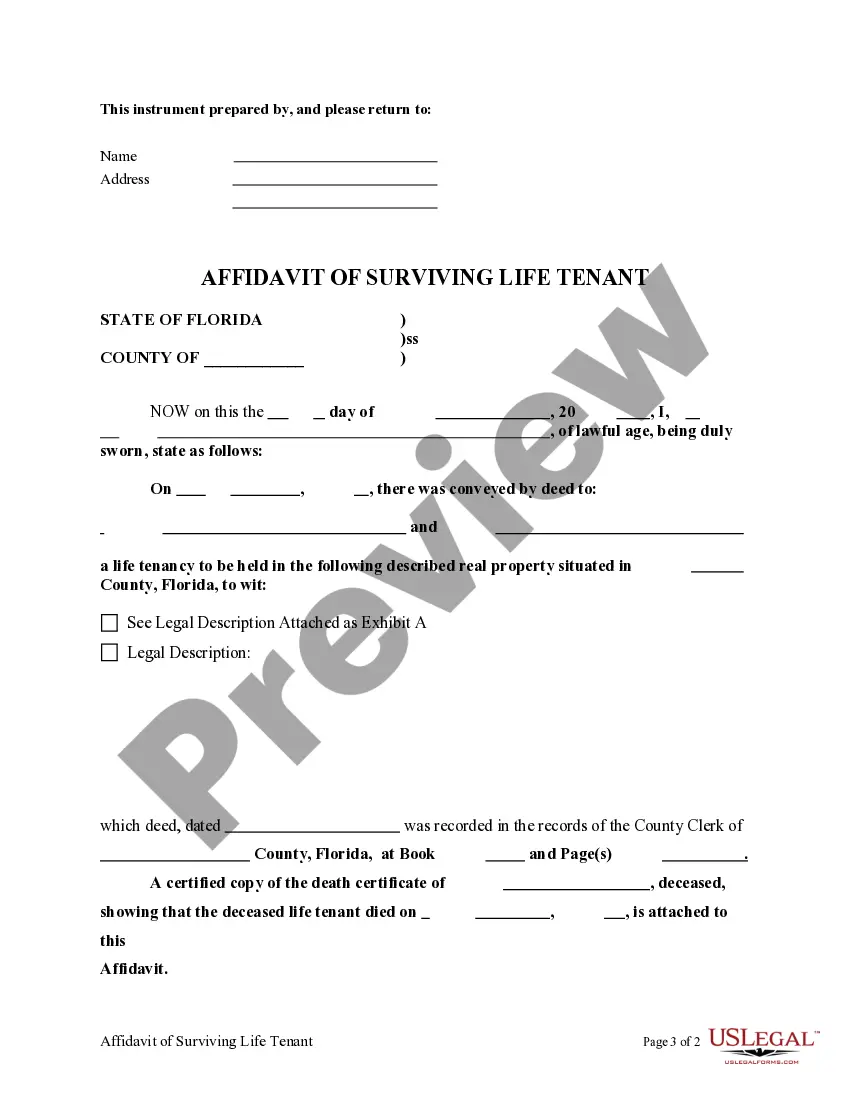

How to fill out Florida Affidavit Of Surviving Life Tenant?

Managing legal documents and procedures can be a lengthy addition to your daily routine.

Life Tenant In Will and similar forms often necessitate that you locate them and comprehend how to fill them out correctly.

For that reason, whether you're dealing with financial, legal, or personal affairs, having a comprehensive and user-friendly online directory of forms at your disposal will be immensely beneficial.

US Legal Forms is the leading online resource for legal templates, boasting over 85,000 state-specific forms and a variety of tools to help you complete your paperwork with ease.

Is this your first experience with US Legal Forms? Register and create an account in a few minutes, and you'll gain entry to the form catalog and Life Tenant In Will. Then, follow these steps to complete your form.

- Browse the collection of relevant documents available with a single click.

- US Legal Forms provides state- and county-specific forms accessible at any time for download.

- Safeguard your document management processes with premium support that enables you to create any form in just a few minutes without additional or concealed fees.

- Simply Log In to your account, find Life Tenant In Will and retrieve it right away from the My documents section.

- You can also view previously saved forms.

Form popularity

FAQ

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner. The Life Tenant Owner maintains the absolute and exclusive right to use the property during his or her lifetime. This can be a sole owner or joint Life Tenants.

Also called a ?tenant for life,? a life tenant is a person who has a beneficial interest in an estate or property that is limited in duration to their or another's lifespan.

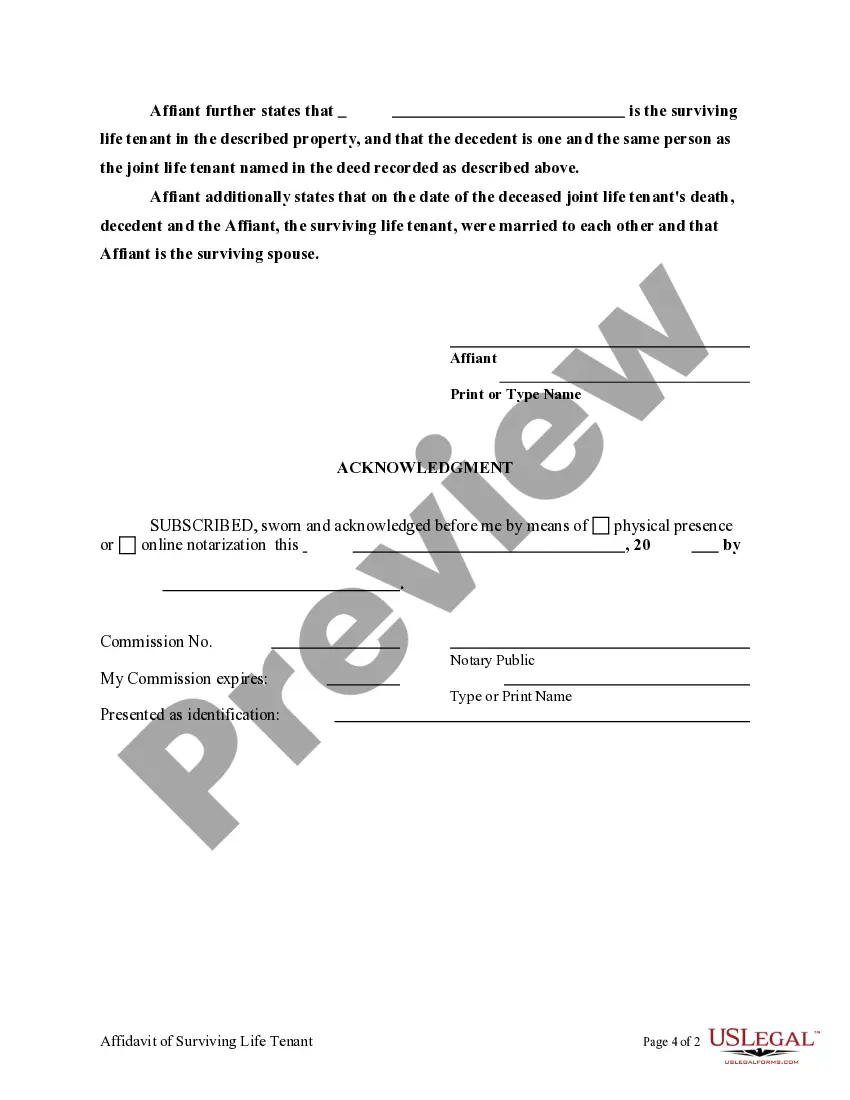

Upon the life tenant's death, the remaindermen receive what is known as a "stepped-up" basis in the property. This means the property's tax basis is its fair market value at the time of the life tenant's death, not the value at which the life tenant originally purchased the property.

When the life tenant dies, the remainderman typically receives a step-up tax basis in the property. This means the remainderman takes ownership of the home at its fair market value at the time of the life tenant's death. This can save the remainderman capital gains tax when the property is sold.