Payment For Outstanding Invoice

Description

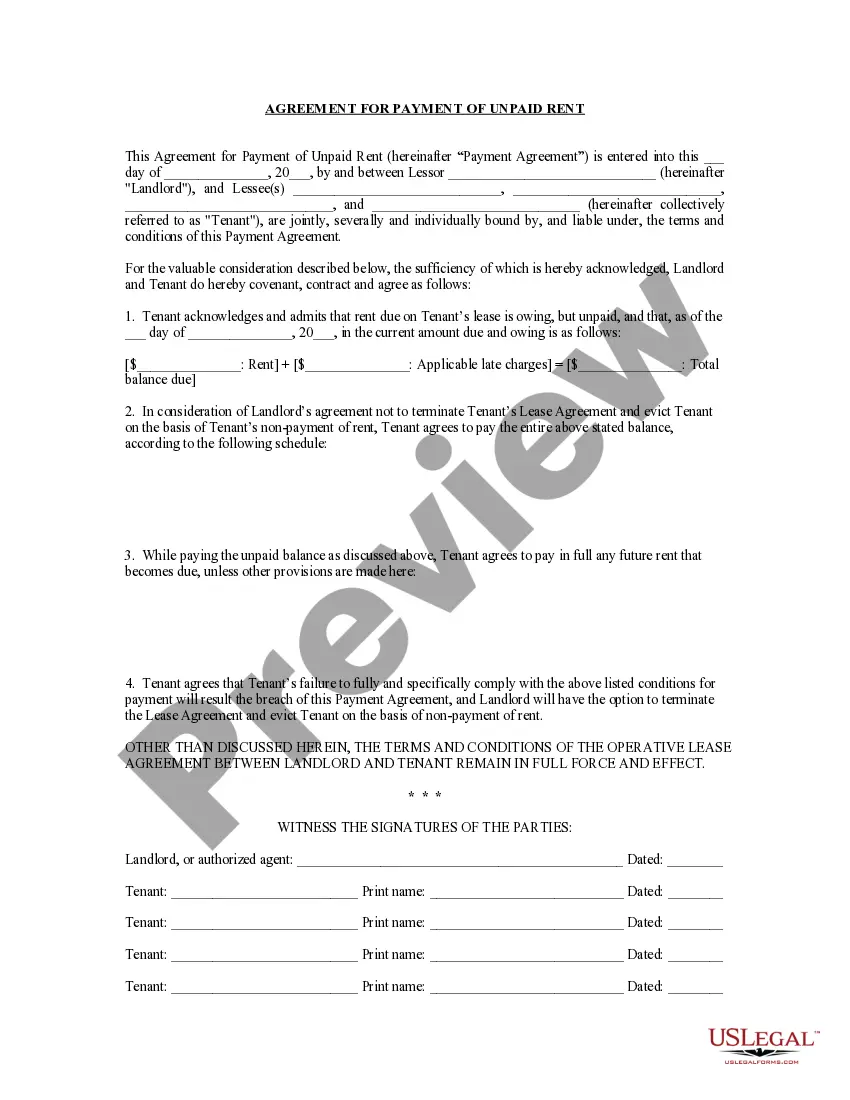

How to fill out Florida Agreement For Payment Of Unpaid Rent?

It’s no secret that you can’t become a law expert immediately, nor can you figure out how to quickly prepare Payment For Outstanding Invoice without having a specialized set of skills. Creating legal forms is a time-consuming venture requiring a particular education and skills. So why not leave the creation of the Payment For Outstanding Invoice to the professionals?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court documents to templates for internal corporate communication. We know how important compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the document you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Payment For Outstanding Invoice is what you’re looking for.

- Start your search over if you need a different template.

- Set up a free account and choose a subscription plan to purchase the template.

- Choose Buy now. As soon as the transaction is through, you can get the Payment For Outstanding Invoice, fill it out, print it, and send or mail it to the necessary individuals or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

The invoice was due on [due date], and payment is now overdue by [number of days overdue]. Be advised that late payment interest may be applied if we do not receive payment within 30 days. Let us know when we can expect to receive payment for the outstanding invoice.

When should you record an unpaid invoice as bad debt? You have to leave the invoice unpaid and create an expense under the category 'bad debt' if: The service has already been provided to the customer, or. The product has not been returned by the customer.

With cash-method accounting, revenue is counted only once it's been received. So, if you never receive payment, there is nothing to write off. With accrual-based accounting, revenue is counted once it's earned. Once it's been determined that that income won't be collected, it can be written off.

Recording an unpaid invoice as bad debt If you provide a product to a company and they simply don't pay, you shouldn't cancel the debt that's owed, but rather acknowledge this bad debt. Simply put, bad debt is any money that's lost by your business. It therefore counts as an expense.

Include the following details in your overdue invoice letter: Invoice number and date. Amount owing. Payment terms such as late fees. Reminders of previous letters. Instructions for payment (include links in emails) Your contact information.