Default On Lease Agreement With Guarantor

Description

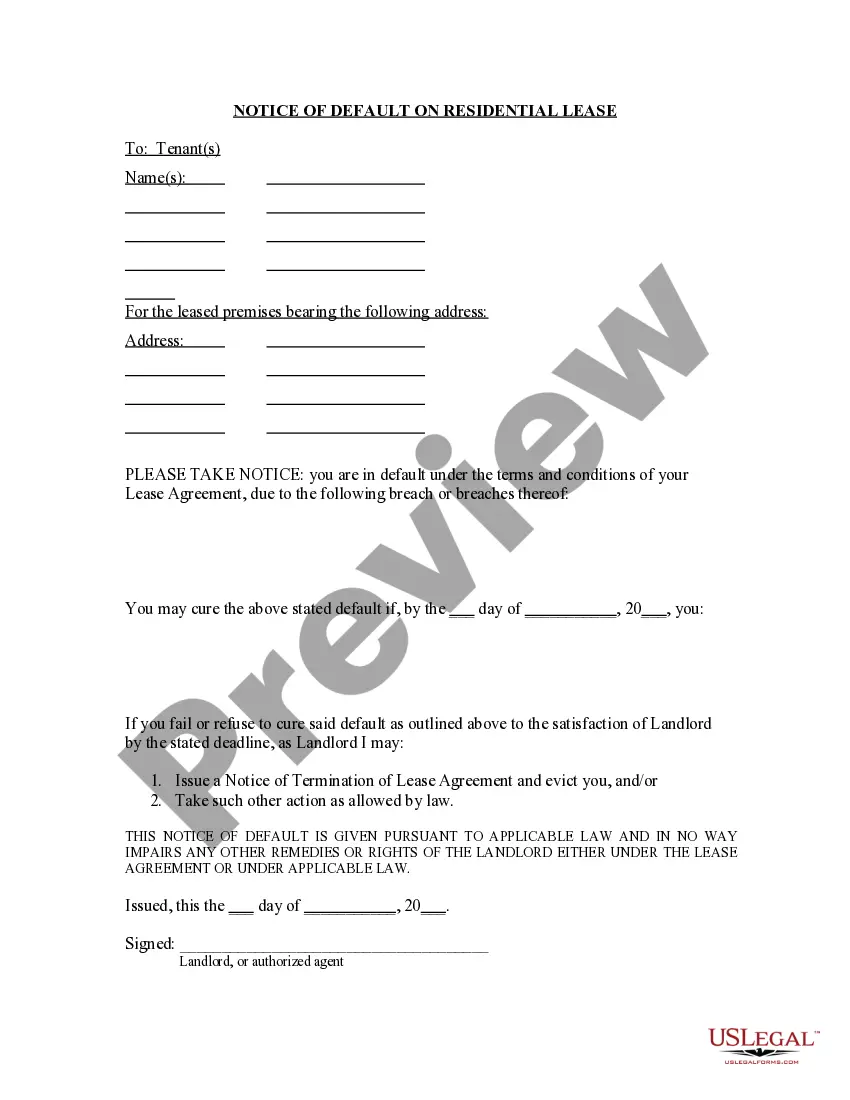

How to fill out Florida Notice Of Default On Residential Lease?

It’s no secret that you can’t become a legal professional immediately, nor can you learn how to quickly prepare Default On Lease Agreement With Guarantor without having a specialized background. Creating legal forms is a time-consuming venture requiring a certain education and skills. So why not leave the preparation of the Default On Lease Agreement With Guarantor to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court documents to templates for internal corporate communication. We know how important compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our platform and obtain the form you need in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Default On Lease Agreement With Guarantor is what you’re looking for.

- Start your search again if you need a different template.

- Register for a free account and select a subscription plan to purchase the template.

- Choose Buy now. Once the transaction is complete, you can download the Default On Lease Agreement With Guarantor, complete it, print it, and send or send it by post to the designated people or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms.

Being a guarantor itself typically doesn't show up on your credit record with credit reference agencies. However, there are other ways that being a guarantor might impact your report: You will be liable for making the loan repayments if the borrower is unable to do so, and this will appear on your credit report.

The act of becoming a guarantor doesn't, by itself, normally appear on your credit report. But there are ways being a guarantor could affect your report: If the borrower can't make their repayments, the responsibility for paying them will fall on you ? and this will form part of your credit record.

The usual way that a guaranty is enforced is through a written demand (although this is not usually required in most forms) followed by the filing of a law suit. If the guarantor has pledged collateral to secure the guaranty obligation, foreclosure proceedings against that will often be commenced.

Guarantors will need to provide information to a landlord or letting agency to ensure they can take on the responsibility of being a guarantor: Proof of identity, like a passport or UK driving licence. There will be credit checks that they need to pass.