Florida Rental Application With Cosigner

Description

How to fill out Florida Residential Rental Lease Application?

Managing legal matters can be exasperating, even for seasoned professionals.

When you're in search of a Florida Rental Application With Cosigner and lack the time to dedicate to locating the correct and current version, the process can become overwhelming.

With US Legal Forms, you can.

Access a valuable collection of articles, guides, and resources related to your situation and requirements.

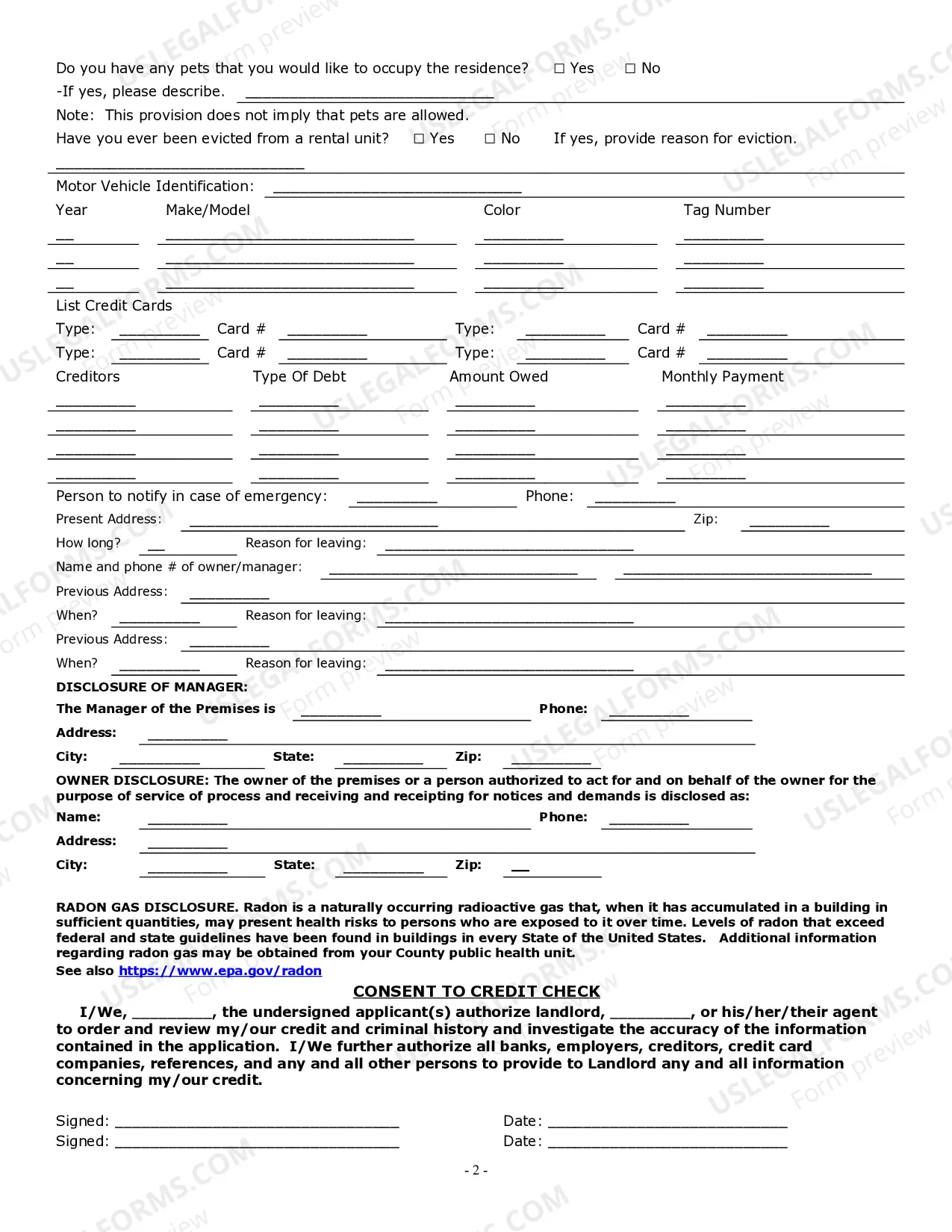

Confirm that this is the correct form by previewing it and reviewing its details.

- Save time and energy searching for the documents you need, and utilize US Legal Forms’ advanced search and Preview tool to locate and download the Florida Rental Application With Cosigner.

- If you're a member, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to review the documents you've previously downloaded and manage your folders as desired.

- If it’s your first experience with US Legal Forms, create an account to gain unlimited access to all the platform's features.

- Follow these steps after accessing the form you need.

- A comprehensive online form library can be a transformative resource for anyone looking to effectively handle these circumstances.

- US Legal Forms is a frontrunner in online legal documents, offering over 85,000 state-specific legal forms accessible at any time.

- Utilize sophisticated tools to fill out and manage your Florida Rental Application With Cosigner.

Form popularity

FAQ

Getting approved for an apartment with a co-signer can be easier than applying alone, especially if your co-signer has a strong credit history and stable income. Landlords often view a co-signer as added security, which can improve your chances of approval. However, remember that each landlord has different criteria, so it's wise to submit a complete and accurate Florida rental application with cosigner. This can help you present a strong case.

To include a co-signer on your Florida rental application with cosigner, you should first discuss it with your landlord or property management. They may have a specific section on the application for co-signers, or you might need to provide additional information separately. Make sure your co-signer understands their responsibilities, as they will be legally accountable for the lease. Using platforms like US Legal Forms can simplify this process by offering templates and guidance.

Yes, a cosigner must fill out a Florida rental application with cosigner. This application allows the landlord to evaluate the cosigner’s financial background and creditworthiness. Including the cosigner on the application ensures that all parties involved are clear about their responsibilities. Using platforms like USLegalForms can simplify this process, making it easier for you and your cosigner to complete the necessary documentation.

One of the most common examples of cosigning is a parent signing an apartment lease for their child.

signer will need to have a good credit score, be able to prove their income, and show that they have the capacity to pay for the unit if needed on top of their own debts and payments.

The cosigner is a party with an established financial history who agrees to back up one or more tenants on the lease. They function as a safety net for the landlord. If the other people named in the lease can't make rent or cause damages they can't afford to repair, the cosigner has agreed to pay instead.

Your Co-Signer Agreement should include information like: who is the landlord; the name(s) of the tenant(s); when the original lease was signed; the rental property's location; the co-signer's name, driver's license and social security number; whether the co-signer will be responsible for any lease extensions or ...

A cosigner is someone who guarantees that they will be legally responsible for paying back a debt if the borrower cannot pay. Some of the best people to cosign are trusted friends or family members with a good credit history and a solid income history.