Florida Double Llc For Sale

Description

Form popularity

FAQ

Yes, you can form multiple LLCs in Florida without limitation, as long as each LLC has a unique name. This strategy can help diversify your business activities or protect your assets. If you're thinking about a Florida double LLC for sale, owning more than one LLC can offer benefits like risk management and flexibility in operations.

In Florida, a husband and wife may choose to treat their jointly owned LLC as a single-member entity for tax purposes. This option simplifies many filing requirements while allowing both partners to manage the company. If you’re considering a Florida double LLC for sale, you can consult with legal experts to determine the best structure for your situation.

To file a multi-member LLC in Florida, you first need to choose a unique name for your business and designate a registered agent. Next, complete and file the Articles of Organization with the Florida Division of Corporations. For a smooth process, consider using services like US Legal Forms, which can guide you in setting up your Florida double LLC for sale correctly.

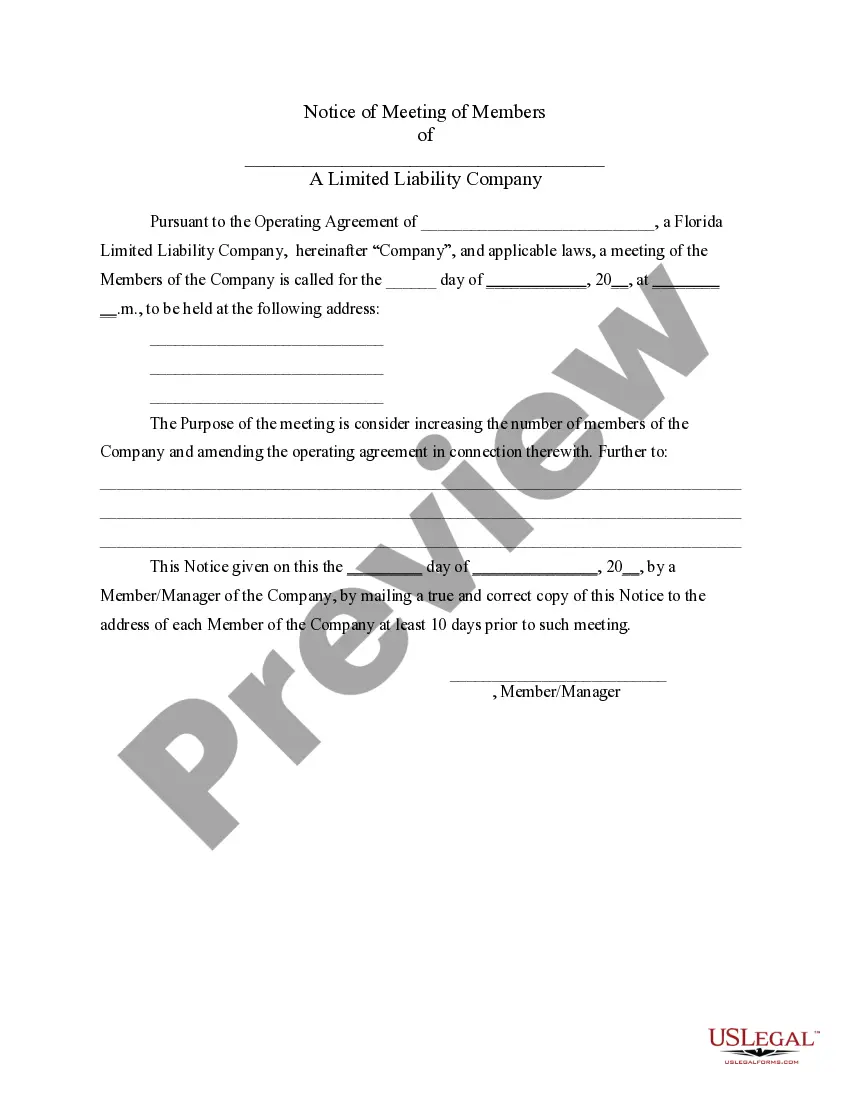

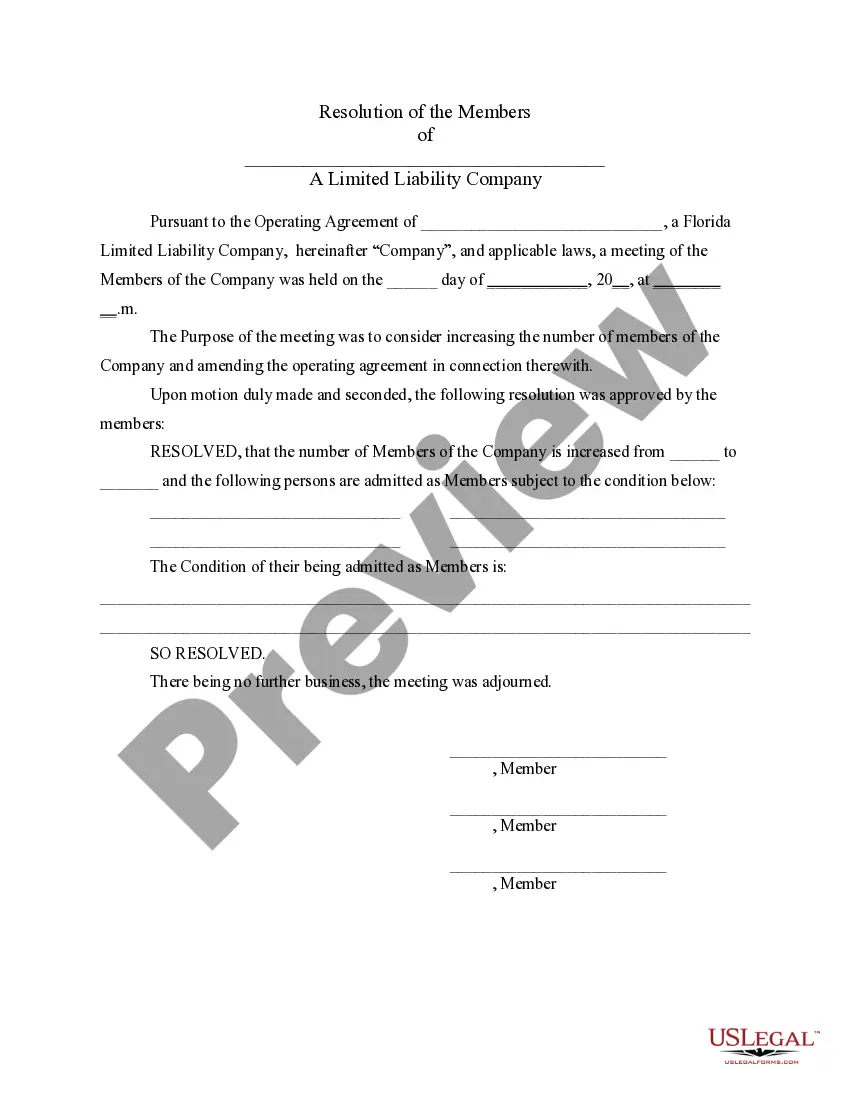

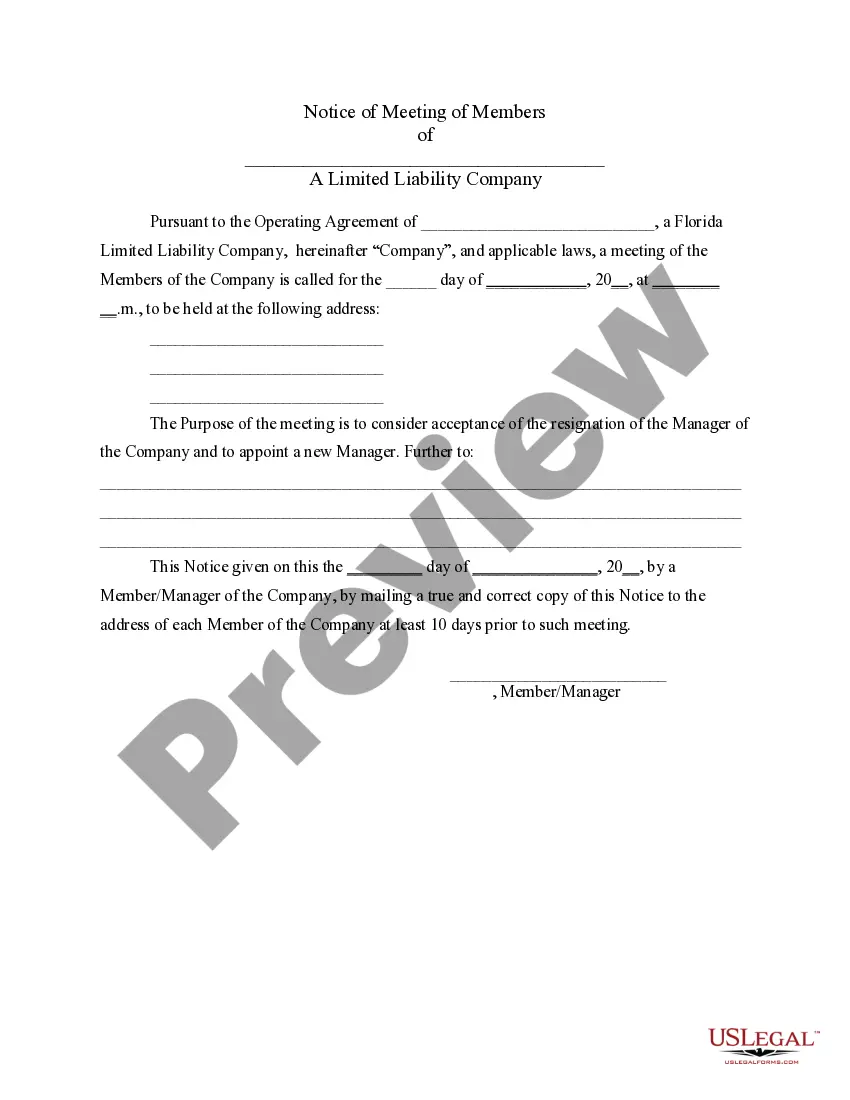

Yes, you can add someone to your LLC in Florida by amending your operating agreement and filing the appropriate paperwork with the state. This process allows for growth and can improve management decisions by bringing in a new member. When exploring options like a Florida double LLC for sale, consider how additional members can bring different perspectives and resources to your business.

In Florida, a single-member LLC has one owner, while a multi-member LLC includes two or more owners. The structure impacts how you file taxes and manage profits and losses. If you are considering a Florida double LLC for sale, a multi-member LLC can provide added flexibility in ownership and tax benefits. Each member can contribute skills and funds, enhancing your business potential.

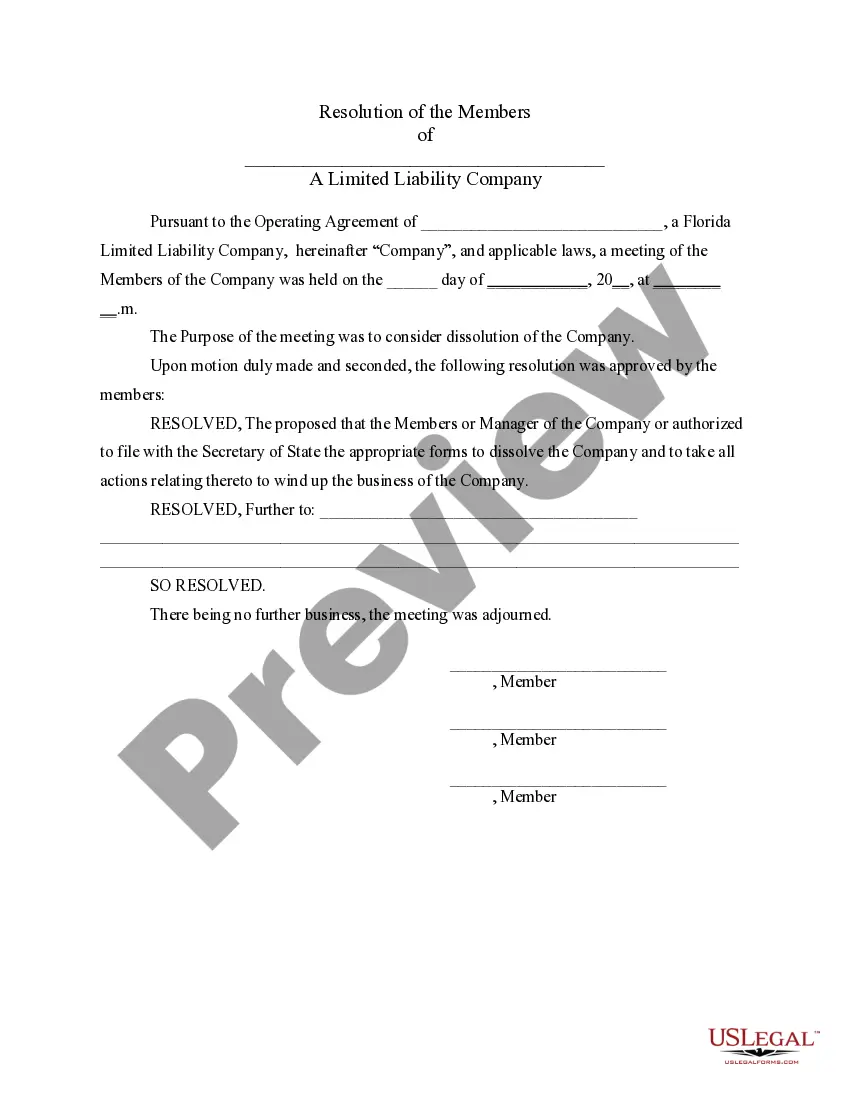

A Florida double LLC is a unique business structure that combines the benefits of two separate LLCs into one. This allows for enhanced asset protection and tax benefits that standard LLCs might not provide. If you're considering a Florida double LLC for sale, you'll gain significant advantages in terms of flexibility and liability protection. The uslegalforms platform offers resources to help you understand this structure and facilitate the setup process smoothly.

The time it takes for Florida to approve an LLC typically varies based on the filing method. If you file online, the approval can happen within 1 to 3 business days. However, if you opt for paper filing, expect a processing time of about 1 to 2 weeks. For those interested in a Florida double LLC for sale, uslegalforms can streamline your filing process, ensuring faster approval and compliance.

A double LLC in Florida refers to a structure where one LLC owns another LLC, providing added layers of liability protection and operational flexibility. This arrangement can be particularly beneficial for entrepreneurs looking to separate various business ventures. Exploring opportunities for a Florida double LLC for sale may offer you the strategic advantage you seek.

In Florida, an LLC can have multiple DBAs, making it easier to operate different businesses under one legal entity. Each DBA must be registered with the state, allowing for diversified branding without the need to create new LLCs. Opting for a Florida double LLC for sale can enhance your business's reach and marketability.

Yes, you can transfer ownership of an LLC in Florida to another individual or entity. This process typically involves updating the operating agreement and filing the necessary paperwork with the state. If you're looking into a Florida double LLC for sale, ensure that potential transfers are clearly defined in your arrangement.