Florida Double Llc For Real Estate

Description

Form popularity

FAQ

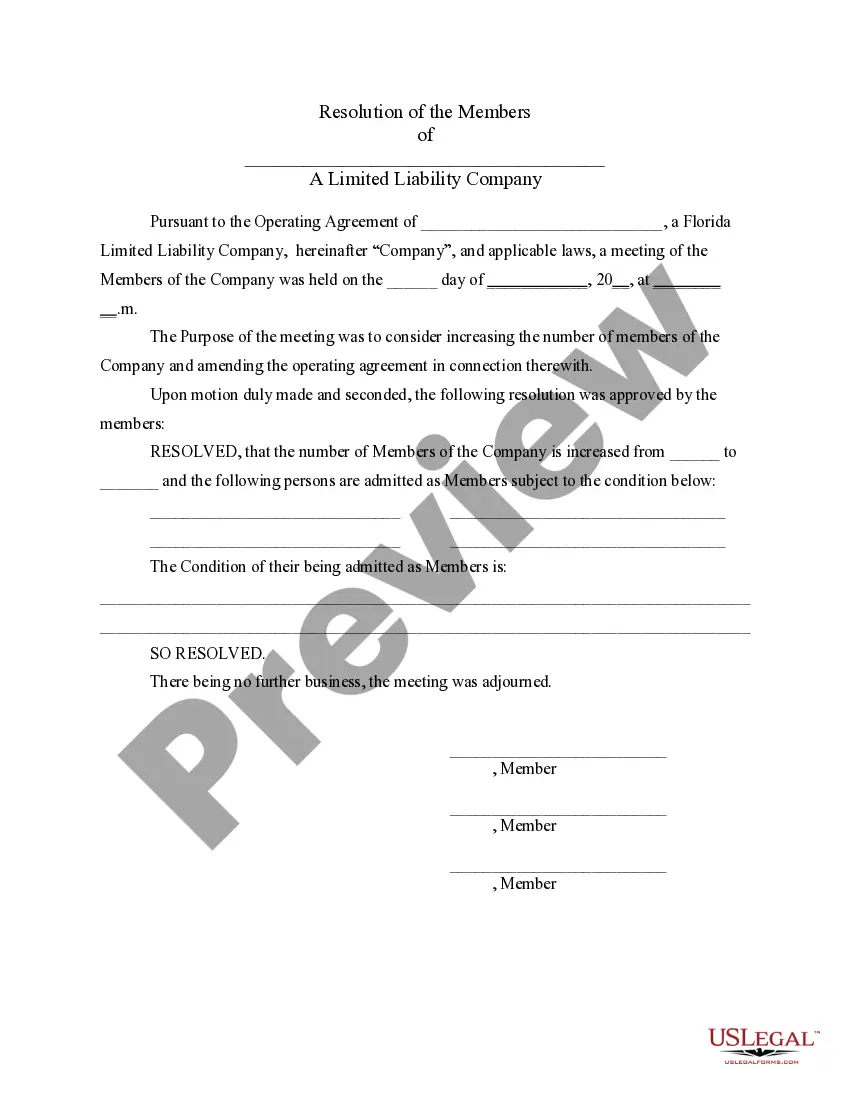

An LLC in Florida can have as few as one member, which may appeal to individual investors or small businesses. On the other hand, there is no cap on the number of owners, providing the opportunity for large partnerships and collaborations. If you are exploring a Florida double LLC for real estate, you can easily accommodate multiple owners to optimize your investments. This unlimited ownership structure makes LLCs a popular choice for those involved in real estate.

In Florida, there is no maximum limit to the number of members an LLC can have. This allows for flexibility and scalability, making it a feasible option for many real estate ventures. Whether you are considering a Florida double LLC for real estate or establishing a simple LLC, you can include multiple owners to fit your business needs. This structure supports collaborative real estate investments, offering potential for shared responsibilities and profits.

To put multiple businesses under one LLC in Florida, you first need to register your LLC and obtain the necessary licenses. After that, you can establish different DBAs for each business venture. You will manage all these DBAs under the LLC, ensuring compliance with state regulations. Platforms like uslegalforms make this process easier, offering guidance and templates to streamline your setup.

When you have multiple businesses under one legal structure, it's often referred to as a 'business conglomerate' or simply multiple ventures. This setup allows various enterprises to operate under a shared management structure. A Florida double LLC for real estate can be an excellent way to create a cohesive strategy among your different businesses, making it easier to manage them collectively.

Yes, you can have multiple businesses under one LLC in Florida. This approach streamlines your operations and reduces administrative costs. A Florida double LLC for real estate enables you to manage various properties or ventures under a single entity. This not only simplifies your tax reporting but also provides liability protection.

Yes, an LLC in Florida can have two or more owners, referred to as members. This setup is quite common and allows for shared management and profits. You can structure the LLC in a way that fits both your vision and business objectives. A Florida double LLC for real estate can benefit greatly from this shared ownership, pooling resources for investment.

In Florida, an LLC can have multiple DBAs, also known as 'doing business as' names. This flexibility allows you to operate different businesses under one legal entity. However, each DBA must be registered with the state. This approach is particularly useful for a Florida double LLC for real estate, as it helps maintain brand identity while simplifying your business structure.

The main difference between a single member LLC and a multi-member LLC in Florida lies in ownership. A single member LLC is owned by one individual, while a multi-member LLC has two or more owners. This distinction impacts tax treatment and management structure. Forming a Florida double LLC for real estate can provide collaborative business opportunities and diverse investment strategies, appealing to multi-member arrangements.

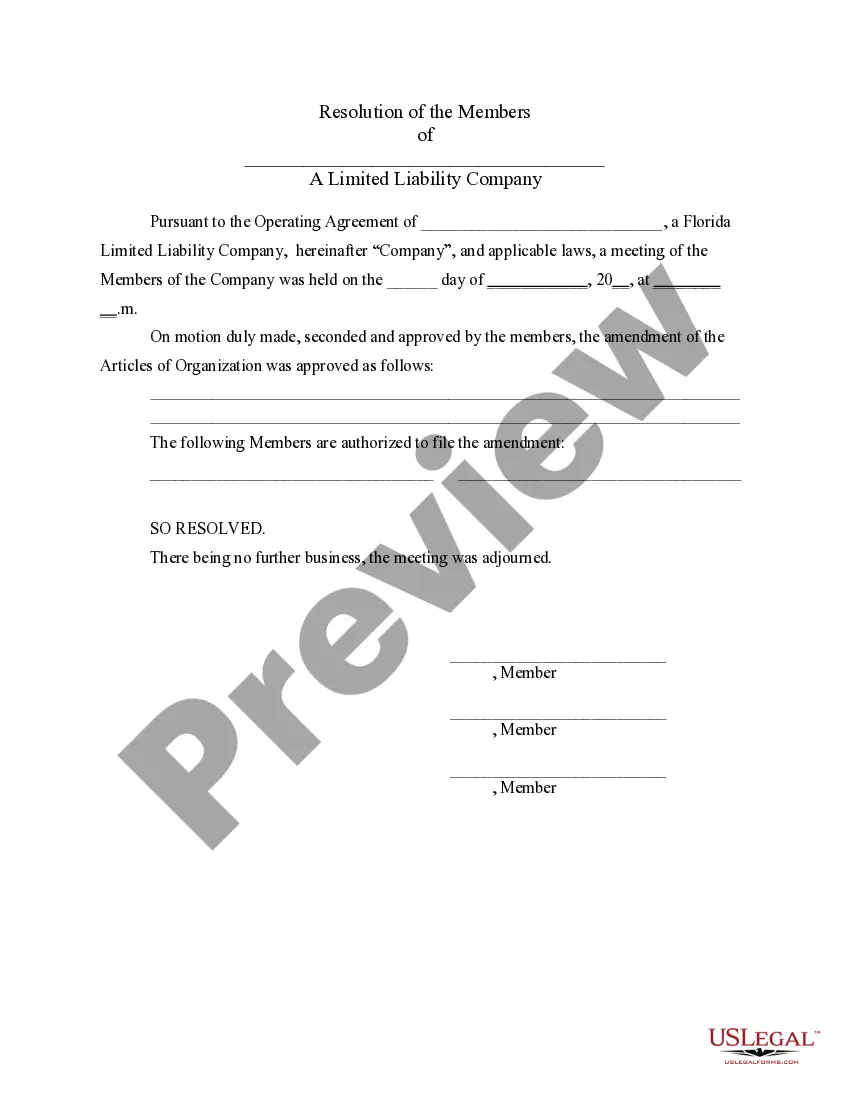

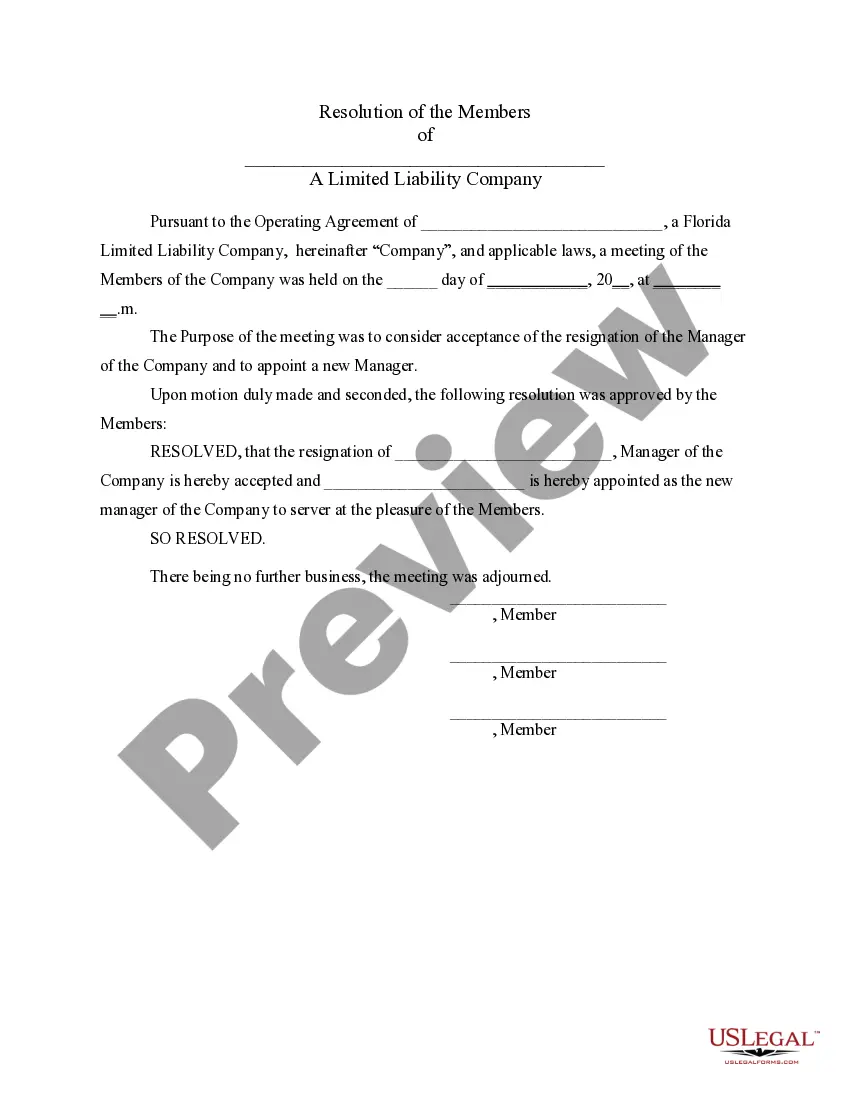

To start a multi-member LLC in Florida, first choose a suitable name that complies with state regulations. Next, file the necessary paperwork, specifically the Articles of Organization, with the state. It’s essential to draft an Operating Agreement to delineate roles, responsibilities, and profit-sharing among members. Using USLegalForms can speed up this process and ensure all legal bases are covered for your Florida double LLC for real estate.

Some disadvantages of an LLC in Florida include initial formation costs and ongoing maintenance requirements, such as annual reports. Additionally, members must adhere to state regulations, which can be complex at times. Despite these challenges, using a Florida double LLC for real estate can offer significant tax benefits and asset protection, making it a worthwhile investment. USLegalForms can provide guidance through the complexities.