Lease Property Form For A Business

Description

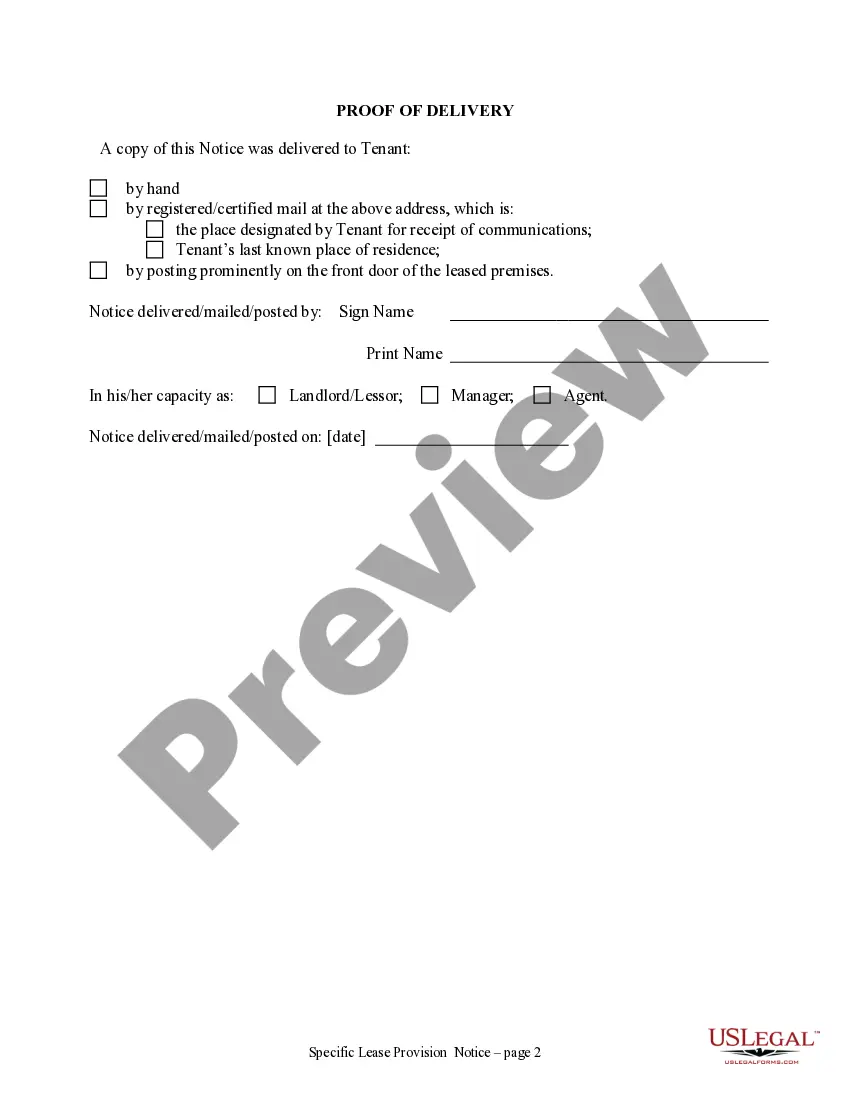

How to fill out Florida Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With No Right To Cure For Residential Property From Landlord To Tenant?

- If you are a returning user, log in to your account and locate the required form template by clicking the Download button. Ensure your subscription is active; if not, renew it.

- For first-time users, start by checking the Preview mode to review form descriptions and verify that you have selected the correct document that meets your local jurisdiction's requirements.

- If needed, utilize the Search tab above to browse other templates until you find the perfect match for your needs.

- Once you've chosen your form, click the Buy Now button and select your preferred subscription plan to access the document library.

- Complete your purchase by entering your credit card details or using your PayPal account to finalize the subscription.

- Download and save your form on your device. You can also access it later in the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of obtaining legal documents, making it accessible for everyone. With an extensive library of over 85,000 forms and the backing of premium expert assistance, you can ensure that your business lease agreements are clear and compliant.

Start your journey to properly documenting your business lease today!

Form popularity

FAQ

Yes, you can lease your own property to your business, effectively allowing the business to operate from your own real estate. This strategy can have tax benefits and establish a clear financial boundary between personal and business finances. Be sure to complete a lease property form for a business to document the arrangement properly.

Yes, you can lease your property to an LLC. This arrangement often helps in protecting your personal assets while also establishing a formal business structure. Ensure that you use a lease property form for a business that includes specific terms tailored for LLCs, keeping your interests covered.

Filling out a corporate lease application requires careful attention to detail. Begin by providing accurate information about your business, including its legal structure and financial position. Then, prepare to disclose any additional requirements outlined in the lease property form for a business, such as references or financial statements. Finally, ensure all fields are completed correctly before submitting your application, as this builds trust with landlords.

To create a compelling business proposal for a lease, start by outlining your needs clearly. Specify the type of property you seek and how it fits your business goals. Next, include terms you are willing to negotiate, such as lease duration and rent amount. Lastly, present any additional information that demonstrates your reliability as a tenant, such as previous lease history or financial stability.

The best commercial tenants typically have strong financial backgrounds and a solid business model. Look for tenants with good credit history and a positive reputation in their industry. Utilizing a lease property form for a business can help ensure you secure tenants who can meet their obligations and maintain your property.

Retail tenants, especially those in shopping centers, are most likely to have a percentage lease. This lease ties a portion of rent to sales volume, aligning the interests of landlords and businesses. By using a lease property form for a business, you can structure this lease effectively, ensuring fairness for both parties.

The best lease type for commercial property varies according to your situation, but many consider a modified gross lease to be beneficial. This lease type shares expenses, making it easier for both landlords and tenants. Using a lease property form for a business can help you tailor your lease for optimal results.

The best type of commercial lease depends on your business needs and goals. Typically, there are three main types: gross leases, net leases, and modified gross leases. Each has its own benefits, so consider using a lease property form for a business to find the best fit for your situation.

Yes, you can write up your own lease agreement. However, it's important to ensure that it meets all legal requirements to protect both you and your tenant. A lease property form for a business can simplify this process, making sure you cover all necessary terms and conditions efficiently.

Yes, you can lease your own property to your business, which can provide tax benefits and help you separate personal and business finances. It’s essential to draft a formal lease agreement to comply with IRS regulations. A lease property form for a business can be particularly useful here, ensuring that all terms are clear and legally binding.