Limited Business

Description

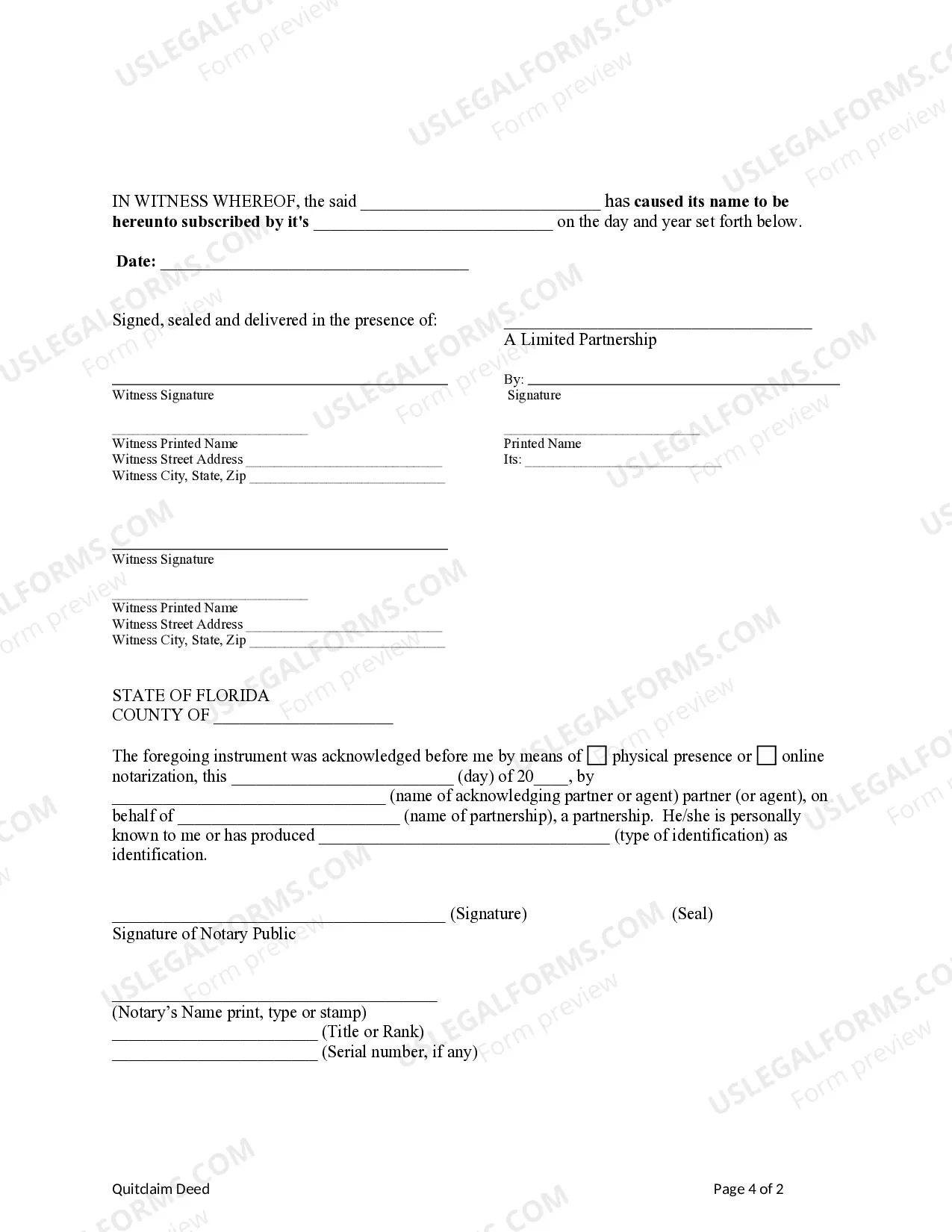

How to fill out Florida Quitclaim Deed From Limited Partnership To Limited Liability Company?

- Log in to your existing US Legal Forms account or create a new one if it's your first visit.

- Browse through the extensive online library to find the specific form template that suits your legal requirements.

- Review the form description and Preview mode to confirm its compatibility with your local jurisdiction.

- If the document does not perfectly fit your needs, utilize the Search tab to explore alternative templates.

- Select the desired form and click on 'Buy Now'. Choose a subscription plan that aligns with your usage needs.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- After purchasing, download your selected form and save it to your device for easy access anytime via the 'My Forms' section.

By following these steps, you can quickly and easily access the legal documents your limited business requires. US Legal Forms not only provides a vast selection of forms but also enables you to consult with premium experts for assistance in completing them accurately.

Start today and ensure your limited business is legally equipped for success!

Form popularity

FAQ

To qualify as a limited company, your business must register under specific regulations that restrict owner liability for company debts. This means your personal assets are generally safeguarded from business liabilities. Additionally, you must adhere to particular operational requirements and maintain certain records. Engaging with platforms like uslegalforms can simplify the registration process and ensure compliance.

While a private limited company and an LLC share similarities, they are not identical. Both provide limited liability protection, but the regulations and structures can differ significantly based on jurisdiction. It's important to understand the legal implications in your area. Resources available through uslegalforms can help you navigate these distinctions effectively.

Limited partnerships allow you to include both general partners, who manage the business, and limited partners, who invest without personal liability. This structure can be beneficial for raising funds while securing the business's limited status. On the other hand, an LLC offers more simplicity in management. Think about your specific needs when deciding, and explore resources like uslegalforms to guide you.

Choosing between an LTD and an LLC often depends on your business goals. An LLC, or limited liability company, provides personal protection from debts while offering flexibility in management. On the other hand, limited business structures like LTD often attract certain investors due to their formal governance. Ultimately, consider your priorities and consult legal advice for the best fit.

In the context of business, 'limited' refers to the limitation of liability for business owners. This arrangement keeps personal assets safe from business liabilities and debts. Thus, if the business fails or faces legal issues, owners are only at risk for their investment. This safeguarding feature enhances entrepreneur confidence as they pursue growth and innovation.

If a business is a limited company, it means it operates as a distinct legal entity. This status contributes to limiting the financial responsibilities of the owners, giving them peace of mind regarding personal asset protection. This structure signals to clients and partners that the business is serious, often enhancing its credibility in the market. Options available on uslegalforms can simplify the formation process and ensure legality.

A limited company and an LLC both protect owners from personal liability, but they cater to different legal and tax needs. A limited company is a formal structure recognized by shares, while an LLC, or Limited Liability Company, is more flexible in ownership and management. Choosing between them often depends on your business's specific requirements, financial plans, and intended growth. Utilizing platforms like uslegalforms can help you navigate these options effectively.

Being a limited company means that the business is legally separate from its owners. This separation protects the owners' personal assets, as they are not personally liable for the company’s debts. In essence, your financial risk is limited to your investment in the business. This structure offers advantages in credibility and potential tax benefits.

While 'limited' and 'LLC' are often used interchangeably, they serve different purposes. 'Limited' refers to the limitation of liability in different types of business entities, while 'LLC' specifically points to limited liability companies. You can often use the term 'limited' in your business name, but it's crucial to ensure compliance with state regulations. If you’re considering forming a limited business, resources like US Legal Forms can guide you through the process.

known example of a limited liability company is 'Amazon, LLC.' This structure allows Amazon to operate as a separate legal entity from its owners, limiting their personal liability. Many startups prefer this model because it protects personal assets while allowing for growth and flexibility. Choosing a limited liability company can be a strategic move for aspiring business owners.