Quitclaim Deed Form For Florida

Description

How to fill out Florida Quitclaim Deed - Timeshare From Two Individuals To One Individual?

The Quitclaim Deed Form For Florida displayed on this site is a reusable legal template created by experienced attorneys in adherence to federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts access to over 85,000 verified, state-specific documents for various professional and personal needs. It is the fastest, most direct, and most reliable method to acquire the necessary paperwork, as the service ensures bank-grade data security and anti-malware safeguards.

Register with US Legal Forms to access verified legal templates for all of life's situations at your fingertips.

- Search for the document you require and examine it.

- Browse through the sample you searched and view or verify the form description to ensure it meets your criteria. If it doesn't, utilize the search feature to find the appropriate one. Click Buy Now once you have located the template you need.

- Subscribe and Log In.

- Select the payment plan that fits you and create an account. Use PayPal or a credit card for a swift transaction. If you possess an existing account, Log In and check your subscription to proceed.

- Retrieve the editable template.

- Choose the format you prefer for your Quitclaim Deed Form For Florida (PDF, DOCX, RTF) and download the sample to your device.

- Complete and sign the document.

- Print the template to fill it out by hand. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill in and sign your form with a valid signature.

- Download your documents once again.

- Utilize the same document at any time when needed. Access the My documents tab in your profile to re-download any previously saved forms.

Form popularity

FAQ

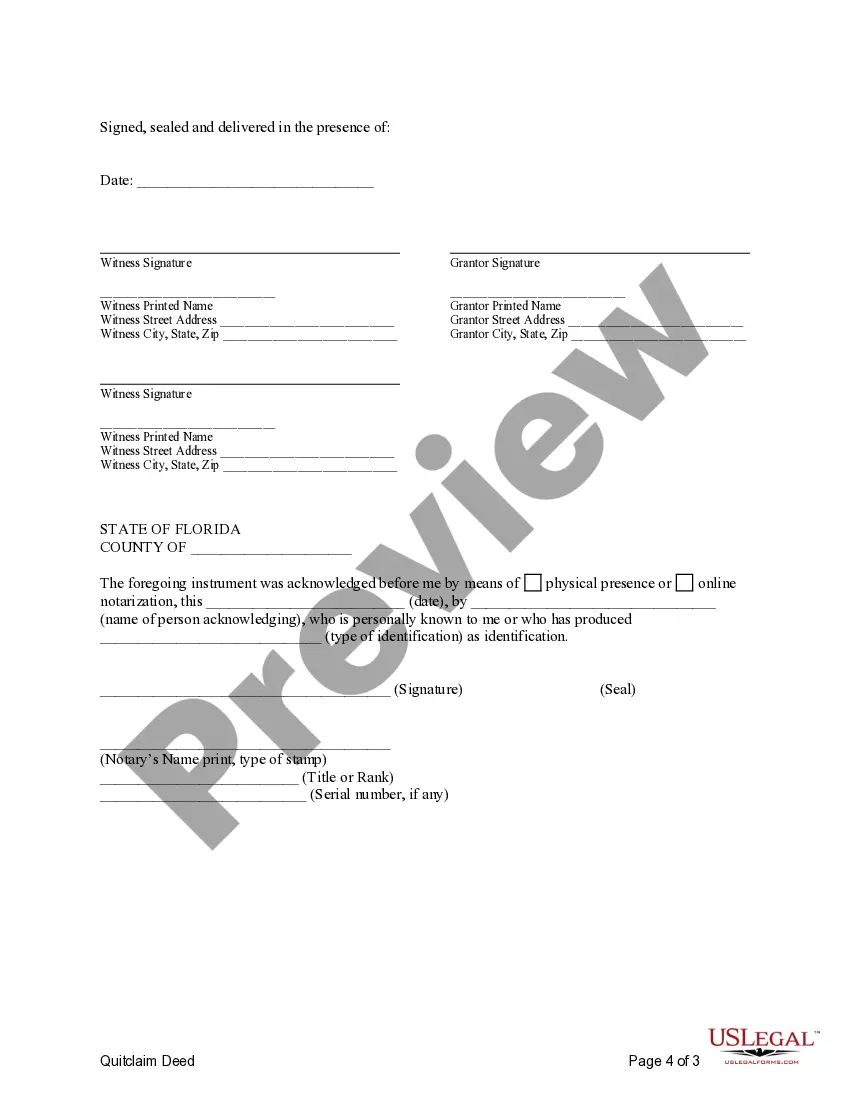

To file a quitclaim deed in Florida, you first need to complete the quitclaim deed form. Once filled out, it must be signed in front of a notary and witnessed. After notarization, you need to submit the deed to the county clerk for recording. Utilizing platforms like USLegalForms can streamline this process, as they provide easy access to templates and guidance to help you successfully file your quitclaim deed form for Florida.

Although you can make a quitclaim deed yourself, we suggest hiring a real estate lawyer to ensure your deed is done right and meets the legal and filing requirements for Flordia and the local country recorders office where the property is located.

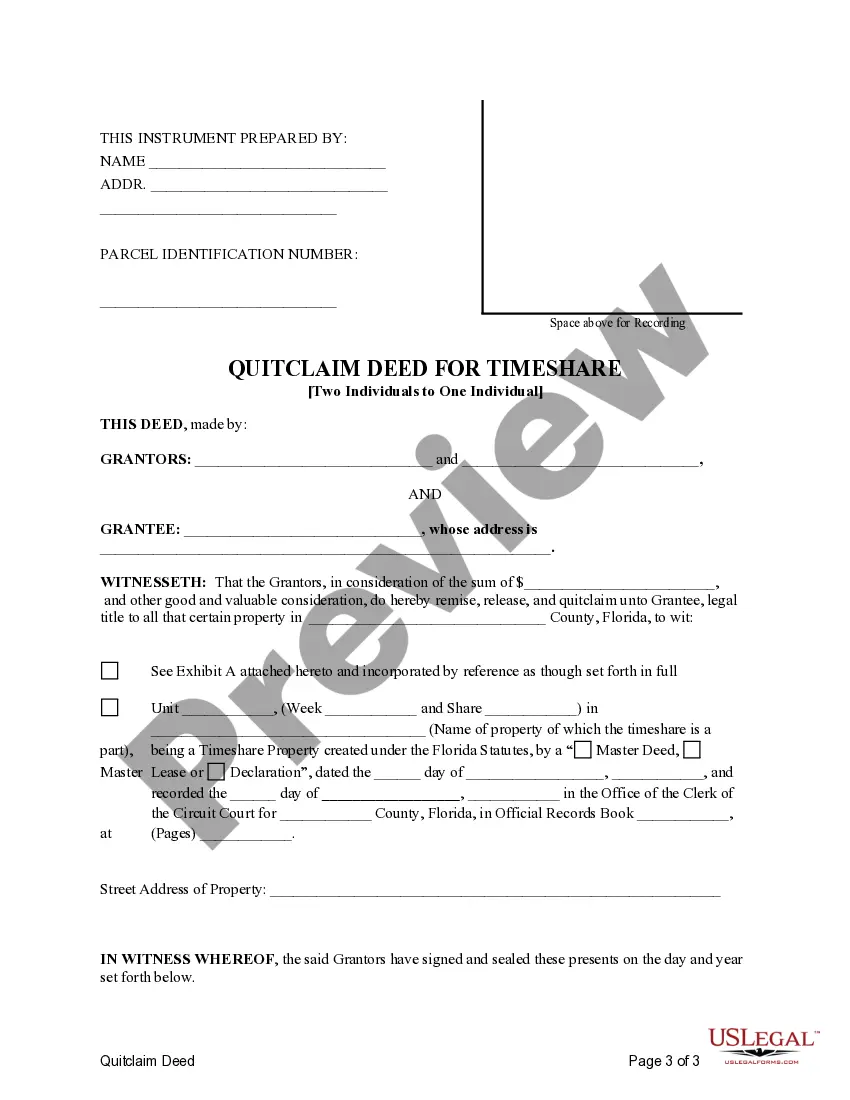

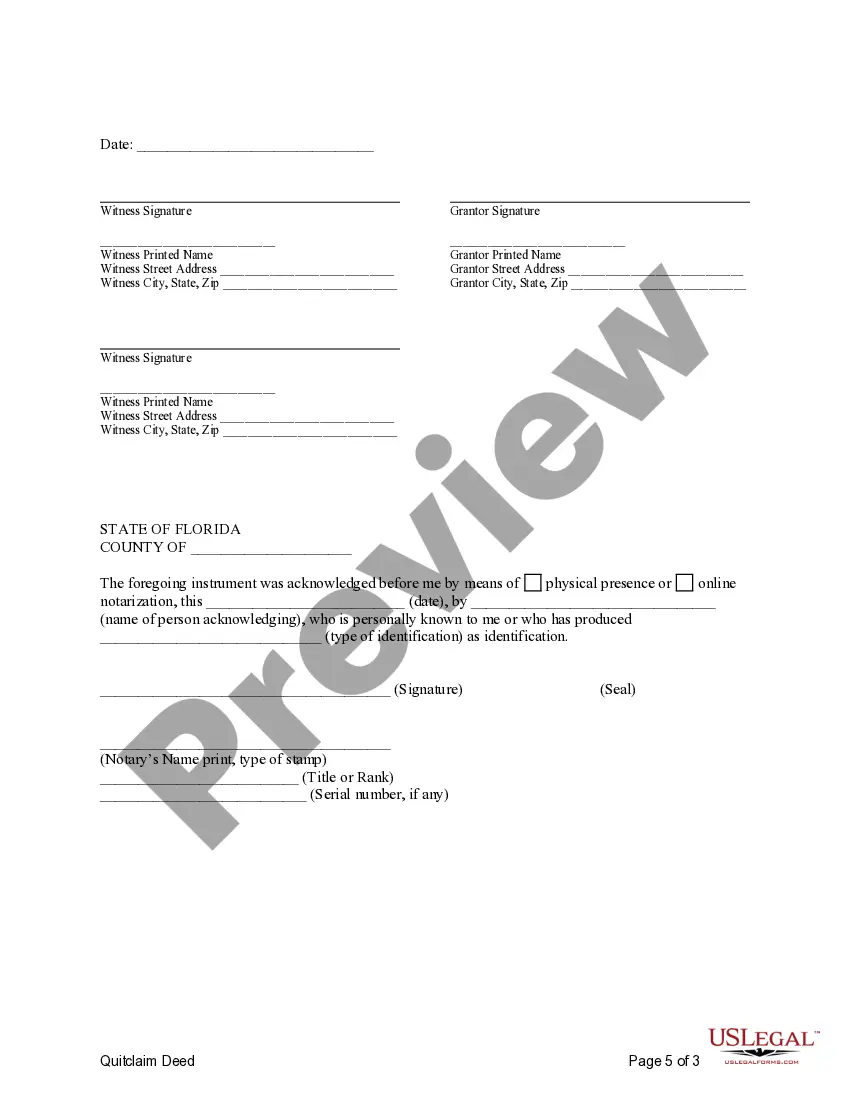

Ing to Florida Statute 695.26, a quitclaim deed must contain these certain elements: Name and address of person preparing the deed. Grantor's name and address. Grantee's name and address. Signatures of the grantors. Two witnesses for each signature/ Notary acknowledgment with signature.

Ing to Florida Statute 695.26, a quitclaim deed must contain these certain elements: Name and address of person preparing the deed. Grantor's name and address. Grantee's name and address. Signatures of the grantors. Two witnesses for each signature/ Notary acknowledgment with signature.

Quitclaims are typically taxable The person giving the gift is responsible for paying tax, and the recipient doesn't have to report the gift at all. There are some exclusions, however. In 2022, one person can gift another person up to $16,000 in cash or assets in a calendar year without paying tax on the gift.

If properly executed, a Florida quitclaim deed usually requires two weeks to three months to be recorded. The parties involved in real estate transactions generally seek to record the deed immediately after the closing process is concluded.