Quitclaim Deed With With A Will

Description

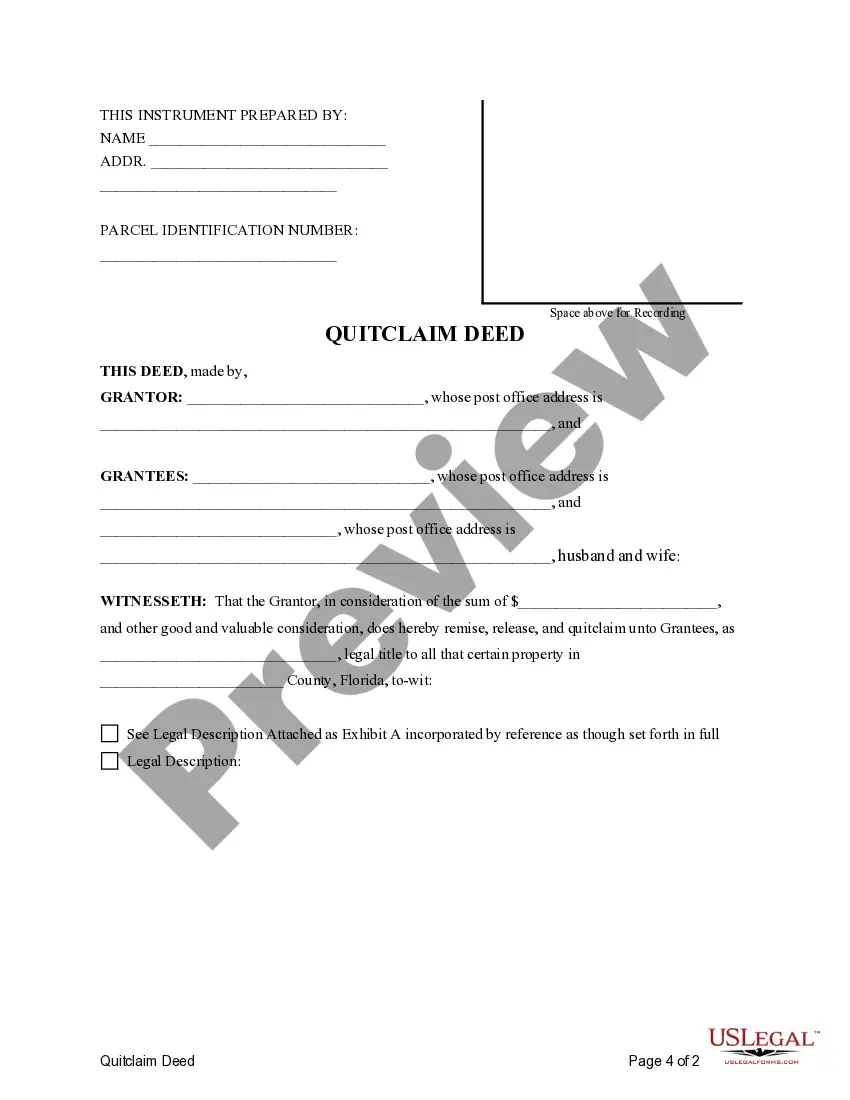

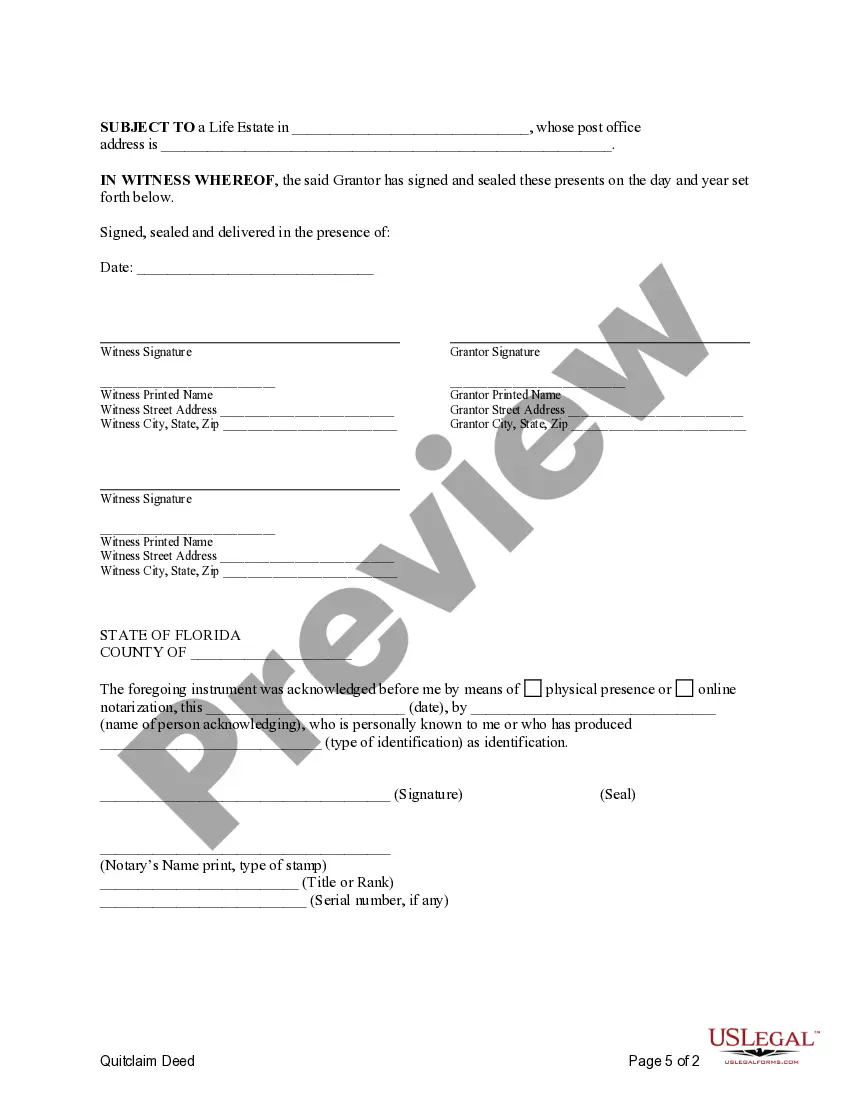

How to fill out Florida Quitclaim Deed - One Individual To Two Individuals / Husband And Wife - With Life Estate In An Individual?

- Login to your US Legal Forms account if you're a returning user. Ensure your subscription is active to access the templates.

- If you're new, start by previewing available forms. Check for a quitclaim deed with a will that fits your requirements and complies with relevant jurisdiction.

- Search for additional templates using the Search tab if the initial one doesn’t meet your needs.

- Proceed to purchase the right document by clicking the 'Buy Now' button and selecting a suitable subscription plan.

- Complete your payment using a credit card or PayPal, and confirm your transaction.

- Once purchased, download the form to your device. You can access it anytime through the 'My Forms' section of your profile.

Once you have your quitclaim deed with a will in hand, you can efficiently fill out and tailor the document to your specific requirements. US Legal Forms not only provides a robust library of over 85,000 legal documents but also connects you to premium experts for guidance.

Take the first step in securing your estate by utilizing US Legal Forms today. Start your journey towards effective estate planning now!

Form popularity

FAQ

Several factors can void a quitclaim deed, including but not limited to fraud, mistake, or lack of proper execution. If it is proven that the grantor was not mentally competent or unaware of the transaction, the deed could be voided. Additionally, if the transfer violates any laws or regulations, it can also lead to invalidation. For peace of mind, consider using tools provided by UsLegalForms to ensure that your quitclaim deed with a will is executed correctly.

A quitclaim deed is generally not valid after the death of the grantor unless it is part of an estate plan like a will. Once the grantor passes away, the property typically transfers according to the will or by state laws of intestacy if no will exists. Therefore, a quitclaim deed with a will becomes an essential part of ensuring your wishes are carried out after your passing. Understanding these nuances can be beneficial to all involved.

A quitclaim deed can be deemed invalid if it lacks essential elements such as signature, notarization, or proper identification of the parties involved. Additionally, if the deed does not accurately describe the property or fails to meet state requirements, it risks being challenged in court. When preparing a quitclaim deed with a will, it is vital to ensure that all legal aspects are correctly addressed to prevent issues later. Utilizing services like UsLegalForms can help you navigate the requirements efficiently.

A quitclaim deed with a will can potentially be voided under certain conditions, such as fraud or lack of consent from one of the parties involved. If you believe that the deed was signed under duress or with misinformation, you may have grounds for contesting its validity. To navigate this process, consider consulting with a legal expert or using platforms like UsLegalForms that give you resources to address these complexities. Being proactive can help you protect your interests.

In most cases, a will does not override a quitclaim deed with a will. A quitclaim deed transfers ownership of property immediately and effectively while a will only outlines how assets are to be distributed after death. Therefore, if a quitclaim deed has been executed before the death of the owner, the property will go to the grantee, overriding any instructions in a will. Understanding this distinction is crucial for estate planning.

Individuals seeking a quick way to transfer property ownership often benefit the most from a quitclaim deed with a will. This method works well for family members or close friends, as it allows for a smooth transition of property without the complications of traditional sales. Additionally, it is valuable for those who want to clear any doubts about ownership among heirs and beneficiaries. By utilizing a quitclaim deed with a will, you can simplify inheritance matters.

A quitclaim deed with a will cannot typically be recorded after the property owner's death, as the individual must be alive to sign the deed. Once the person has passed, property transfers must follow the stipulations laid out in the will or through probate. If you are navigating property issues after a death, consider using US Legal Forms for guidance on filing necessary documents properly and efficiently.

A quitclaim deed with a will does not inherently override the terms of that will. However, if the quitclaim deed transfer took place before the individual’s death, it may take precedence over the will regarding the property. This means that beneficiaries named in the quitclaim deed will receive the property, regardless of other designations in the will. It is important to consult with a legal professional to fully understand these implications.

Yes, a quitclaim deed with a will can override the instructions of the will regarding that specific property. If a property is transferred through a quitclaim deed, it is no longer part of the estate, and the will's provisions will not apply to it. Therefore, if you plan to use a quitclaim deed, it's important to ensure that your overall estate plan reflects your intentions appropriately. US Legal Forms can assist you in understanding how to effectively manage these legal instruments.

In general, a quitclaim deed with a will takes precedence over the instructions outlined in a will when it comes to property ownership. Once a quitclaim deed is executed and recorded, it conveys the title to the property immediately, regardless of what the will states about that property. That's why it is crucial to make sure all estate documents are aligned to avoid any legal confusion later. Consulting professionals or platforms like US Legal Forms can help clarify these roles.