Florida Deed Individuals Without A Will

Description

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Quitclaim - Individual To Five Individuals?

Drafting legal documents from scratch can sometimes be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more cost-effective way of preparing Florida Deed Individuals Without A Will or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online library of over 85,000 up-to-date legal documents addresses almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-specific forms diligently put together for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can quickly locate and download the Florida Deed Individuals Without A Will. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and navigate the catalog. But before jumping straight to downloading Florida Deed Individuals Without A Will, follow these recommendations:

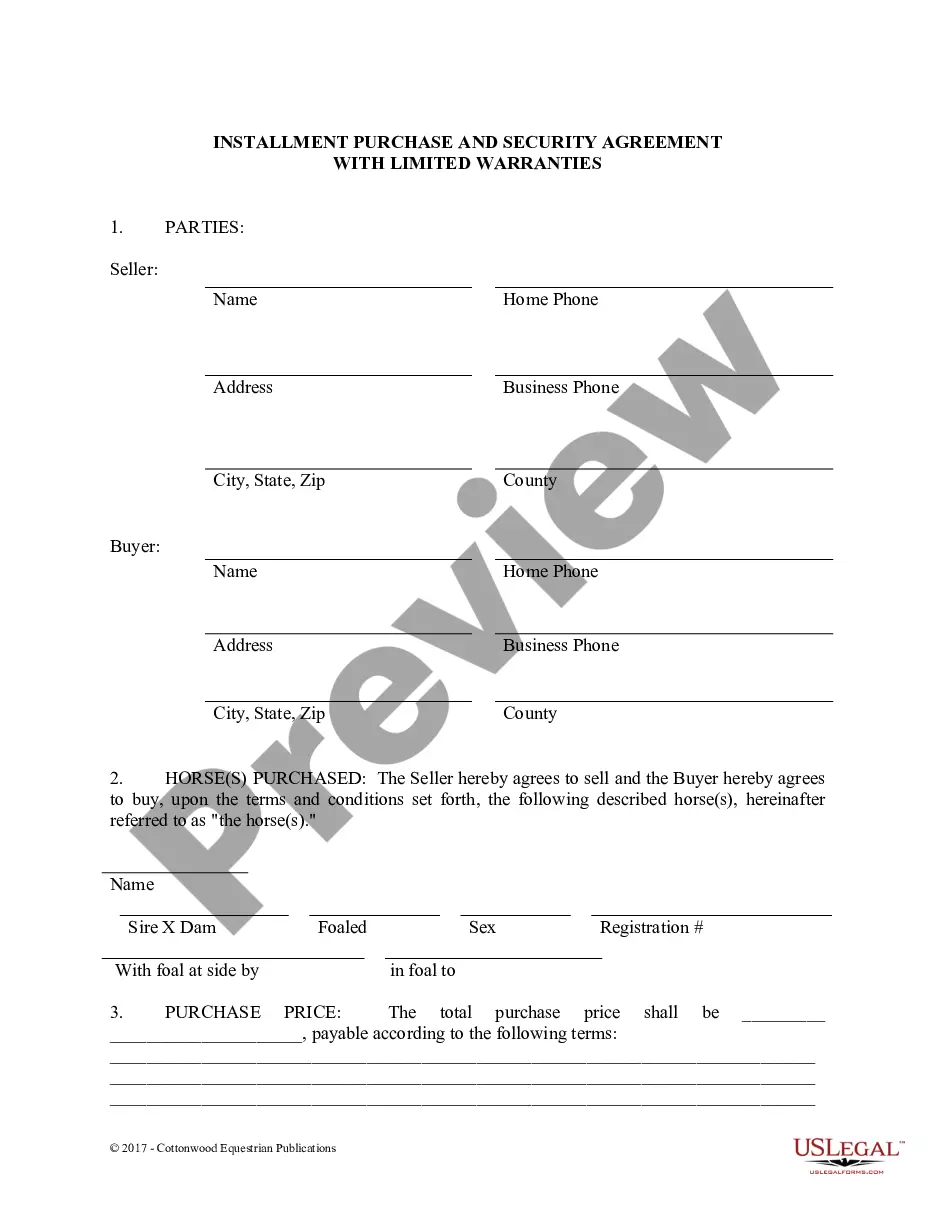

- Check the form preview and descriptions to ensure that you are on the the document you are searching for.

- Make sure the template you choose complies with the requirements of your state and county.

- Choose the right subscription option to purchase the Florida Deed Individuals Without A Will.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and transform document completion into something easy and streamlined!

Form popularity

FAQ

If you are not married, then the Florida Intestacy Statutes gives everything to your descendants, meaning your children. If a child has died, his share passes that child's children, or if there are none, then it passes to your remaining children. If there are no children, then your estate passes to your parents.

How can I transfer property after death without a will in Florida? If the controlling deed does not contain life estate language, then the only way to transfer property without a will is by either a summary administration or by a formal probate administration based on Florida's intestacy law.

If a Florida resident dies without a will, their property will pass to their closest relatives through the Florida intestate laws. Intestate laws set out a rigid formula for judges to distribute assets to family members to avoid a situation where the deceased person's assets end up with the state.

In the state of Florida, if someone dies without a will, their estate will pass by "intestate succession." This means the state will decide how to distribute the person's assets. The individual's spouse will typically be appointed as the personal representative, followed by any children of the deceased.

If a family member dies intestate (without a will), an heir must go to court and obtain ?Letters of Administration.? In this case, probate court assigns a relative to serve as the personal representative. This assigned person has the authority to settle all matters regarding the decedent's estate.