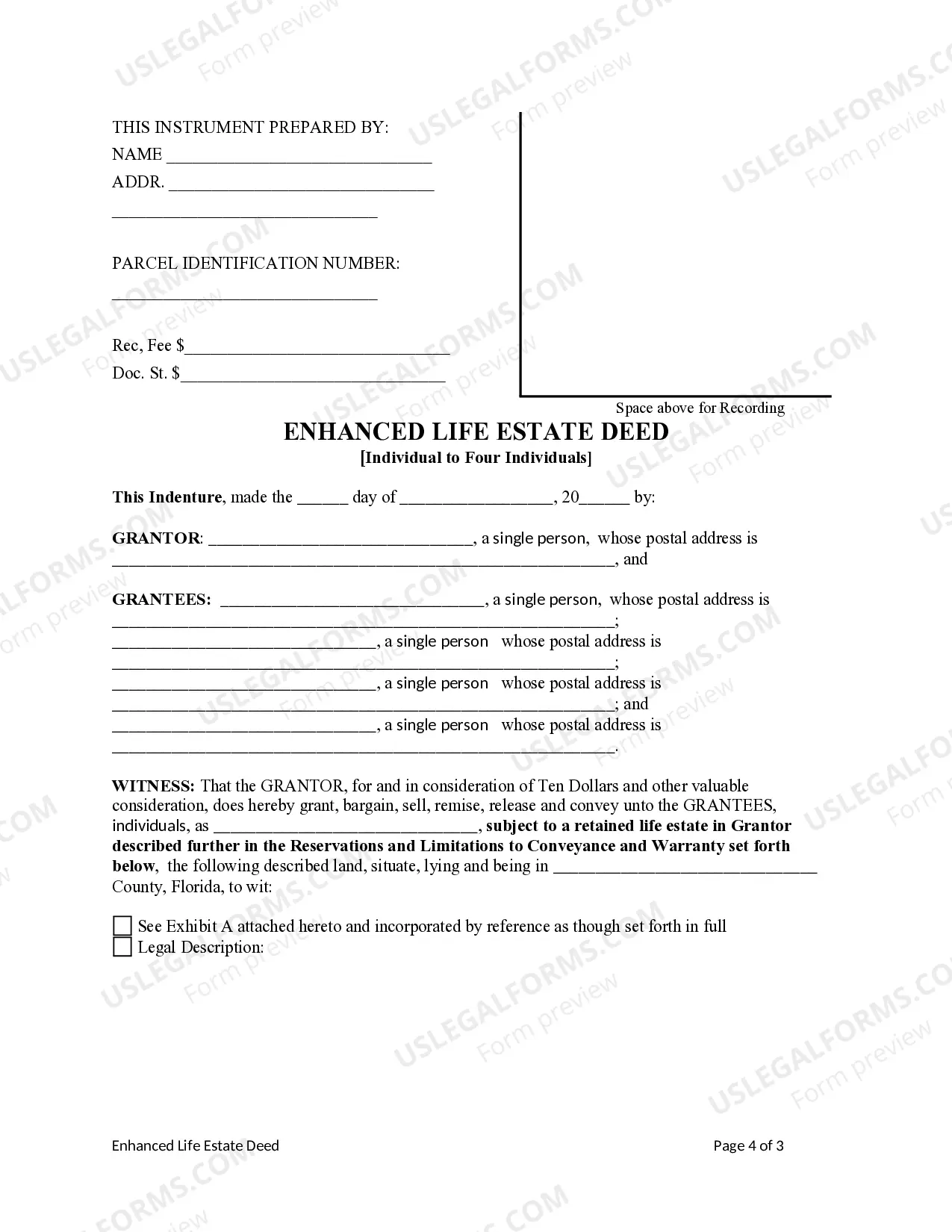

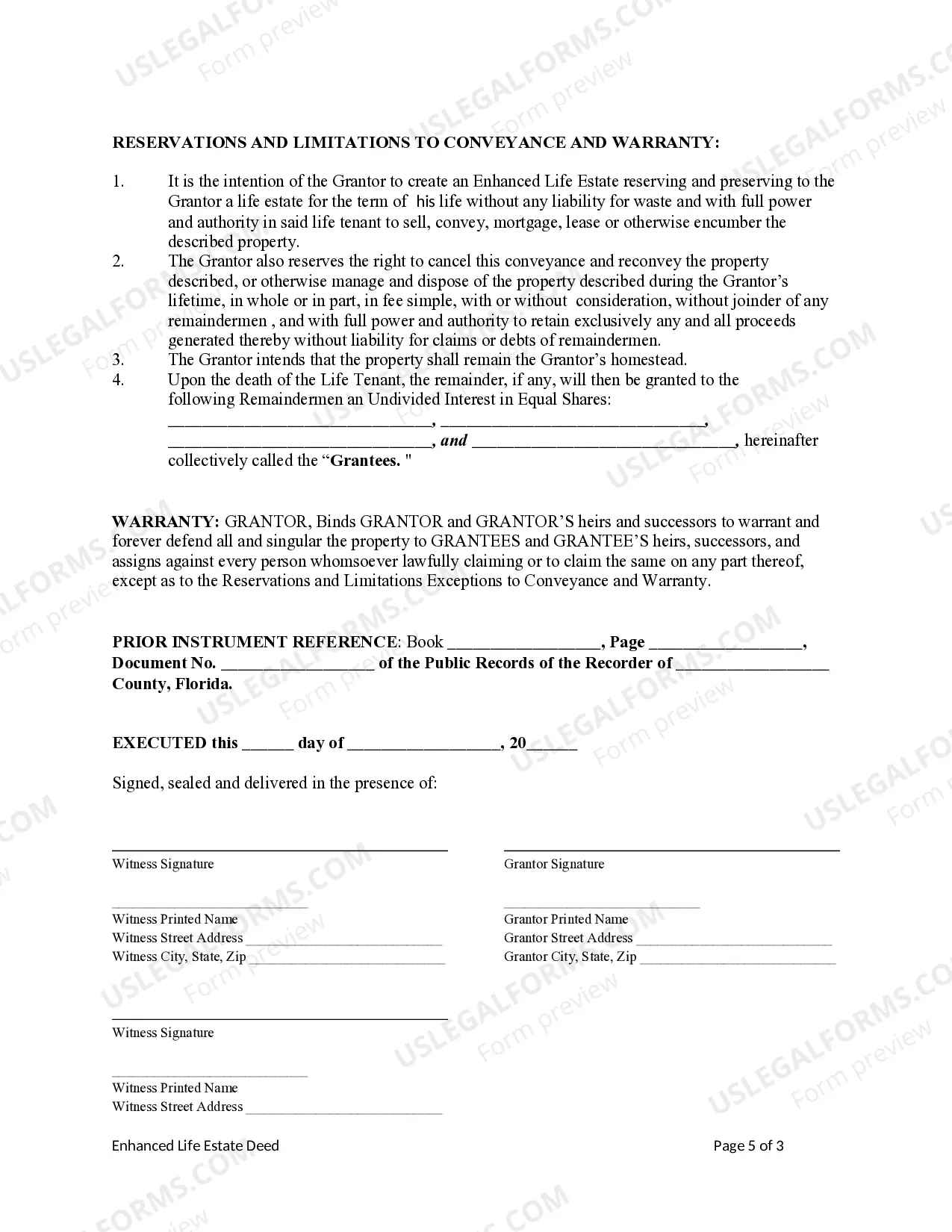

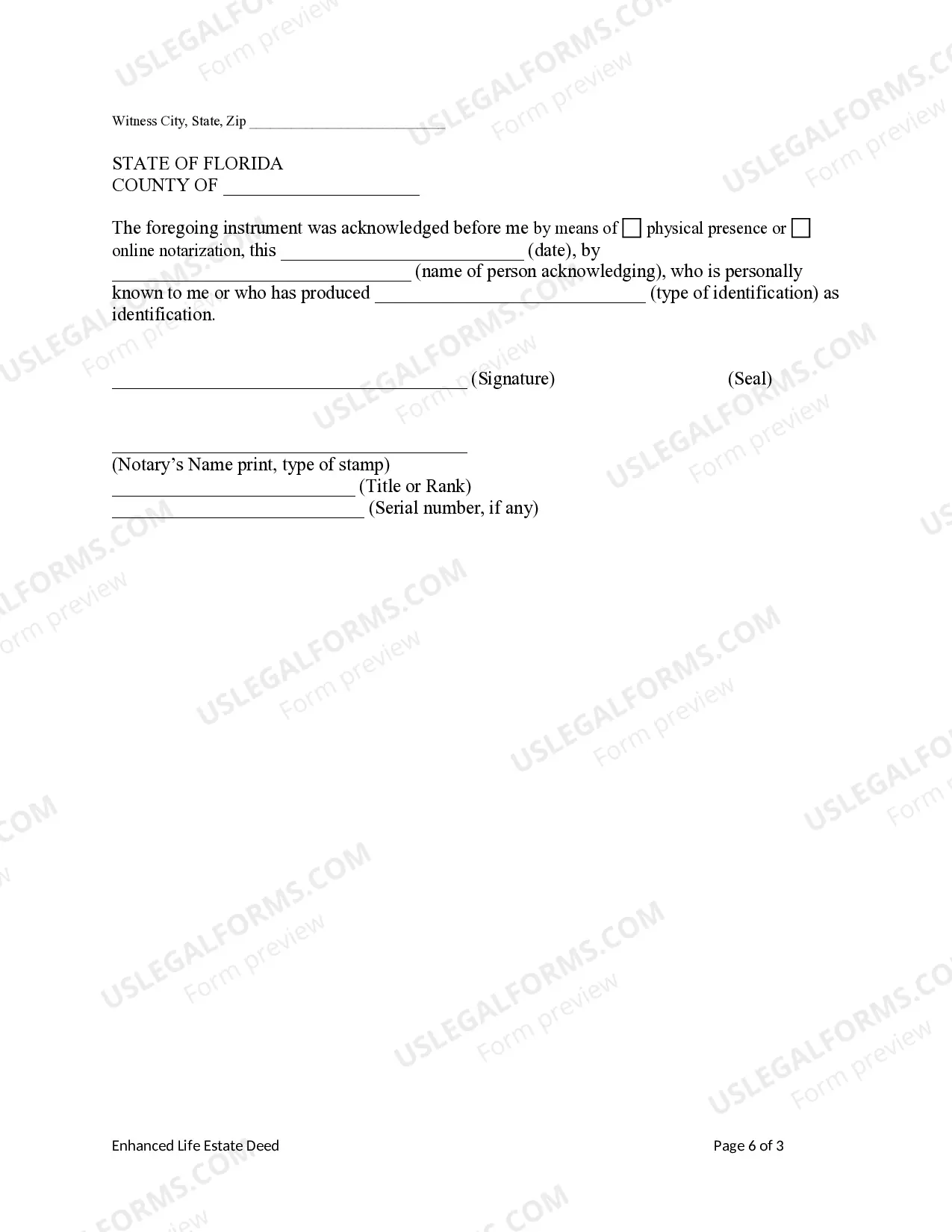

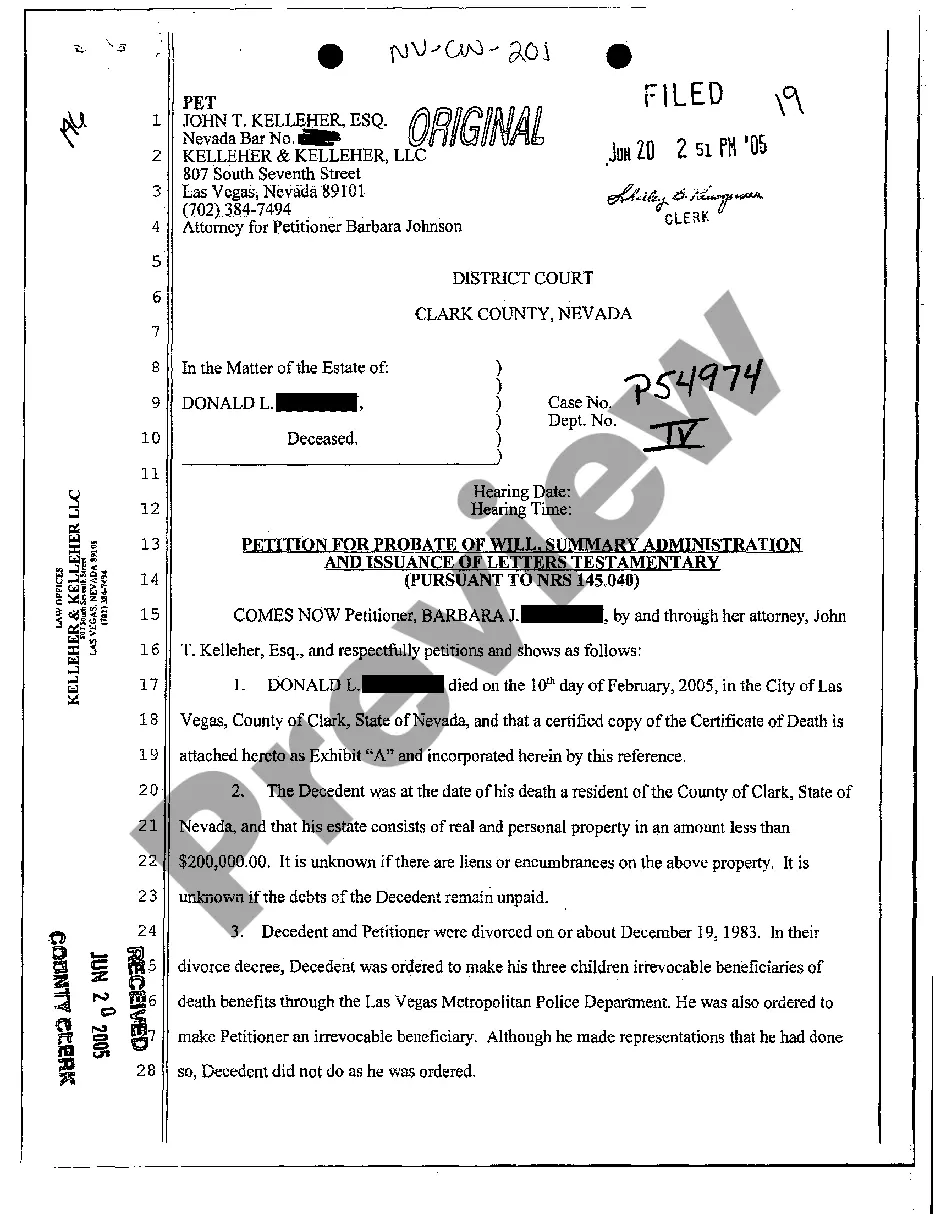

This form is an Enhanced Life Estate Deed where the Grantor is an individual and the Grantees are four individuals. Grantor conveys the property to Grantees subject to a retained enhanced life estate. Further, the Grantor retains for life the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Lady Bird Deed On Mortgaged Property

Description

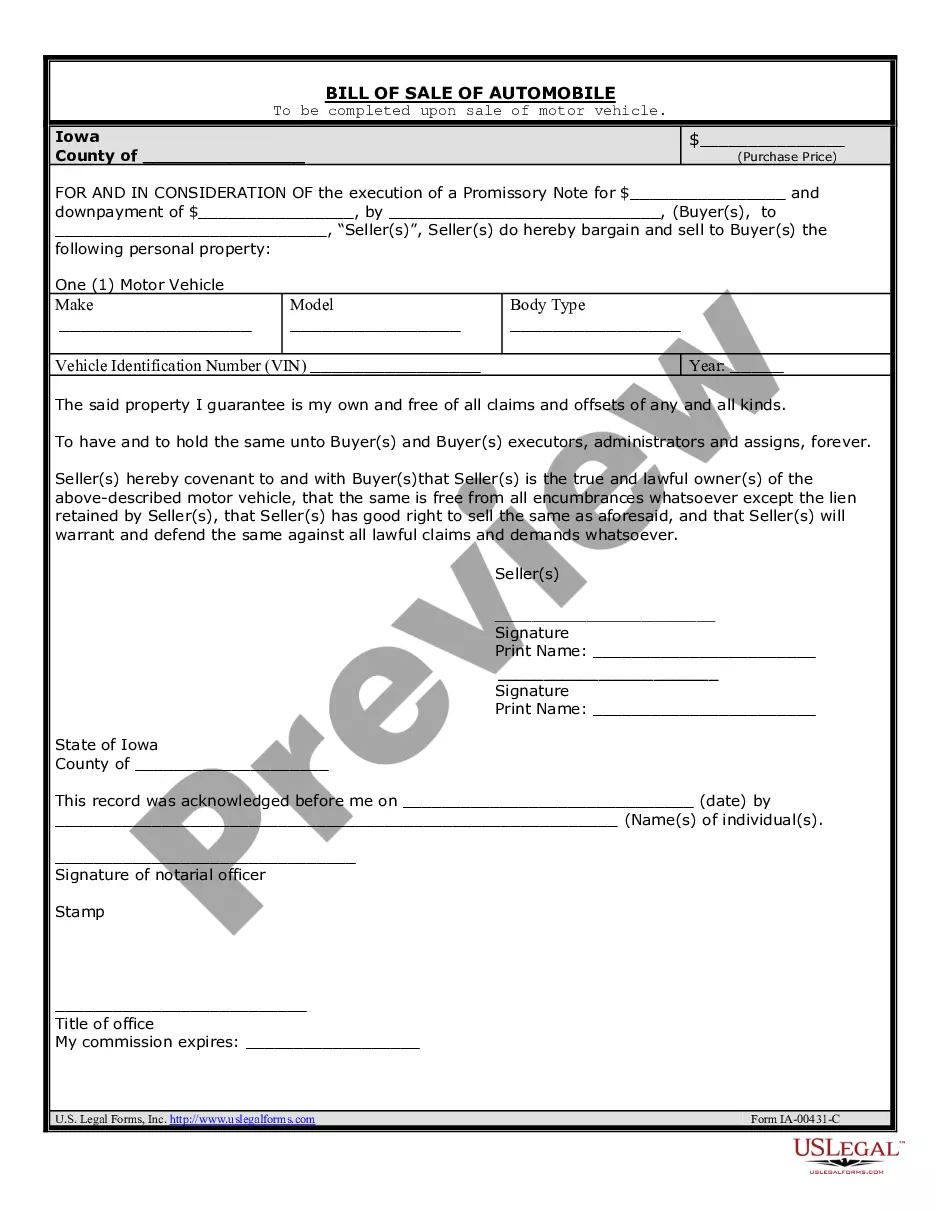

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - An Individual To Four Individuals?

The Lady Bird Deed Concerning Mortgaged Property you observe on this webpage is a reusable formal template created by skilled attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has offered individuals, enterprises, and legal experts with more than 85,000 confirmed, state-specific documents for any business and personal situation. It’s the fastest, most direct, and most dependable way to access the documents you require, as the service assures bank-level data protection and anti-malware security.

Select the format you desire for your Lady Bird Deed Concerning Mortgaged Property (PDF, DOCX, RTF) and store the sample on your device.

- Search for the document you require and examine it.

- Browse through the sample you searched and preview it or review the form description to ensure it meets your requirements. If it doesn't, use the search bar to find the appropriate one. Click Buy Now once you have identified the template you need.

- Register and sign in.

- Choose the pricing plan that works for you and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

One disadvantage of a lady bird deed on mortgaged property is that it does not prevent the property from being subject to claims from creditors. Any debts incurred during your lifetime remain attached to the property, potentially complicating matters for your beneficiaries. It's essential to weigh these aspects against the benefits and consult with professionals to fully understand what this means for your estate planning.

While a lady bird deed on mortgaged property offers many benefits, there are some drawbacks to consider. For instance, it may not provide protection from creditors or estate taxes, which could impact your estate. Additionally, if the property appreciates significantly, it may affect the tax basis for your heirs, leading to potential tax implications down the road.

Choosing between a trust and a lady bird deed on mortgaged property depends on your specific needs and goals. A trust can offer more comprehensive asset management and protection during your lifetime and after death, while a lady bird deed simplifies property transfer without the complexity of a trust. It is wise to assess your circumstances and consult with a legal professional to determine the best option for you.

In the case of a lad bird deed on mortgaged property, you, the property owner, hold the deed until your passing. After that, the deed transfers automatically to the designated beneficiaries. This process circumvents probate, enabling a straightforward transition while maintaining the mortgage obligations during your lifetime.

A lady bird deed on mortgaged property allows you to transfer ownership while retaining certain rights, including the ability to sell or mortgage the property. Since you remain the owner during your lifetime, the mortgage remains in your name. It is crucial to inform your lender about the lady bird deed to maintain clear communication and avoid potential misunderstandings.

In many cases, a lady bird deed on mortgaged property protects your home from Medicaid recovery after your death. This type of deed allows you to maintain control over the property during your lifetime, while transferring it automatically to your beneficiaries upon your passing. However, specific rules can vary by state, so it's advisable to consult a legal expert for your situation.

A lady bird deed on mortgaged property typically takes precedence over a will in the transfer of property ownership. When you designate beneficiaries through a lady bird deed, those named beneficiaries will receive the property directly without it going through probate. This can simplify the process and ensure a smoother transition of ownership.

You can indeed create a lady bird deed on mortgaged property. This option lets you keep ownership rights while simplifying the transfer of your home after your death. Be sure to consult with professionals who can guide you through the process and ensure your mortgage obligations are duly addressed.

Yes, you can obtain a lady bird deed on mortgaged property. This type of deed allows you to retain control of the property during your lifetime while designating a beneficiary for the future. It's important to note that having a mortgage does not prevent you from transferring the deed through a lady bird arrangement.

One disadvantage of a lady bird deed on mortgaged property is that it may not protect your home from creditors. If you pass away, the property could be susceptible to claims from creditors. Additionally, the lady bird deed does not eliminate the mortgage; so, you still need to manage those payments and obligations.