Trust To Individual For Meaning

Description

Form popularity

FAQ

A trust is a legal arrangement where one party holds assets for the benefit of another party, known as the beneficiary. On the other hand, an individual beneficiary is a specific person who stands to gain from the trust’s assets. Understanding this distinction helps clarify how assets are managed and distributed. This clarity is essential when navigating the complexities of wealth management or estate planning.

Having trust for someone means you believe in their reliability and integrity. It involves a sense of safety and assurance that the person will act in your best interest. When you trust an individual, you foster a strong relationship built on honesty and support. This concept can be emotionally resonant, reflecting a deeper commitment in personal and professional interactions.

To file taxes for a trust, you'll need to complete IRS Form 1041, which is specifically designed for fiduciaries. It's important to gather all income records, deductions, and information related to the beneficiaries. Additionally, working with platforms like uslegalforms can simplify this process, guiding you through proper compliance. Remember, thoroughness in filing will help protect trust funds and ensure accurate reporting.

A trust is neither a company nor an individual; it stands as its own legal entity designed to manage assets. It allows for the distribution of wealth according to the wishes of the grantor while offering distinct tax and legal benefits. Trusts can operate similarly to an individual in managing finances, yet they are bound by specific regulations. When considering trusts, it's essential to grasp their unique identity in the financial landscape.

Yes, a trust is a separate legal entity from an individual. This separation provides important legal protections for the trust's assets and helps maintain the objectives set forth by the trust creator. However, individuals may still retain certain rights or responsibilities depending on the structure of the trust. It's vital to understand this division when establishing and managing a trust.

The new IRS rules introduce changes that affect how trusts must report income. These updates aim to increase transparency and compliance, especially regarding foreign trusts and beneficial ownership. Trusts must stay compliant with these rules to avoid penalties or complications in managing trust assets. Staying informed on IRS regulations can greatly benefit your understanding of the trust to individual for meaning.

One of the most significant mistakes parents make is failing to clearly specify the terms and conditions of the trust fund. Many assume that their intentions are obvious, but ambiguity can lead to misunderstandings among beneficiaries. It is essential to communicate your wishes comprehensively to avoid disputes later. UsLegalForms provides resources to help parents craft a transparent and effective trust fund document.

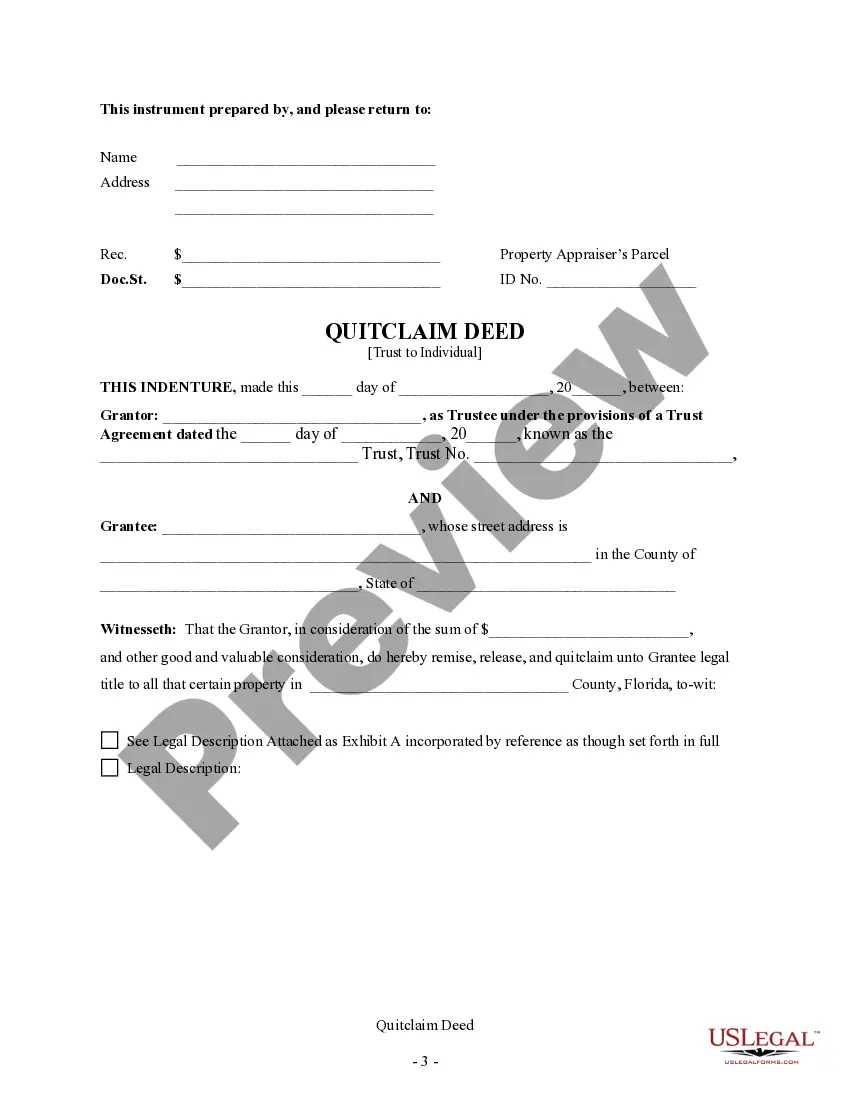

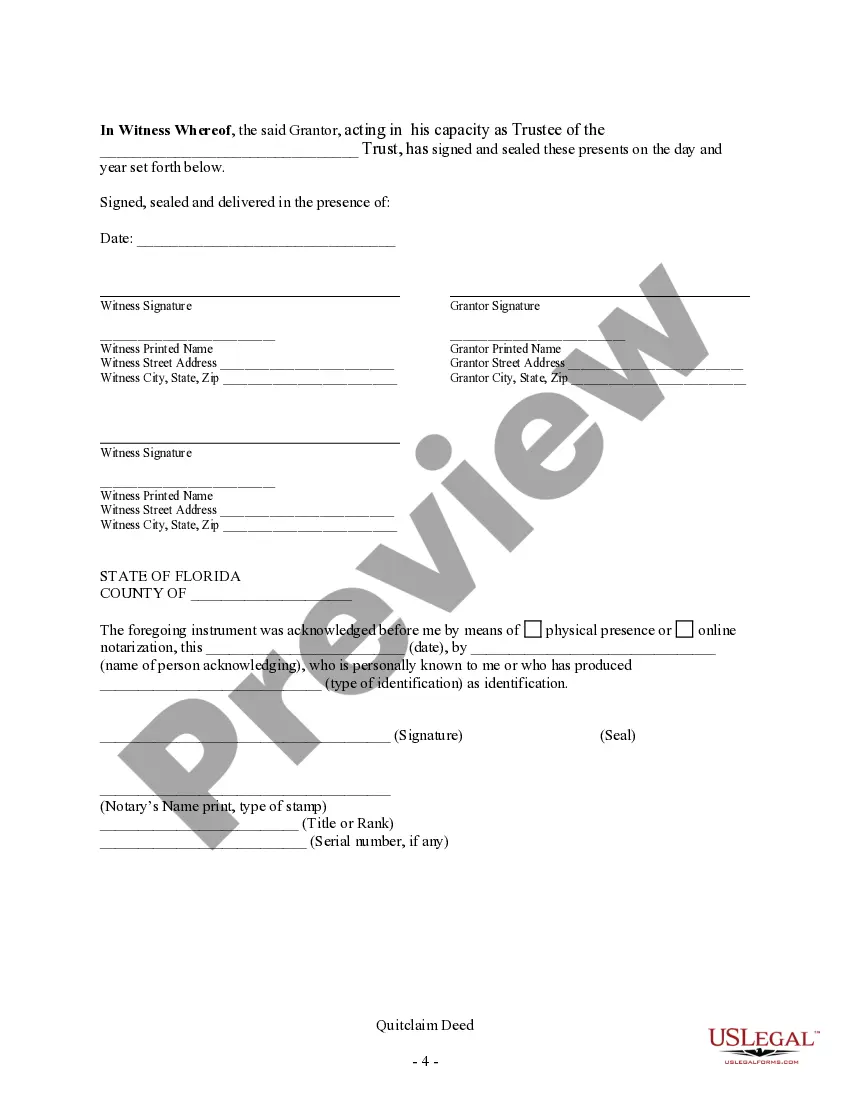

To write a trust, start by drafting a trust document that outlines the intent and details of the arrangement. Include information such as the names of the grantor, trustee, and beneficiaries, as well as how assets will be distributed. Ensuring the document complies with state laws is important to avoid complications. UsLegalForms can assist you in this process by offering user-friendly templates tailored to your needs.

A commonly recognized example of a trust is a family trust, which allows individuals to transfer assets to beneficiaries while avoiding probate. This type of trust illustrates the notion of a trust to individual for meaning, as it designates family members to benefit from the trust. Assets placed in a family trust remain under the management of a trustee, providing security for the family. With UsLegalForms, you can access examples and templates to create your own family trust.

Writing a trust requires clarity and precision to ensure your wishes are understood. Begin by defining the grantor, the trustee, and the beneficiaries, alongside the trust's purpose. Clearly outline how assets will be managed and distributed among beneficiaries. For an organized approach, consider using UsLegalForms, which provides detailed documents and instructions tailored for creating a comprehensive trust.