Florida Personal Representative Form For Estate

Description

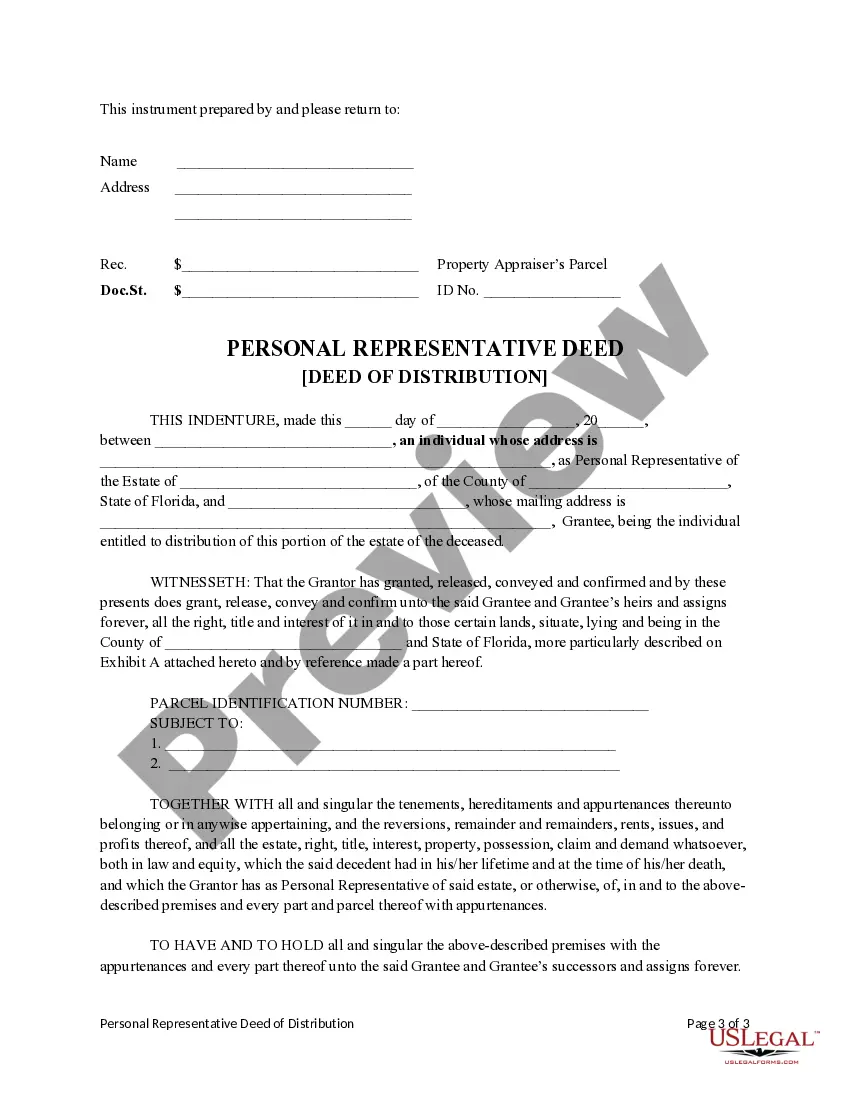

How to fill out Florida Personal Representative's Deed Of Distribution?

Creating legal documents from the ground up can occasionally feel a bit daunting. Some situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more budget-friendly method of producing the Florida Personal Representative Form For Estate or any other paperwork without unnecessary complications, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access state- and county-specific templates meticulously prepared by our legal professionals.

Utilize our service whenever you need a dependable and trustworthy platform to quickly find and download the Florida Personal Representative Form For Estate. If you’re already familiar with our site and have set up an account previously, just Log In to your account, find the template, and download it, or re-download it at any point from the My documents section.

Ensure that the form you choose complies with the rules and regulations of your state and county. Select the appropriate subscription plan to acquire the Florida Personal Representative Form For Estate. Download the form, then complete it, verify it, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and make form completion a straightforward and efficient process!

- Not registered yet? No worries.

- Setting it up is quick and easy, allowing you to browse the catalog.

- Before proceeding to download the Florida Personal Representative Form For Estate, consider these suggestions.

- Review the document preview and descriptions to confirm you’re looking at the correct document.

Form popularity

FAQ

Yes, an estate can be settled without probate in Florida under certain circumstances. If the deceased's assets are below a certain value, or if they were held in joint tenancy, you may be able to bypass the probate process. However, it is essential to ensure that you follow the correct procedures to avoid legal issues. Utilizing a Florida personal representative form for estate can provide guidance on how to manage this process effectively.

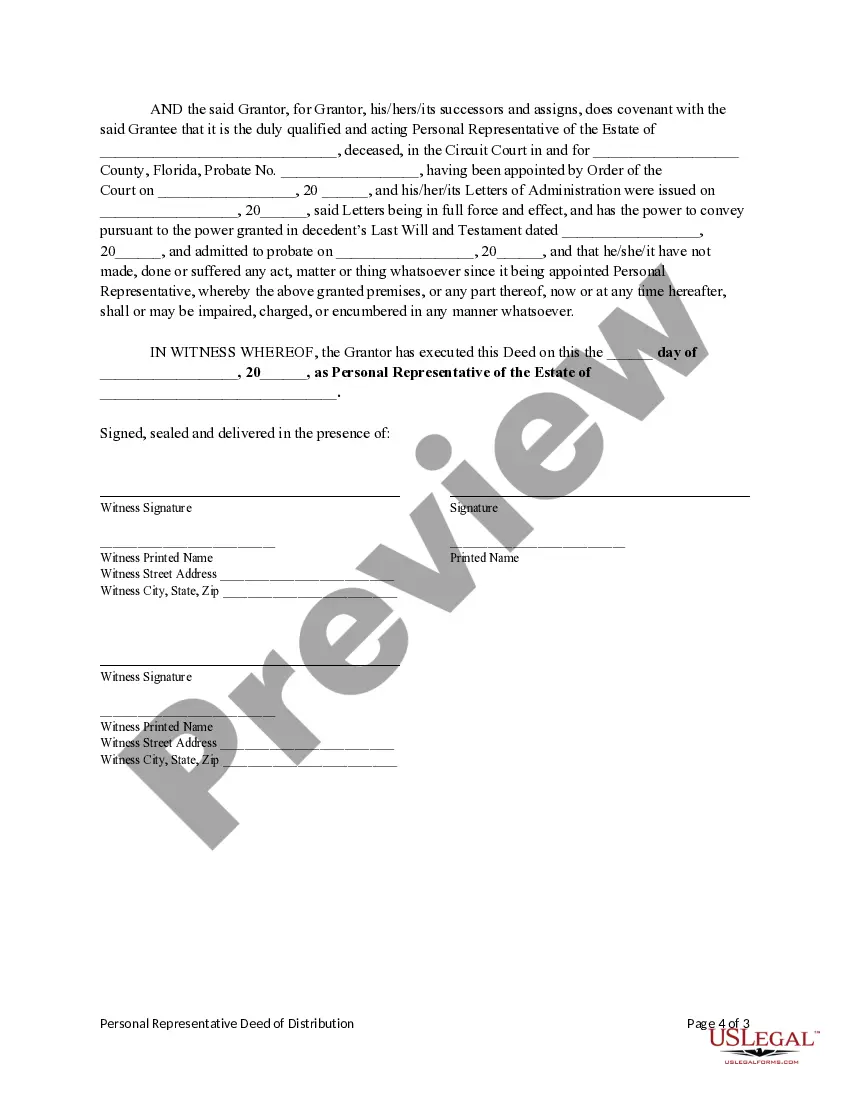

To become a personal representative in Florida, you must first be appointed by the probate court. You need to file a petition that includes a completed Florida personal representative form for estate, which outlines your qualifications and the deceased's assets. Additionally, you must be a Florida resident or related to the deceased in some way. Once the court approves your application, you can begin managing the estate’s affairs.

In Florida, an executor is a term often used interchangeably with personal representative, but they refer to the same role. A personal representative is appointed by the court to manage the estate of a deceased person. This role includes settling debts, distributing assets, and ensuring that the estate is handled according to Florida law. To simplify this process, using a Florida personal representative form for estate can help clarify your responsibilities and streamline the appointment.

Hear this out loud PauseDetermine your eligibility: In Florida, the personal representative of a probate estate must be at least 18 years old and have no felony convictions. You must also be a Florida resident, a close relative of the deceased, or a Florida resident who is related by marriage or adoption to the deceased.

Hear this out loud PauseFormal administration is required for any estate with non-exempt assets valued at over $75,000 when a decedent died less than two years ago. Formal administration is also required any time that a personal representative is needed to settle the affairs of the decedent.

In Florida, this role typically falls on the shoulders of the personal representative of the estate. Personal representatives, who some other states refer to as ?executors?, are generally nominated in a Will, but can also be appointed by the probate court in the absence of a Will.

Hear this out loud PauseWithin 1 year, distribute the assets: Once all the claims against the estate are satisfied, the personal representative can transfer the remaining assets to beneficiaries ing to the terms of the will. Or, if there is no will, following the state laws of inheritance. Close the estate.