Timeshare Pitch

Description

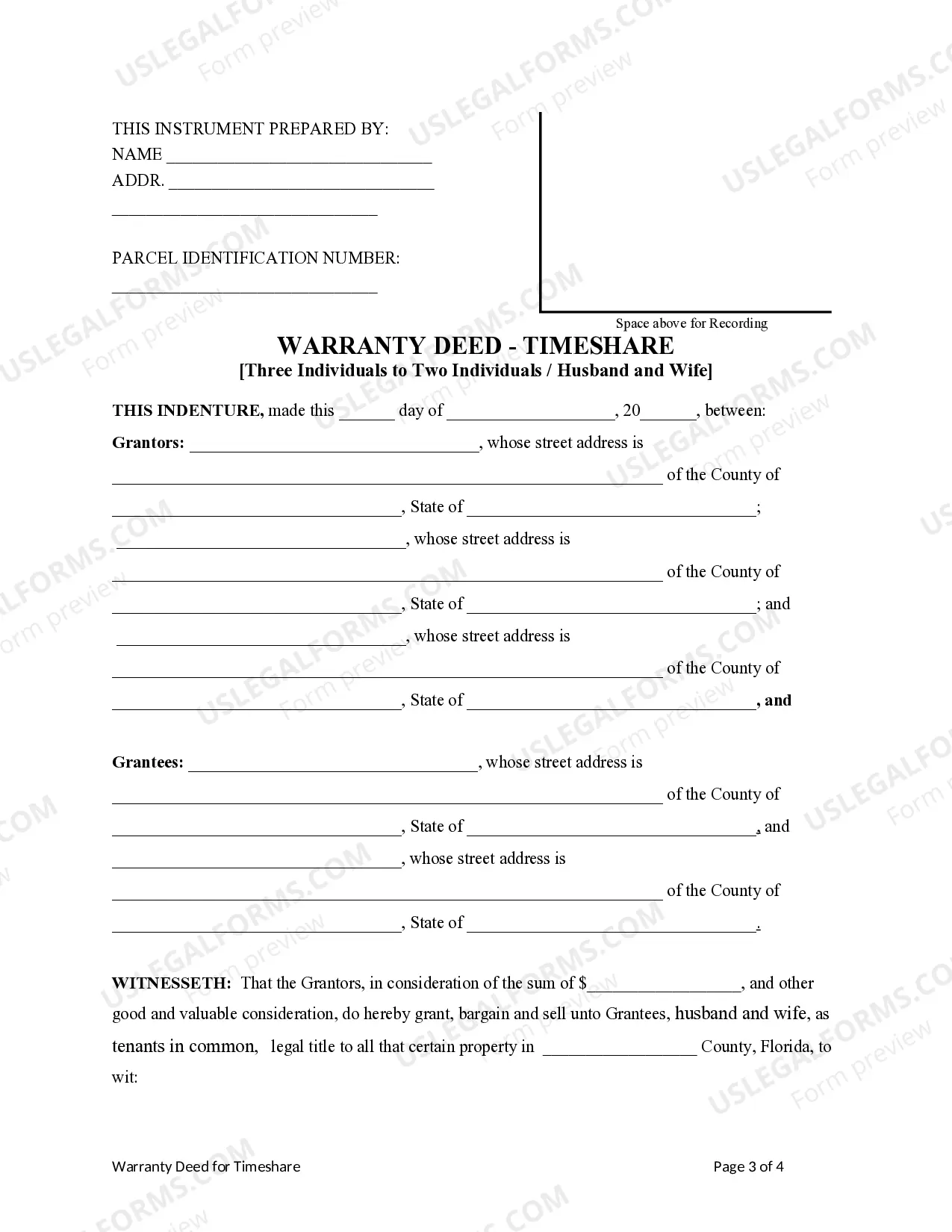

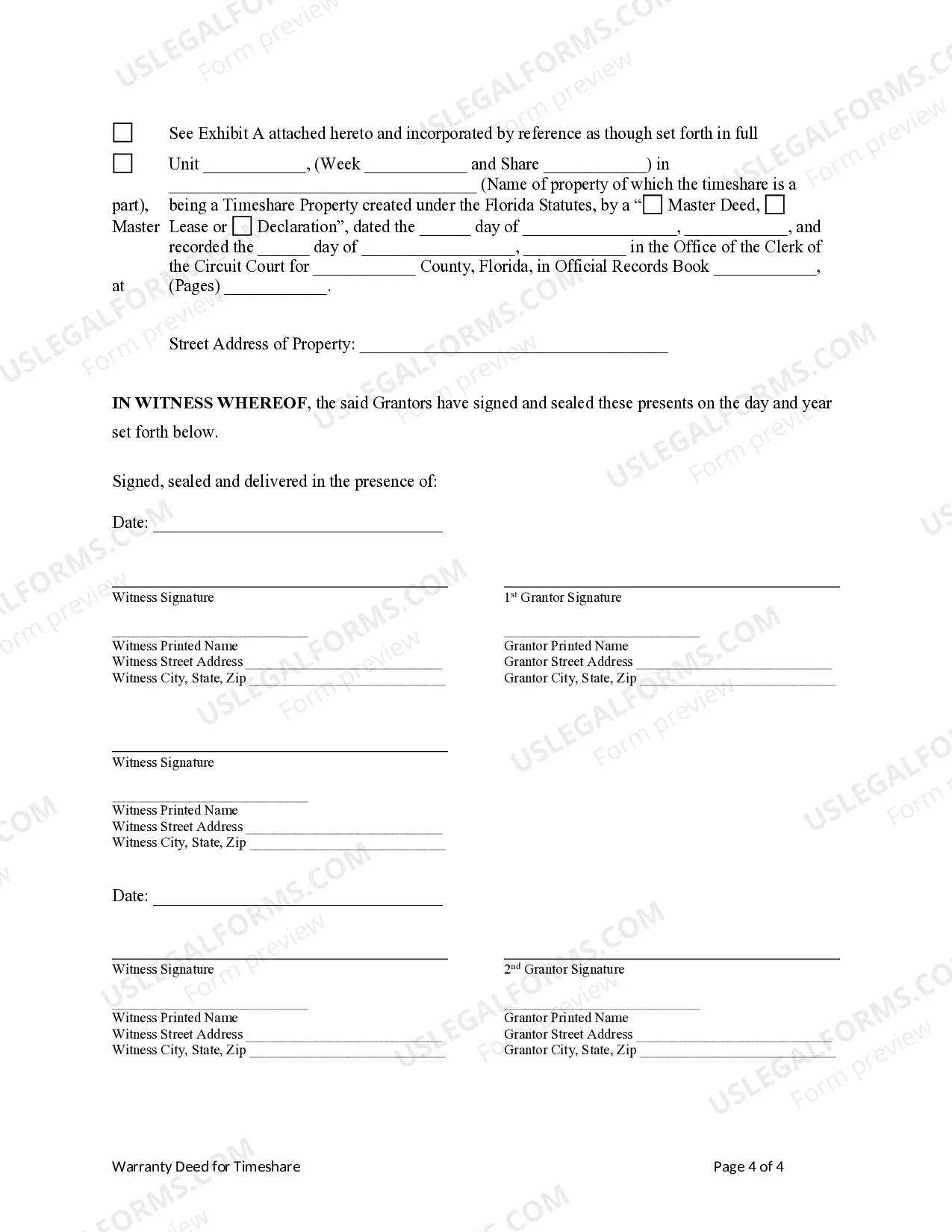

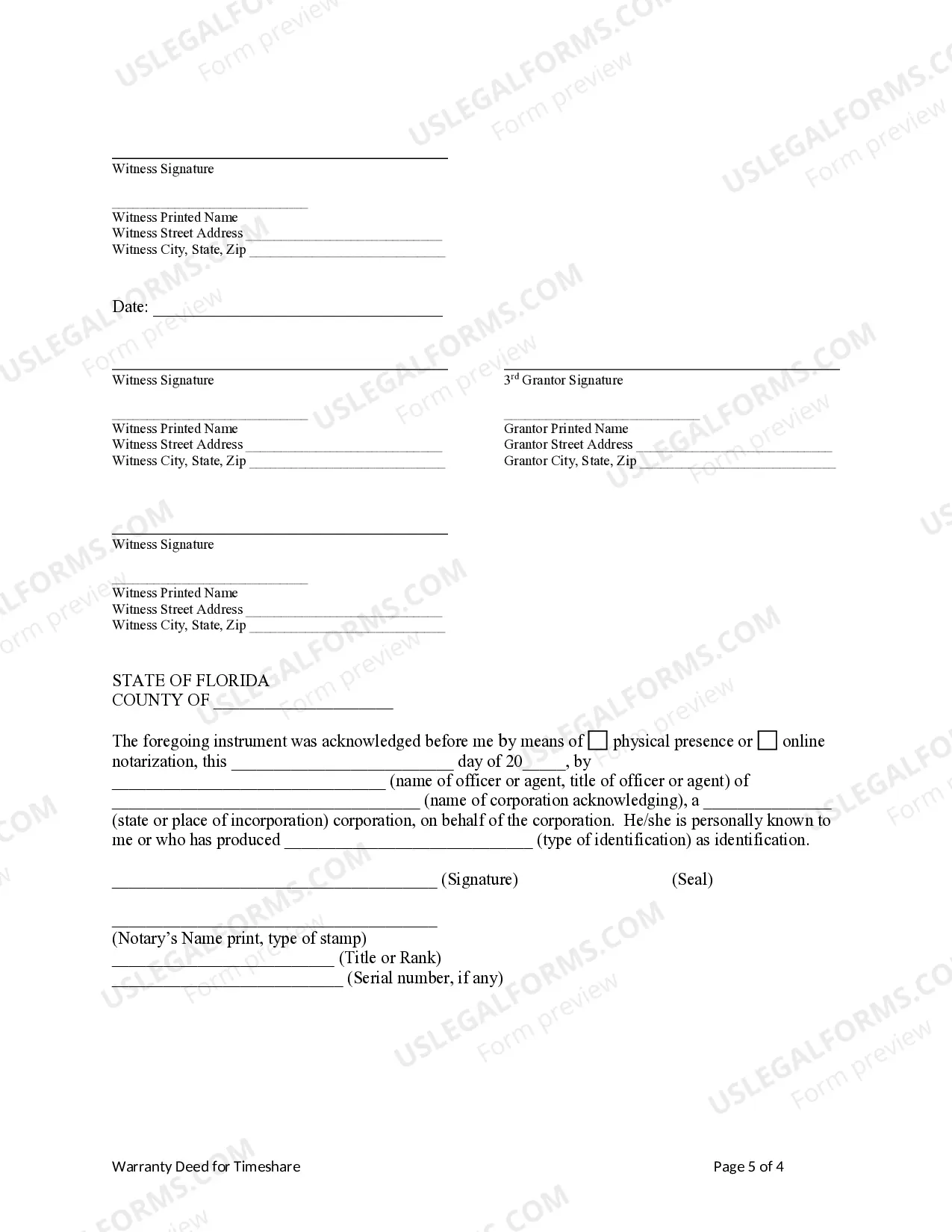

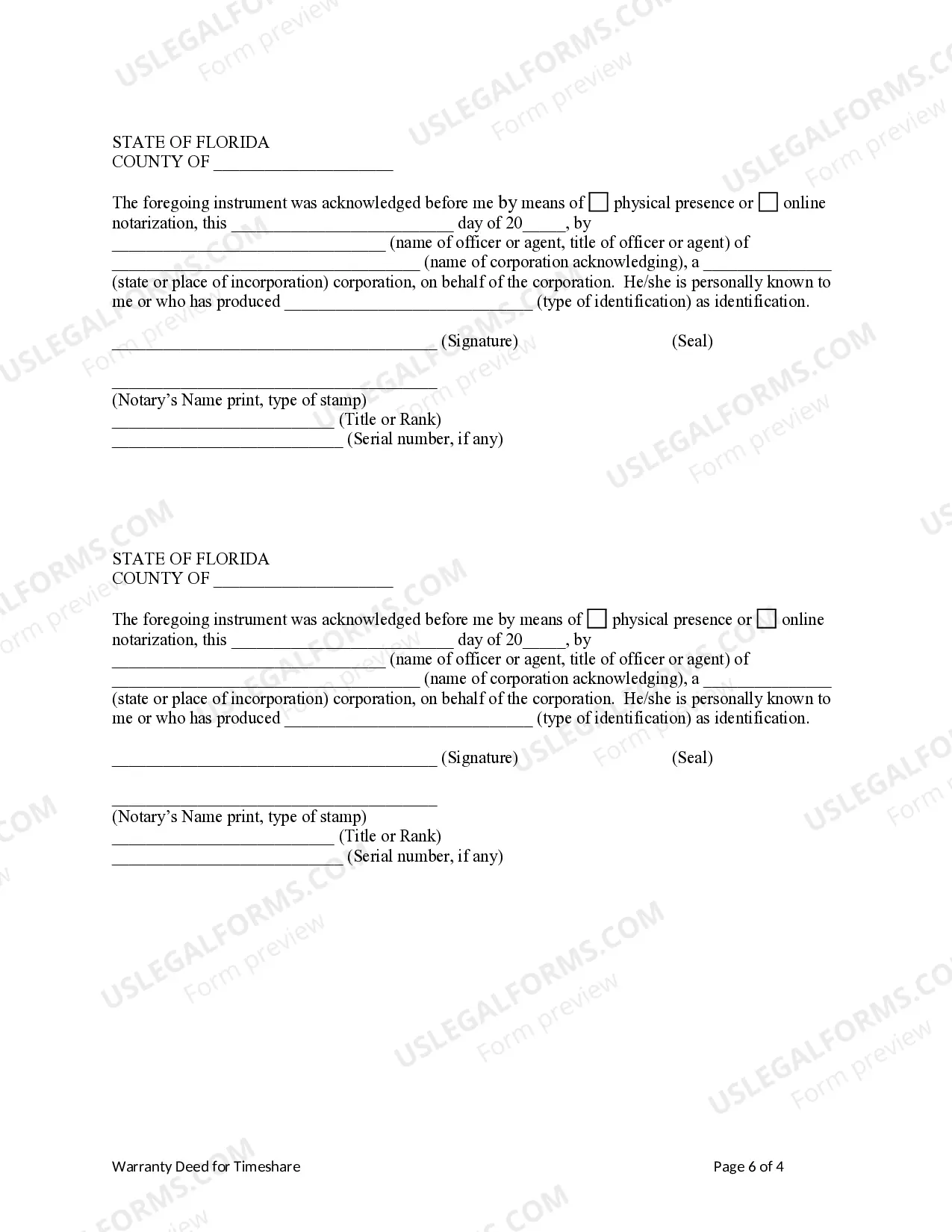

How to fill out Florida Warranty Deed - Timeshare - Three Individuals To Husband And Wife / Two Individuals?

- If you're a returning user, log in to your account and download the necessary template by clicking the Download button. Ensure your subscription is active; if it's not, renew it according to your selected plan.

- For first-time users, begin by reviewing the Preview mode along with the form descriptions to select the appropriate document that complies with your local jurisdiction's requirements.

- Should you need a different template, use the Search tab at the top to find a suitable option. Once you confirm it meets your needs, proceed to the next step.

- Purchase the desired document by clicking the Buy Now button, and select your preferred subscription plan. You will need to create an account to gain access to the complete library.

- Complete your transaction by entering your credit card information or using your PayPal account for payment.

- Finally, download the template to your device. You can find it later in the My Forms section of your profile.

US Legal Forms empowers individuals and attorneys by providing a comprehensive library of over 85,000 easily editable legal forms. This extensive collection ensures that you have more options at a comparable cost compared to other services.

By using US Legal Forms, you ensure that your timeshare pitch is backed by legally sound documentation. Start taking advantage of this resource today and secure your peace of mind!

Form popularity

FAQ

Claiming your timeshare on your taxes involves reporting any income from it, as well as documenting expenses like maintenance fees or repairs. You can deduct these expenses on Schedule E if you rent it out. Properly tracking your finances helps ensure you comply with tax regulations while maximizing benefits related to your timeshare.

To navigate a timeshare pitch successfully, be prepared with questions and clear on your financial limits. Maintain focus on your vacation needs rather than getting lost in the enticing offers presented. Remember, it's okay to walk away if the offer doesn't meet your expectations or priorities.

Timeshare pitches can provide valuable insights into vacation ownership benefits, often highlighting the financial aspects of owning a timeshare. However, it is important to do thorough research beforehand to ensure it aligns with your lifestyle and financial goals. Engaging with a reputable company, like US Legal Forms, can help you navigate the intricacies before making any decisions.

To report income from your timeshare, list it on your tax return under the income section. Use Schedule E for rental income, and include any expenses you incurred while generating this income. Remember, being honest and thorough can help you avoid any issues with the IRS.

Rental income from a timeshare is generally considered taxable income. You must report this income on your tax return and may face tax depending on your total earnings. Keep track of all expenses related to the rental, as these may be deductible, helping to reduce your taxable income.

The 1 in 4 rule states that if you rent out your timeshare more than once in a four-year period, you may lose some of the tax benefits associated with your property. This can impact how you report rental income and your ability to deduct related expenses. It is essential to consult a tax professional to understand how this rule applies to your specific situation.

To qualify for a timeshare presentation, you typically need to meet certain criteria set by the company hosting the event. Generally, this includes being at least 21 years old, earning a specific income level, and having a valid form of identification. Additionally, attending these presentations often requires a commitment to listen to the timeshare pitch fully, as they aim to provide valuable information about the ownership experience. If you have questions regarding the qualification process, US Legal Forms can assist you with the necessary documentation and details.

During a timeshare presentation, an energetic host will introduce you to the concept of vacation ownership. You will receive insights into the costs and perks of investing in a timeshare. Additionally, keep in mind that there will be a question-and-answer segment, allowing you to clarify any doubts. Always remember, you have the option to leave where you feel it is necessary.

At a timeshare pitch, expect a structured presentation that showcases vacation properties and ownership benefits. The sales team will detail how timeshare plans can offer affordable holiday experiences. You may participate in tours of the property or receive promotional materials. While the environment may feel inviting, be ready for a sales approach aimed at securing your commitment.

Whether it's worth sitting through a timeshare presentation depends on your interests and budget. If you are genuinely considering a timeshare, it may offer valuable insights. However, if you already know it's not for you, valuing your time might lead you to skip to find better opportunities.