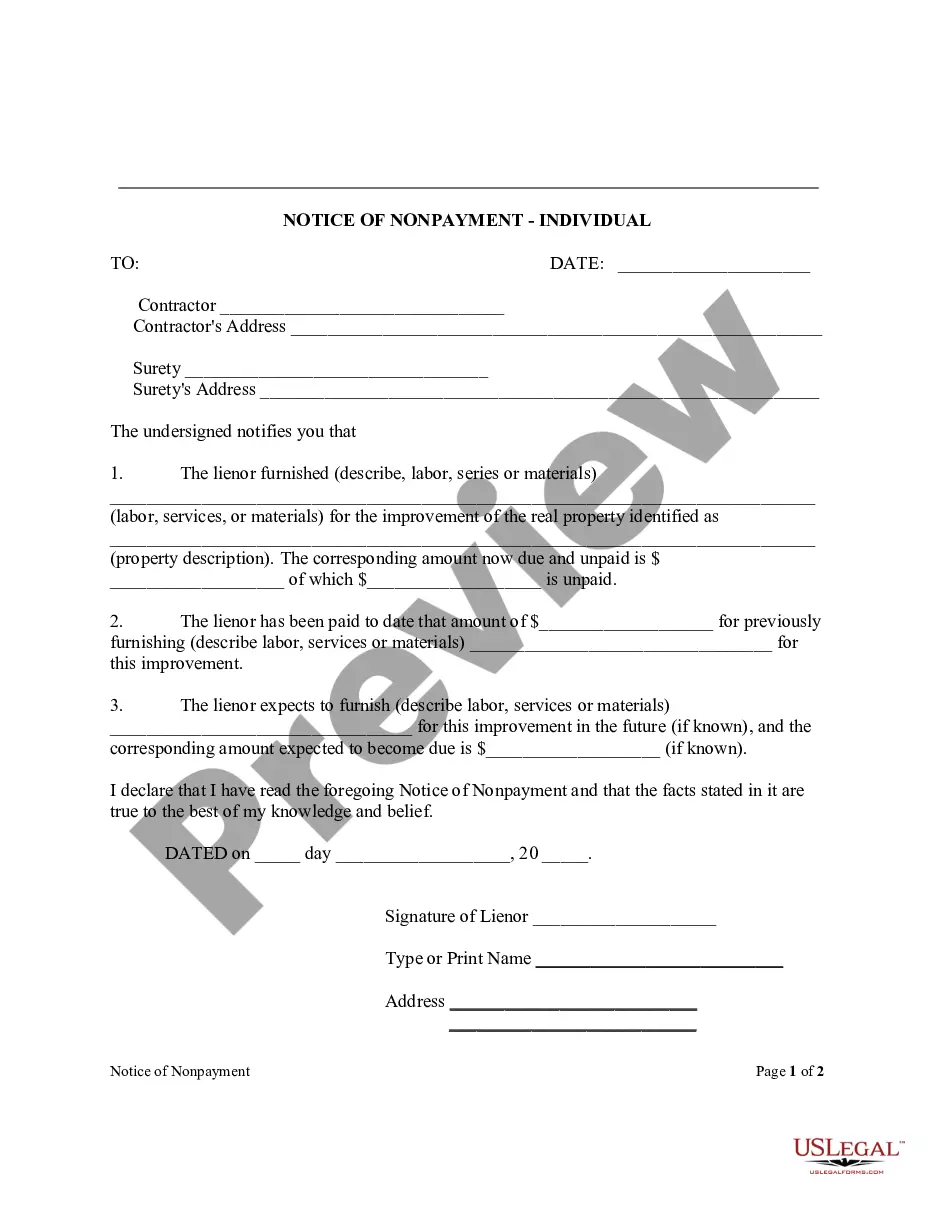

Florida Lien Law Notice Of Nonpayment Form

Description

Form popularity

FAQ

The Notice to Owner (NTO) process in Florida serves as a crucial step for contractors and suppliers seeking payment. When you file a Florida lien law notice of nonpayment form, you notify the property owner of potential claims related to unpaid work. This process helps protect your rights as a claimant in the construction process. Utilizing platforms like USLegalForms can simplify the NTO filing, ensuring you meet all legal requirements efficiently.

The lien law 713.06 in Florida outlines the procedures for property owners and contractors regarding payment disputes. It emphasizes the importance of using the Florida lien law notice of nonpayment form to formally notify parties when payment is overdue. This legal document serves as a crucial step in safeguarding the rights of subcontractors and suppliers. Knowing how to effectively use this notice can significantly impact your ability to recover unpaid debts.

An NOC, or Notice of Computation, in Florida is used to inform parties of the amounts owed under a contract or agreement. Its main purpose is to outline any discrepancies and facilitate communication regarding payments. By incorporating the Florida lien law notice of nonpayment form, it can enhance clarity, leading to a smoother resolution of payment disputes.

In Florida, you cannot file a lien without first sending a Notice to Owner (NTO) if you are a subcontractor or supplier. The NTO is necessary for establishing your claim to the property. If you use the Florida lien law notice of nonpayment form, it can assist in documenting that you have followed the required steps before filing a lien.

In Florida, the timeline for a notice to owner (NTO) is critical to ensure your rights are protected. Typically, you must send the NTO within 45 days from the date you commenced work or delivered materials. Using the Florida lien law notice of nonpayment form properly within this timeframe can help secure your right to file a lien against the property in case of nonpayment.

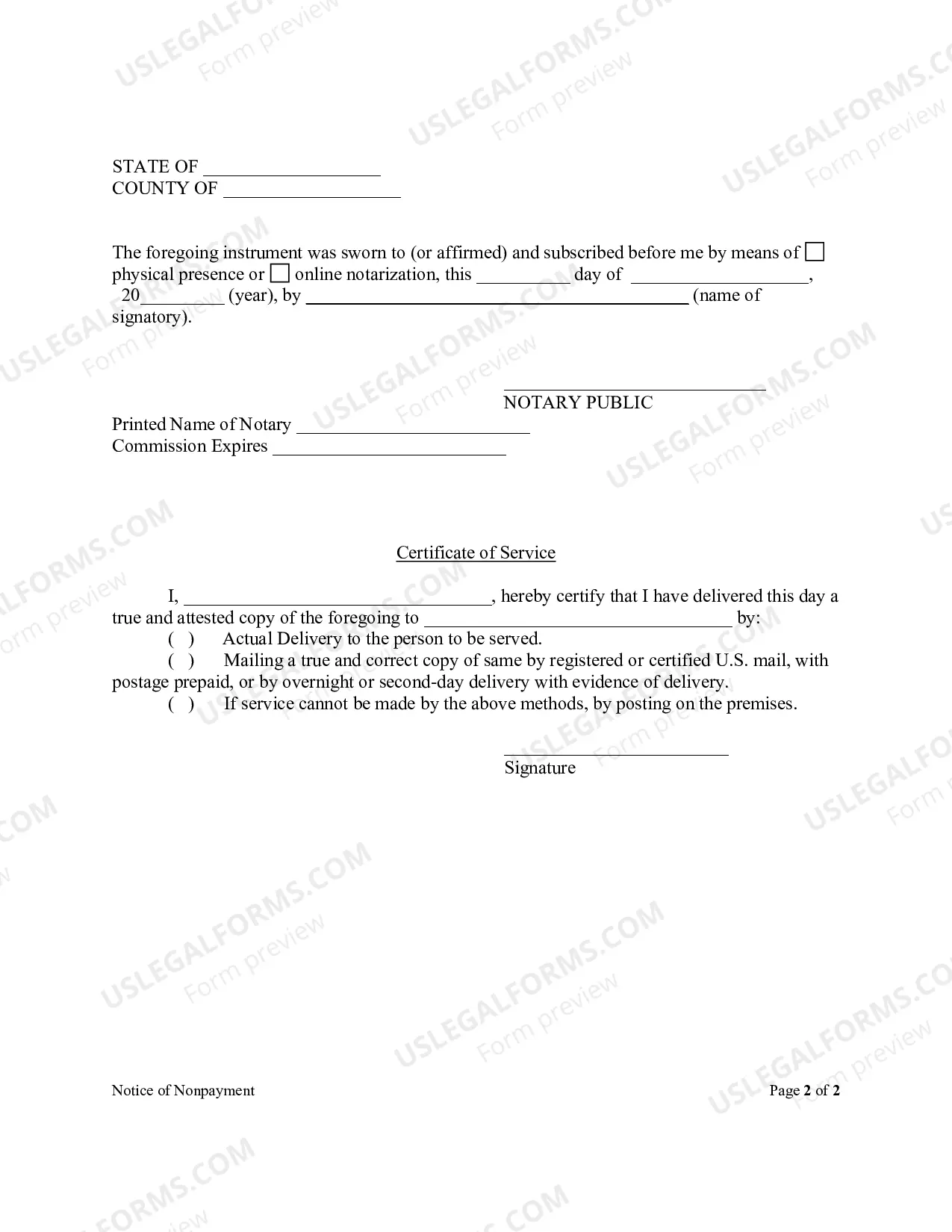

The notice of nonpayment form in Florida serves as a formal notification that payment has not been received for services or materials provided. This document helps to alert the property owner and other parties involved about the outstanding balance. Utilizing the Florida lien law notice of nonpayment form is essential for creating a paper trail, which can be crucial for any future legal actions.

In Florida, it is possible to file a lien without sending a notice to owner, but doing so can limit your ability to enforce the lien effectively. For certain parties, like contractors who have a direct contract with the property owner, sending a notice to owner strengthens their claim and facilitates payment. Utilizing the Florida lien law notice of nonpayment form in conjunction with a notice to owner helps protect your right to receive compensation for services rendered. It is generally advisable to adhere to notification requirements to avoid complications.

In Florida, the notice to owner requirement specifies that parties involved in construction projects notify the property owner about their work in a timely manner. This formally alerts the owner of the parties that may claim a lien if they do not receive payment, giving them an opportunity to settle before a lien is filed. Using the Florida lien law notice of nonpayment form can help facilitate communication regarding outstanding payments and avoid potential disputes. Ensure you deliver the notice within the specified timeframe to protect your rights.

To place a lien on someone's property in Florida, file a claim using the Florida lien law notice of nonpayment form along with relevant details about the debt owed. You need to ensure that all information is complete, including the property owner's name and a clear description of the property. After filing, it is crucial to follow up to confirm that the lien has been recorded properly. This recording gives you a legal claim against the property for the unpaid debt.

To file a lien for unpaid work in Florida, you should start by completing the appropriate forms, including the Florida lien law notice of nonpayment form. Next, you need to file these documents with the county clerk where the property is located. Be sure to include all required documentation and details about the work performed and the payment due. This process will help you secure your right to collect payment for your services.