Waiver Release Lien With The Irs

Description

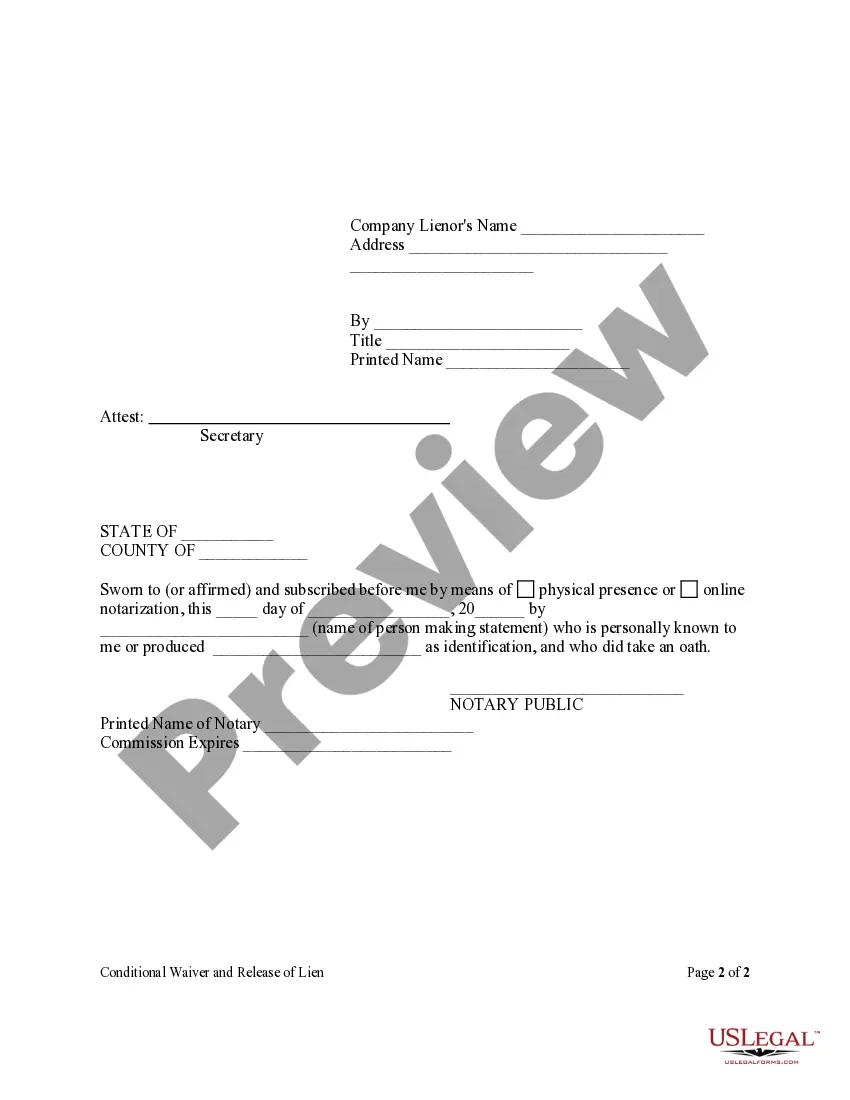

How to fill out Florida Conditional Waiver And Release Of Lien Upon Final Payment - Corporation Or LLC?

Creating legal documents from the ground up can frequently be daunting. Certain situations may require extensive research and significant financial investment.

If you're looking for a simpler and more cost-effective method to prepare the Waiver Release Lien With The Irs or any other documents without unnecessary complications, US Legal Forms is always accessible.

Our online repository of more than 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can promptly obtain state- and county-compliant forms meticulously prepared for you by our legal experts.

Utilize our platform whenever you require a dependable and trustworthy service through which you can effortlessly find and download the Waiver Release Lien With The Irs. If you're already familiar with our services and have previously registered an account, simply Log In to your account, locate the form, and download it or access it again later in the My documents section.

Verify that the template you choose complies with your state and county regulations. Select the appropriate subscription plan to acquire the Waiver Release Lien With The Irs. Download the document, then fill it out, authenticate it, and print it. US Legal Forms boasts a strong reputation and over 25 years of experience. Join us today and simplify your document completion process!

- Not registered yet? No worries.

- It takes minimal time to sign up and browse the catalog.

- Before proceeding to download the Waiver Release Lien With The Irs, follow these guidelines.

- Review the form preview and descriptions to ensure you have selected the correct document.

Form popularity

FAQ

To obtain more information about the lien, contact the Attorney General's Office. For business taxes call 1-888-246-0488. For individual taxes call 1-888-301-8885.

Hear this out loud PauseOhio Judgment Law Attorney General's Office need only refile a tax lien every 15 years in Common Pleas Court to keep the lien operative against the tax debtor. A lien must be canceled after 40 years.

60. Under M.G.L. c. 60 § 52, municipalities may sell tax obligations to third-party investors at several points in the tax foreclosure process (as receivables, liens or tax titles) to raise immediate revenue.

How To Invest In Tax Liens Consider What Type of Property You Want to Buy. Contact Your County Office For Auction Information. Research Available Properties. Attend the Tax Lien Auction and Bid. Pay Back the Debt On the Tax Lien. Collect Payments From the Property Owner.

A federal tax lien comes into being when the IRS assesses a tax against you and sends you a bill that you neglect or refuse to pay it. The IRS files a public document, the Notice of Federal Tax Lien, to alert creditors that the government has a legal right to your property.