A corporate owner may terminate the period of effectiveness of a notice of commencement by executing, swearing to, and recording a notice of termination.

Form Construction Mechanic Corporation For Sale

Description

How to fill out Florida Notice Of Termination Of Notice Of Commencement Form - Construction - Mechanic Liens - Corporation Or LLC?

- Begin by logging in to your existing US Legal Forms account. Make sure your subscription is active; if not, renew it based on your payment plan.

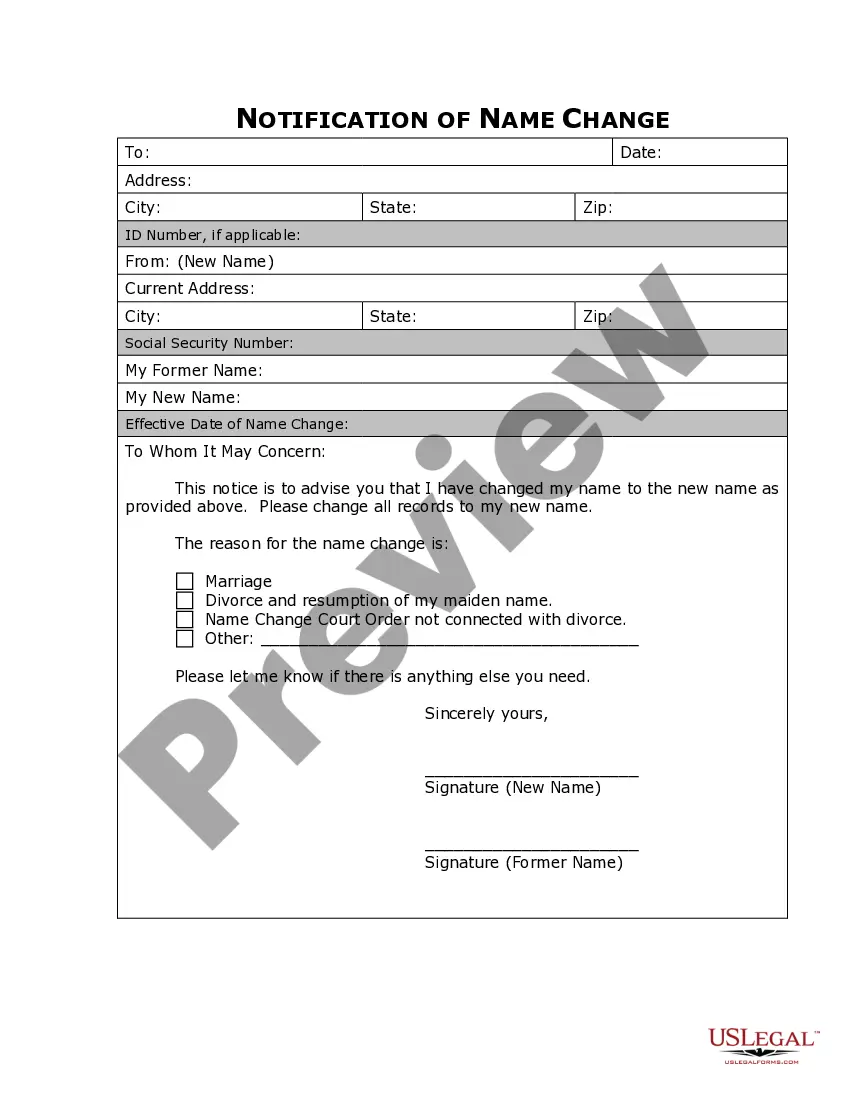

- If this is your first visit, browse through the preview and description of the form to ensure it aligns with your needs and local jurisdiction.

- If you find discrepancies or need a different template, utilize the search feature to locate the correct one.

- Once you have the desired document, select the 'Buy Now' option and choose your preferred subscription plan. You will need to create an account.

- Complete your purchase by entering your payment details, either through a credit card or your PayPal account.

- After payment, download the form to your device. You can also revisit your form anytime from 'My Forms' in your profile.

By following these simple steps, you'll quickly have access to the legal forms you need.

Don't hesitate—start your documentation journey with US Legal Forms today and ensure everything is legally sound!

Form popularity

FAQ

In Texas, a mechanic's lien typically lasts for one year from the date it is filed. However, it can be extended if legal action is taken within that timeframe. Understanding the duration of such liens is critical when considering a form construction mechanic corporation for sale to ensure you are making informed decisions.

As mentioned earlier, a mechanic's lien is not a general lien. It specifically relates to the property where the work occurred and ensures that contractors receive payment for their services. This clear distinction is vital to remember, especially if you are navigating options like a form construction mechanic corporation for sale.

In most cases, a lien cannot be placed on property without prior notification to the property owner. The law generally requires that homeowners receive a notice before a lien is filed, allowing them a chance to settle any disputes. This process emphasizes the benefit of understanding your rights when considering a form construction mechanic corporation for sale.

To place a lien, certain conditions must be met. Typically, the work must be performed, and payment must be due but not received. Additionally, the contractor or supplier must adhere to specific notification and filing requirements, which you can review when investigating a form construction mechanic corporation for sale.

No, a mechanic’s lien is not considered a general lien. It specifically attaches to the property where the work was performed and is used to secure payment for labor or materials. When exploring options like a form construction mechanic corporation for sale, understanding this distinction is crucial for protecting your investment.

In Minnesota, specific rules govern how liens are filed and enforced. Generally, contractors must provide a notice of intent to file a lien before taking action, and the lien must be recorded within 120 days after the last work was performed. This ensures that homeowners are informed about potential claims against their property, which is useful when looking for a form construction mechanic corporation for sale.

The minimum amount for a mechanics lien can vary by jurisdiction, but it is often set at $500 or higher. Familiarizing yourself with local laws will help you ensure you meet this minimum requirement before filing. Accurate understanding of lien amounts protects your rights when owed for work done. If you are engaged with a Form construction mechanic corporation for sale, knowing these amounts is crucial for your financial operations.

The key difference between 1099-NEC and 1099-MISC lies in the types of payments reported. The 1099-NEC is specifically for non-employee compensation, while the 1099-MISC covers a broader range of payments. Understanding these differences is important for accurate tax reporting. If you plan on a Form construction mechanic corporation for sale, knowing these distinctions can save you from confusion during tax season.

C corporations typically do not require 1099 forms for their payment transactions, as these entities are generally exempt from this reporting. However, if the corporation earns income as an independent contractor, you would issue a 1099-NEC for those earnings. This distinction helps simplify your reporting obligations to the IRS. If you're exploring a Form construction mechanic corporation for sale, careful compliance with reporting regulations is always beneficial.

In Oregon, specific rules govern the filing of mechanics liens, including deadlines and documentation requirements. Generally, a lien must be filed within 75 days of project completion, and there are particular forms that need to be submitted. Understanding these rules can prevent complications and keep your transactions valid. If your ventures include a Form construction mechanic corporation for sale, familiarize yourself with Oregon's lien regulations for peace of mind.