Lien Liability Company With The Us

Description

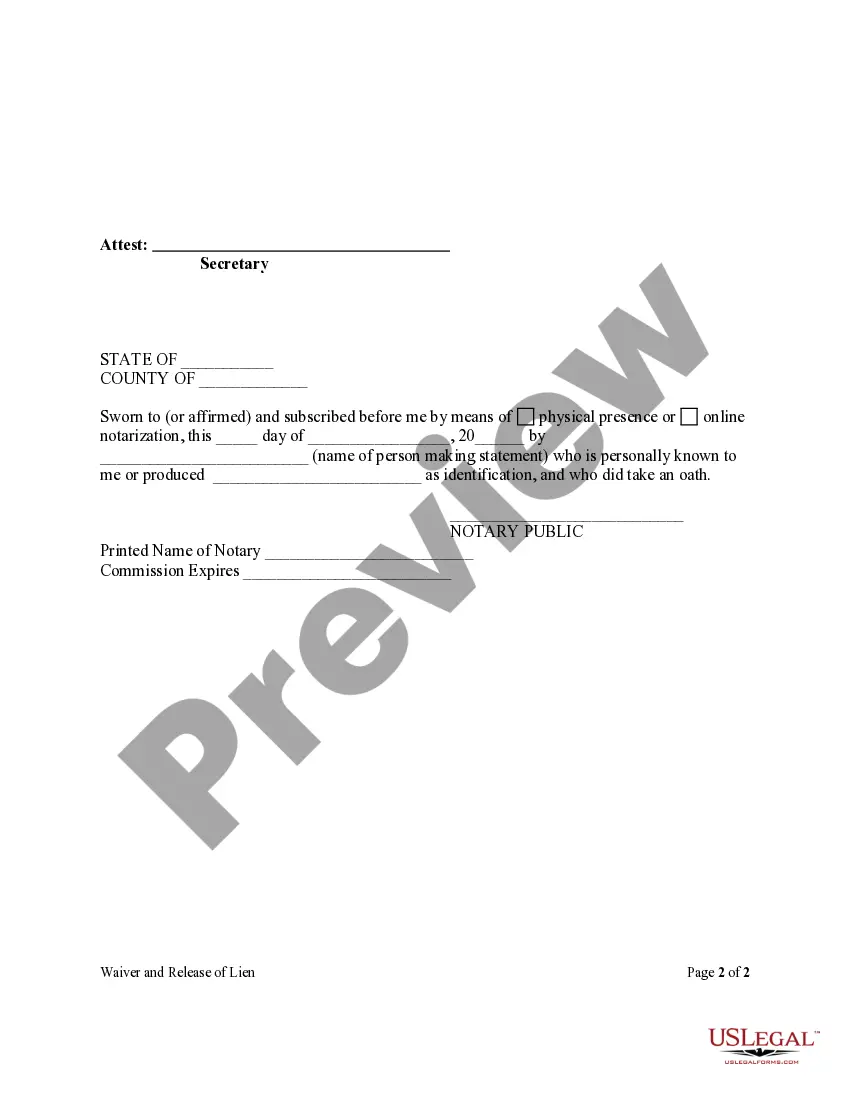

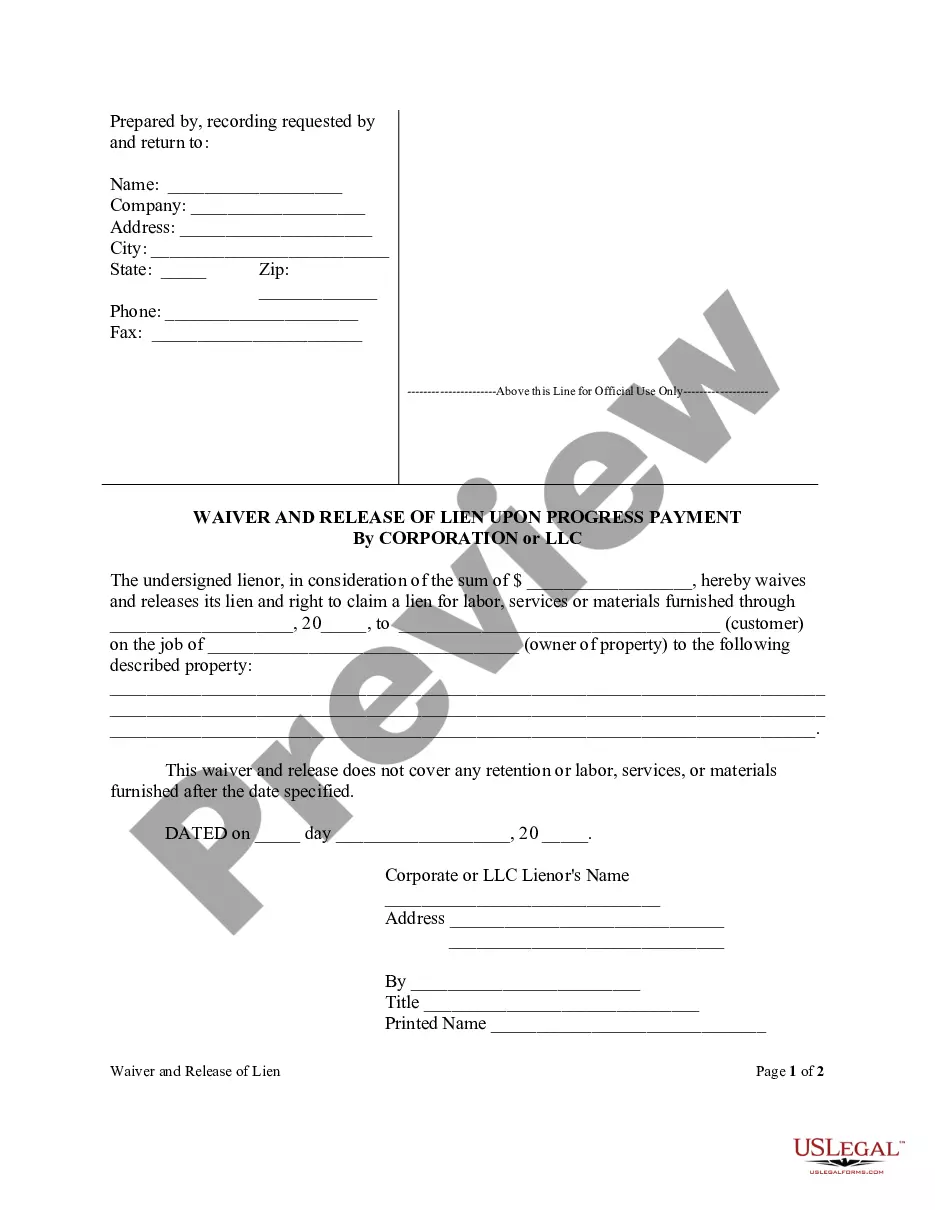

How to fill out Florida Waiver And Release Of Lien Upon Final Payment Form - Construction - Mechanic Liens - Corporation Or LLC?

- Log in to your account if you’re a returning user and click on the Download button for your desired form. Ensure your subscription is active; otherwise, renew it as needed.

- For first-time users, start by browsing the available forms. Check the Preview mode and descriptions to confirm the document fits your needs and complies with local jurisdiction requirements.

- If you cannot find the appropriate template, use the Search tab to locate a suitable form. If found, proceed to the next step.

- Purchase the document by clicking on the Buy Now button, select your preferred subscription plan, and create an account for access to the library.

- Make your payment using a credit card or PayPal to complete your purchase.

- Download your selected form and save it to your device. Access it anytime from the My Forms menu in your profile.

US Legal Forms offers an extensive library with over 85,000 editable documents, making it more robust than competitors. Plus, assistance from premium experts ensures your forms are completed accurately and legally.

Take control of your legal documentation today with US Legal Forms. Start simplifying your process now!

Form popularity

FAQ

To perform a lien search on a company, you can access public records from the Secretary of State or local court systems. Online databases may also be available for convenience. If you’re involved in a lien liability company with the US, using platforms like USLegalForms can simplify the search process, providing access to important documents efficiently.

If a title search reveals a lien, the property owner will face restrictions on property usage and potential legal actions from the lienholder. This situation can complicate sales or refinancing options. For businesses within a lien liability company with the US, addressing the lien promptly can help restore clear title and access to financial opportunities.

Yes, you can find out if there is a lien on a title through a lien search conducted at your local property records office. This search will reveal any existing claims against the property. If you're involved with a lien liability company with the US, conducting this search is a critical step before making property transactions, ensuring clarity and security.

A lien search typically takes a few days to several weeks, depending on the jurisdiction and the complexity of the search. Local government offices handle these requests, and delays may occur if they are busy. When dealing with a lien liability company with the US, investing time in a thorough search can prevent potential legal issues down the line.

Yes, the IRS can place a lien on an LLC for unpaid taxes. This lien serves as a declaration that the government has a claim against the LLC's assets. If you operate a lien liability company with the US, being proactive about your tax obligations can prevent this from happening. Regular tax assessments help keep your LLC protected.

A title search focuses on verifying the ownership and legal rights to a property, while a lien search uncovers existing liens against it. Title searches often reveal any claims or encumbrances on the property’s title. For those involved in a lien liability company with the US, understanding these differences informs your decisions and protects your interests.

To put a lien against a company, you need to file a legal document known as a lien notice with your local jurisdiction. This procedure varies by state and can include specific forms and fees. If you’re dealing with a lien liability company with the US, working with a legal professional may streamline this process. Correct documentation ensures the lien is enforceable.

Yes, the IRS can put a lien on a business if taxes remain unpaid. This lien attaches to the business’s assets and acts as a legal claim. If you run a lien liability company with the US, awareness of this risk is vital. Addressing tax obligations promptly can help avoid such situations.

Yes, the IRS can target your LLC for unpaid taxes or debts. If your LLC falls behind on tax payments, the IRS may take action, including placing liens on your business assets. Being aware of this potential risk is essential when establishing a lien liability company with the US, as understanding your obligations can help mitigate these risks.

Yes, the IRS can place a lien on your LLC for unpaid taxes. This legal claim secures the government's interest in your business assets until the debt is resolved. If you own a lien liability company with the US, it's crucial to address any tax issues promptly to avoid complications.