Lien Liability Company For Insurance

Description

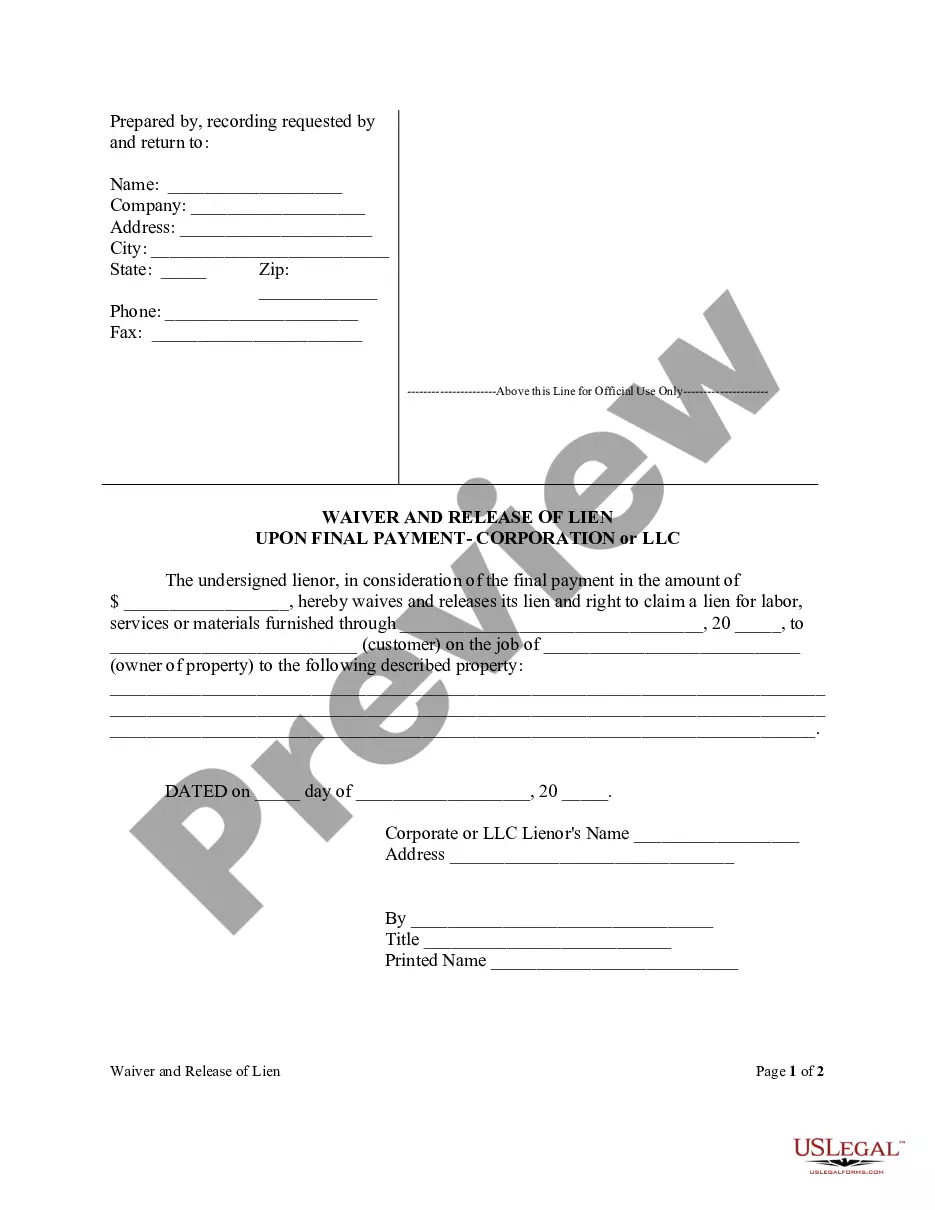

How to fill out Florida Waiver And Release Of Lien Upon Final Payment Form - Construction - Mechanic Liens - Corporation Or LLC?

- If you’re a returning user, log in to access your account and select the form you need, ensuring your subscription is active. If required, renew your plan.

- For first-time users, begin by reviewing the preview mode and description of your desired form to confirm it aligns with your local jurisdiction.

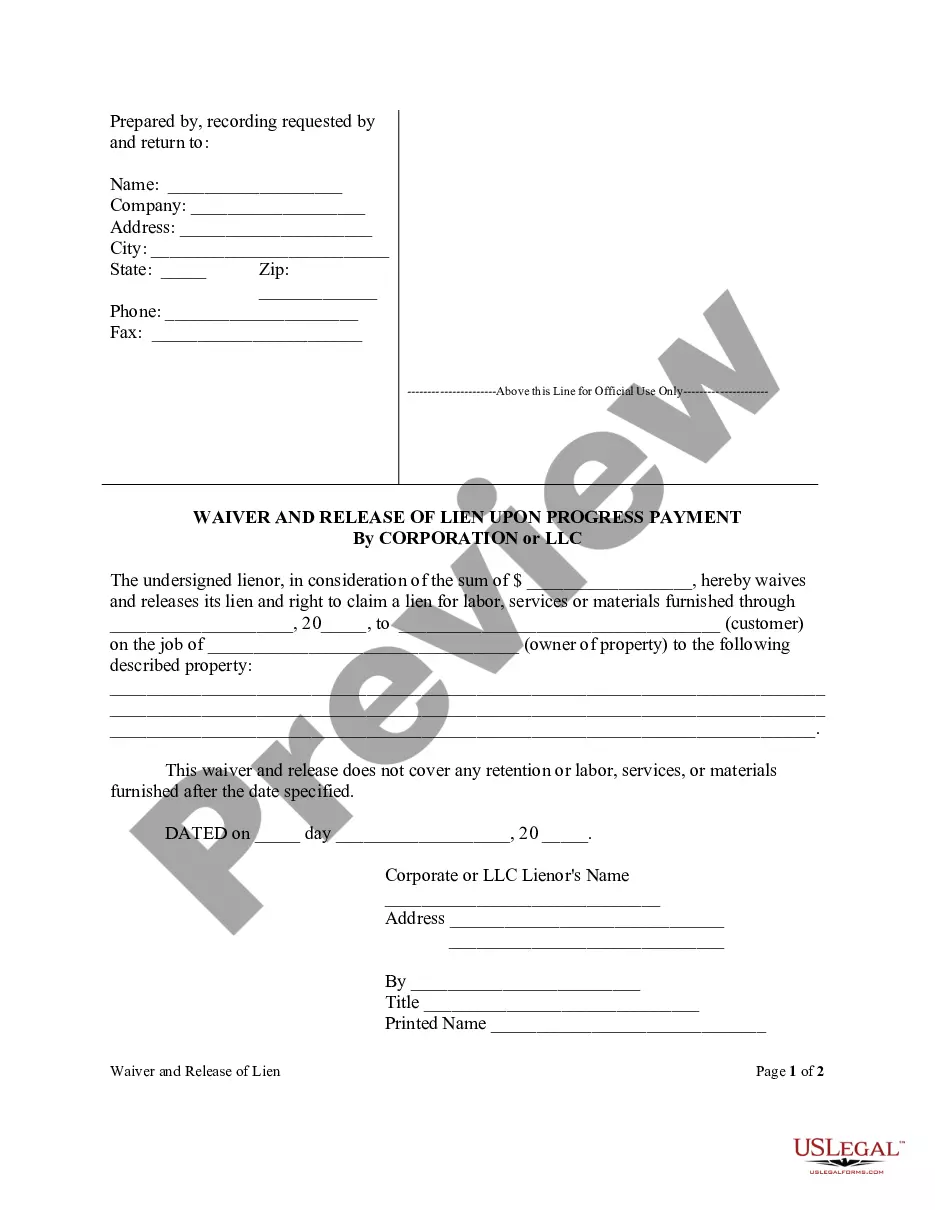

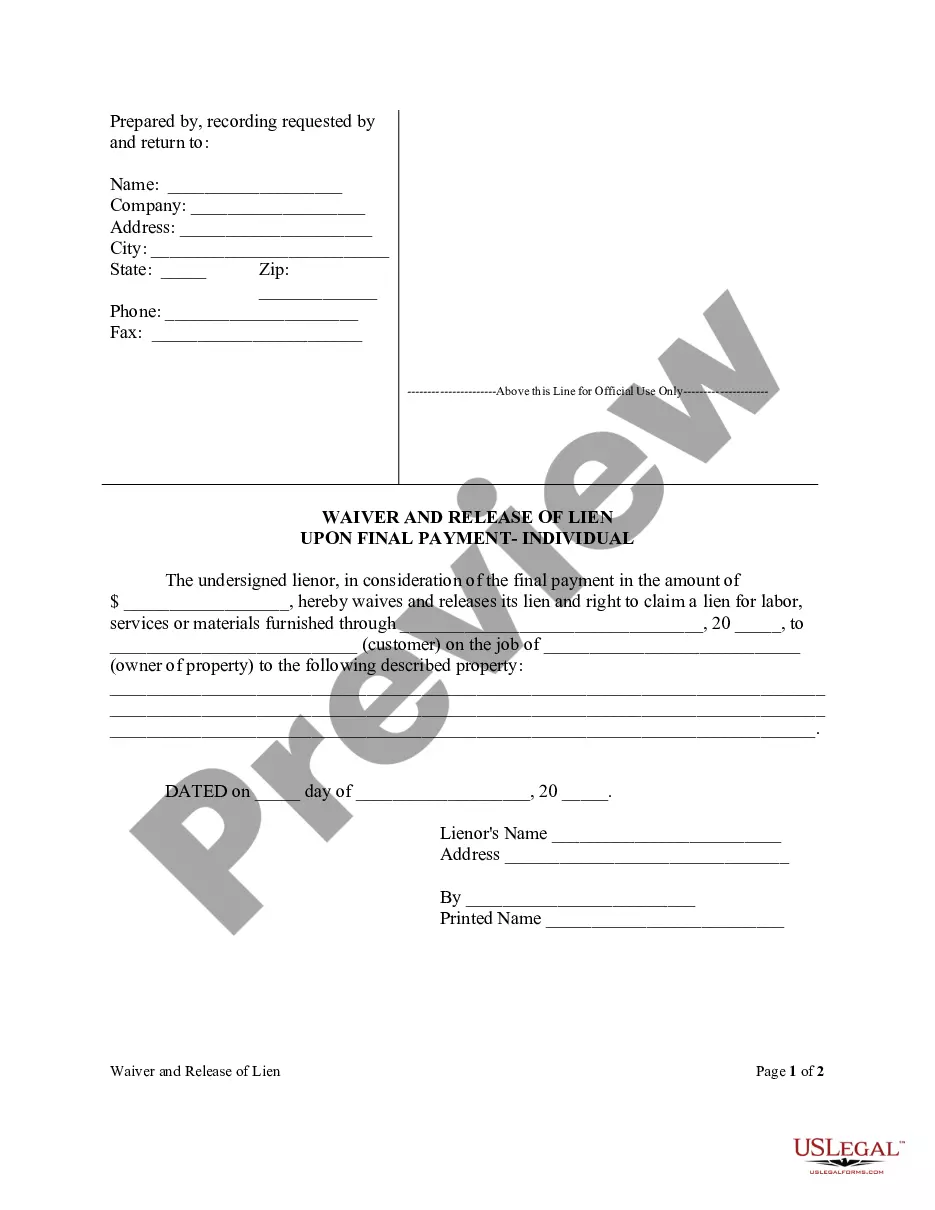

- If you identify a need for a different template, utilize the Search tab to locate the correct form. Once found, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. Note that creating an account is necessary for full access.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Finally, download your form and save it to your device. You can also access it anytime through the My Forms section in your profile.

US Legal Forms ensures that individuals and attorneys can efficiently generate legal documents with its extensive collection of over 85,000 editable forms. This resource minimizes the time and complexity often associated with legal paperwork.

Ready to get started? Visit US Legal Forms today to streamline your document preparation process and gain confidence in your legal needs.

Form popularity

FAQ

Completing a lien release involves filing a formal document that clears the lien from your title or property. It is important to follow the specific guidelines your lien liability company for insurance provides, as each state may have different requirements. You can simplify the process by using uslegalforms, which offers templates and guidance to ensure everything is done correctly.

Depositing an insurance check made out to both you and your lienholder usually requires both signatures. This process ensures that both parties agree to the payment and allows the lien liability company for insurance to manage their interests effectively. If you need assistance, you can use uslegalforms to understand the process better and access the right forms.

Your lienholder appears on your insurance check because they have a financial interest in the asset being insured. This ensures they receive payment in case of a claim, protecting their investment. The lien liability company for insurance acts as a safeguard for both you and the lienholder, ensuring that debts are settled properly.

The duration of lien resolution can vary widely based on several factors, including the complexity of the case and local laws. Typically, the lien resolution process can take from a few weeks to several months. Engaging a lien liability company for insurance can help expedite the process, as they understand the legal requirements and can navigate the complexities on your behalf. Staying proactive and responsive during this time is crucial for a quicker resolution.

Yes, an insurance company can put a lien on your house under certain circumstances. This usually happens if you default on payments or have an outstanding debt related to your policy. When an insurance company files a lien, it secures their financial interest in your property. It's advisable to communicate with a lien liability company for insurance to understand your rights and obligations.

To add a lien to your insurance, first, contact your lien liability company for insurance. They will guide you through the necessary documentation and provide you with the steps to follow. Typically, you will need to fill out specific forms and submit them along with any required information about your property. Once processed, the lien will be officially added to your insurance policy.

The lienholder is listed on your car insurance policy because they have a financial stake in your vehicle. This ensures that any damage to the car is covered by your insurance, protecting their interest. If you are using a lien liability company for insurance, clarifying this aspect of your policy is essential.

When an insurance company takes liability, it means they assume financial responsibility for a claim under specific circumstances. This usually occurs in cases where you, the policyholder, are at fault for an accident. Understanding this relationship is crucial, especially when dealing with lien liability companies for insurance.

To add a lienholder to your insurance policy, contact your lien liability company for insurance and provide them with the lienholder’s information. This process usually involves submitting a form or making a request via their online platform. They will guide you through the necessary steps to ensure the lienholder is recognized in your coverage.

Liability insurance typically does not cover damages caused by an unlicensed driver in an accident. Insurance companies view the lack of a license as a significant risk factor. It’s advisable to check with your lien liability company for insurance for specific policy limitations and coverage details.