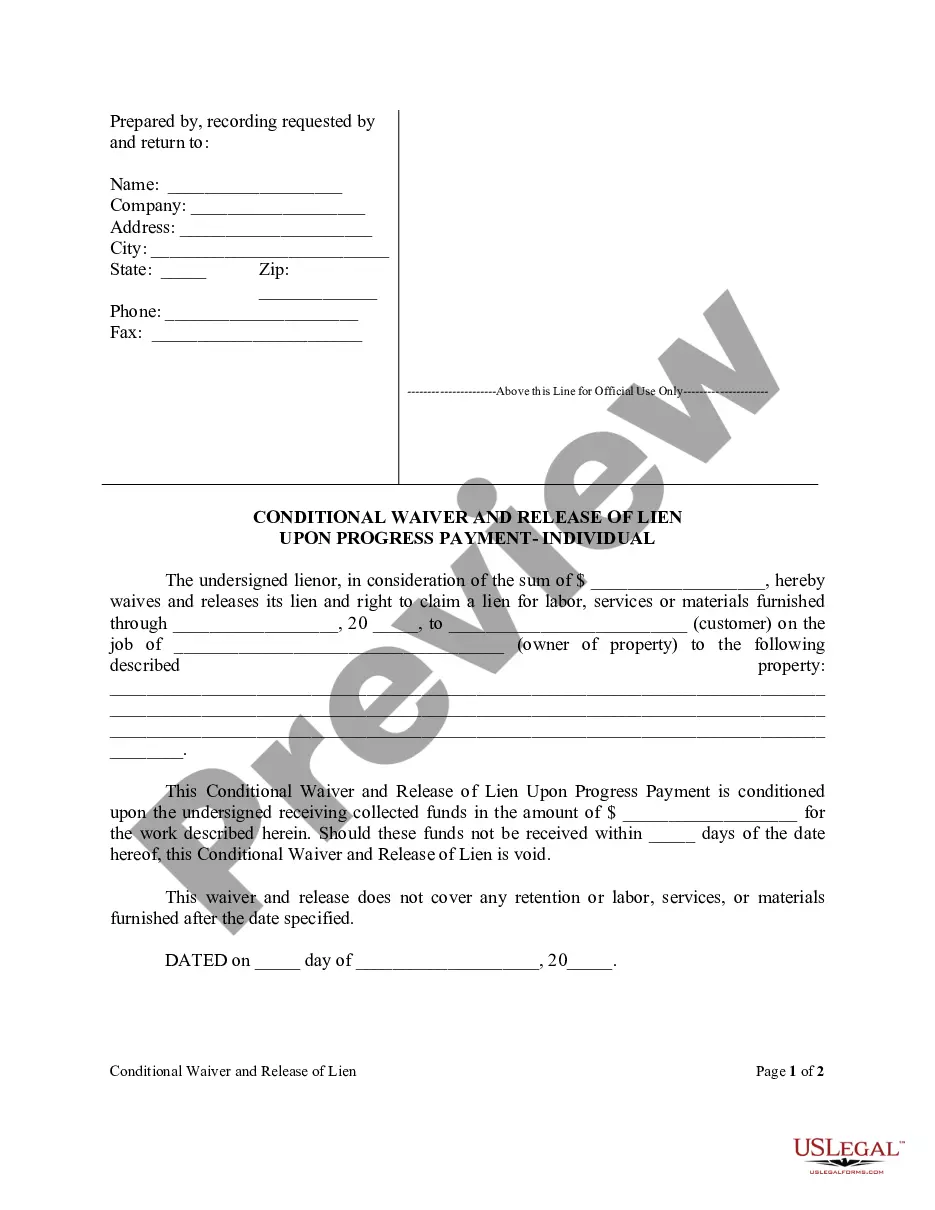

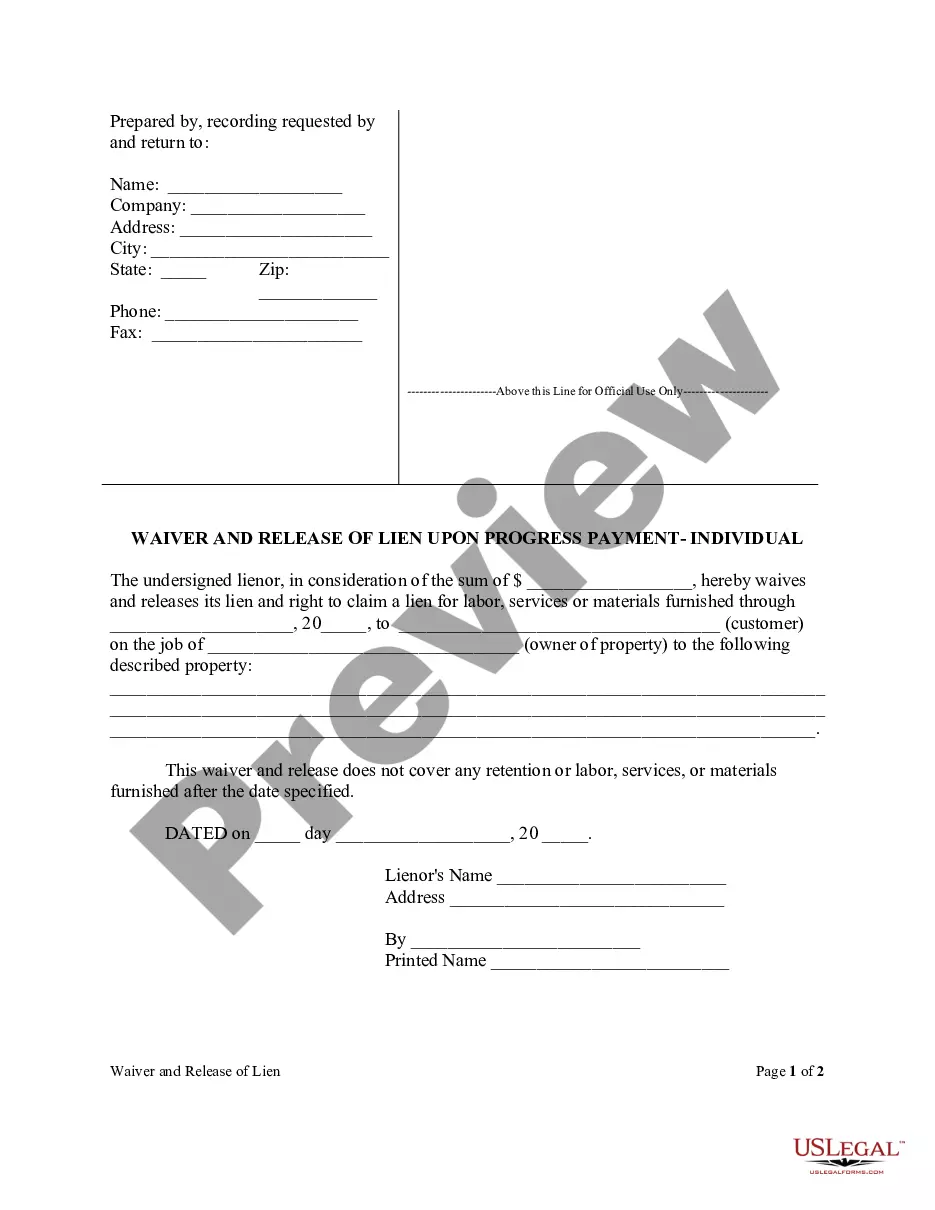

Partial Lien Release Florida With Lien Release

Description

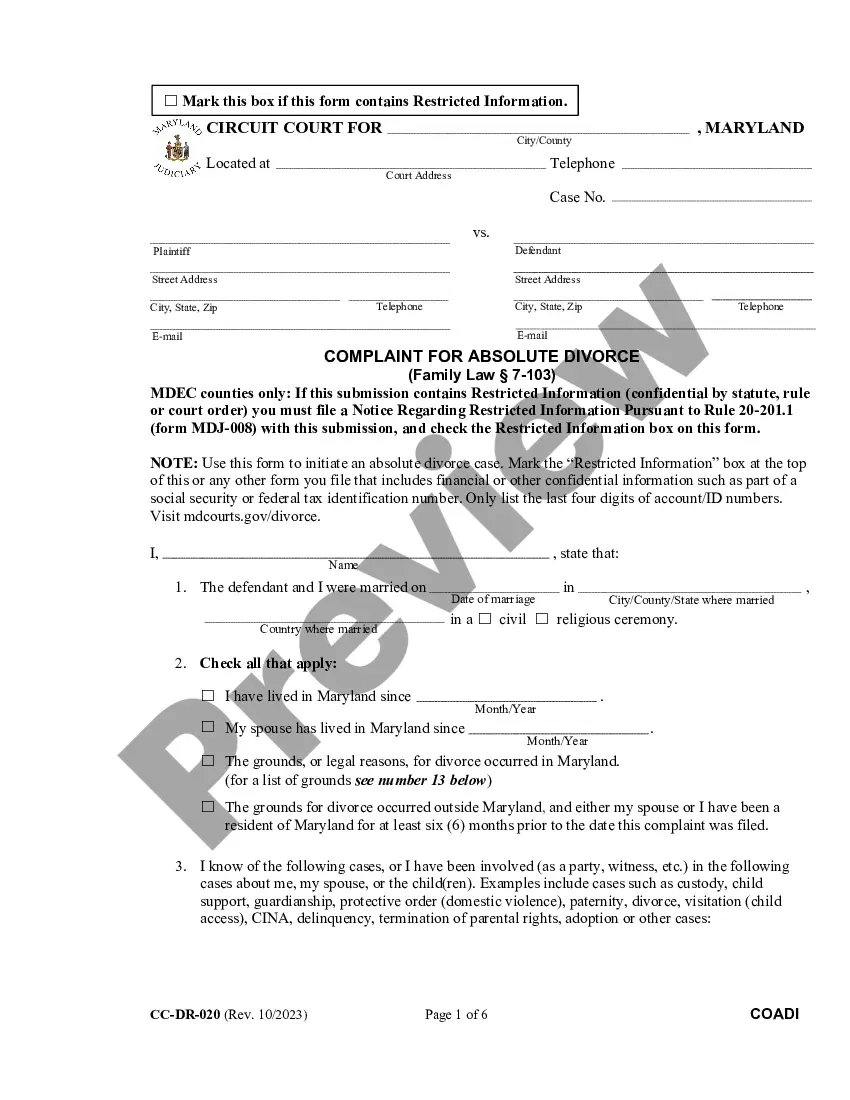

How to fill out Florida Conditional Partial Release And Waiver Of Lien Form - Construction - Mechanic Liens - Individual?

Creating legal documents from the ground up can frequently feel somewhat daunting.

Certain situations may necessitate extensive research and significant financial expenditure.

If you're in search of a more straightforward and budget-friendly method for producing Partial Lien Release Florida With Lien Release or any other forms without the hassle of bureaucratic red tape, US Legal Forms is continuously available to assist you.

Our digital repository of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs.

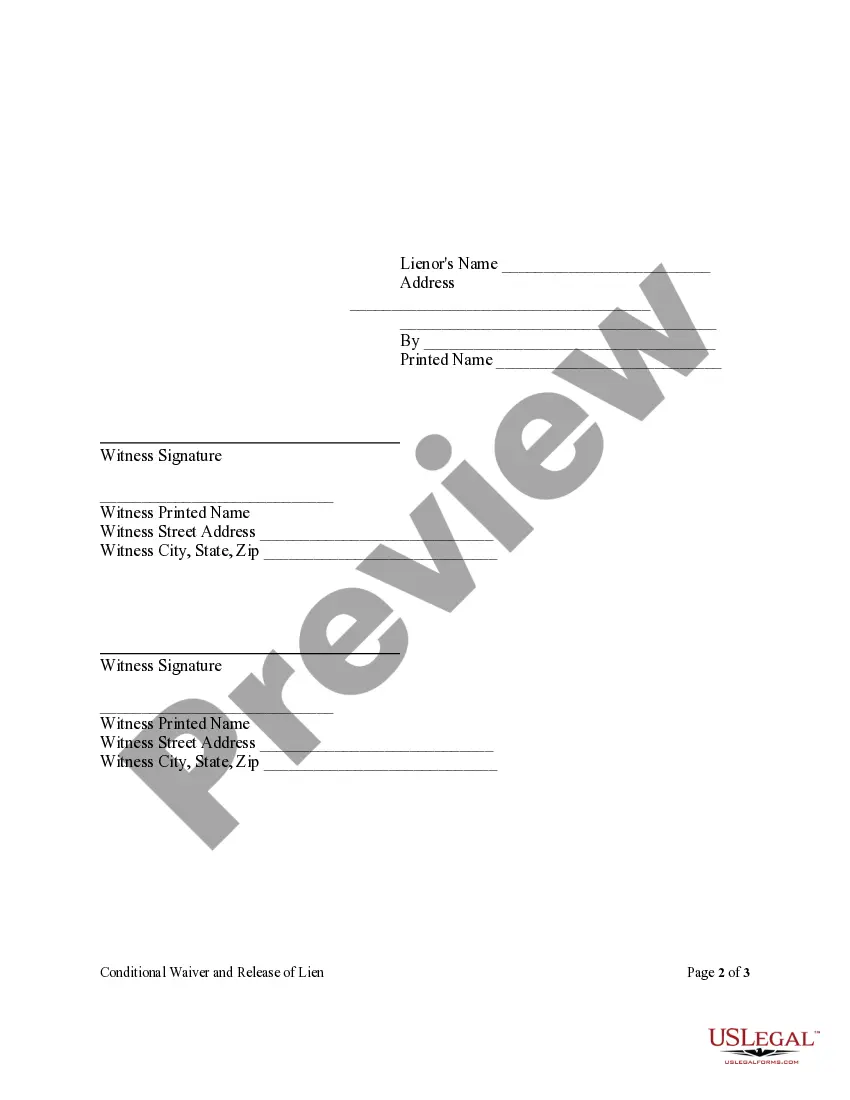

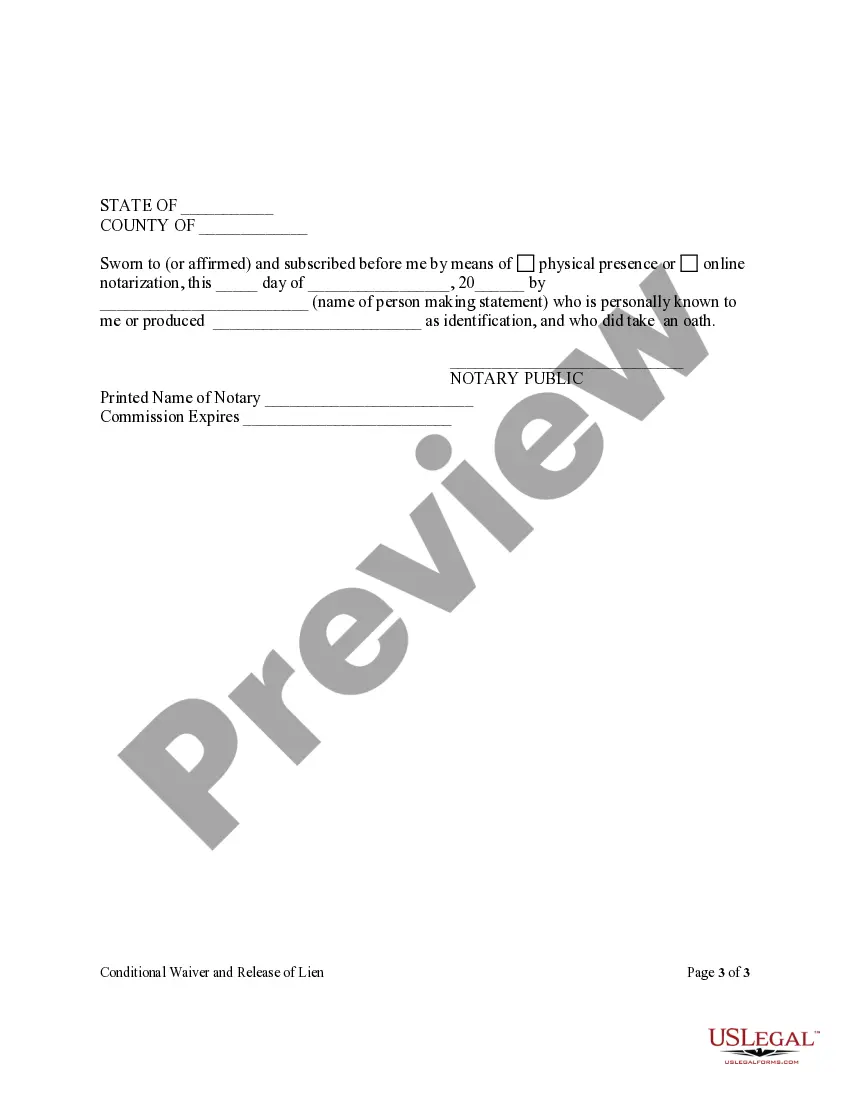

However, before proceeding to download Partial Lien Release Florida With Lien Release, please adhere to these suggestions: Verify the document preview and details to ensure you have located the correct form. Confirm that the template you select adheres to the laws and regulations of your region. Choose the most suitable subscription plan to acquire the Partial Lien Release Florida With Lien Release. Download the file, then fill it out, sign it, and print it. US Legal Forms boasts a stellar reputation and over 25 years of experience. Enlist with us now and make document management a straightforward and efficient process!

- With only a few clicks, you can swiftly access state- and county-compliant forms meticulously prepared for you by our legal professionals.

- Utilize our website anytime you require a dependable and trustworthy service through which you can effortlessly discover and download the Partial Lien Release Florida With Lien Release.

- If you're already familiar with our site and have set up an account before, just sign in to your account, find the form, and download it or retrieve it anytime from the My documents section.

- Don't possess an account? No worries. It takes minimal time to create it and explore the library.

Form popularity

FAQ

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

See Amended Returns. Most taxpayers qualify to electronically file their Connecticut income tax return.

Amended returns for prior years can be filed using Form CT-1120X for the applicable year. Combined unitary filers should continue to use Form CT-1120CU, Combined Unitary Corporation Business Tax Return, to file amended returns.

IRS Free File Guided Tax Preparation Options Do your taxes online for free with an IRS Free File provider. If your adjusted gross income (AGI) was $73,000 or less, review each provider's offer to make sure you qualify. Some offers include a free state tax return.

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

File and pay Form CT-1040 electronically using myconneCT at portal.ct.gov/DRS-myconneCT. The Connecticut Department of Revenue Services (DRS) urges you to electronically file your 2022 Connecticut state income tax return.

Free tax help is available to lower-income residents through the Volunteer Income Tax Assistance program East Hartford VITA, 840 Main Street, East Hartford, 860-290-4329. Manchester VITA, 78 N Main St, Manchester, 860-236-4511. The Village South, 331 Wethersfield Ave, 860-236-4511.

Does Connecticut tax-free week apply to online purchases? The short answer is yes ? online purchases of items under $100 are exempt during Connecticut's sales tax-free week. However, you must pay for the items in full when you place your online order.