Form Mechanic Llc Blank For Business

Description

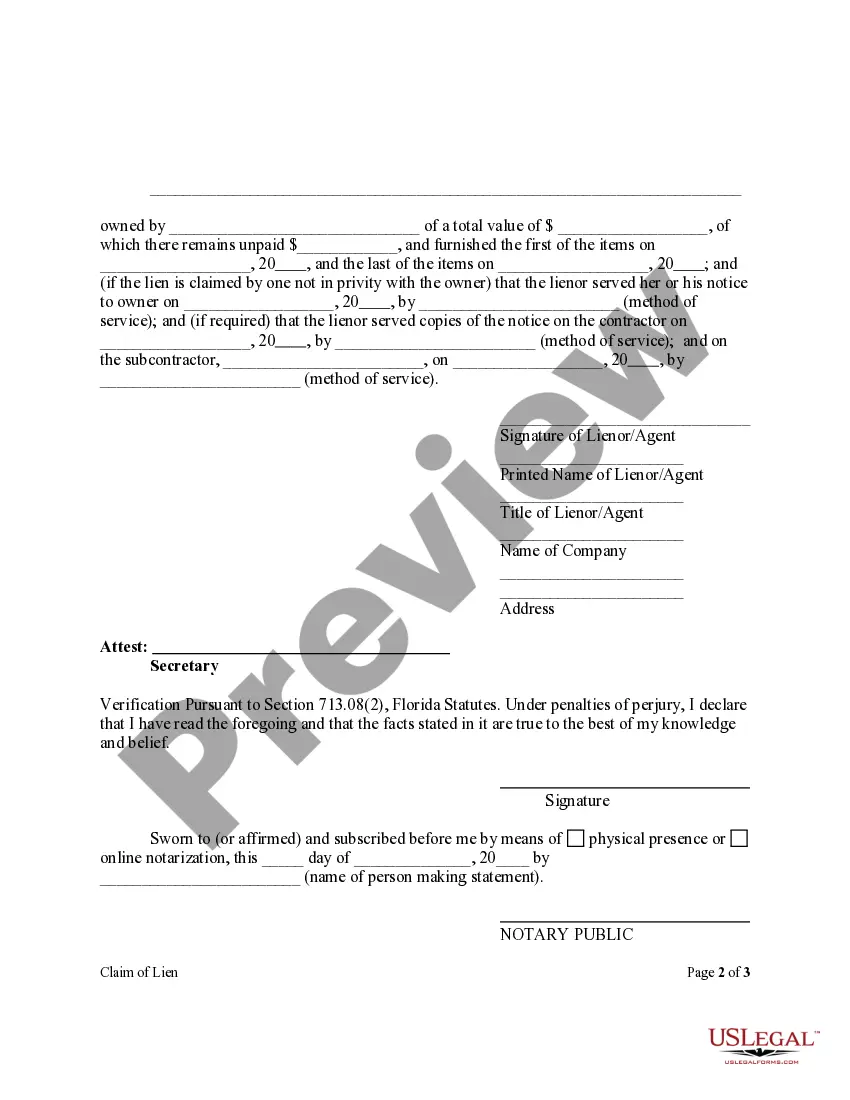

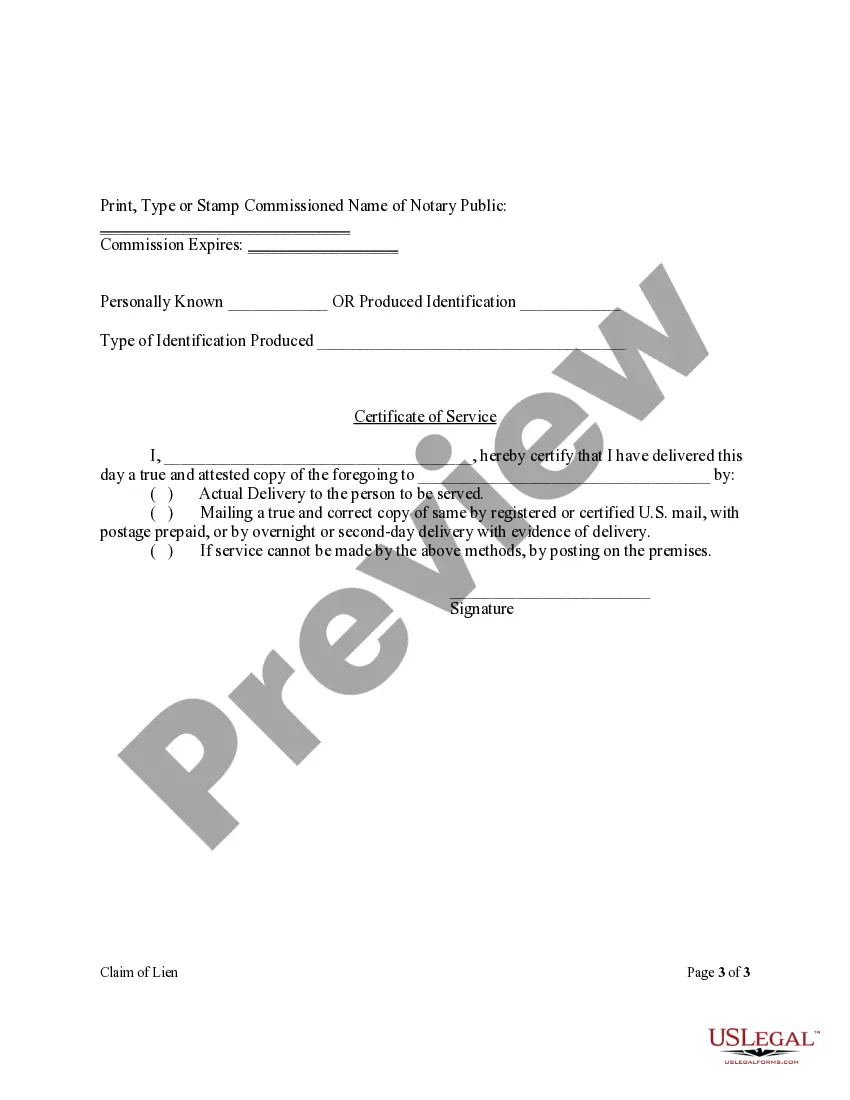

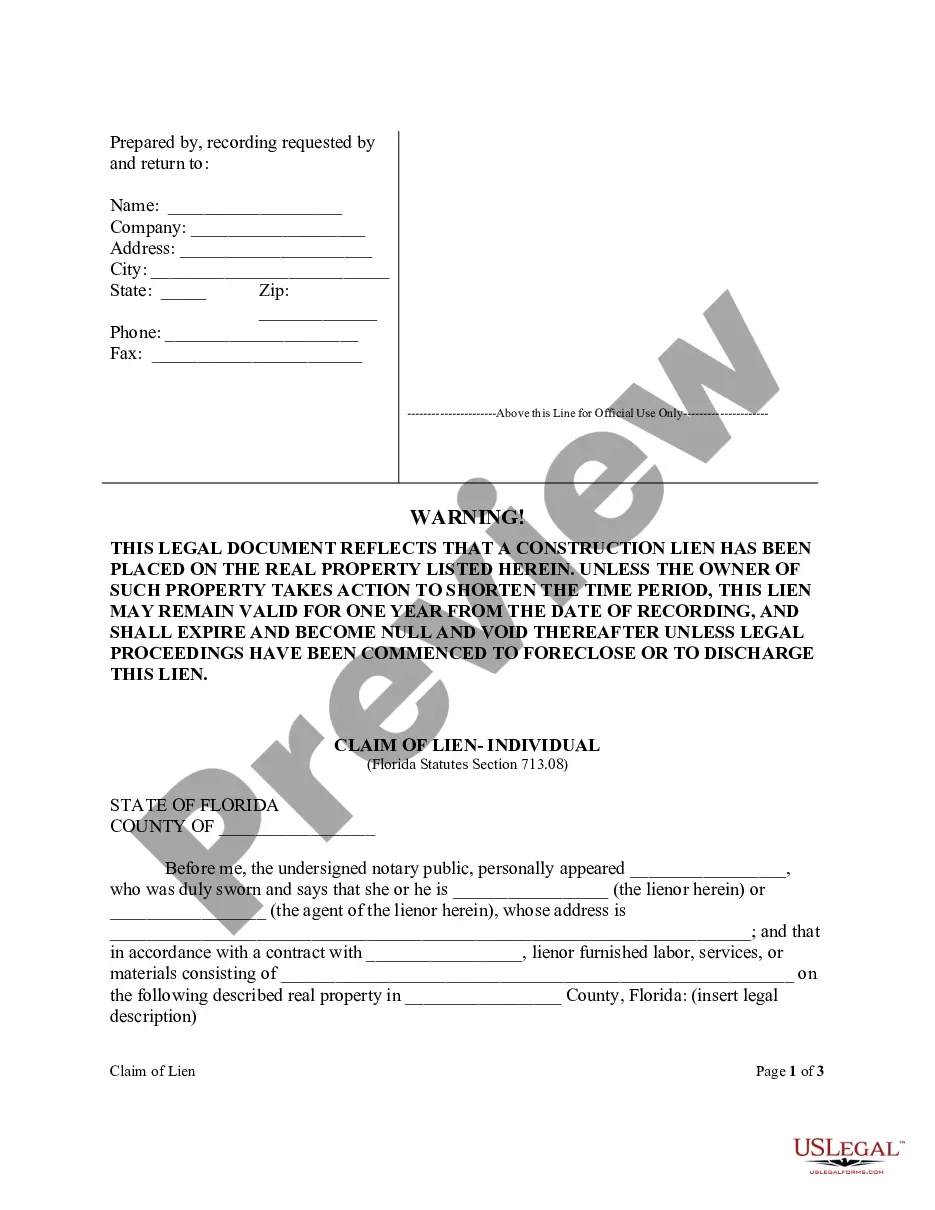

How to fill out Florida Claim Of Lien Form - Construction - Mechanic Liens - Corporation Or LLC?

- Log in to your account on US Legal Forms. Ensure your subscription is active; if not, renew it as per your plan.

- Preview the form and its description to confirm it fits your needs and adheres to local jurisdiction requirements.

- If necessary, use the Search feature to locate a different template that better suits your criteria.

- Purchase the document by clicking the Buy Now button and selecting the suitable subscription plan. You’ll need to create an account for library access.

- Complete your purchase by entering your credit card details or PayPal information.

- Download your form to your device. You can find it later in the My Forms section of your profile.

Once you follow these straightforward steps, you'll have the necessary legal documentation at your fingertips.

Leverage the power of US Legal Forms to navigate your legal needs seamlessly. Start your journey today!

Form popularity

FAQ

Before forming an LLC, gather knowledge about the different types of LLC structures. You should also familiarize yourself with the state-specific rules and regulations that could affect your business. Moreover, using resources like the 'Form mechanic llc blank for business' can streamline your setup process, ensuring you meet all legal requirements. Proper preparation can significantly ease the establishment of your LLC.

While LLCs provide flexibility, there are some downsides to consider. You may face higher startup costs compared to other business structures, along with additional paperwork. Furthermore, states require ongoing fees and taxes, which can add up. Understanding these factors, including how they relate to the 'Form mechanic llc blank for business,' is crucial before you begin your LLC journey.

Launching an LLC requires a good grasp of various legal and tax obligations. Before starting, you should know the importance of obtaining the right permits and licenses. Additionally, having a clear business plan in place can help you navigate the 'Form mechanic llc blank for business' process more smoothly, setting you up for long-term success. Preparation will make your journey with an LLC much less stressful.

Filing form 8832 is essential for some LLCs, especially if you want them taxed as a corporation. It's not always necessary, but it can offer tax advantages depending on your situation. If you are unsure, it’s wise to consult a professional who can guide you through using the 'Form mechanic llc blank for business' process effectively. Understanding this form can help you make informed decisions for your LLC.

member LLC is not automatically classified as an S or C corporation. By default, the IRS treats it as a sole proprietorship for tax purposes. However, you have the option to elect SCorp or CCorp status if it aligns with your business goals. Using a 'Form mechanic llc blank for business' can help clarify your structure and tax implications.

You typically do not need to file Form 720 just because you have an LLC. This form is mainly for businesses that owe certain types of federal excise taxes. If your LLC falls under this category, ensure you're using the proper 'Form mechanic llc blank for business' to stay compliant with tax requirements.

An LLC is not a Schedule C by default; it is a separate entity for tax purposes. However, single-member LLCs can choose to report income and expenses on Schedule C of their personal tax return. When considering the 'Form mechanic llc blank for business', make sure to understand how your specific business structure influences your tax obligations.

To write a simple operating agreement for an LLC, start by outlining the basic structure of your business. Include details like the business name, address, and member contributions. You can find a helpful 'Form mechanic llc blank for business' template that guides you through the necessary sections, ensuring you cover decision-making, profit-sharing, and member responsibilities clearly.

The best business structure for a mechanic shop is often the LLC due to its flexibility and liability protection. An LLC shields your personal assets while giving you the operational freedom to run your shop effectively. By utilizing tools like the form mechanic llc blank for business, you can navigate the formation process effortlessly and adapt your structure as your business evolves.

One downside of forming an LLC involves the ongoing compliance requirements and fees that differ by state. You may face additional paperwork and costs such as annual reports. However, these requirements can often be managed effectively by using resources like the form mechanic llc blank for business, which helps streamline your business processes while enjoying the benefits of LLC protection.