Enhanced Life Estate For The Future

Description

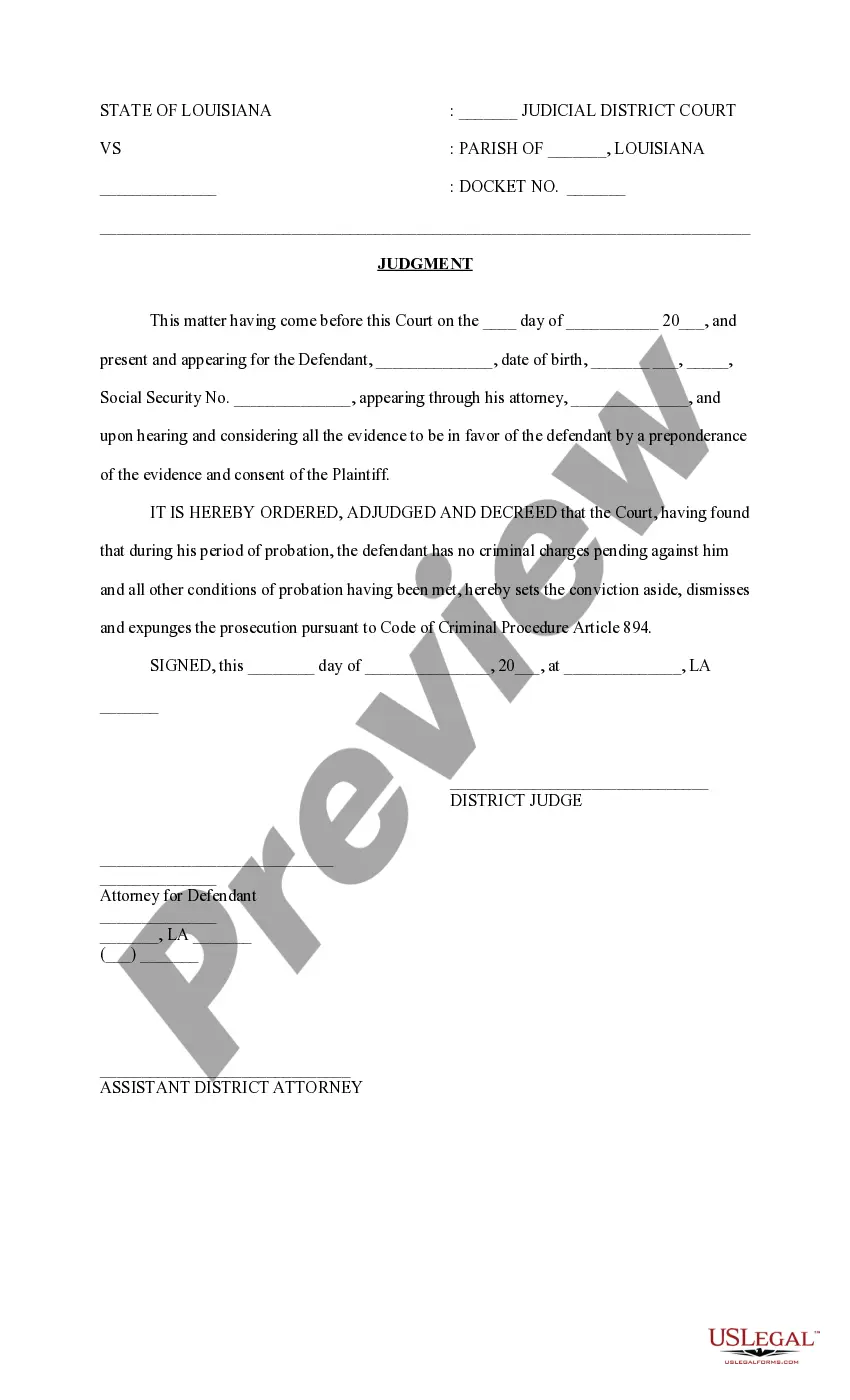

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Individual To Two Individuals / Husband And Wife?

- Log into your US Legal Forms account if you're a returning user, ensuring your subscription is active. If not, renew your plan.

- For new users, start by reviewing the available legal forms. Check the Preview mode and descriptions to ensure the form suits your needs and complies with local laws.

- If you need a different template, use the Search tab to find the right one that fits your requirements.

- Once you've selected the form, purchase it by clicking the Buy Now button and choosing a subscription plan that fits your needs.

- Complete your purchase by entering your payment information using either a credit card or PayPal.

- Download your selected form to your device for easy access and future use, available any time in the My Forms section of your account.

With US Legal Forms, you’ll benefit from an extensive online library of over 85,000 legal templates, ensuring you find exactly what you need. Plus, the platform connects you with premium experts to assist with form completion, guaranteeing accuracy and compliance.

Take control of your legacy today by utilizing US Legal Forms for your enhanced life estate documents. Start your journey towards a secure future!

Form popularity

FAQ

Future interest in a life estate refers to the rights that beneficiaries receive after the current property owner's death. When using an enhanced life estate for the future, the beneficiaries automatically gain ownership once the life estate ends. Understanding future interest is crucial for anyone looking to plan their estate effectively, as it dictates how property is transferred following a person's passing.

An example of an enhanced life estate deed could look like this: 'I grant the property located at Address to myself, Your Name, for my lifetime, and upon my death, to Beneficiary's Name.' This structure ensures that you retain your rights during your lifetime, while also providing seamless transfer of ownership to your chosen beneficiary, reflecting the benefits of an enhanced life estate for the future.

To establish a life estate, specific language needs to be included in the deed. Typically, you will use phrases like 'To Grantee's Name, for their lifetime.' This clear wording ensures that the intent of creating a life estate is understood and legally binding.

A life estate deed grants the owner the right to live in the property for their lifetime, with the remainder going to a beneficiary after death. In contrast, an enhanced life estate for the future lets the owner live in the property but also automatic transfer upon death, which simplifies inheritance. This distinction allows property owners to gain flexibility with their estate planning.

The best deed to avoid probate is often the enhanced life estate for the future. This deed allows property owners to transfer their assets to beneficiaries while retaining the right to live in the property until their death. By using this deed, you can help your loved ones bypass the lengthy probate process, ensuring they receive their inheritance quickly and efficiently.

People create life estates primarily to maintain control over their property during their lifetime while ensuring it passes to chosen beneficiaries without going through probate. This can be a strategic move to manage one’s estate effectively while providing for future generations. Moreover, life estates can offer peace of mind as they clarify ownership intentions. As you plan, consider how an enhanced life estate for the future aligns with your goals.

To navigate around a life estate, individuals often consider various legal strategies, including creating a revocable trust. This allows property transfer outside of the life estate's limitations. Consulting with a legal professional can provide tailored solutions. Platforms like US Legal Forms offer resources to help you understand your options in relation to an enhanced life estate for the future.

In Florida, an enhanced life estate deed provides the benefit of retaining rights to live in the property while also planning for future generations. This deed allows you to avoid the complexities of probate, ensuring a smoother transition of ownership. Additionally, it may offer favorable tax implications compared to traditional life estates. This makes it an attractive option for those looking to secure an enhanced life estate for the future.

The enhanced life estate deed in Florida offers significant advantages, such as avoiding probate. This allows assets to pass directly to your chosen beneficiaries, simplifying the transfer process. Furthermore, it enables you to retain control over your property while providing financial security for your loved ones. Thus, it effectively serves as a strategic tool for managing your estate in the context of an enhanced life estate for the future.

One key disadvantage of a life estate deed is the limitation on ownership rights. The original owner, known as the life tenant, cannot sell or mortgage the property without the consent of the remainderman. Additionally, life estates can lead to complications when it comes to taxes and maintenance responsibilities. However, understanding these challenges can help you leverage the benefits of an enhanced life estate for the future.