Corporation Llc Limited Companies For Small

Description

How to fill out Florida Notice To Owner Form - Construction - Mechanic Liens - Corporation?

Whether for business purposes or for personal matters, everybody has to manage legal situations sooner or later in their life. Completing legal papers needs careful attention, starting with picking the appropriate form sample. For instance, when you pick a wrong version of a Corporation Llc Limited Companies For Small, it will be declined once you submit it. It is therefore important to have a trustworthy source of legal documents like US Legal Forms.

If you have to get a Corporation Llc Limited Companies For Small sample, stick to these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Look through the form’s description to make sure it fits your case, state, and region.

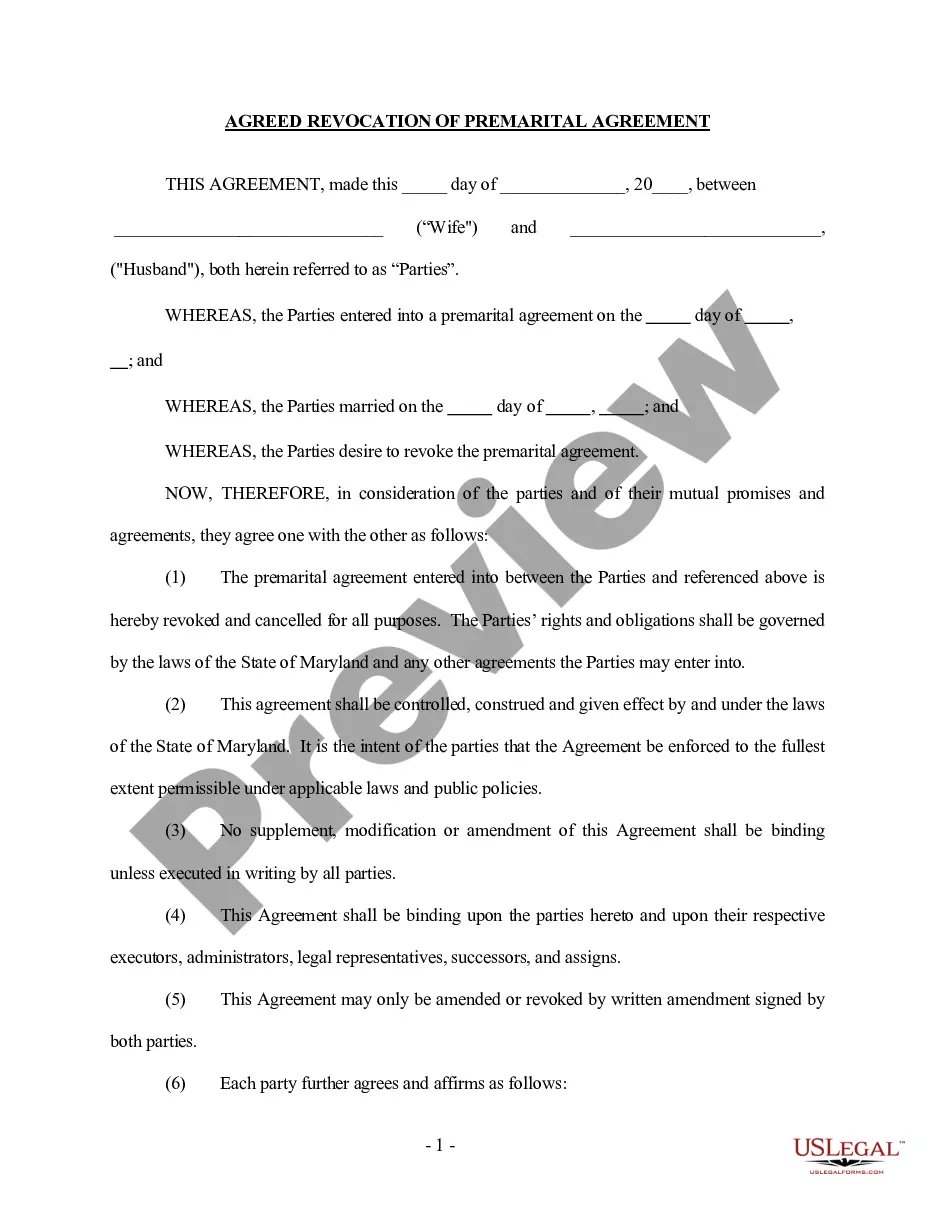

- Click on the form’s preview to see it.

- If it is the wrong form, go back to the search function to find the Corporation Llc Limited Companies For Small sample you require.

- Download the file when it meets your requirements.

- If you already have a US Legal Forms profile, simply click Log in to access previously saved documents in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Pick your payment method: you can use a bank card or PayPal account.

- Choose the document format you want and download the Corporation Llc Limited Companies For Small.

- After it is saved, you can fill out the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you don’t have to spend time seeking for the appropriate sample across the web. Take advantage of the library’s easy navigation to get the right template for any situation.

Form popularity

FAQ

Create an LLC Holding Company With Individual LLCs Under It. Another option for running multiple businesses is to create individual LLCs for each of the businesses and then put them under one parent LLC that acts as a holding company.

You can run two or more businesses under one LLC by either: running all the business activities under one LLC name, or. registering DBAs (?doing business as?), also known as Fictitious Names.

You can run two or more businesses under one LLC by either: running all the business activities under one LLC name, or. registering DBAs (?doing business as?), also known as Fictitious Names.

For the most part, LLC and Ltd. are the same type of company. LLC (limited liability company) is more commonly used in the U.S. whereas Ltd. (limited) is more commonly used in the U.K. The differences in types and jurisdictions stipulate the different rules regarding ownership, taxes, and dividends.

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders. S corporations cannot be owned by corporations, LLCs, partnerships or many trusts.