This is the Notice to Owner required to be given by liens of corporate or limited liability entities not in privity with the owner.

Corporation Limited Liability Form With Tax Id

Description

How to fill out Florida Notice To Owner Form - Construction - Mechanic Liens - Corporation?

Obtaining legal templates that comply with federal and local regulations is essential, and the internet offers many options to pick from. But what’s the point in wasting time searching for the correctly drafted Corporation Limited Liability Form With Tax Id sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal case. They are easy to browse with all documents grouped by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Corporation Limited Liability Form With Tax Id from our website.

Getting a Corporation Limited Liability Form With Tax Id is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the steps below:

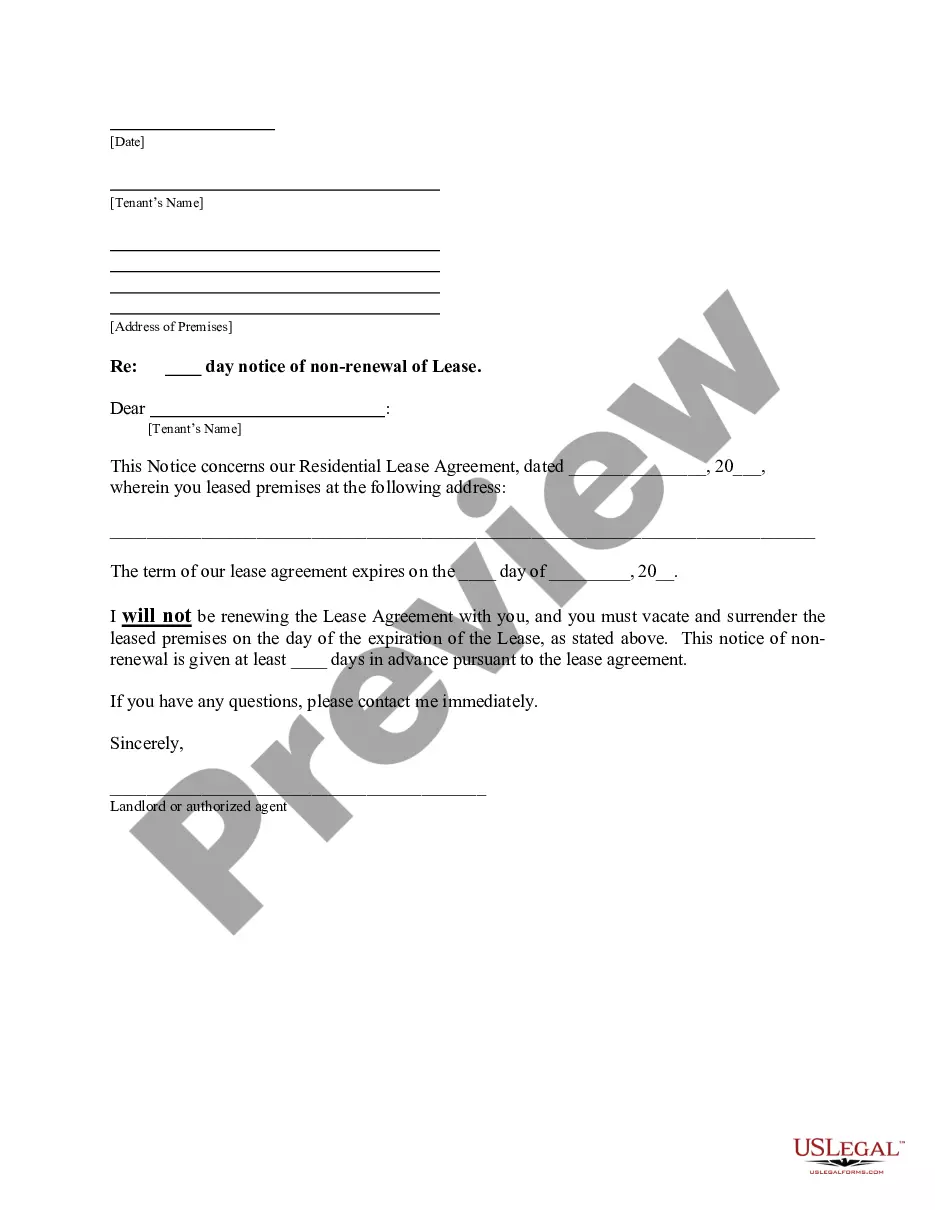

- Examine the template using the Preview option or through the text description to ensure it meets your needs.

- Locate another sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Corporation Limited Liability Form With Tax Id and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Disregarded entities are the simplest tax classification with straightforward tax reporting. Your LLC is not taxed or required to file a tax return. Instead, the business profits and losses pass to you as the sole owner to be reported on your personal income tax return.

An EIN is not the same as an LLC (Limited Liability Company). An EIN, also known as a federal identification number or business tax ID, is a tax identity. The IRS assigns EINs to distinguish unique business entities, including sole proprietors, LLCs, corporations, partnerships, and nonprofit organizations.

The U.S. Taxpayer Identification Number may be found on a number of documents, including tax returns and forms filed with the IRS, and in the case of an SSN, on a social security card issued by the Social Security Administration.

For individuals resident in Canada, their authorized tax identification number is their nine-digit Canadian Social Insurance Number (SIN) issued by Service Canada.

Completing the W-9 Form On the first two lines of the form, enter your full name and the legal name of your LLC. ... Next, check the box for your tax classification as described in the section above. ... If you have an EIN (employer identification number), you should enter it on the W-9. ... Next, enter your full address.