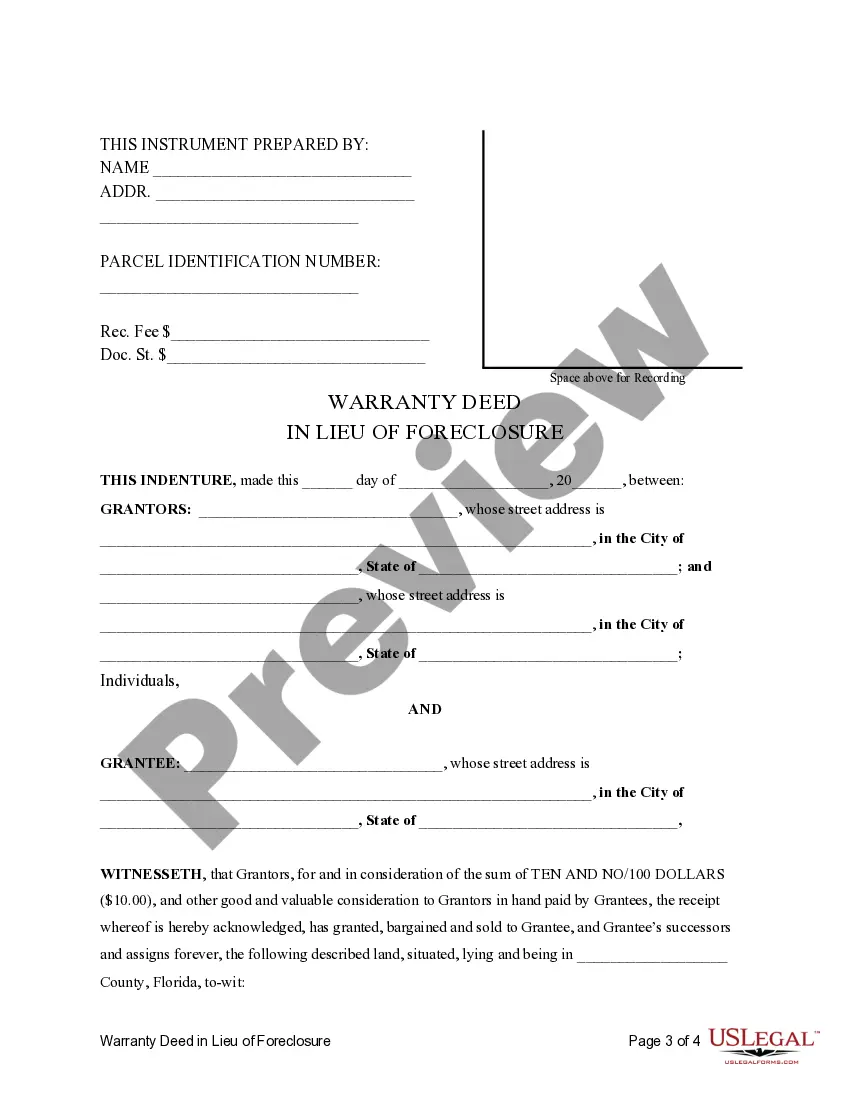

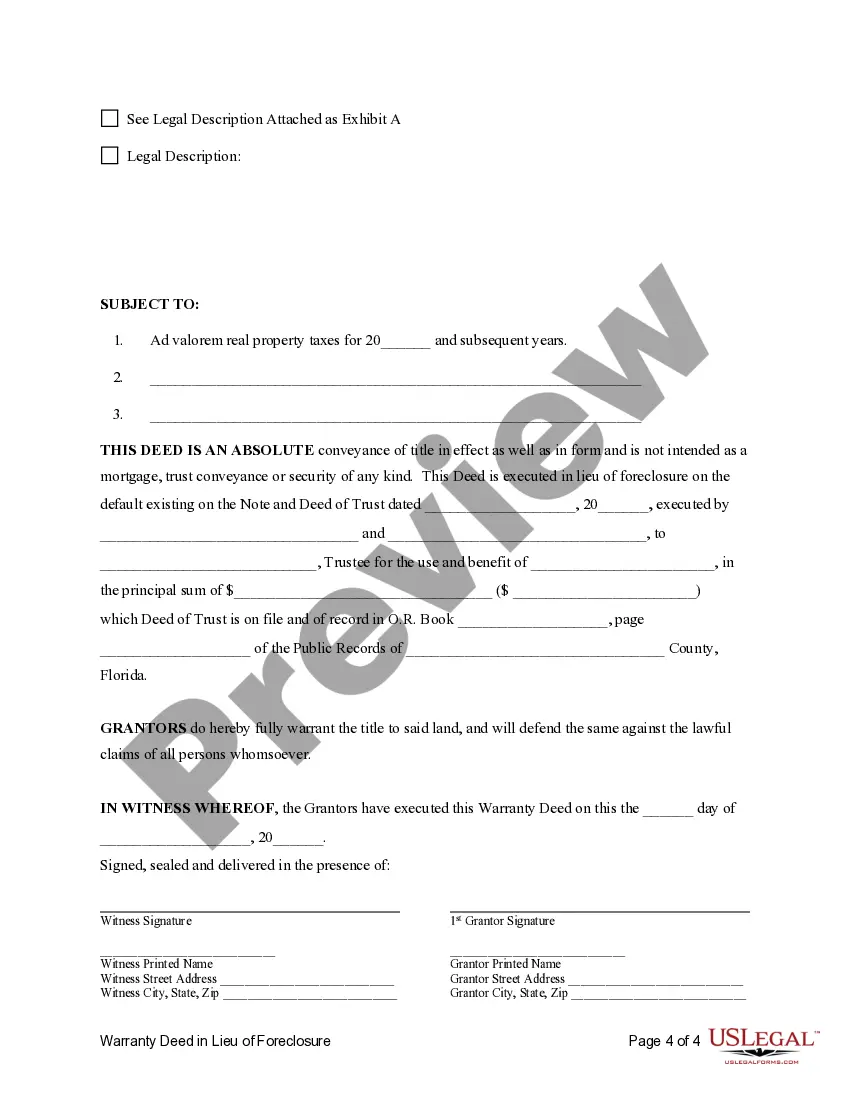

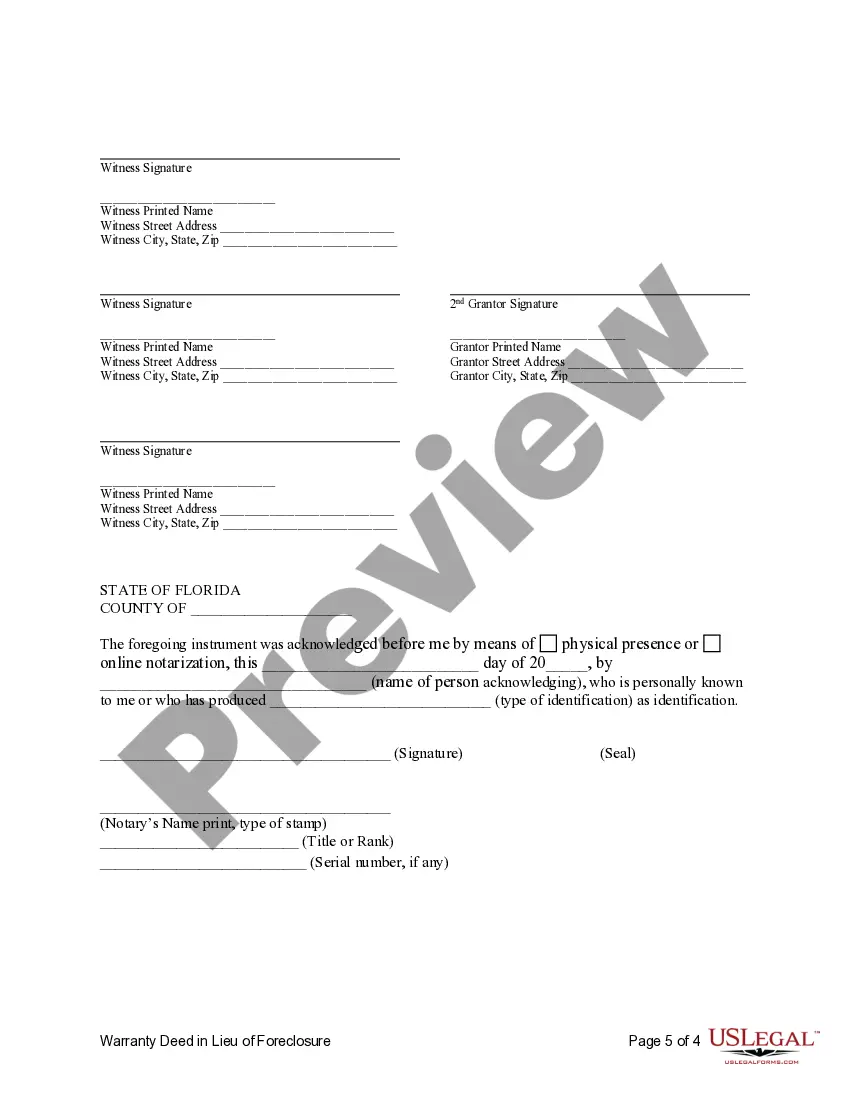

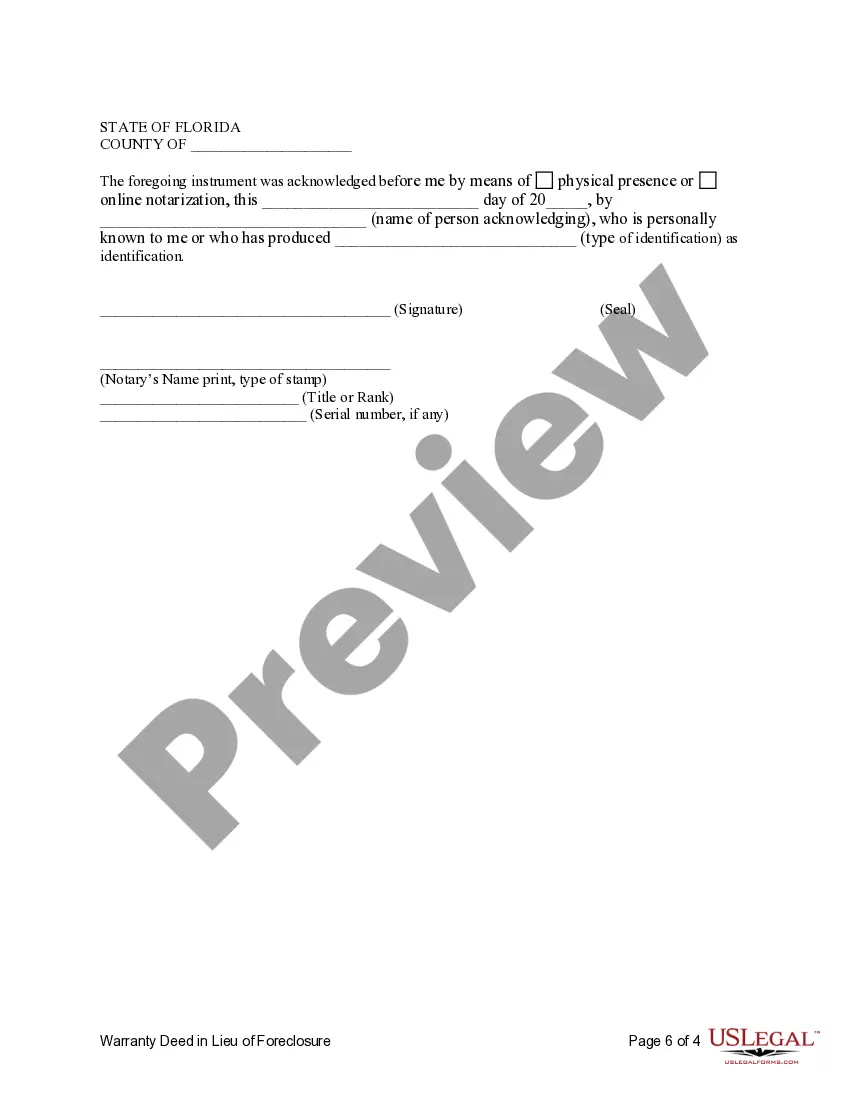

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Warranty Deed in Lieu of Foreclosure, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Deed in Lieu of Foreclosure Forms for Reverse Mortgage: A Comprehensive Guide When homeowners face financial distress and are unable to meet the obligations of their reverse mortgage, one option to consider is a "deed in lieu of foreclosure." This legal process allows the borrower to transfer ownership of the property voluntarily to the lender, thereby avoiding a lengthy and costly foreclosure proceeding. To initiate this process, specific Deed in Lieu of Foreclosure forms for reverse mortgage must be completed. This article will provide a detailed description of what these forms entail, ensuring a better understanding of the procedure. 1. Form Introduction: Deed in Lieu of Foreclosure forms for reverse mortgage generally begin with an introduction, outlining the purpose and scope of the document. This section clarifies that the homeowner willingly transfers the property to the lender to extinguish their debt and release them from further mortgage obligations. 2. Borrower Information: The forms require the homeowner to provide their personal details, including full name, contact information, and loan reference number. This information allows the lender to identify the borrower and verify their eligibility for a deed in lieu arrangement. 3. Property Information: Crucial property-related information needs to be provided on the forms. Homeowners must include the property's legal description, address, and any associated parcel numbers or property identifiers. This section ensures clarity regarding the exact property being transferred. 4. Mortgage Details: Reverse mortgage agreement specifics need to be shared in this section. Borrowers must provide the original loan amount, the date of loan origination, and any relevant loan numbers. This helps the lender review the reverse mortgage agreement and understand the terms that contribute to the foreclosure situation. 5. Financial Documentation: To assess the borrower's current financial situation accurately, the forms typically require the submission of necessary financial documents. These might include recent bank statements, income statements, tax returns, and information on other outstanding debts. This information assists the lender in evaluating the borrower's eligibility for a deed in lieu arrangement. 6. Statement of Financial Hardship: In order to ascertain the homeowner's genuine need for a deed in lieu arrangement, they are often required to draft a detailed statement explaining their financial hardship. This statement should describe the circumstances that have led to their inability to meet the reverse mortgage obligations. 7. Assumption of Ownership: Once the lender reviews the submitted forms and approves the deed in lieu arrangement, this section specifies the transfer of ownership. It outlines that the borrower willingly conveys full ownership rights to the lender, absolving themselves from any further responsibilities associated with the property. Types of Deed in Lieu of Foreclosure Forms for Reverse Mortgage: While the core content of Deed in Lieu of Foreclosure forms remains similar, some variations may exist depending on the jurisdiction, specific lender requirements, or additional legal provisions. Some potential variations include: 1. Standard Deed in Lieu of Foreclosure Form: This is the most commonly used form, adhering to the general requirements outlined above. It covers all essential aspects of the reverse mortgage deed in lieu process. 2. State-Specific Forms: Certain states might have their own tailored versions of the deed in lieu of foreclosure forms, which include additional clauses or requirements mandated by local laws. Homeowners should check with their state's housing authority or consult legal professionals to determine if such specific forms exist. By understanding the contents of Deed in Lieu of Foreclosure forms for reverse mortgage, homeowners can navigate the process more effectively. It is crucial to carefully review and complete these forms accurately to ensure a smooth transition of property ownership and a resolution to their financial hardship. Seeking professional advice from real estate attorneys or housing counselors experienced in reverse mortgages is highly recommended ensuring compliance with all legal requirements.