Florida Attorney Property For Probate

Description

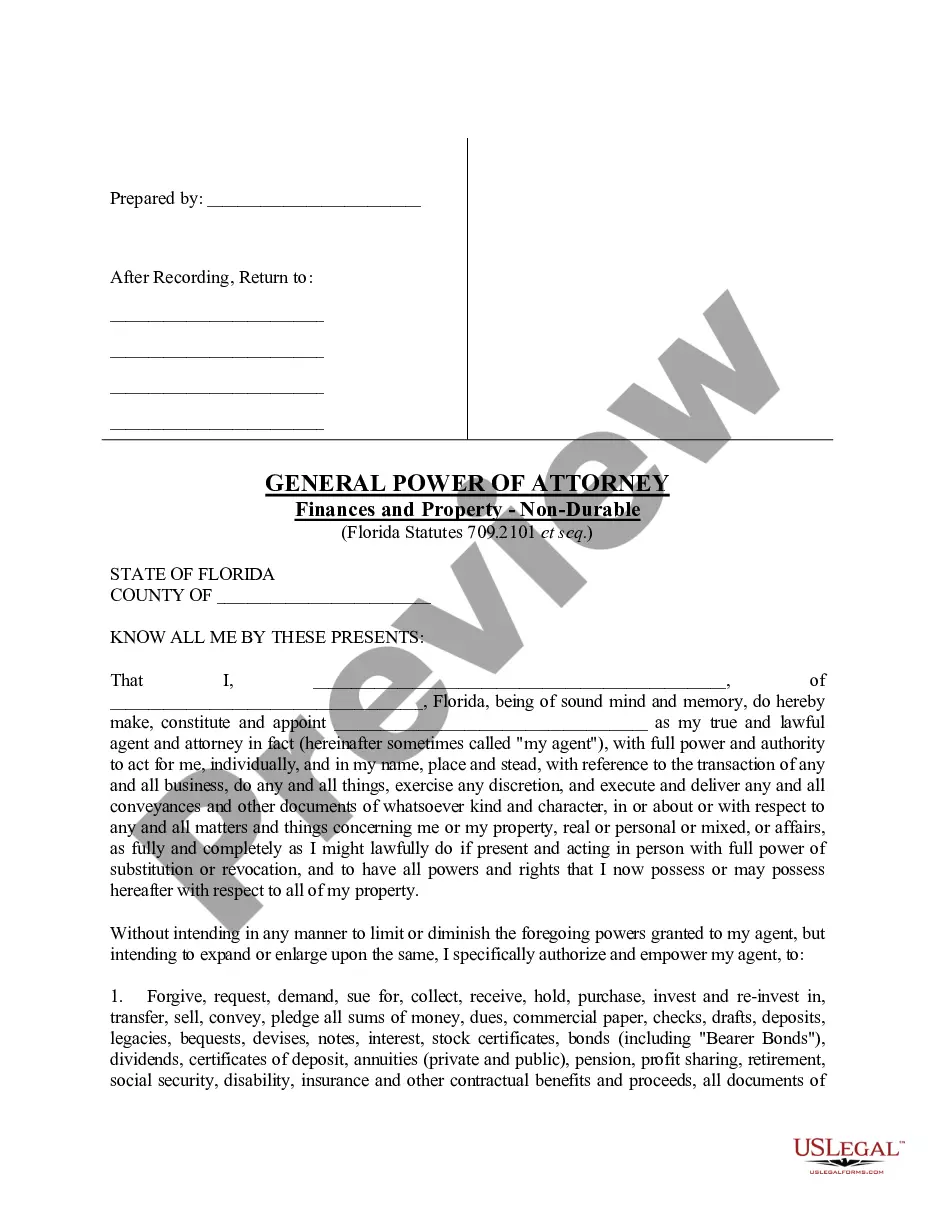

How to fill out Florida General Power Of Attorney For Property And Finances - Nondurable?

Obtaining a reliable source to access the most up-to-date and pertinent legal templates is half the battle of dealing with bureaucracy.

Selecting the appropriate legal documents requires precision and meticulousness, which is why it is crucial to obtain samples of Florida Attorney Property For Probate solely from trustworthy sources, such as US Legal Forms.

Once you have the form on your device, you can modify it with the editor or print it and fill it out by hand. Remove the hassle that accompanies your legal documentation. Explore the extensive US Legal Forms catalog to locate legal samples, verify their suitability for your situation, and download them instantly.

- Utilize the library navigation or search bar to locate your template.

- Examine the form’s description to determine if it meets the criteria of your state and locality.

- Inspect the form preview, if available, to confirm that the form is indeed what you are looking for.

- Return to the search and find the correct template if the Florida Attorney Property For Probate does not align with your requirements.

- Once you are certain about the form’s applicability, download it.

- If you are an authorized user, click Log in to verify and access your chosen forms in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Select the pricing plan that fits your needs.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Florida Attorney Property For Probate.

Form popularity

FAQ

Navigating the probate process in Florida can be complex, and having a Florida attorney for property probate is highly beneficial. An attorney can guide you through the legal requirements, ensure all documents are filed correctly, and help you avoid potential pitfalls. Without expert assistance, you may face delays or difficulties that could complicate the distribution of the estate. Using a qualified Florida attorney for property probate can save you time and provide peace of mind.

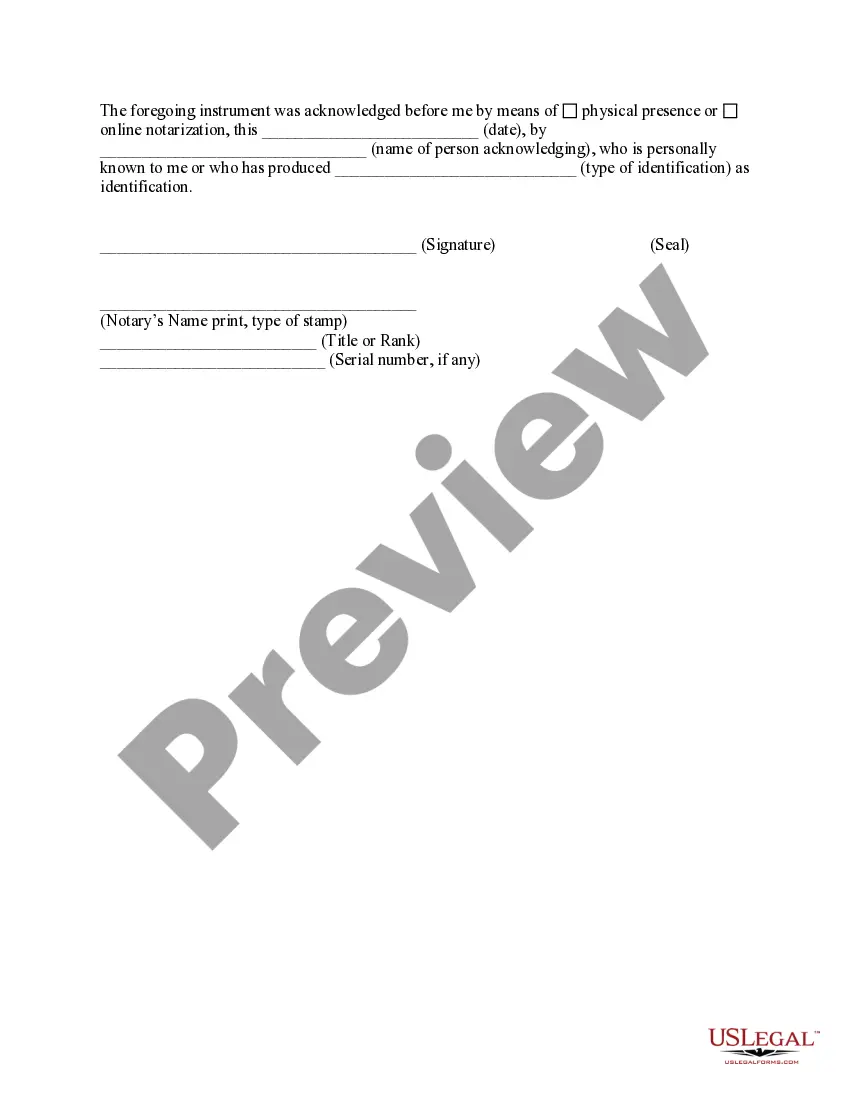

To fill out power of attorney forms correctly, begin by determining the specific powers you want to grant. Clearly write your name, the agent's name, and any limitations on the powers granted. US Legal Forms offers easy-to-follow templates that help ensure compliance with Florida laws. For added peace of mind, consult a Florida attorney focused on property for probate to review your document.

Probating property in Florida starts with filing a petition in the probate court. You will need to provide the death certificate and any will documents to initiate the process. Utilizing services like US Legal Forms can streamline obtaining the correct forms. Additionally, a Florida attorney specializing in property for probate can assist you with navigating the complexities of the probate process.

Filling out a power of attorney form in Florida involves several straightforward steps. First, clearly state the powers you wish to grant and include your personal information, as well as that of the agent. Use US Legal Forms for reliable templates and guidance tailored to Florida's laws. Engaging a Florida attorney experienced in property for probate can also ensure your form is legally sound.

Yes, you can write your own power of attorney in Florida, but it is essential to follow state requirements closely. The document must be in writing, signed, and dated by you, and must be witnessed by two individuals. To ensure that it meets all legal standards, consider consulting with a Florida attorney specializing in property for probate to avoid potential complications.

Filling out probate papers requires careful attention to detail. Start by gathering all necessary documents, including the death certificate and will, if available. You can use the resources provided by US Legal Forms to find the correct probate forms specific to Florida. A Florida attorney experienced in property for probate can also guide you through this process.

Probate administration only applies to probate assets. Probate assets are those assets that the decedent owned in his or her sole name at death, or that were owned by the decedent and one or more co-owners and lacked a provision for automatic succession of ownership at death.

If property, bank accounts, insurance policies, annuities, 401K plans, and all assets have beneficiaries or joint owners, probate is unnecessary. However, without a will or trust all assets must pass through probate court if no beneficiary or joint owner is named.

Formal administration in Florida Submit the will. First, you'll submit the will to the deceased's local court. ... File for probate. ... Receive authorization from the court. ... Contact beneficiaries. ... Inventory assets. ... Pay debts. ... Request approval to distribute assets. ... Close the estate.

Florida's probate threshold is currently set at $75,000. That means if the total value of a person's estate is less than $75,000, their heirs can inherit without going through probate.