Fl Estate Form For Tax

Description

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Two Individual / Husband And Wife To Individual?

Regardless of whether it's for corporate reasons or personal matters, everyone must confront legal issues at some point in their lives.

Completing legal documents necessitates meticulous care, beginning with selecting the correct template.

With an extensive catalog provided by US Legal Forms, you won't need to waste time searching for the appropriate sample online. Utilize the user-friendly navigation of the library to locate the right template for any situation.

- Locate the document you require through the search bar or through catalog browsing.

- Review the details of the form to ensure it aligns with your situation, state, and locality.

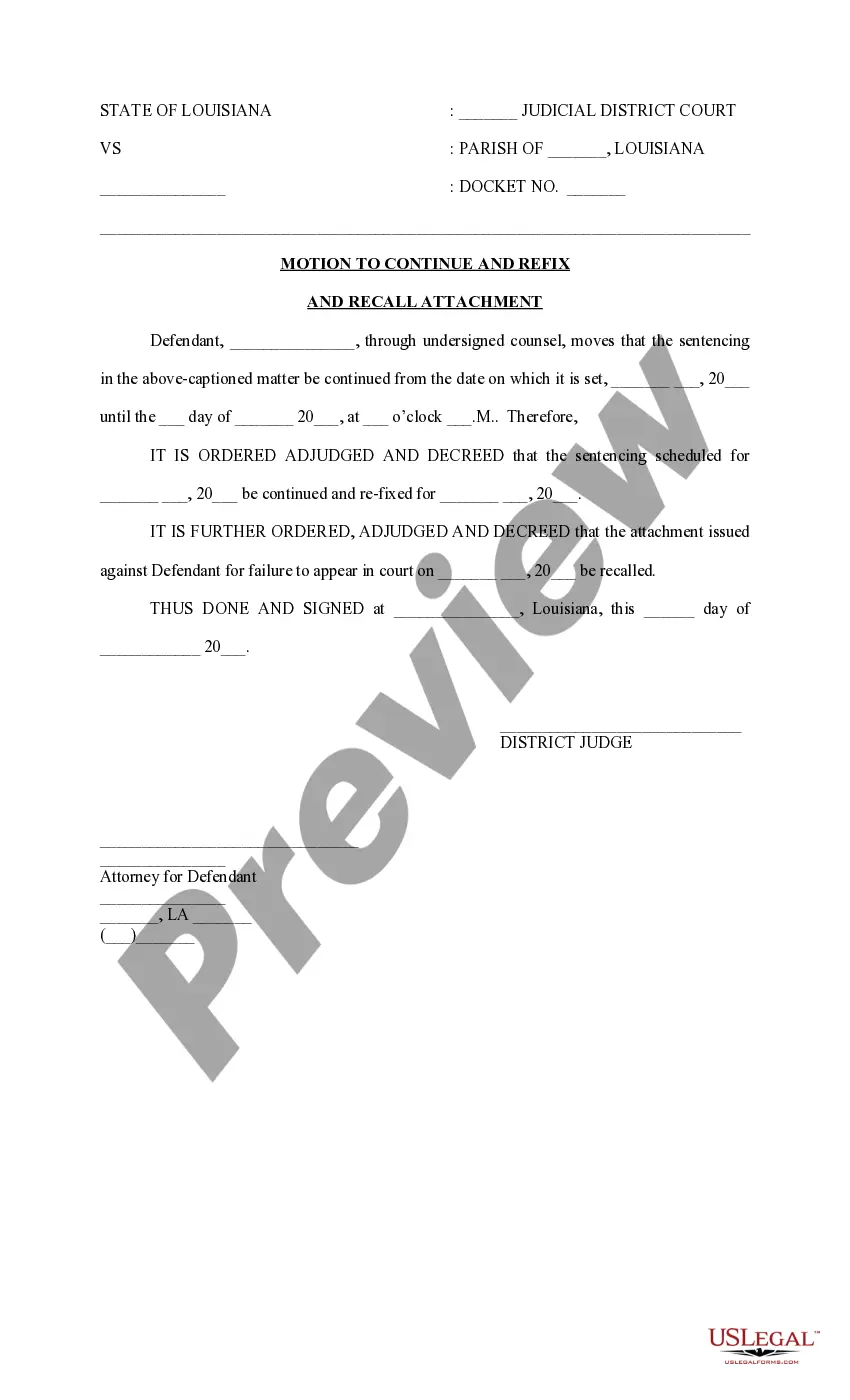

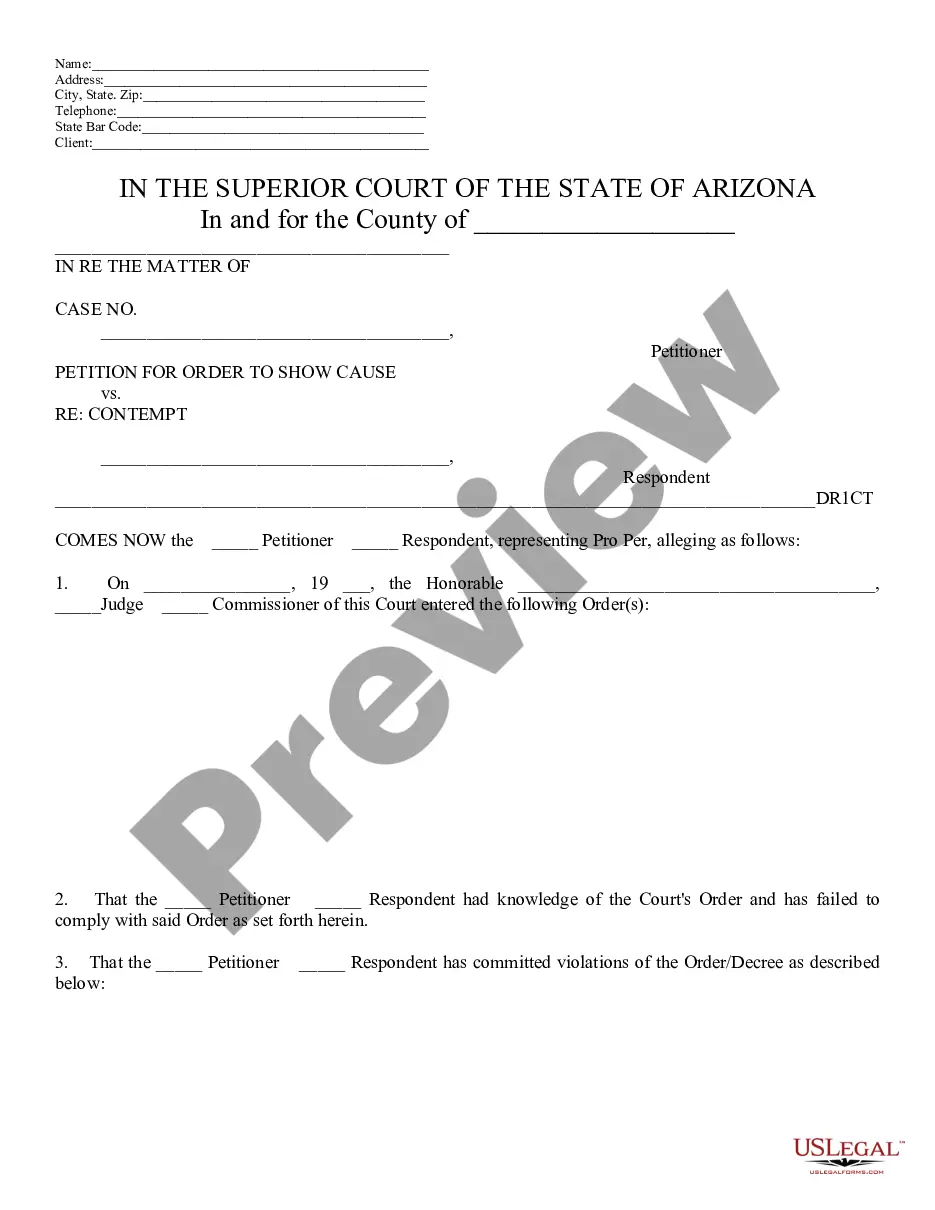

- Select the form's preview to inspect it.

- If it's the incorrect document, return to the search option to find the Fl Estate Form For Tax template you require.

- Download the file once it suits your needs.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the correct pricing choice.

- Fill out the profile registration form.

- Choose your payment option: you can utilize a credit card or a PayPal account.

- Select the document format you prefer and download the Fl Estate Form For Tax.

- Once downloaded, you have the choice to fill out the form using editing software or print it out and complete it by hand.

Form popularity

FAQ

1 forms are typically sent to beneficiaries of estates, as well as partners in partnerships and shareholders in S corporations. If you gain from the income generated by an estate, project income or assets, expect to receive a 1. This ensures that beneficiaries properly report their share of the income received. Employing resources like the FL estate form for tax can make navigating this process much easier.

Not all estates must file form 706. This form is specifically for reporting estate taxes, which only applies if the estate's value exceeds the federal exemption limit. It’s crucial to evaluate the estate's total value to determine filing requirements. If in doubt, consulting the FL estate form for tax can clarify specific situations regarding filing.

Individuals receive a K-1 when they are beneficiaries of an estate or a partnership, reporting their share of income, deductions, and credits. This ensures they accurately report earnings on their personal tax returns. The K-1 acts as a tool for transparency in tax obligations. By using the FL estate form for tax, you can simplify the reporting process linked to the K-1.

You may receive a K-1 from an estate because you are a beneficiary who benefits from the estate's income-generating assets. The K-1 form outlines your share of that income, which you need for your personal tax return. Understanding this form is important to ensure you comply with tax regulations. Keep in mind, utilizing the FL estate form for tax can assist in managing your filings.

The executor or personal representative of an estate must file a form 1041 when the estate generates income during its administration. This form reports income, deductions, and tax liability for the estate. If the estate has gross income of $600 or more, you must file. Using the FL estate form for tax helps ensure that your filings are accurate and compliant.

Beneficiaries of an estate typically receive a K-1. This tax form details income distributions they receive during the estate's administration. If you inherit an asset that generates income, such as real estate or investments, you might receive this form. It helps you accurately report your income for tax purposes using the FL estate form for tax.

In Florida, there is no state estate tax, so you can inherit any amount without paying state inheritance taxes. However, federal laws may apply, depending on the estate's size. It’s essential to consult an FL estate form for tax to ensure all necessary federal obligations are met. Understanding these regulations helps you manage your estate effectively.

If you don’t file an estate tax return when required, you could face penalties and interest. The IRS may pursue the estate for back taxes owed, resulting in financial stress for heirs. Using an FL estate form for tax ensures compliance and clarity in your estate's financial matters. This proactive step can save you from unforeseen complications.

An estate tax return is usually triggered when the value of the estate exceeds a certain threshold set by the IRS. In Florida, this may also involve using an FL estate form for tax to ensure proper reporting. Common triggers include the total value of assets and any outstanding debts. Filing this return is crucial to avoid potential penalties.

Yes, you need to report the sale of inherited property to the IRS. When you sell inherited property, you may have to complete an FL estate form for tax purposes. This form helps determine if you owe taxes on any gains from the sale. It's good practice to keep accurate records of the property's basis for your tax filings.