Evict Tenant For Personal Use

Description

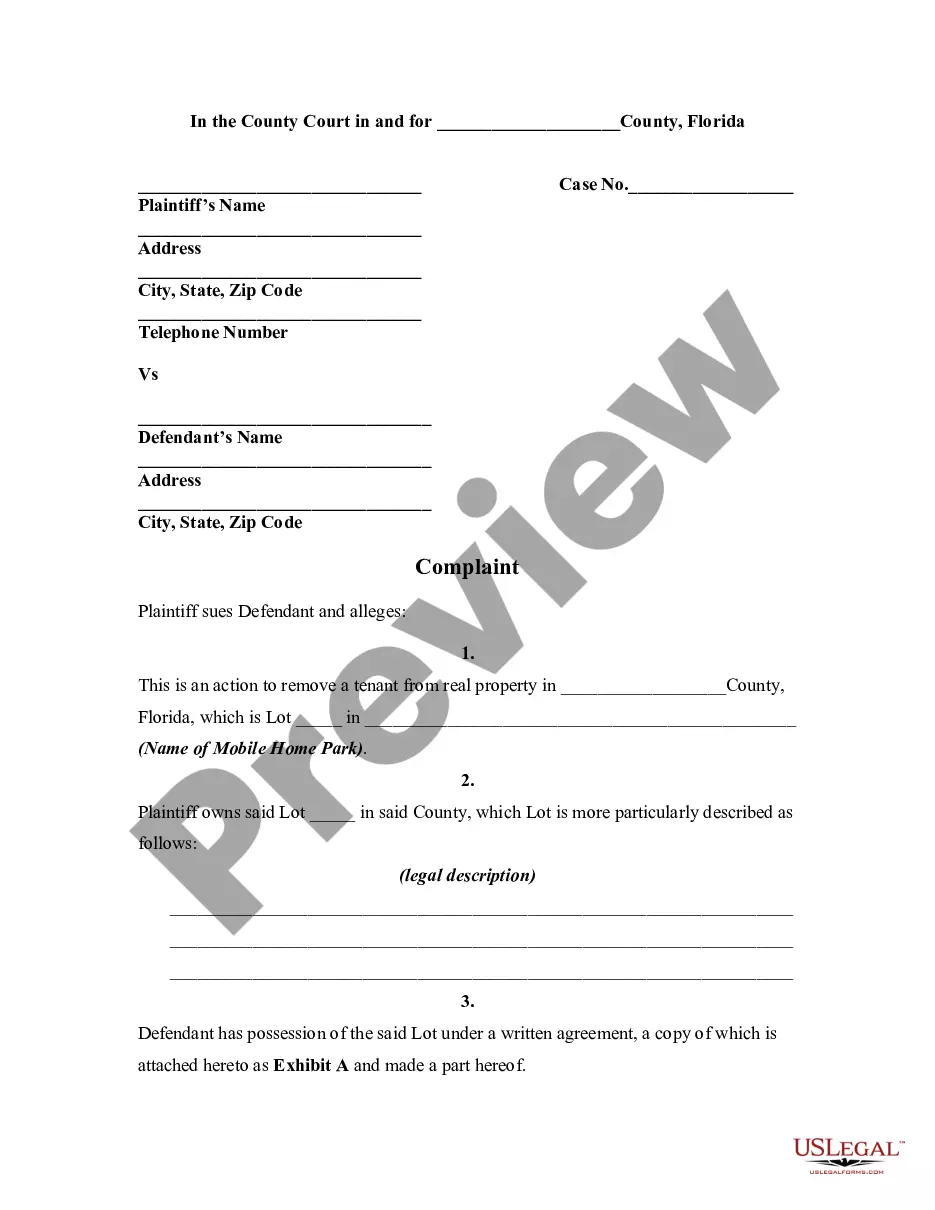

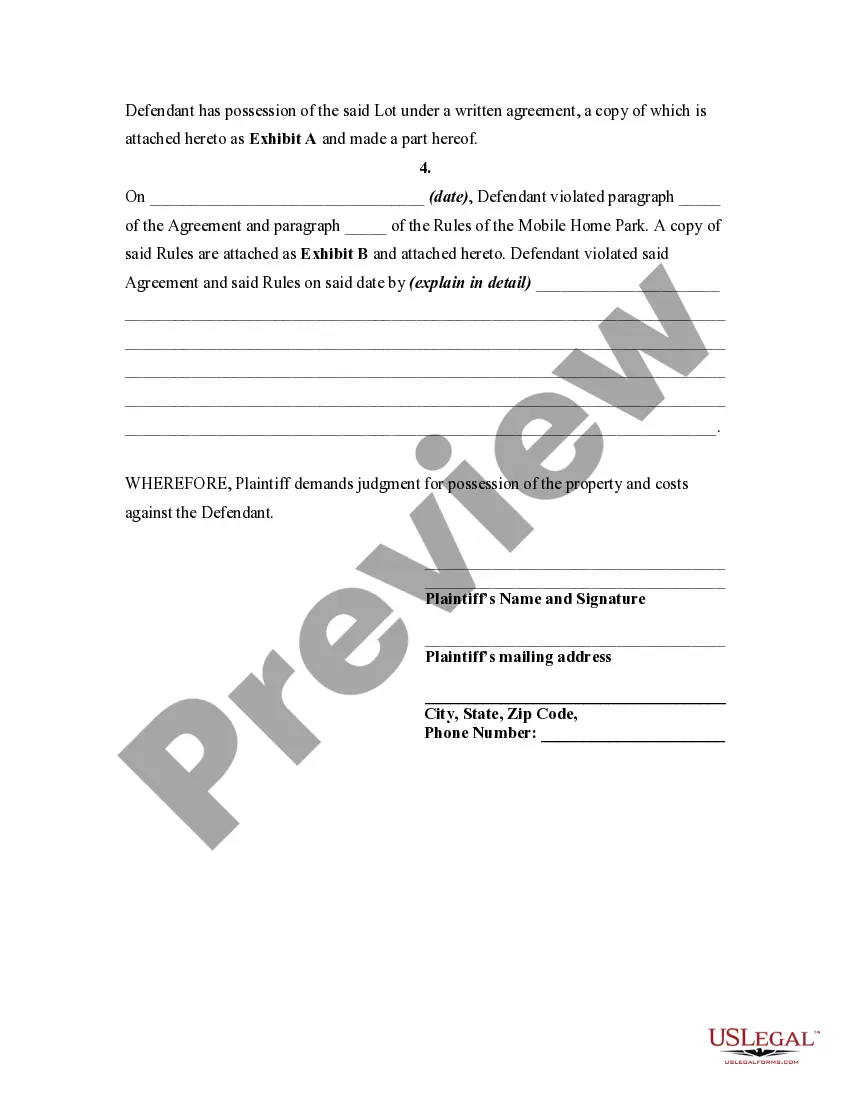

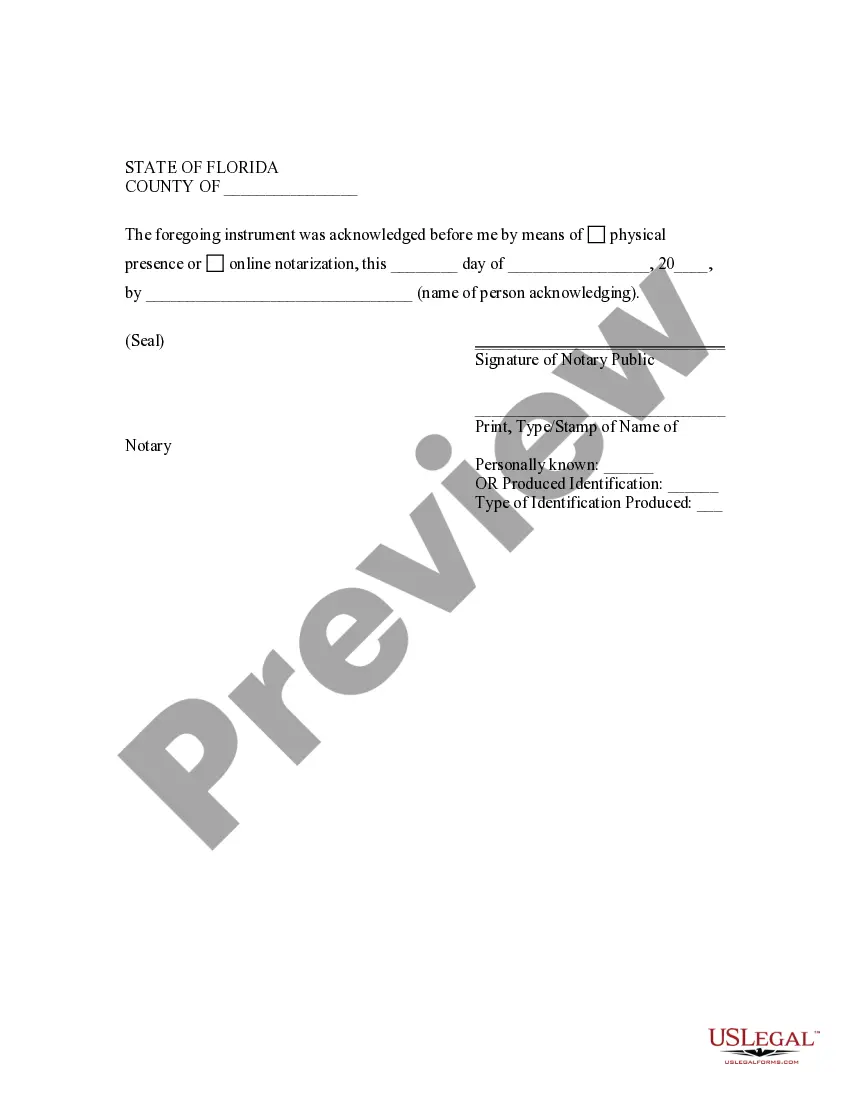

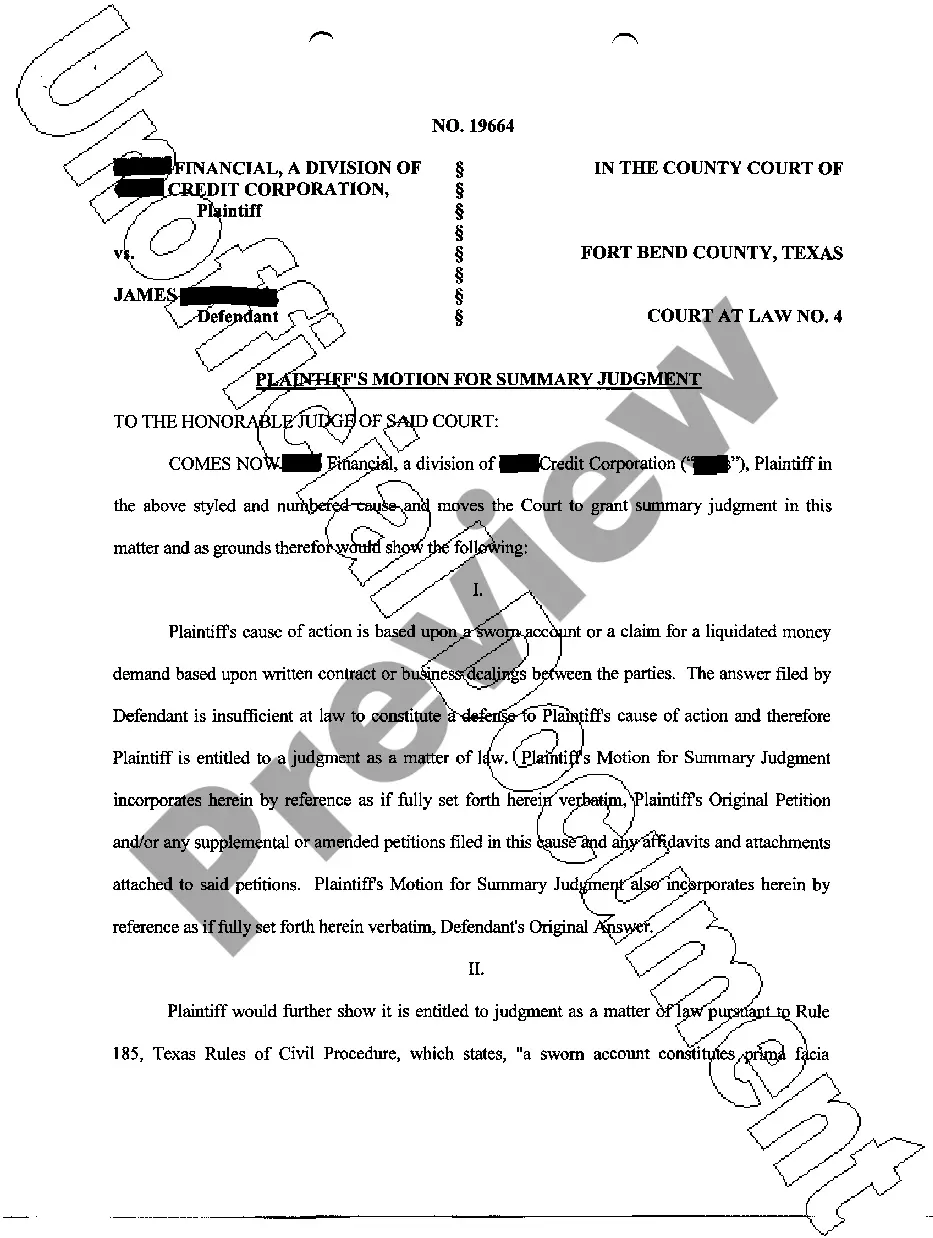

How to fill out Florida Complaint To Remove A Tenant For Improper Behavior In Violation Of Lease And/or Rules Of Mobile Home Park?

Securing a primary location to obtain the most up-to-date and pertinent legal documents is a significant part of dealing with bureaucracy. Locating the appropriate legal forms requires precision and meticulousness, which is why it's crucial to obtain samples of Evict Tenant For Personal Use solely from reliable sources, such as US Legal Forms. An incorrect document will squander your time and prolong the situation you face. With US Legal Forms, you have minimal concerns. You can review and verify all the details regarding the document’s applicability and relevance for your situation and within your state or area.

Follow these steps to complete your Evict Tenant For Personal Use.

Eliminate the stress associated with your legal documents. Discover the extensive US Legal Forms collection where you can find legal forms, assess their relevance to your needs, and download them instantly.

- Utilize the catalog navigation or search bar to locate your sample.

- Examine the form’s details to confirm if it aligns with the regulations of your state and area.

- View the form preview, if available, to ensure it is the document you need.

- Return to the search to find the correct template if the Evict Tenant For Personal Use does not meet your requirements.

- If you are confident about the form’s applicability, download it.

- For registered users, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to purchase the form.

- Choose the pricing plan that suits your needs.

- Complete the registration to finalize your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Evict Tenant For Personal Use.

- After obtaining the form on your device, you can modify it using the editor or print it to fill it out manually.

Form popularity

FAQ

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

You might be able to avoid probate in West Virginia by: Establishing and funding a Revocable Living Trust. Titling property smartly: in Joint Tenancy.

How to Create a Living Trust in West Virginia Decide which type of trust is best for you. ... Assess your property. ... Name a trustee. ... Create the document. ... Sign the trust in front of a notary public. Fund the trust by transferring your assets into it.

The Disadvantage of a Revocable Living Trust Expansive: Creating a revocable living trust can be more expensive than a simple will due to legal fees and document preparation. Complexity: Managing a trust requires ongoing paperwork and record-keeping, which can be burdensome and time-consuming.

How to Write ( Fill Out ) a Living Trust Form Step 1: Fill out the grantor information. ... Step 2: Indicate the purpose of the trust. ... Step 3: Include trustee information. ... Step 4: List beneficiaries and make specific gifts. ... Step 5: Sign and notarize the completed document.

The two basic types of trusts are a revocable trust, also known as a revocable living trust or simply a living trust, and an irrevocable trust. The owner of a revocable trust may change its terms at any time.

Limitations: Requires adherence to trust document's instructions on asset assignments. Joint assets, including certain IRAs and retirement plans, cannot be placed into a one-person trust. No complete tax avoidance: Total avoidance of taxes is rarely possible with living trusts, though there may be ways to reduce them.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.