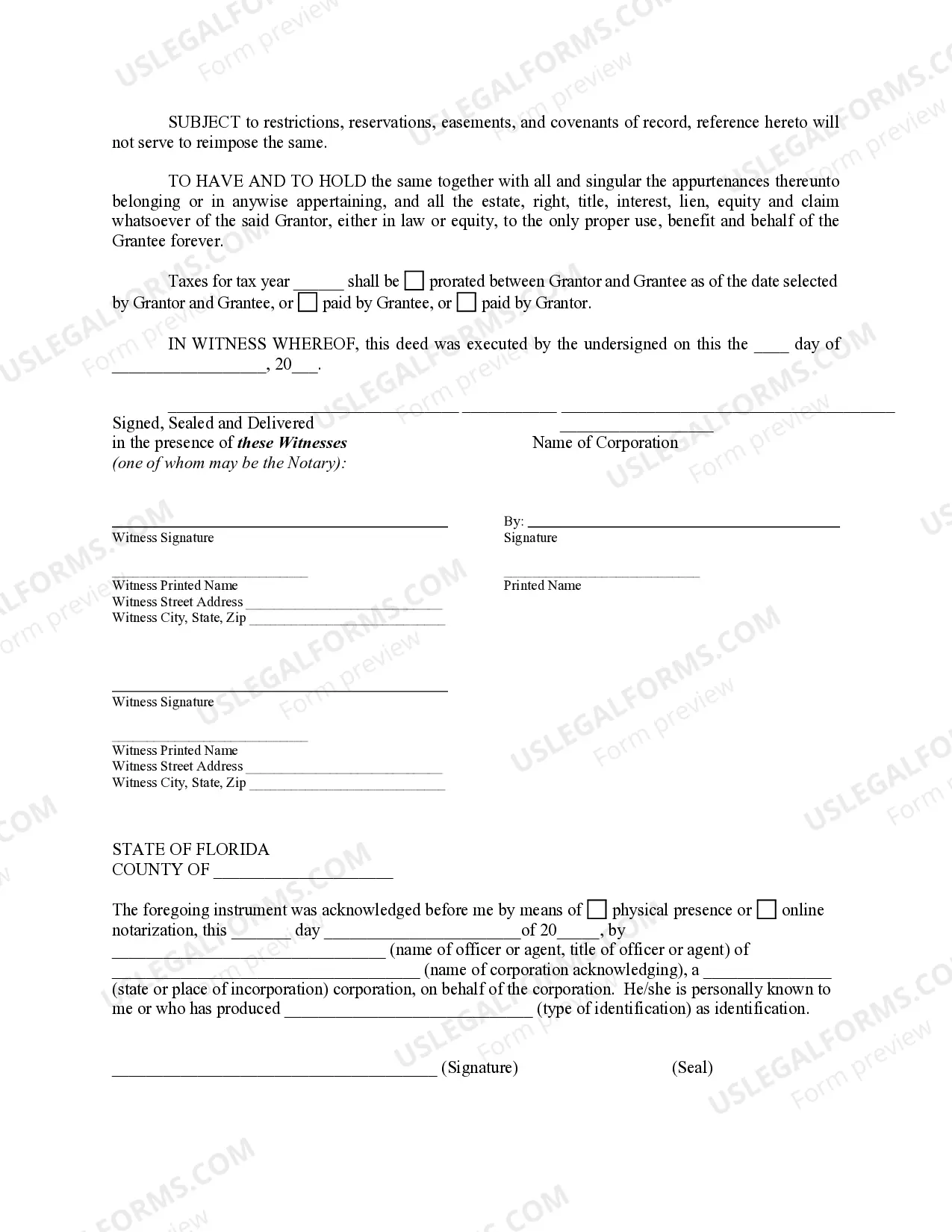

This Quitclaim Deed from Corporation to Individual form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Quitclaim Deed Florida With Mortgage

Description

How to fill out Florida Quitclaim Deed From Corporation To Individual?

No longer is it necessary to waste time searching for legal documents to fulfill your local state obligations.

US Legal Forms has compiled all of them in one location and streamlined their accessibility.

Our platform provides over 85k templates for any corporate and personal legal situations categorized by state and usage area.

Make use of the Search field above to find another template if the current one does not meet your needs. Click Buy Now next to the template title once you discover the correct one. Select the most appropriate subscription plan and create an account or Log In. Proceed with payment for your subscription using a credit card or via PayPal. Choose the file format for your Quitclaim Deed Florida With Mortgage and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to complete it in an online editor. Preparing official documentation in accordance with federal and state laws and regulations is quick and straightforward with our library. Experience US Legal Forms today to maintain your documentation in order!

- All forms are expertly crafted and verified for accuracy, allowing you to feel confident in obtaining an up-to-date Quitclaim Deed Florida With Mortgage.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active prior to accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all previously acquired documents whenever necessary by accessing the My documents tab in your profile.

- If you have never utilized our platform before, the process will involve a few additional steps to complete.

- Here’s how new users can secure the Quitclaim Deed Florida With Mortgage from our inventory.

- Review the page content thoroughly to ensure it contains the example you seek.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

The time it takes to execute a quitclaim deed in Florida usually ranges from a few days to several weeks, depending on how promptly you complete the necessary steps. Once you sign and notarize the deed, you need to file it with the county, which could add additional time. To expedite your process and ensure everything is done correctly, consider using US Legal Forms, which provides a structured approach to handle quitclaim deed Florida with mortgage efficiently.

Several factors can void a quitclaim deed in Florida. Common reasons include lack of proper execution, if the deed is not notarized, or if it was signed under duress. Additionally, if there's a pending mortgage foreclosure, that may complicate the validity of a quitclaim deed Florida with mortgage. For a solid understanding of your rights and obligations, consulting an expert is advisable.

You can prepare a quitclaim deed yourself in Florida, provided you meet all the legal requirements. The process involves filling out the appropriate forms, signing the deed in front of a notary, and then filing it with the county clerk's office. However, for peace of mind and accuracy, consider leveraging the resources available on US Legal Forms, which can simplify your understanding of quitclaim deed Florida with mortgage.

Yes, you can execute a quitclaim deed on a house with a reverse mortgage in Florida. However, you should understand that the mortgage lender might have specific guidelines regarding the transfer of property ownership. It’s essential to consult with the lender to ensure compliance and to avoid complications with the quitclaim deed Florida with mortgage. Utilizing a platform like US Legal Forms can help guide you through this process.

Filling out a Florida quit claim deed involves writing a clear title at the top, stating the intention of the transfer. Include the names and addresses of both the grantor and grantee, along with a comprehensive legal description of the property. After signing, the document must be notarized and recorded with the local county clerk's office. For many, the US Legal Forms platform provides user-friendly resources tailored for managing a quitclaim deed Florida with mortgage effectively.

To fill out a quit claim deed in Florida, gather all necessary information about the property's current owner and the new owner. Clearly state the intent to transfer ownership and include a detailed property description. Ensure to sign the document in front of a notary, which is required for validity. If you're uncertain, detailed resources on the US Legal Forms platform can assist you with a quitclaim deed Florida with mortgage, making the process seamless.

One significant disadvantage of a quitclaim deed is that it does not guarantee the title's validity. This means you could inherit issues like unpaid mortgages, liens, or claims from previous owners. While a quitclaim deed can expedite property transfers, it often leaves the grantee vulnerable to such risks. Understanding these implications is essential, especially in cases involving a quitclaim deed Florida with mortgage, where the mortgage liability can transfer as well.

To fill out the quitclaim deed form in Florida, start with the grantor's name, the property description, and the grantee's details. It's crucial to specify the relationship between the parties and to indicate if the property has a mortgage. Remember to include any legal descriptions and parcel numbers relevant to the property. For those seeking guidance, US Legal Forms offers templates and resources that simplify this process, especially for a quitclaim deed Florida with mortgage.

In Florida, anyone can prepare a quitclaim deed, but it is highly recommended to seek assistance from a qualified professional. Real estate attorneys or title companies can ensure the deed complies with Florida laws and regulations. Utilizing resources like US Legal Forms can simplify this process and guarantee you have the right documentation for your quitclaim deed Florida with mortgage.

Florida functions primarily as a mortgage state. This means mortgages are the standard financing method for purchasing property. However, understanding the nuances between deeds and mortgages, such as how a quitclaim deed Florida with mortgage interacts with financing options, is crucial for effective property transactions.