Trust A B With Hmrc

Description

How to fill out Florida Marital Deduction Trust - Trust A And Bypass Trust B?

Drafting legal paperwork from scratch can often be daunting. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more cost-effective way of creating Trust A B With Hmrc or any other forms without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of over 85,000 up-to-date legal forms addresses virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific forms diligently prepared for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can easily locate and download the Trust A B With Hmrc. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Trust A B With Hmrc, follow these recommendations:

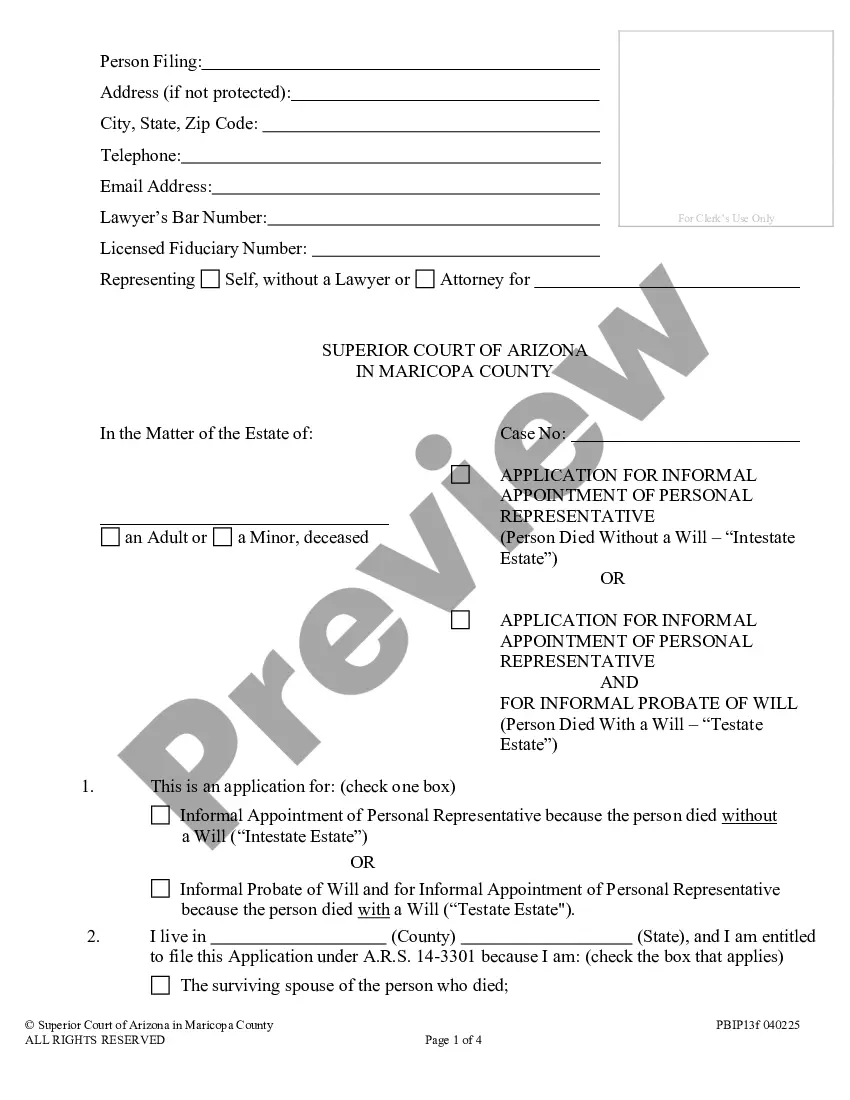

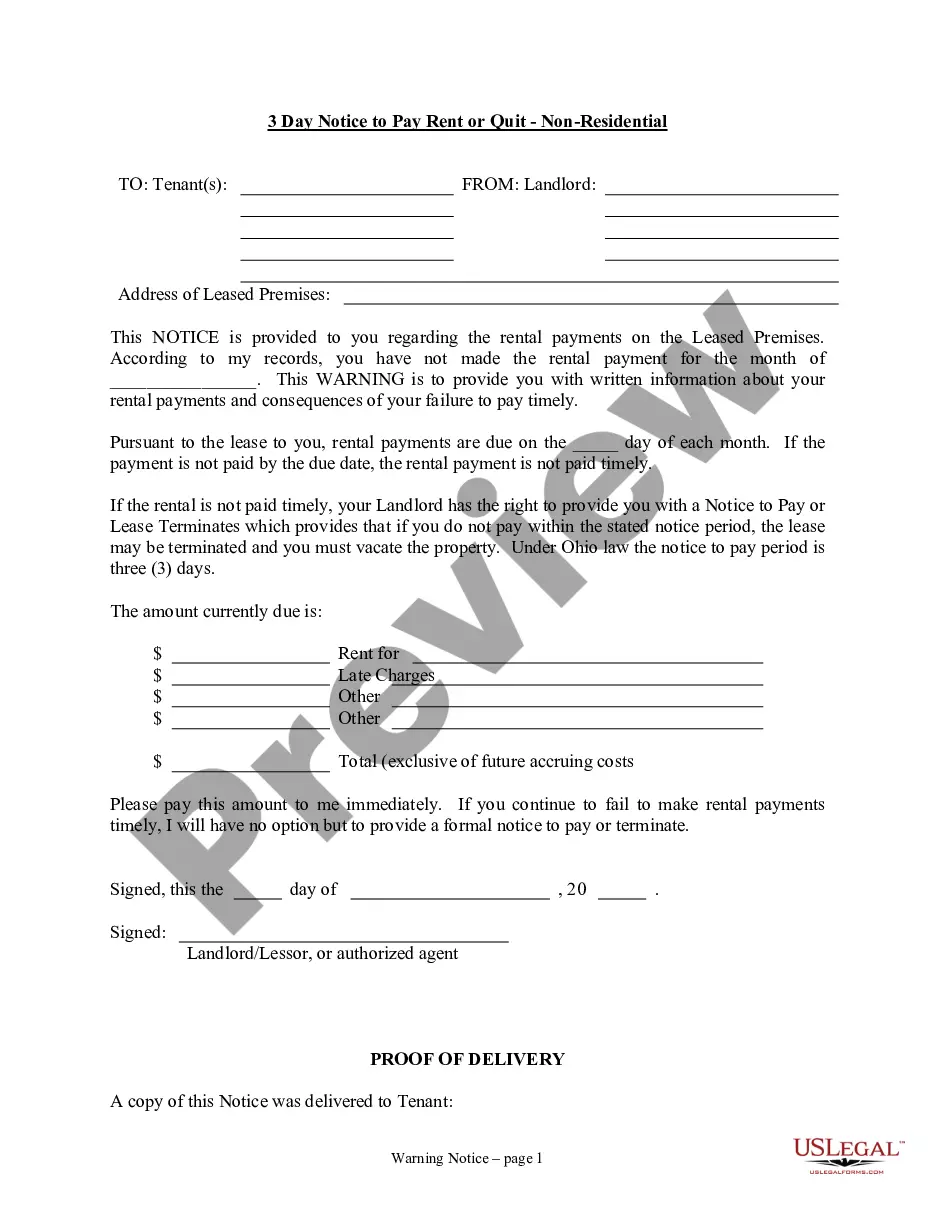

- Check the document preview and descriptions to ensure that you are on the the form you are searching for.

- Check if form you select complies with the requirements of your state and county.

- Pick the best-suited subscription option to purchase the Trust A B With Hmrc.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and transform document execution into something easy and streamlined!

Form popularity

FAQ

An A-B trust is a joint trust created by a married couple; upon one spouse's death, the trust splits into a survivor portion (the A trust) and a bypass portion (the decedent's trust, or B trust).

The cost of creating a simple trust is usually in the region of £1000 - £1,500. The exact amount depends on how much legal advice you need and how long it takes your solicitor to draft the precise wording. Trusts come in many shapes and sizes and they are a flexible way to structure your financial affairs.

The document usually records the portion of the ownership of the property, as well as other terms agreed by the parties. The owners usually hold the property on trust for themselves as beneficial owners. However, individuals may hold the property on trust for someone else, even if they do not benefit from the property.

How Do I Create a Trust? Step 1: Decide Upon the Assets. You will need to list the items and value of those items that have been allocated, or will otherwise be acquired, at trust inception. Step 2: Appoint Trustee(s) ... Step 3: Determine the Beneficiaries. ... Step 4: Outline the Terms.

Organisations and Trusts that are eligible to register under Section 12A of the Income Tax Act are required to fill a form under 10A online. One must note that applicants are required to provide a digital signature to file form 10A.