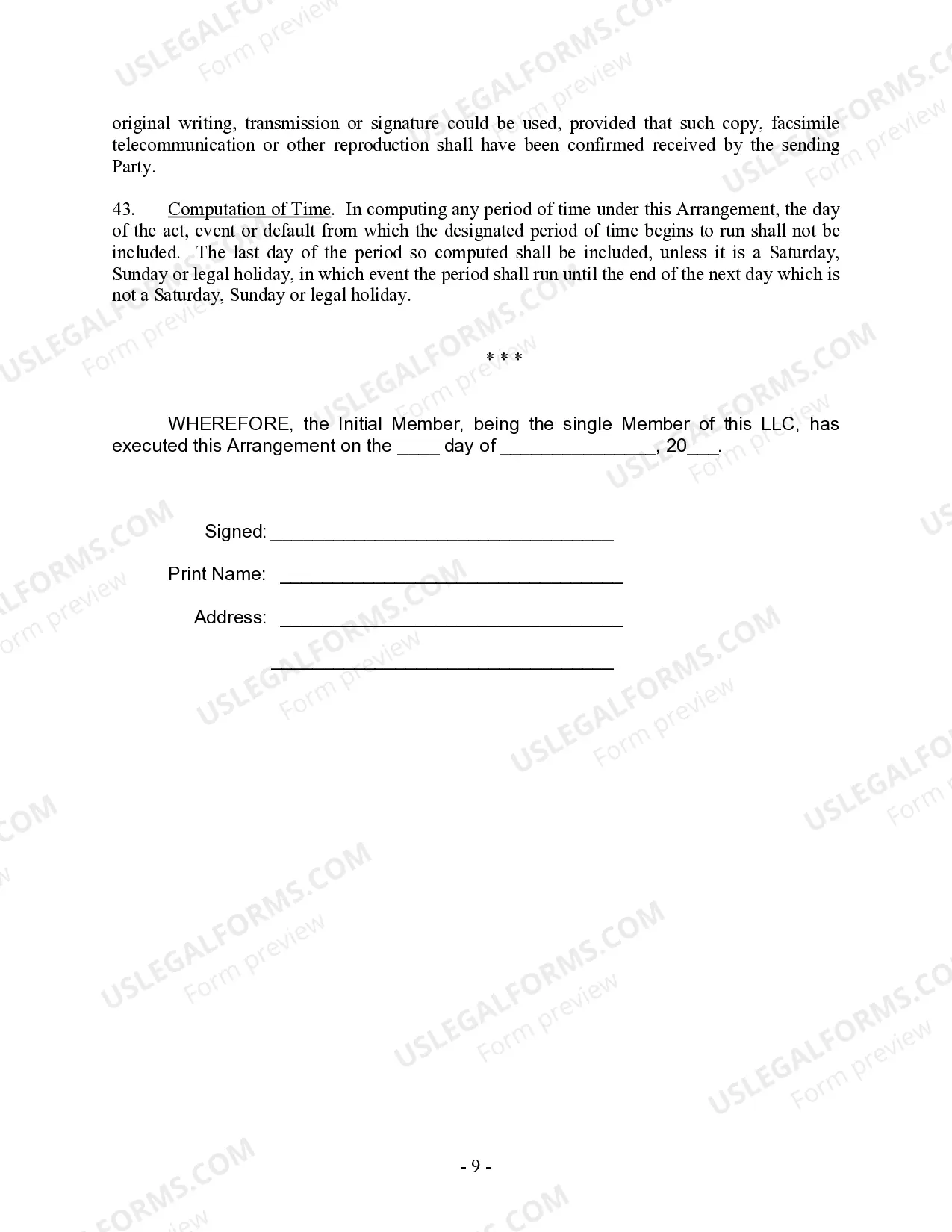

This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. It allows for eventual adding of new Members to LLC.

Single Member Llc Requirements

Description

How to fill out Florida Single Member Limited Liability Company LLC Operating Agreement?

It’s no secret that you can’t become a legal expert overnight, nor can you figure out how to quickly draft Single Member Llc Requirements without having a specialized set of skills. Putting together legal forms is a long process requiring a particular education and skills. So why not leave the creation of the Single Member Llc Requirements to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court papers to templates for in-office communication. We understand how important compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our platform and get the form you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Single Member Llc Requirements is what you’re looking for.

- Begin your search over if you need any other template.

- Set up a free account and choose a subscription plan to buy the template.

- Pick Buy now. Once the transaction is complete, you can download the Single Member Llc Requirements, fill it out, print it, and send or send it by post to the designated individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

For federal income tax purposes, a single-member LLC classified as a disregarded entity generally must use the owner's social security number (SSN) or employer identification number (EIN) for all information returns and reporting related to income tax.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. We require an SMLLC to file Form 568, even though they are considered a disregarded entity for tax purposes.

Some choices for a single-member LLC title are ?Owner,? ?President,? or ?CEO? (Chief Executive Officer). For multi-member LLCs, you might use other corporate titles for LLC owners. These titles can include a COO (Chief Operating Officer) and CFO (Chief Financial Officer).

Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. The LLC is organized in California.

How to Fill Out W9 for Single Member LLC - YouTube YouTube Start of suggested clip End of suggested clip Then you would put your own personal name in line. One. If you're an LLC that's taxed as an SMoreThen you would put your own personal name in line. One. If you're an LLC that's taxed as an S corporation. Or if you're a partnership or another kind of corporation.