Florida Corporations With Credit

Description

How to fill out Florida Corporate Records Maintenance Package For Existing Corporations?

Getting a go-to place to access the most current and relevant legal samples is half the struggle of handling bureaucracy. Choosing the right legal files demands precision and attention to detail, which is why it is crucial to take samples of Florida Corporations With Credit only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You may access and see all the details about the document’s use and relevance for your circumstances and in your state or county.

Take the listed steps to complete your Florida Corporations With Credit:

- Utilize the library navigation or search field to find your template.

- View the form’s description to see if it fits the requirements of your state and county.

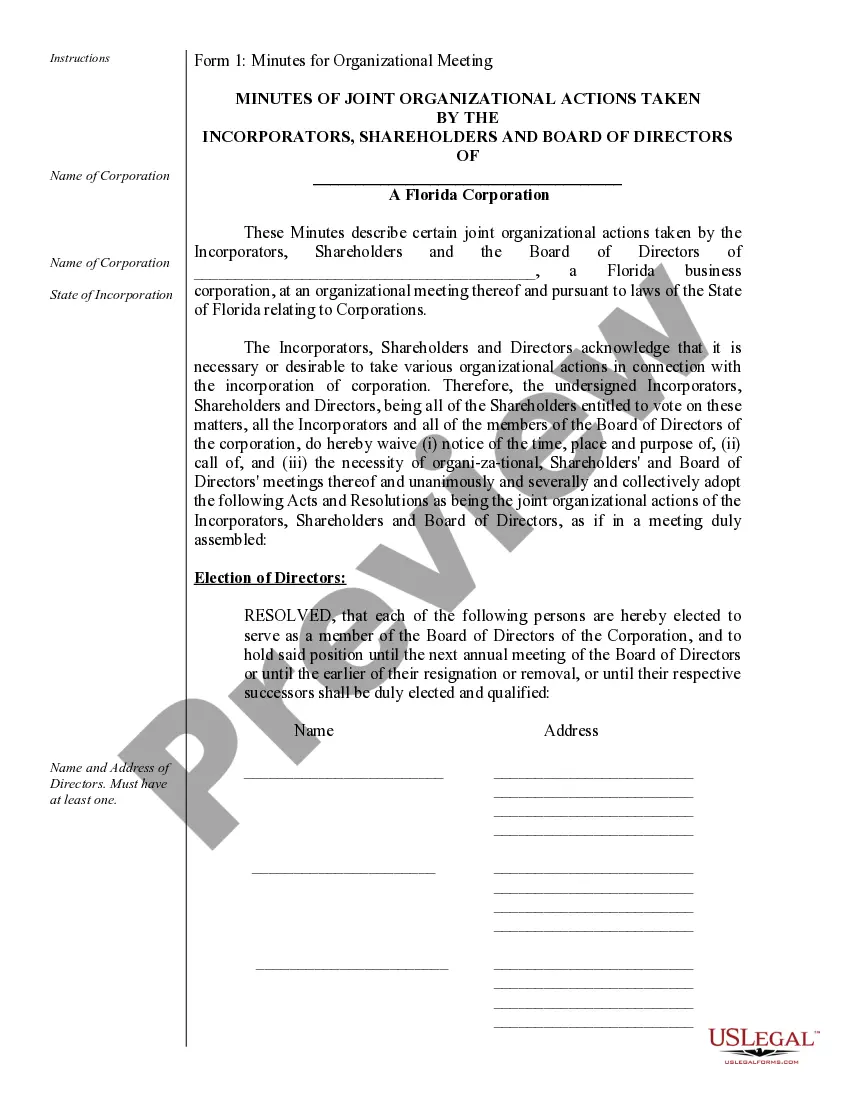

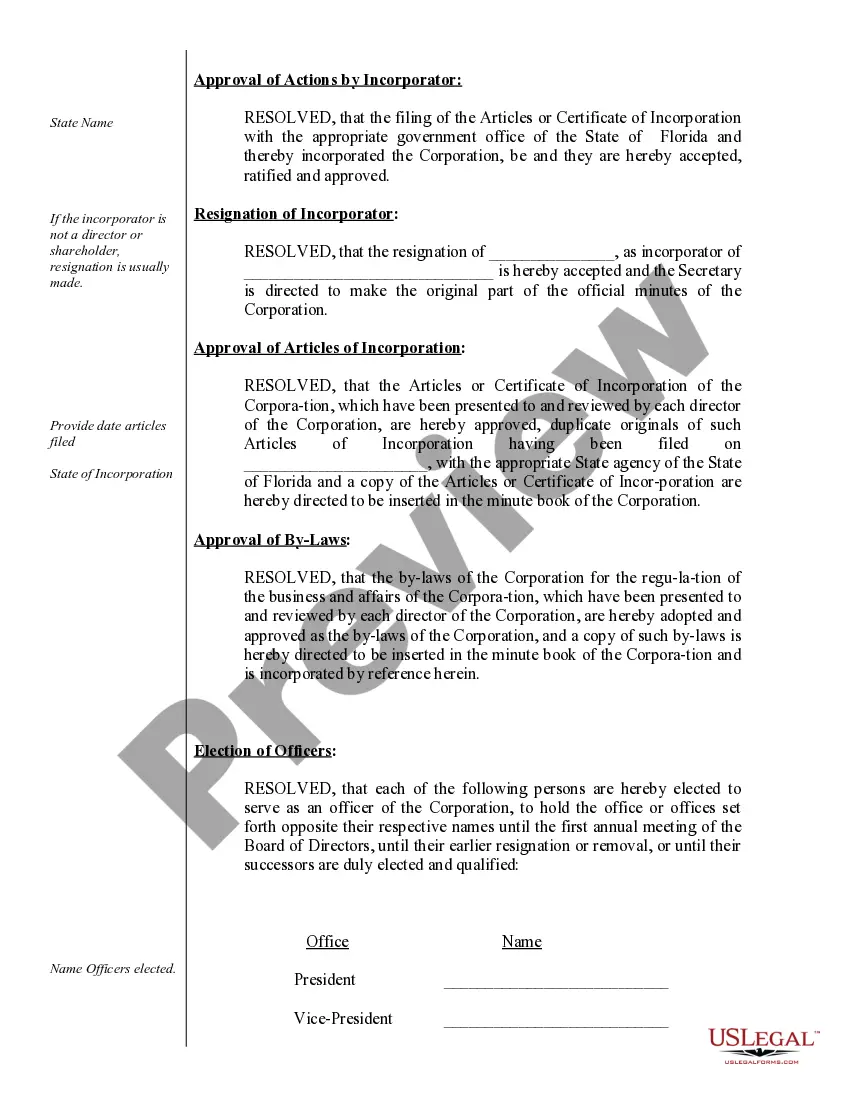

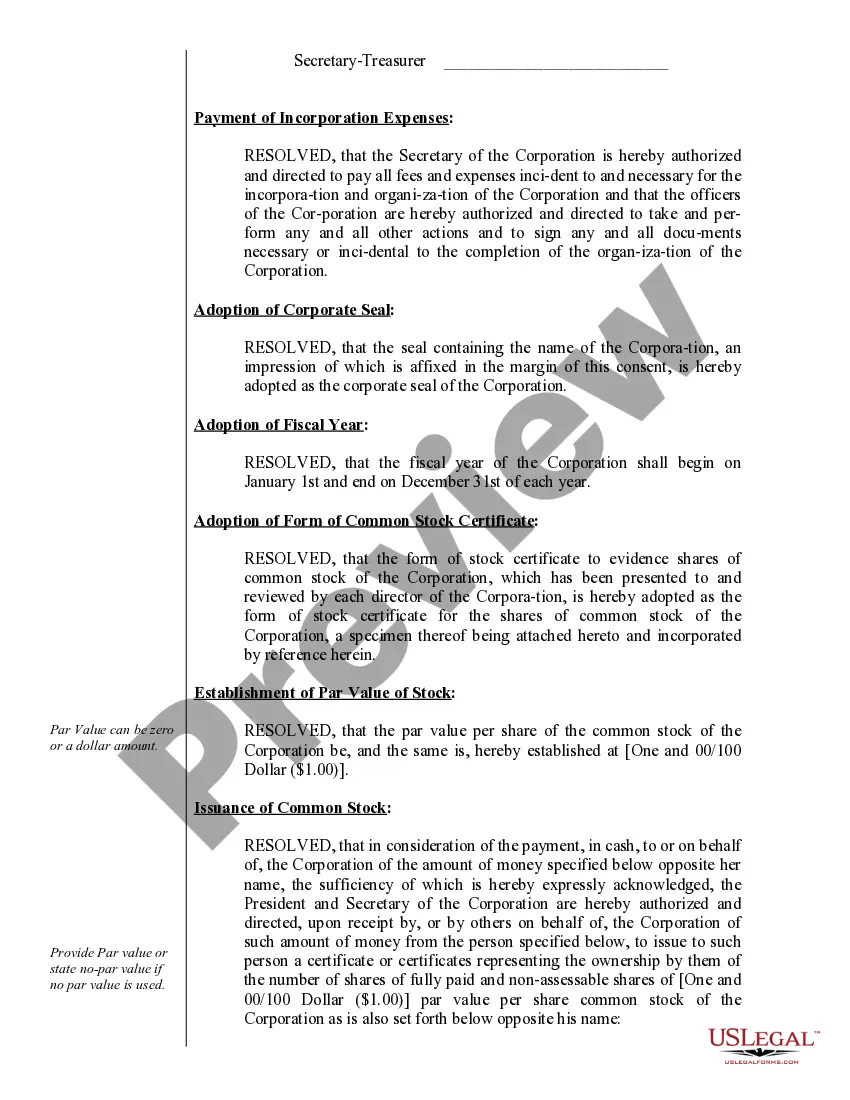

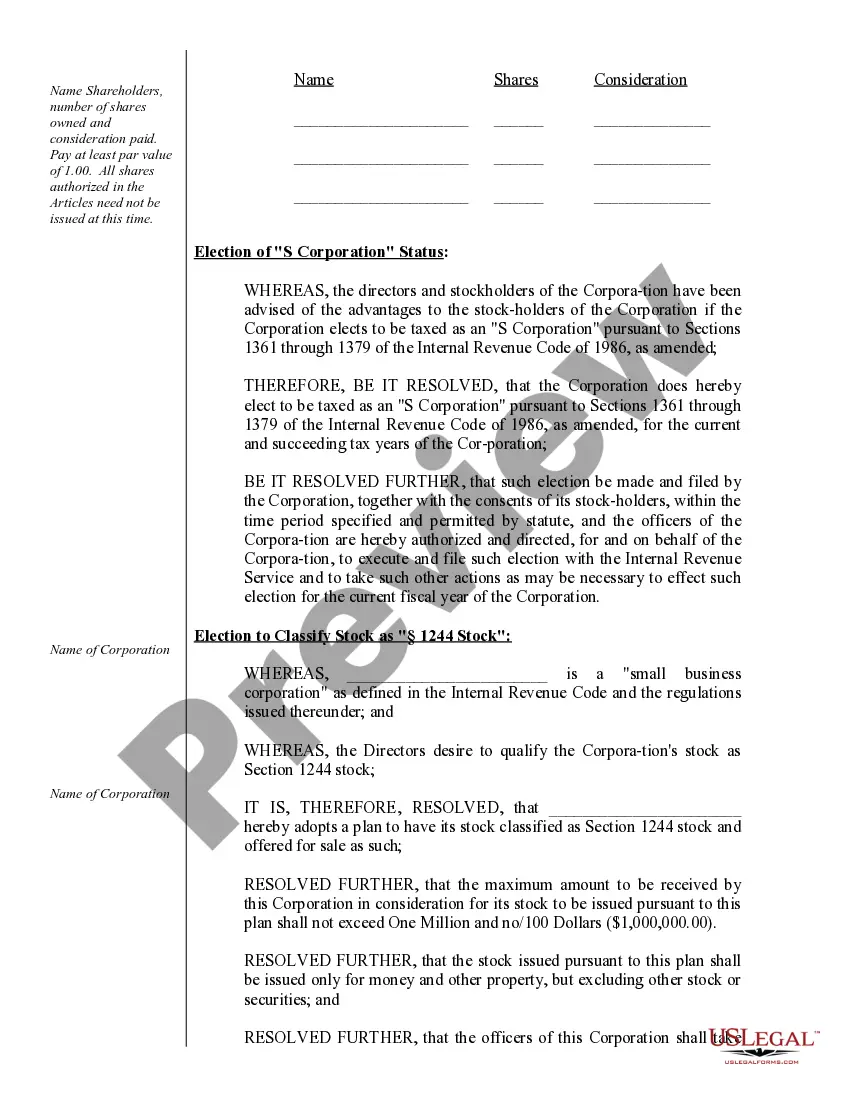

- View the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Go back to the search and locate the appropriate document if the Florida Corporations With Credit does not match your needs.

- When you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Pick the pricing plan that suits your needs.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by selecting a transaction method (credit card or PayPal).

- Pick the file format for downloading Florida Corporations With Credit.

- When you have the form on your gadget, you may modify it with the editor or print it and finish it manually.

Get rid of the hassle that accompanies your legal paperwork. Explore the extensive US Legal Forms collection to find legal samples, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Who is Eligible to File Florida Form F-1120A? Corporations or other entities subject to Florida corporate income tax must file Florida Form F-1120 unless qualified to file Florida Corporate Short Form Income Tax Return, Florida Form F-1120A.

Under Florida law, corporations are required to apportion their business income to the state using a three-factor formula comprised of a payroll, property, and double-weighted sales factor.

Once enrolled, select "Corporate Income Tax File and Pay" from the File and Pay webpage to: File the Florida Corporate Short Form Income Tax Return (Form F-1120A) File Form F-7004. Pay the corporate income tax due on Forms F-1120 and F-1120A. Pay the tentative tax due on Form F-7004.

A corporation doing business outside Florida may apportion its total income. Adjusted federal income is usually apportioned to Florida using a three-factor formula. The formula is a weighted average, designating 25% each to factors for property and payroll, and 50% to sales.

To become an S Corporation, a company must file Form 2553 and pay the fee while meeting the following criteria: The company only has one class of stock. The company must qualify as a small business having no more than 100 shareholders. All shareholders must be domestic, meaning that they cannot be nonresident aliens.