Fl Corporations With Credit Package

Description

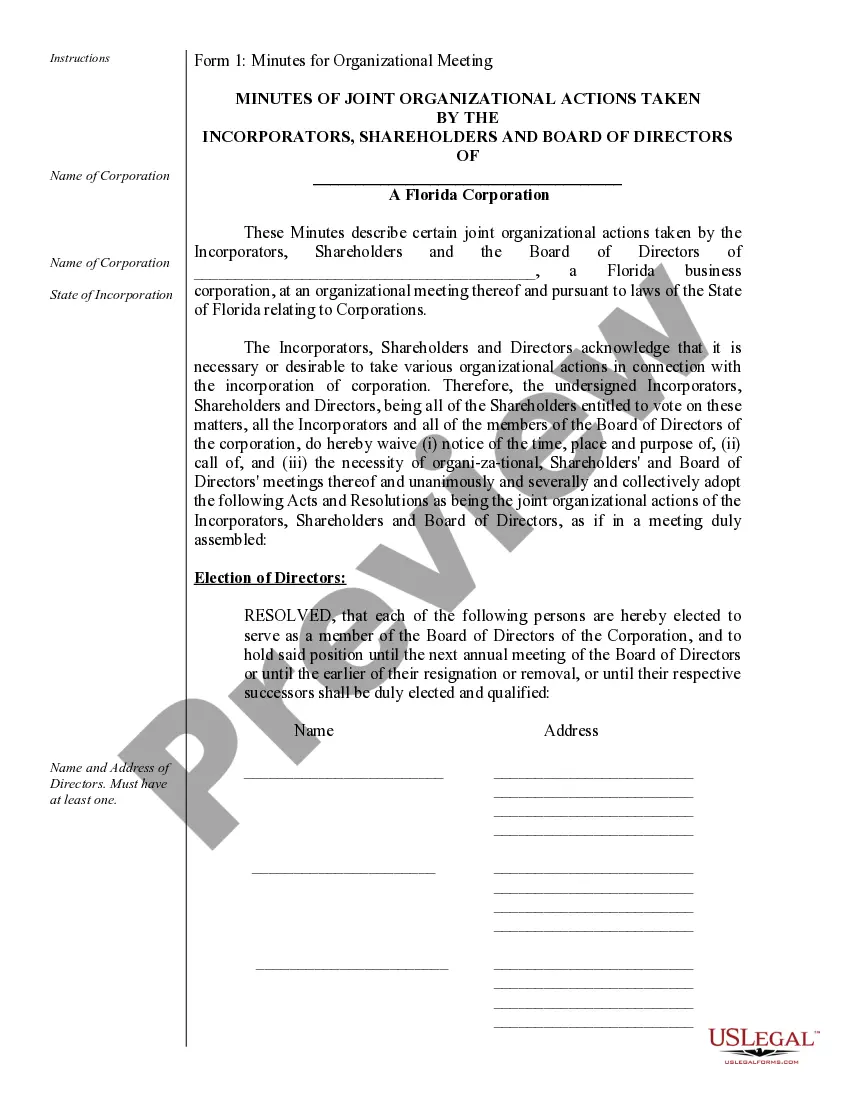

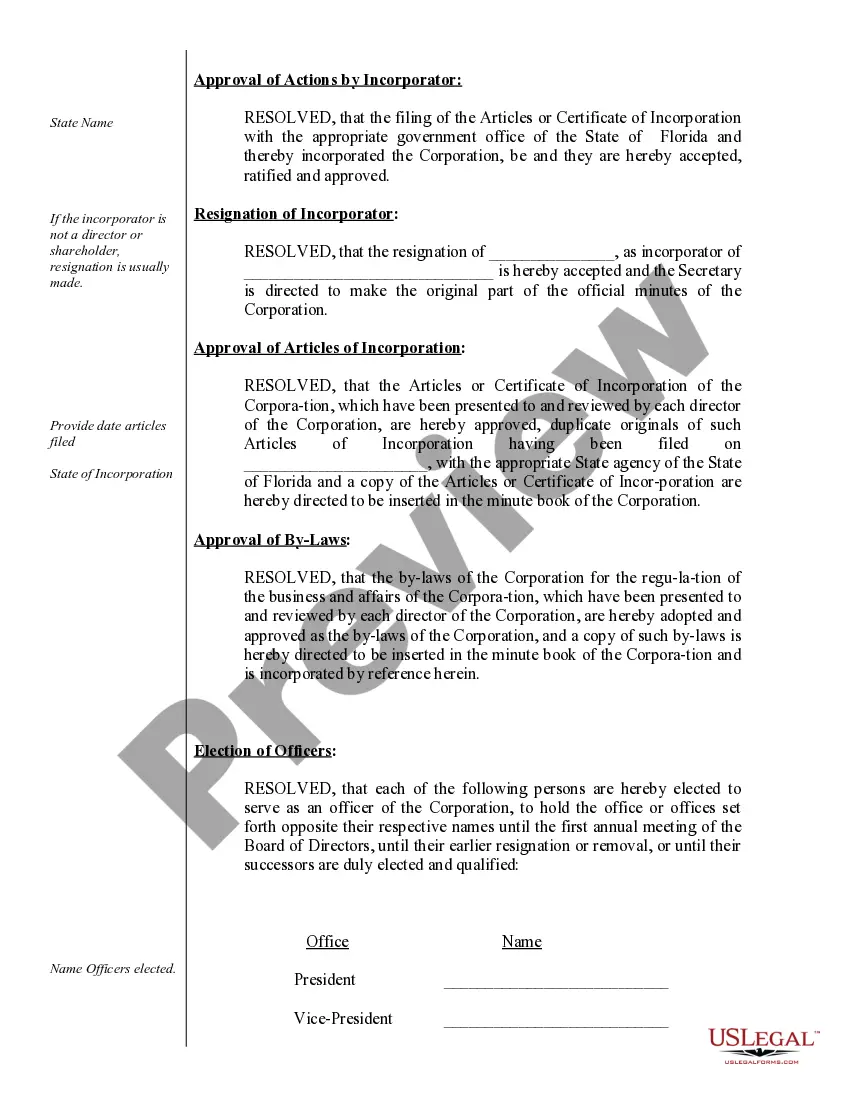

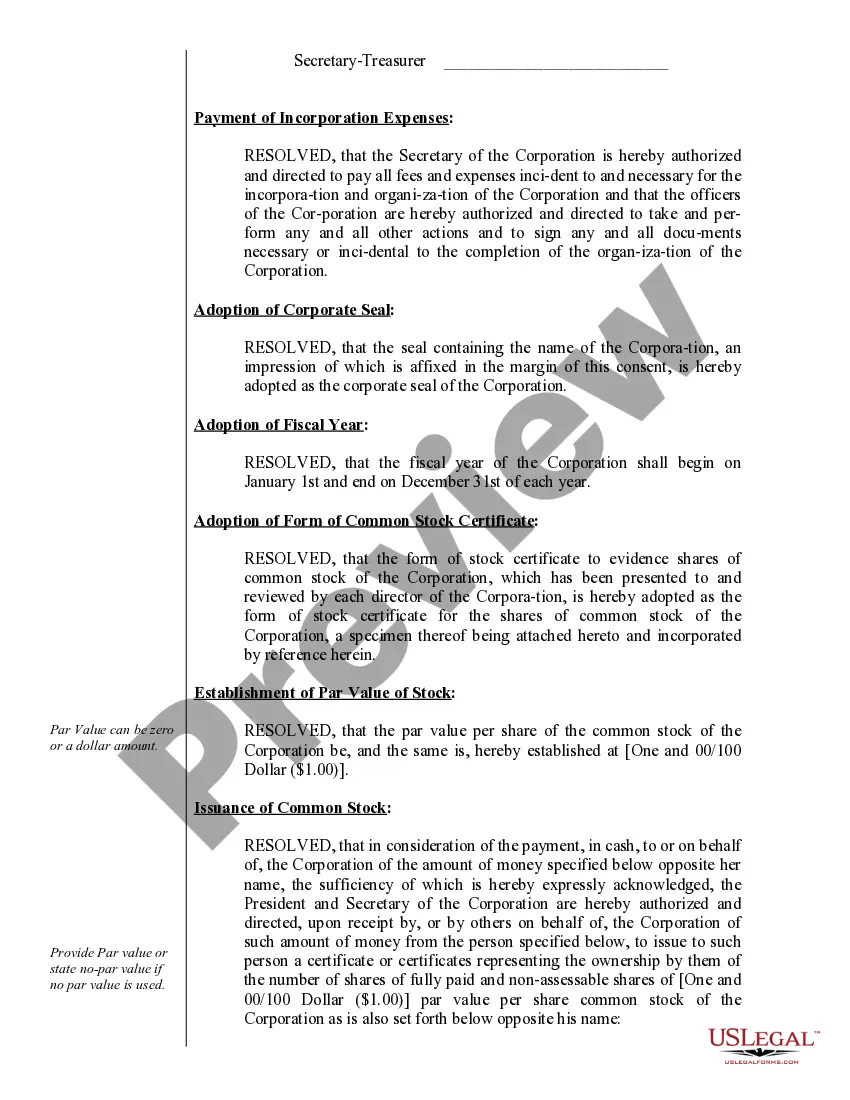

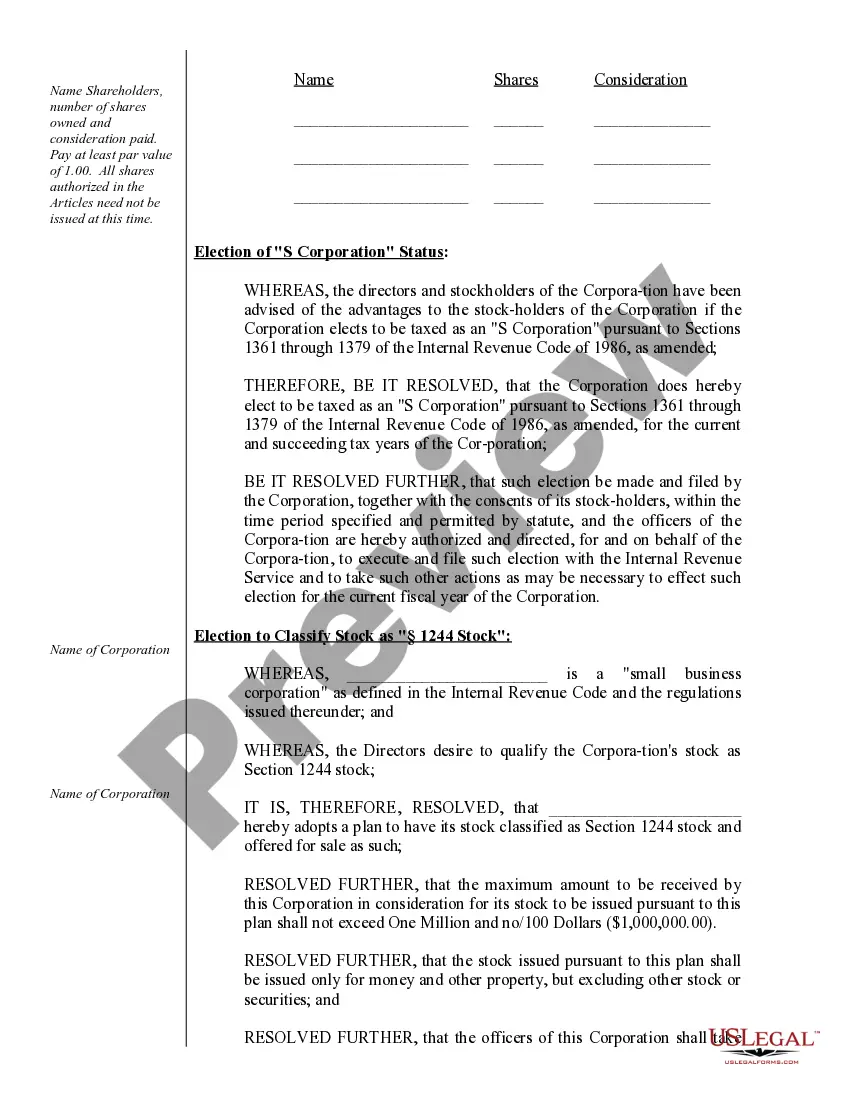

How to fill out Florida Corporate Records Maintenance Package For Existing Corporations?

Handling legal paperwork and procedures can be a time-consuming addition to the day. Fl Corporations With Credit Package and forms like it typically require that you look for them and understand how you can complete them appropriately. For that reason, if you are taking care of economic, legal, or personal matters, having a extensive and hassle-free web catalogue of forms at your fingertips will significantly help.

US Legal Forms is the top web platform of legal templates, boasting more than 85,000 state-specific forms and a number of resources to help you complete your paperwork quickly. Check out the catalogue of relevant papers open to you with just one click.

US Legal Forms gives you state- and county-specific forms offered by any moment for downloading. Protect your papers managing procedures with a high quality support that allows you to make any form within minutes without having extra or hidden fees. Just log in to your account, locate Fl Corporations With Credit Package and download it immediately in the My Forms tab. You may also access previously downloaded forms.

Would it be your first time utilizing US Legal Forms? Sign up and set up up a free account in a few minutes and you will get access to the form catalogue and Fl Corporations With Credit Package. Then, adhere to the steps below to complete your form:

- Make sure you have discovered the proper form by using the Preview option and looking at the form information.

- Pick Buy Now once all set, and choose the monthly subscription plan that suits you.

- Press Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of experience assisting users handle their legal paperwork. Find the form you want right now and improve any process without having to break a sweat.

Form popularity

FAQ

Who Must File? All corporations (including tax-exempt organizations) doing business, earning income, or existing in Florida. Every bank and savings association doing business, earning income, or existing in Florida.

After you form an LLC in Florida, you must file an Annual Report for your LLC and pay $138.75 every year. You need to file your Florida LLC Annual Report each year in order to avoid the penalty and keep your LLC in compliance and in good standing with the Florida Division of Corporations (aka ?Sunbiz?).

Annual Report Fees ServicePriceAnnual Report - Profit Corporation$150.00Annual Report - Non-Profit Corporation$61.25Annual Report - Limited Liability Company$138.75Annual Report - Limited Partnership or Limited Liability Limited Partnership$500.00

?S? corporations are not subject to the tax, except for taxable years when they are liable for the federal tax under the Internal Revenue Code. An ?S? corporation must file a Florida Corporate Income/Franchise and Emergency Excise Tax Return (Form F-1120, incorporated by reference in rule 12C-1.051, F.A.C.)

Corporate income and franchise tax returns. Every taxpayer must file a Florida corporate income and franchise tax return using Form F-1120 for each taxable year in which the taxpayer is liable for tax under the Florida income tax code or is required to file a federal income tax return.