Delaware Disclosure Sales With Vat

Description

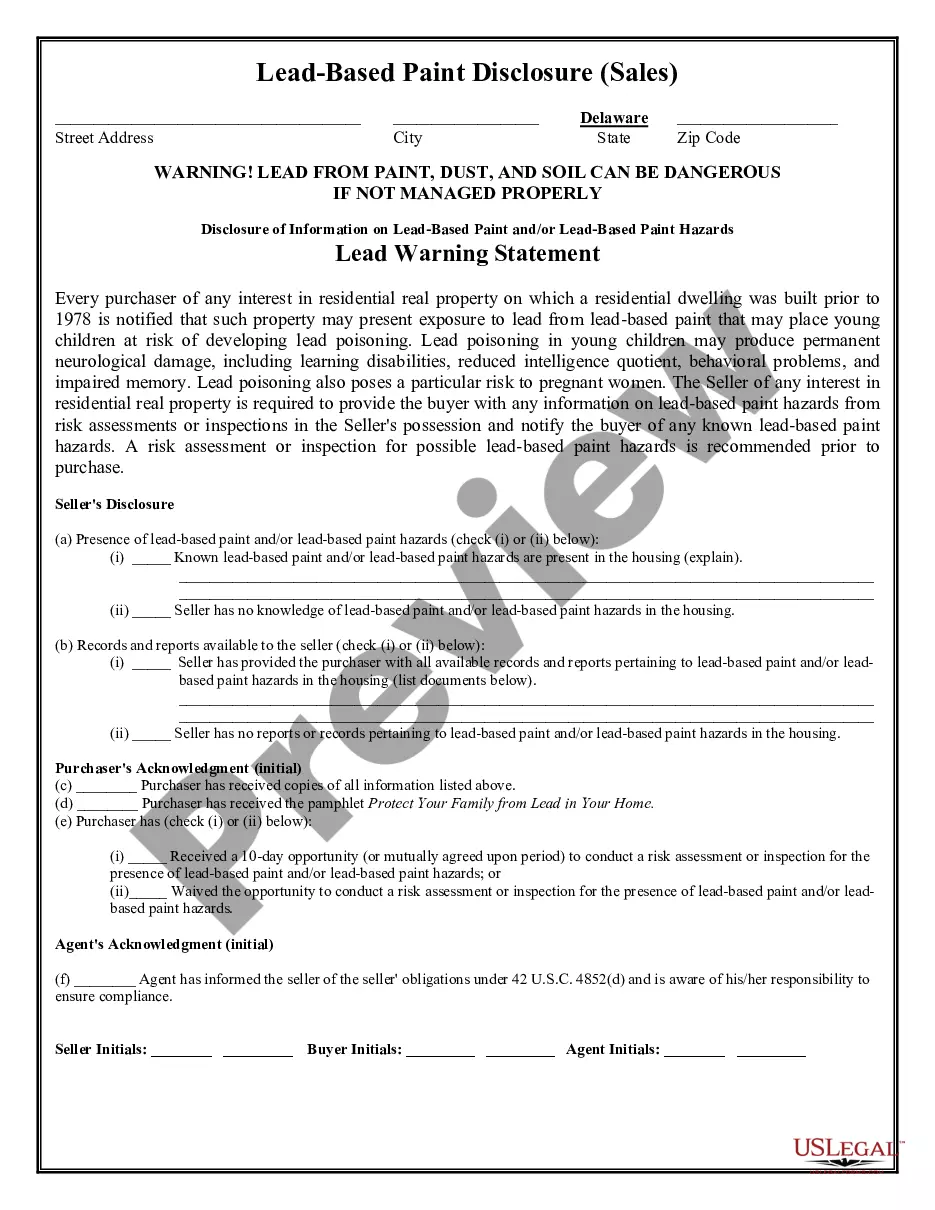

How to fill out Delaware Lead Based Paint Disclosure For Sales Transaction?

The Delaware Disclosure Sales With Vat featured on this page is a reusable official template crafted by experienced attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners over 85,000 validated, state-specific documents for any business and personal situation. It’s the fastest, most straightforward, and most trustworthy method to acquire the required paperwork, as the service ensures the utmost level of data protection and anti-malware security.

Choose the format you prefer for your Delaware Disclosure Sales With Vat (PDF, Word, RTF) and download the template to your device.

- Search for the document you need and review it.

- Browse the sample you searched and preview it or read the form explanation to verify it meets your requirements. If it doesn't fit, utilize the search bar to find the appropriate one. Click Buy Now once you locate the template you require.

- Subscribe and sign in.

- Select the pricing option that best fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to move forward.

- Obtain the editable template.

Form popularity

FAQ

No U.S. state currently has a Value Added Tax (VAT). The concept of VAT is more prevalent in many other countries, but U.S. states typically rely on a sales tax system. Delaware's lack of VAT is beneficial for businesses, especially those involved in Delaware disclosure sales with VAT, as it simplifies the sales process and enhances financial outcomes.

Delaware does not impose a sales tax, whether online or in-person. This absence of sales tax creates a favorable environment for e-commerce businesses and consumers alike. For those conducting Delaware disclosure sales with VAT, this unique feature allows for seamless transactions without the complication of sales tax.

The United States does not have a federal Value Added Tax (VAT) like many other countries. Instead, states have their own sales tax systems, which vary significantly. This absence of a federal VAT makes Delaware's tax structure particularly appealing for businesses engaging in Delaware disclosure sales with VAT, as they can avoid the complexities of a VAT system.

Delaware has strategically positioned itself as a business-friendly state by not implementing sales tax. This approach attracts companies looking to minimize expenses and maximize profits. Consequently, businesses involved in Delaware disclosure sales with VAT can benefit from this system, enhancing their overall operational efficiency and market competitiveness.

Currently, there are no states in the U.S. that implement a Value Added Tax (VAT). However, several states, including Delaware, do not impose a sales tax. This unique tax structure enhances Delaware's appeal for businesses involved in Delaware disclosure sales with VAT, as it allows companies to operate without the additional tax burden present in other states.

The Delaware business tax loophole refers to the state’s favorable tax structure, which includes no sales tax. Many companies choose to incorporate in Delaware due to its business-friendly environment and legal advantages. This creates opportunities for businesses to engage in Delaware disclosure sales with VAT without the burden of sales tax, allowing for greater profit margins.

Delaware's lack of sales tax is attributed to its strategic approach to attracting businesses and investors. This policy encourages economic growth and makes the state a favorable destination for consumers. When you look at Delaware disclosure sales with VAT, the absence of sales tax simplifies purchasing decisions and enhances the overall business environment.

The seller's disclosure of real property condition report in Delaware is a document that outlines the condition of a property being sold. It includes information about any known issues or defects that may affect the property's value. When considering Delaware disclosure sales with VAT, this report can be vital for transparency in real estate transactions.

Filing Delaware gross receipts tax involves completing the appropriate tax forms and submitting them to the Delaware Division of Revenue. Businesses must report their gross sales, and the tax is based on total revenue rather than profit. For those dealing with Delaware disclosure sales with VAT, ensuring accurate filing is crucial to avoid penalties and maintain compliance.

Delaware does not have a VAT system in place. This absence of VAT is beneficial for businesses and consumers, as it simplifies tax calculations and compliance. If you're looking into Delaware disclosure sales with VAT, rest assured that you won't encounter VAT complications in this state.