Notice Lien About With The

Description

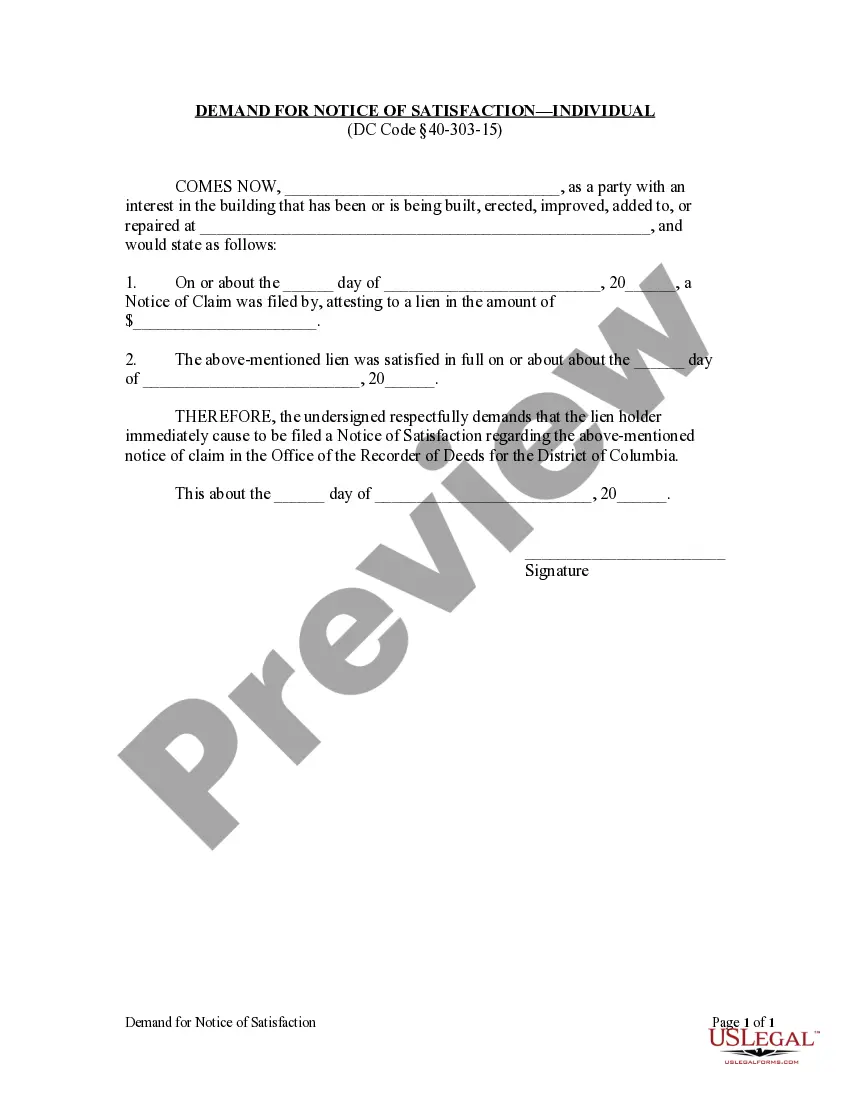

How to fill out District Of Columbia Demand For Notice Of Satisfaction By Corporation?

- If you're an existing user, log in to access your account, and click the Download button for the desired form. Ensure your subscription is up to date and renew if necessary.

- For new users, start by exploring the Preview mode and form description to find the right document that matches your jurisdiction's requirements accurately.

- If you’re unable to find the correct form, utilize the Search feature to locate templates that fit your needs, and proceed only when satisfied.

- Proceed to purchase the document by clicking the Buy Now button and selecting a subscription plan that best suits you. Registration is required to access the library.

- Complete your payment using your credit card or PayPal for a seamless transaction.

- Finally, download your form and save it to your device. You can always revisit it later through the My Forms section of your profile.

By using US Legal Forms, you gain access to a robust collection of more than 85,000 legal forms and packages, ensuring you have everything you need to create legally sound documents.

Take control of your legal needs today and explore the vast collection at US Legal Forms. Start your journey towards hassle-free documentation now!

Form popularity

FAQ

A lien can significantly impact your financial situation and credit score. When you receive a notice lien about with the property or assets you own, it indicates that a creditor has a legal claim to those assets until you settle your debt. This can limit your ability to sell or refinance your property, as potential buyers may hesitate to proceed. Understanding the implications of a lien is crucial, and platforms like USLegalForms can help you navigate this complex process effectively.

Responding to a lien requires understanding your options and drafting a clear reply. Begin by reviewing the lien details to confirm its validity and ensure all necessary information is present. You may want to counter claim or negotiate the terms if there are disputes. In such situations, leveraging resources from US Legal Forms can provide you with templates and guidance, making your response easier and legally sound.

To fill out a lien affidavit, start by gathering all required information, including details about the property, the amount owed, and the parties involved. Use a clear and structured format to ensure accuracy and compliance with local laws. It is essential to provide specific language that clearly states the purpose of the notice lien about with the property. If you're unsure, consider using US Legal Forms, which offers templates to guide you through the process.

To obtain a lien release letter, start by contacting the creditor who placed the lien on your property. You will need to provide documentation such as proof of payment or completion of the obligation that led to the lien. Once processed, the creditor will issue your lien release letter, effectively verifying that the claim has been lifted. Using platforms like US Legal Forms can simplify this process and guide you through the necessary steps.

When a lien is placed on you, it means that a creditor has made a legal claim against your property due to unpaid debts. This action can affect your credit score and your ability to sell or refinance the property without addressing the lien. Understanding the notice lien about with the impact on your assets is crucial for managing your financial situation. You may need to negotiate with creditors to resolve this matter.

The speed at which you can get a lien release depends on several factors, including the responsiveness of the creditor and the type of lien. Generally, once you clear the debt or fulfill the obligations tied to the lien, you can request the release. Creditors typically respond within a few days to weeks after receiving your request. Utilizing a service like US Legal Forms can help expedite the process and ensure you have the necessary documents.

To obtain a copy of your lien release from the IRS, you should contact them directly or visit their website for the required forms. You will need to provide specific information regarding your tax situation, including your Social Security number and details about the lien. By following the steps accurately, you can secure your lien release, which is vital for clearing your credit record. This process addresses the notice lien about with the IRS effectively.

A notice of lien is a public record that a creditor files to claim an interest in your property due to an unpaid debt. This document serves to inform others that the creditor has a legal right to your property until the debt is settled. Understanding the notice lien about with the implications of outstanding debts is essential for property owners. It protects creditors by alerting potential buyers or lenders of the existing claim.

To get your lien release letter, you need to contact the entity that placed the lien on your property. Typically, this is either a lender or governmental agency. You may be required to provide proof of payment or fulfillment of the obligations related to the lien. After verifying your information and requirements, they will issue your lien release letter.

The conditions for a lien generally include having a legitimate debt and notifying the property owner formally. This notice lien about with the property must be documented through a proper filing process, which may vary by state. Each state has its specific requirements, so understanding local laws is crucial. For those uncertain of the process, ulegalforms provides tools and guides to navigate these complexities.