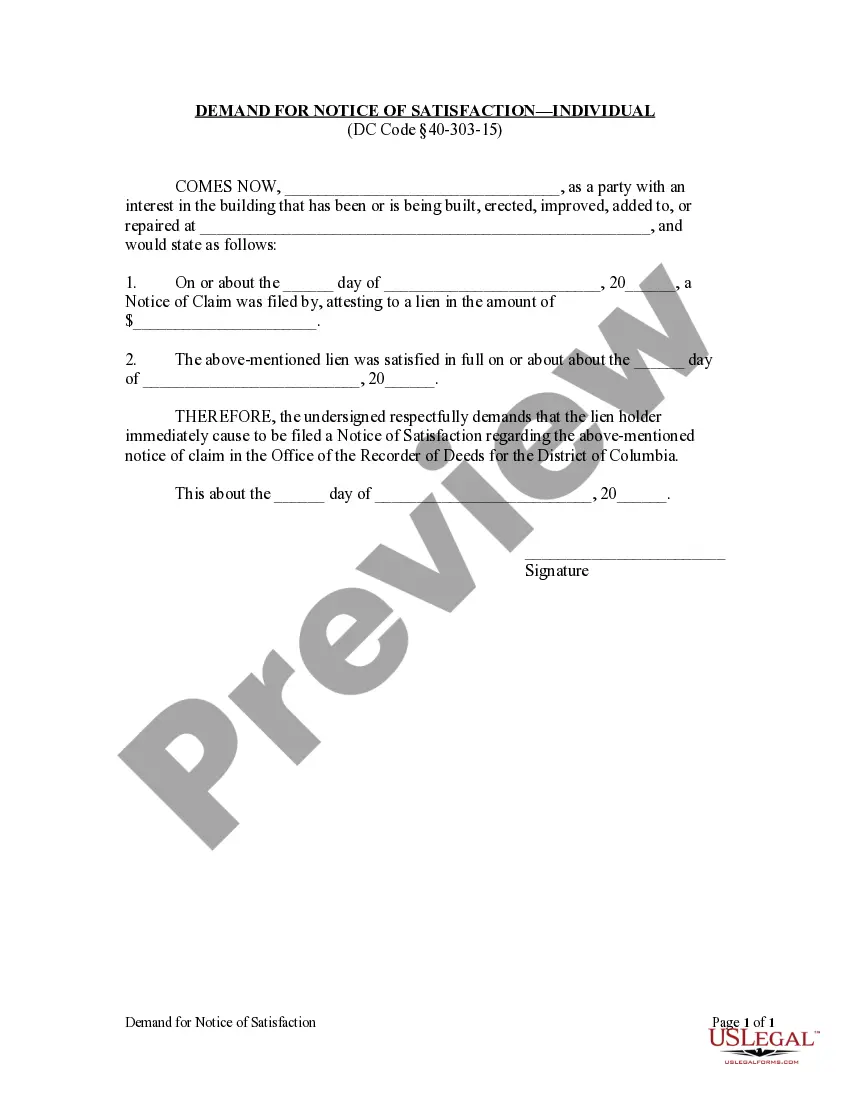

This form is used by a corporate party who has an interest in property under lien to demand that the lienholder file a Notice of Satisfaction.

Limited Liability Company For Rental Property

Description

How to fill out District Of Columbia Demand For Notice Of Satisfaction By Corporation?

- If you're a returning user, log into your account and access the necessary form templates to download them directly to your device. Ensure your subscription is active; if not, renew it as per your payment plan.

- For first-time users, begin by reviewing the available forms in Preview mode to select the one that best suits your rental property needs while adhering to local jurisdictional requirements.

- If you encounter any discrepancies, use the Search tab to find the appropriate document template. Once you find one that meets your needs, proceed to the next step.

- Purchase the selected document by clicking the Buy Now button and choose your preferred subscription plan. Make sure to register for an account to access the full range of resources.

- Complete your purchase by entering your credit card information or selecting PayPal for payment processing.

- Download your chosen form to your device, ensuring easy completion. You can access this document anytime later via the My Forms section of your profile.

With US Legal Forms, you benefit from a robust collection of legal forms, ensuring you have more options than competitors at a similar price. Their extensive library of over 85,000 fillable and editable forms makes document preparation easy and efficient.

Don't hesitate to consult with premium experts available through the platform to get your forms completed accurately. Start your journey towards establishing a limited liability company for your rental property today!

Form popularity

FAQ

To place your rental property in a limited liability company for rental property, begin by forming the LLC through your state's business filing office. Next, draft and sign a deed that transfers ownership of the property from your name to the LLC. Be sure to notify your mortgage lender about the change, as some loans may have restrictions on transferring property to an LLC. Using uslegalforms can streamline this transfer process, providing the necessary templates and guidance tailored to your needs.

To file taxes for a limited liability company for rental property, you typically report your income and expenses on a Schedule E form, which is attached to your individual tax return. It's important to keep detailed records of rents collected and all expenses related to your rental property, such as repairs and property management fees. If your LLC has more than one member, the business may need to file Form 1065, which reports profits and losses to the IRS. Utilizing platforms like uslegalforms can help simplify the process and ensure you meet all tax requirements effectively.

Starting a single-member LLC for rental property is a popular choice for individual owners, providing simplicity and personal liability protection. Alternatively, a multi-member LLC suits partnerships or groups investing together. When creating a limited liability company for rental property, consider your investment goals and consult with a legal expert to choose the best structure.

The best business type for a rental property often is a limited liability company for rental property. This structure protects your personal assets from business liabilities while providing tax flexibility. By forming an LLC, you can manage your rental activities more efficiently while safeguarding your financial interests.

While a limited liability company for rental property provides many benefits, there are drawbacks to consider. These may include higher formation costs, annual fees, and specific tax filing requirements. Understanding these challenges will help you weigh the pros and cons of establishing an LLC for your rental ventures.

An ideal LLC for rental property typically offers asset protection and tax advantages. A single-member LLC or a multi-member LLC, depending on your ownership structure, can benefit your rental business. Establishing a limited liability company for rental property allows for personal liability protection, making it easier to manage risks associated with real estate investments.

The ideal limited liability company for rental property often consists of a single-member or multi-member structure, depending on ownership. A single-member LLC simplifies management and tax reporting, while a multi-member LLC can share responsibilities and resources. When choosing a structure, consider liability protection, tax implications, and your long-term investment goals. Utilizing a platform like US Legal Forms can help guide you through the necessary paperwork.

To place your rental property within a limited liability company for rental property, first, establish the LLC by filing the necessary documents with your state. Next, transfer the property's title to the LLC, which may involve a deed transfer. Additionally, consult a legal or tax professional to ensure compliance with local laws and regulations. This process helps protect your personal assets and streamline management.