Limited Business

Description

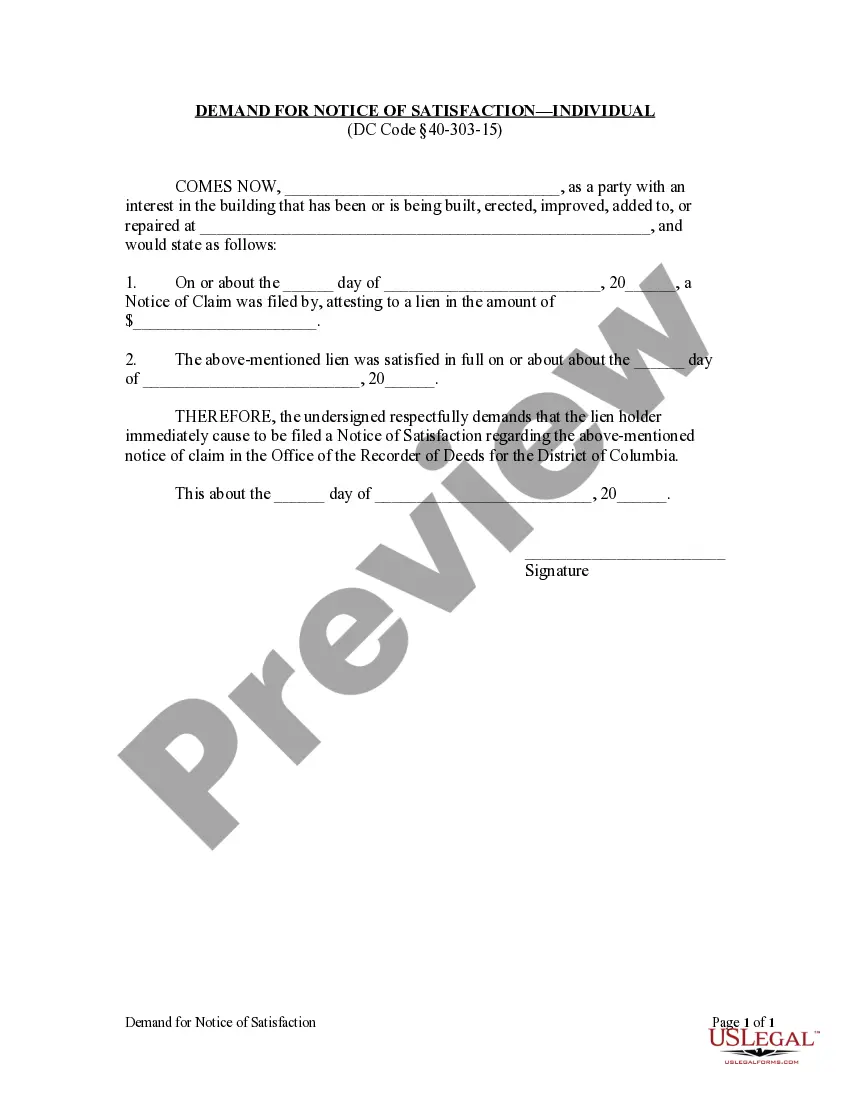

How to fill out District Of Columbia Demand For Notice Of Satisfaction By Corporation?

- Log in to your account if you're a returning user. Ensure that your subscription is active before downloading any forms.

- Preview the available forms to confirm you've selected the one that suits your legal needs and complies with your jurisdiction's requirements.

- If the desired form isn't right, use the search feature to find an alternative template that meets your specifications.

- To purchase the form, click 'Buy Now' and choose a suitable subscription plan. Remember, you'll need to create an account for full access.

- Complete your transaction using your credit card or PayPal to finalize your subscription.

- Download the purchased forms to your device. You can access them anytime via the 'My Forms' section in your account.

US Legal Forms stands out due to its vast collection of over 85,000 fillable and editable legal forms, offering more options than competitors at a similar cost.

In conclusion, accessing legal documents for your limited business has never been easier. Take advantage of US Legal Forms’ robust resources and expert assistance to ensure your documents are precise and legally sound. Start your journey today by visiting US Legal Forms!

Form popularity

FAQ

An example of a limited liability company is a company formed by two or more partners who own a restaurant. In this arrangement, the members are not personally liable for the restaurant’s debts, protecting their assets from any legal actions or financial losses. Limited liability companies offer a combination of liability protection and tax benefits, making them attractive for entrepreneurs. If you plan on starting a limited business, exploring the LLC structure through platforms like US Legal Forms can streamline the process.

An example of a limited business is a limited liability company, or LLC. In an LLC, the owners, known as members, enjoy personal liability protection while benefiting from flexible management structures. This format combines the advantages of traditional corporations and sole proprietorships, making it a popular choice for many small business owners. Therefore, if you are considering starting a limited business, an LLC could be the ideal option.

A limited business typically refers to a structure that limits the liability of its owners. This means that the personal assets of the owners are protected from business debts and liabilities. Common limited business structures include limited liability companies (LLCs) and limited partnerships. By choosing a limited business format, entrepreneurs can safeguard their personal finances while still enjoying the benefits of running their own enterprise.

When a business has 'limited' in its name, it indicates that it operates as a limited liability entity. This means that the personal assets of the owners are shielded from business debts, limiting their financial exposure. This designation not only enhances credibility but also allows for easier capital investment. For anyone starting or running a limited business, it's important to understand how this affects your operation and responsibilities.

In business terminology, 'limited' often describes a company structure that protects its owners from personal liability. This structure separates personal and business finances, which can lead to a more organized and secure financial operation. Additionally, limited businesses often carry a higher level of credibility in the eyes of potential clients and investors. Overall, it is a strategic choice for many entrepreneurs.

Businesses use 'limited' in their name to signify their limited liability status. This designation informs clients and partners that their financial risk in engaging with the company is capped. It builds trust and invites more investment opportunities. Understanding this terminology helps you appreciate the advantages of a limited business form.

A limited company is a type of business entity where the liability of the owners is limited to their shares. This structure helps protect personal assets from business-related debts. When you operate a limited business, you can more easily attract investors, as they share less risk. Choosing to form a limited company can be a smart financial decision, making it essential to understand its implications.

In a business context, 'limited' often refers to 'limited liability.' This means the owners of the business are only personally responsible for the debts and obligations of the business up to the amount they invested. Thus, if the business faces financial trouble, the owner's personal assets are generally protected. Understanding limited liability is crucial for anyone considering a limited business structure.

A limited company is defined by its structure that protects owners from personal liability concerning company debts. It must be registered with the appropriate state authority, adhere to operational regulations, and often maintain a level of statutory compliance. Understanding these requirements is crucial for establishing a successful limited business and avoiding potential legal hurdles.

Using 'limited' instead of LLC can cause confusion and may not meet legal requirements. While both terms reference a limited business structure, trademark and registration mandates dictate the exact terminology. For clarity and compliance, always use the full term 'LLC' in official documents associated with your limited business.