Ct Annual File Withholding

Description

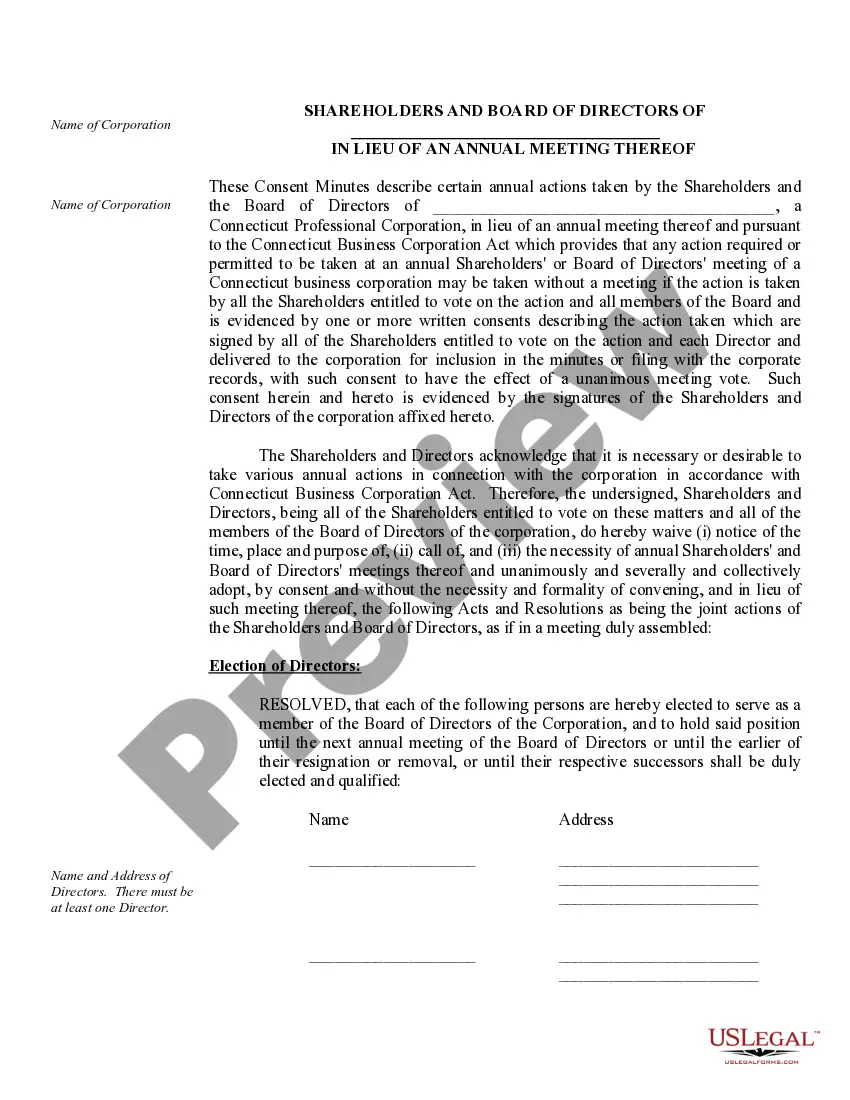

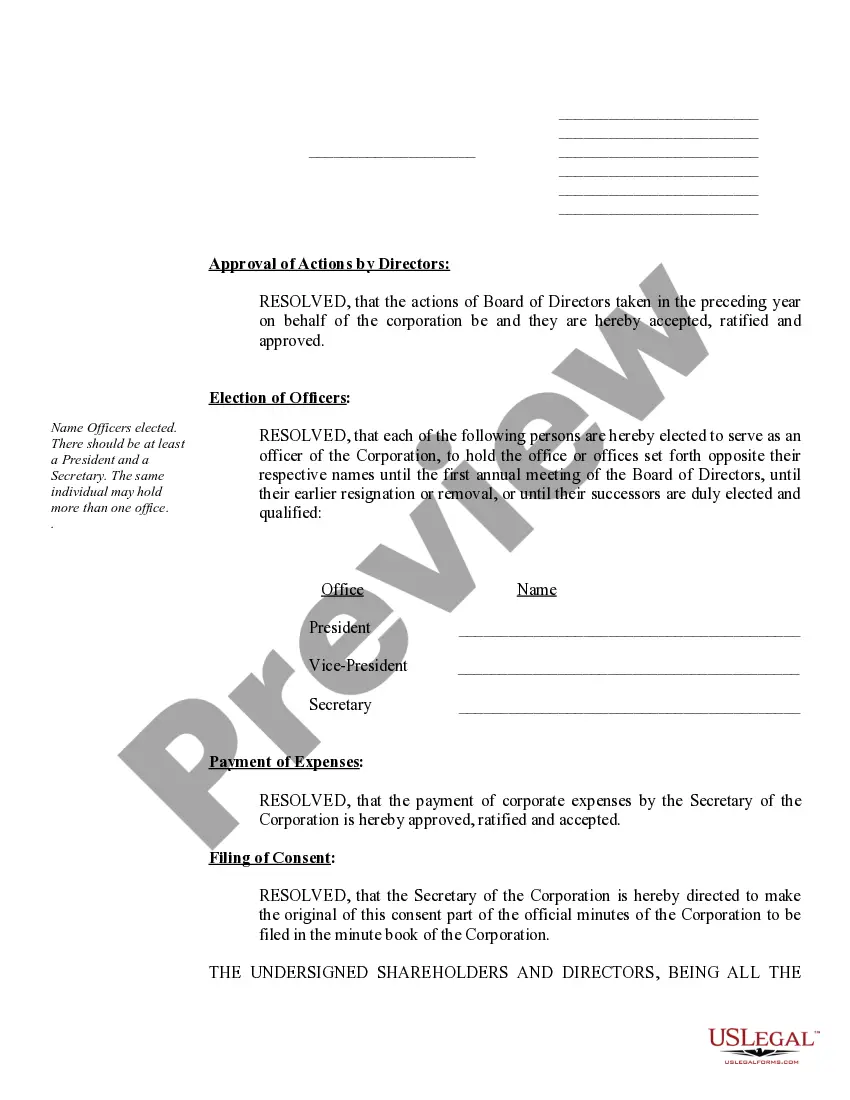

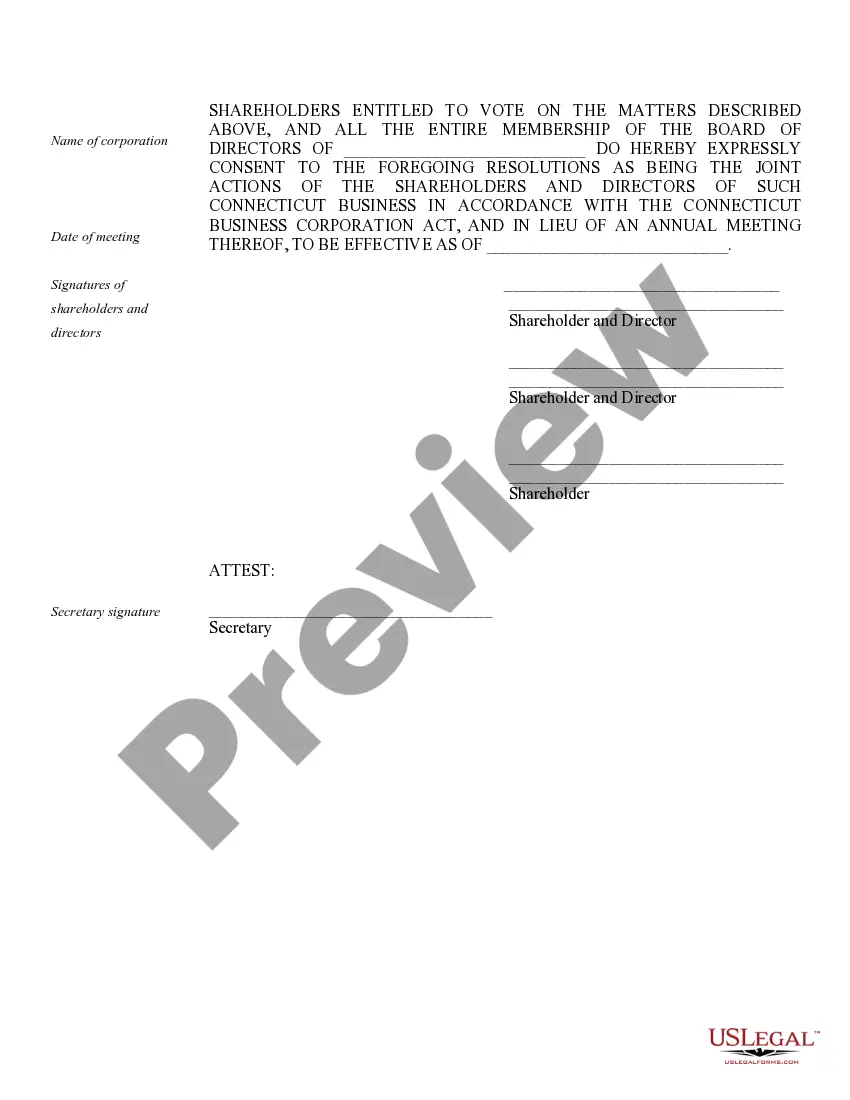

How to fill out Annual Minutes For A Connecticut Professional Corporation?

Managing legal documents can be daunting, even for seasoned professionals.

When you're looking for a Ct Annual File Withholding and don’t have the spare time to search for the correct and current version, the process can be stressful.

US Legal Forms caters to all your needs, spanning personal to commercial document requirements, all conveniently in one location.

Utilize sophisticated tools to complete and manage your Ct Annual File Withholding.

Here are the steps to follow once you've acquired the form you need: Validate that it’s the correct document by previewing and examining its details.

- Tap into a wealth of articles, tutorials, and guides relevant to your circumstances and requirements.

- Conserve time and effort by leveraging US Legal Forms’ advanced search and Preview feature to locate and obtain Ct Annual File Withholding.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the document, and download it.

- Check your My documents tab to review the documents you've previously obtained and manage your folders accordingly.

- If you're new to US Legal Forms, create a free account to enjoy unlimited access to all the platform's advantages.

- Utilize a powerful online form repository to significantly enhance efficiency in these scenarios.

- US Legal Forms stands as a leader in the online legal form sector, offering over 85,000 state-specific legal documents accessible at all times.

- With US Legal Forms, you have the ability to access various legal and business documents tailored to your state or locality.

Form popularity

FAQ

To fill out an employee's withholding allowance certificate, you need to provide accurate personal information such as your name, address, and Social Security number. Additionally, complete the section on the number of allowances you are claiming based on your financial situation. Properly completing this form helps ensure you're aligned with the CT annual file withholding requirements.

Salesperson applicants must: Successfully complete sixty (60) classroom hours of real estate education of which thirty (30) classroom hours must be in the basic principles of real estate, from an accredited postsecondary school or a school or organization licensed by the Arkansas Real Estate Commission [ACA Sect.

In order to pass the Arkansas real estate exam, you'll need a score of at least 70%. Passing the exam is much easier (and less stressful) for anyone who has completed Exam Prep courses.

How many questions is the real estate exam in Arkansas? The Arkansas Salesperson Pre-licensure Exam consists of two sections. The national section asks 80 multiple-choice questions, and the state section asks 30 multiple-choice questions. You need a scaled score of 70 to pass.

We know you have a busy life, and sometimes, it's not realistic to study for hours every day in the weeks leading up to your Arkansas Real Estate licensing exam. That's okay, even just a few hours with our prep guide will mean you are able to pass your AR exam confidently ? first try. Average pass rate is only 64%.

The salesperson exam consists of two portions, the national portion and the Arkansas State Law portion. There are 85 national questions and 40 State Law questions. The broker exam consists of only one portion with 130 questions. There can be 5-10 "Pre-Test" questions in each category.

1. How much does it cost to get your real estate license in Arkansas? Average Course Tuition$369-$589Arkansas Criminal Background Check Fee$22FBI Criminal Background Check Fee$14.25Exam Fee$75License Fee$503 more rows

Yes. Selling your house ?as is? is totally legal! In Arkansas, there is no state law that requires property owners to disclose every aspect of their property's condition when selling.

5 tips for selling your home without a realtor in Arkansas Make minor repairs. Small upgrades and repairs can do a lot to sway potential buyers. ... Price your Arkansas home competitively. ... Stage and market your home. ... Prepare for showings. ... Negotiate for the best possible price.

Key considerations to selling your property quickly: Understand the market and the trends: Search for properties similar to yours. Pick the right market climate and season. Understand the demand in your localities. Sell your property online. Click good property photos. Add a video tour. ... Get repairs and renovations done.