Power Of Attorney Instructions

Description

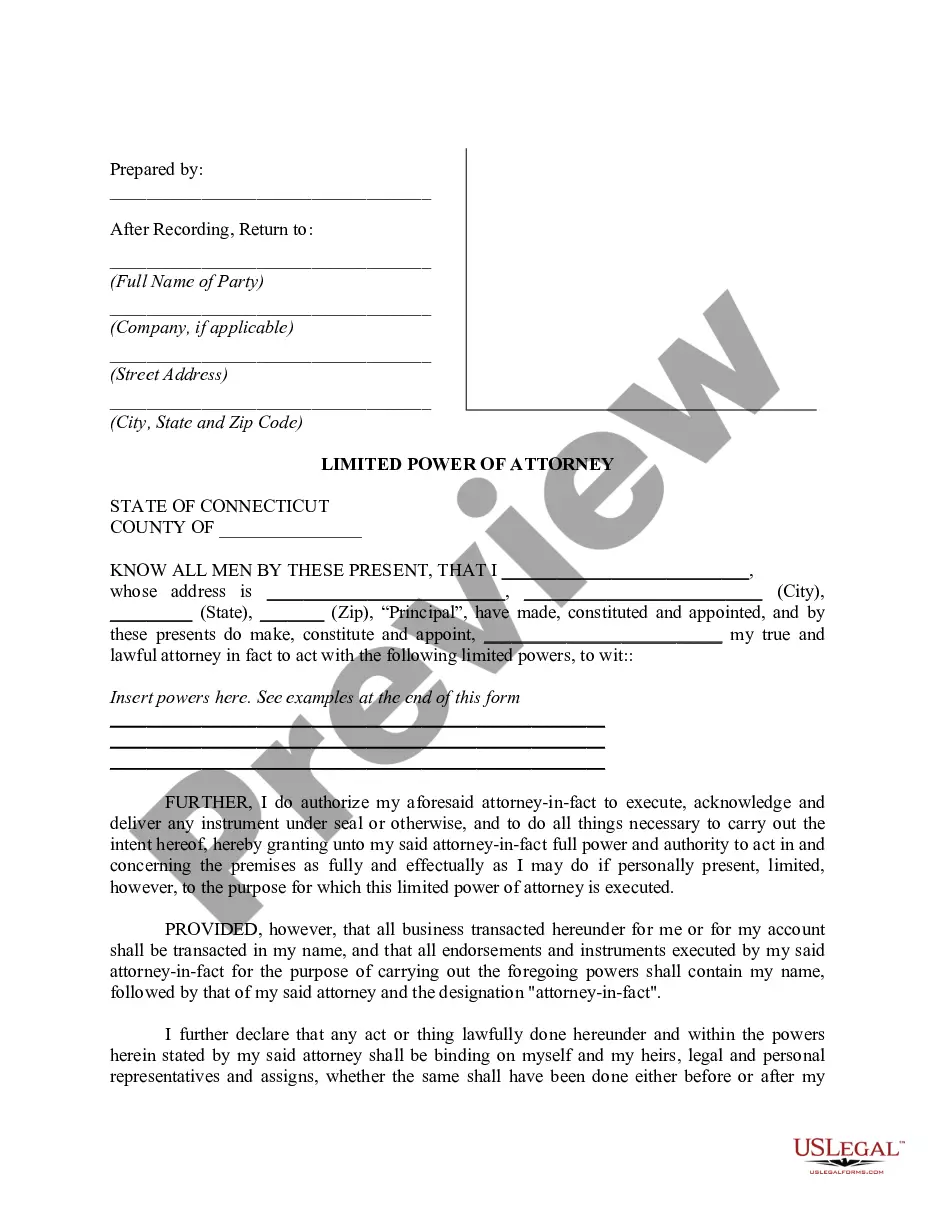

How to fill out Connecticut Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Visit the US Legal Forms website and log in to your account if you're a returning user. Ensure your subscription is active to access the forms.

- If you're new, begin by checking the Preview mode and form description. Confirm that the selected document aligns with your requirements.

- In case of discrepancies or if another template is needed, utilize the Search tab to find more options. Move on once you've located the correct form.

- Proceed to purchase the selected document by clicking the Buy Now button. Choose your preferred subscription plan and create an account for access.

- Complete your transaction using your credit card or PayPal for a smooth checkout process.

- Finally, download your form to your device. You can always revisit the My Forms section in your profile to access or modify the template as needed.

In conclusion, US Legal Forms is designed to streamline your legal paperwork process. By following these power of attorney instructions, you can ensure that your documents are both precise and compliant with legal standards. Don't hesitate to start your journey towards hassle-free legal document preparation today!

Explore our extensive library and get the support you need to create your power of attorney.

Form popularity

FAQ

Yes, you can write your own power of attorney letter using straightforward language. Ensure that you include your name, the name of the person receiving authority, and the powers you wish to grant them. Additionally, make sure to follow your state's legal requirements for signatures and witnesses. For comprehensive power of attorney instructions and to simplify the process, explore the resources available at US Legal Forms.

To write a short power of attorney, begin by clearly identifying yourself, including your full name and address. Next, specify the authority you want to grant, such as financial or medical decisions, and keep it concise. Finally, ensure you sign the document and have it witnessed or notarized to make it valid. For detailed power of attorney instructions, consider visiting US Legal Forms for templates and guidance.

In Minnesota, a power of attorney does need to be notarized to be legally valid. Notarization helps authenticate the document and confirms that the principal signed it willingly. Some situations may also require witnesses to sign alongside the notary. For comprehensive power of attorney instructions in Minnesota, consider using US Legal Forms, which offers state-specific guidance on notarization requirements.

You can create a power of attorney without hiring a lawyer by using online resources and templates. Start by selecting the type of power of attorney you need and then fill out the appropriate forms. Many legal websites also offer power of attorney instructions that guide you through the process. US Legal Forms is an excellent site providing user-friendly templates to help you complete everything correctly, ensuring that your document is legally binding.

Writing a simple power of attorney involves a few key steps. First, you need to identify the principal, the person granting authority, and the agent, the individual receiving authority. Next, outline the specific powers you wish to grant, whether it's for financial management or healthcare decisions. For comprehensive power of attorney instructions, consider using platforms like US Legal Forms, which provide templates to simplify the process.

Choosing the right person for your power of attorney is crucial for your peace of mind. Ideally, select someone you trust deeply, such as a close family member or a trusted friend. This individual should possess good judgment and be capable of making decisions that align with your wishes. Remember to consider their ability to handle the responsibilities involved when you refer to the power of attorney instructions.

Submitting your power of attorney (POA) to the IRS involves filling out Form 2848, which grants the authority for specific matters. After completing the form, you need to mail it to the IRS office designated for the particular tax issue. For efficient handling, ensure all information is accurate and according to the power of attorney instructions provided. Using uslegalforms can help you navigate these requirements smoothly.

Filling out a power of attorney requires careful attention to detail to ensure its validity. Begin by clearly identifying yourself and the person you are appointing as your agent. Next, specify the powers you are granting and include any limitations. Utilize uslegalforms to access templates and guidance that simplify this process, making it easier to follow the power of attorney instructions correctly.

A legal power of attorney can empower someone to make many decisions on your behalf, but there are certain limitations. Primarily, a power of attorney cannot make decisions related to your healthcare if a separate healthcare proxy exists. Additionally, it cannot change your will or make decisions about your estate after your death. Understanding these restrictions can help you navigate the power of attorney instructions effectively.

In New Jersey, creating a power of attorney requires the principal to be of sound mind and the signing of the document in front of a notary public or two witnesses. It is essential to include specific powers being granted and adhere to state laws. Reviewing state-specific power of attorney instructions will ensure compliance with New Jersey regulations. For more guidance, uslegalforms offers state-specific resources.