Connecticut Employee File Withholding Form 2023

Description

How to fill out Connecticut Employment Employee Personnel File Package?

Managing legal documents can be exasperating, even for the most seasoned professionals.

When you're in need of a Connecticut Employee File Withholding Form 2023 and lack the time to invest in finding the suitable and updated version, the process can be stressful.

US Legal Forms addresses all your needs, whether they pertain to personal or business documents, all in one convenient location.

Utilize sophisticated tools to complete and manage your Connecticut Employee File Withholding Form 2023.

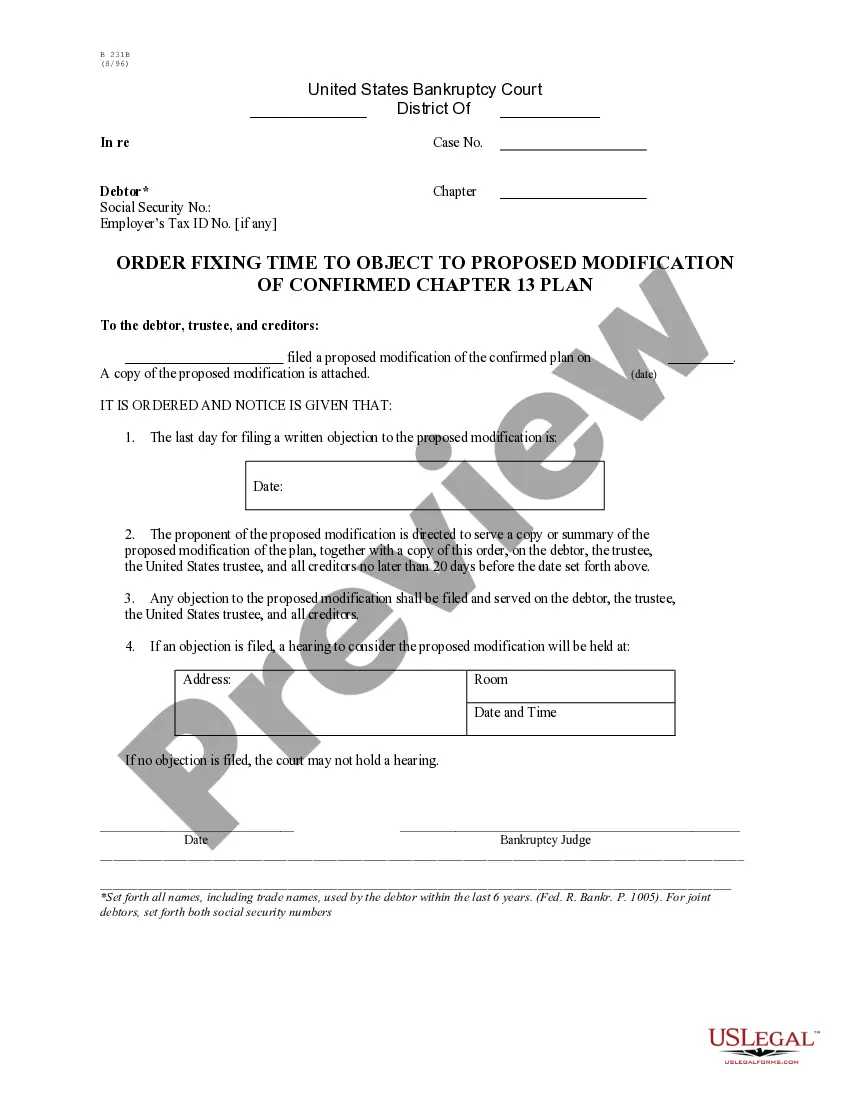

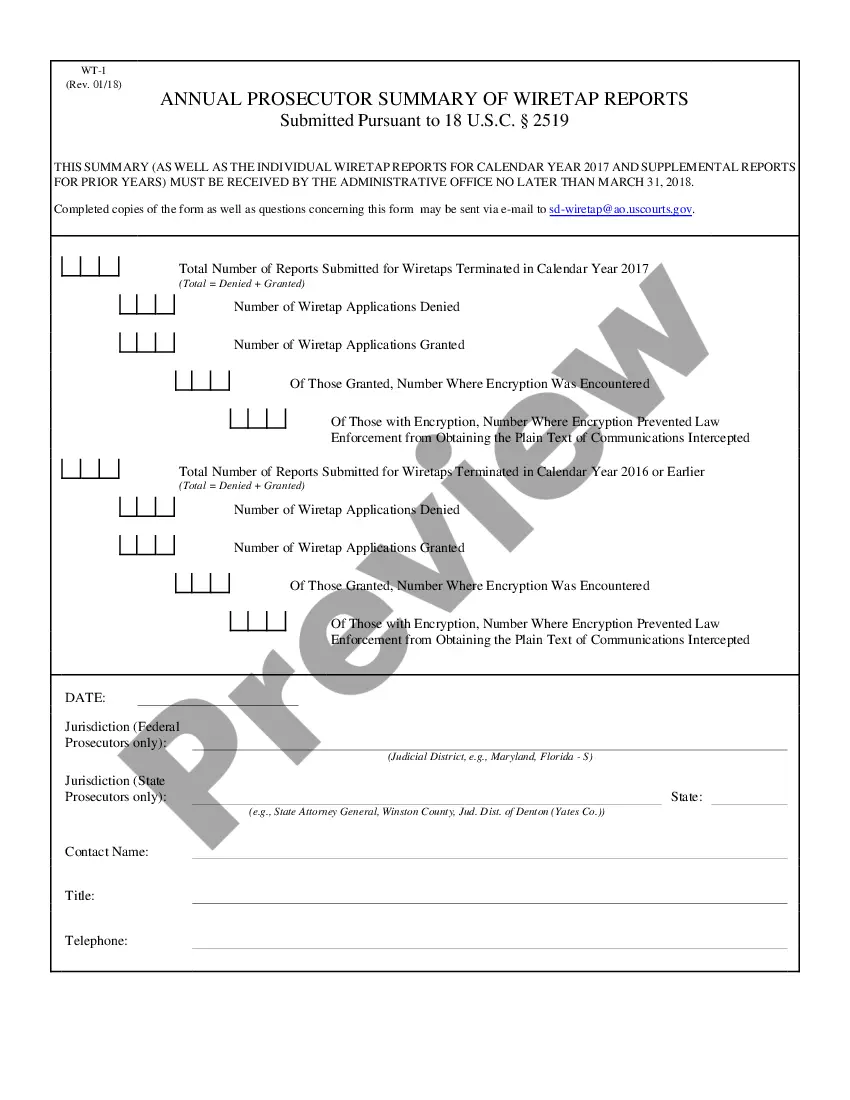

Here are the steps to follow once you access the form you need: Validate that it is the correct document by previewing it and reviewing its description.

- Tap into a valuable collection of articles, guides, handbooks, and materials that pertain to your situation and needs.

- Conserve time and effort in searching for the documents you require, and leverage US Legal Forms’ advanced search and Review tool to find and download the Connecticut Employee File Withholding Form 2023.

- If you're a member, Log Into your US Legal Forms account, locate the form, and download it.

- Visit the My documents tab to view the documents you've downloaded previously and organize your files as you see fit.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- A robust online form repository can be transformative for anyone looking to handle these matters effectively.

- US Legal Forms is a premier provider of online legal documents, offering over 85,000 state-specific forms accessible at any time.

- With US Legal Forms, you can access forms tailored to your state or county.

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

You must begin withholding at the highest marginal rate of 6.99%, from each employee who claimed exempt status from Connecticut income tax withholding in the prior year and who did not provide a new Form CT-W4 on or before February 15 of the current year. See Employees Claiming Exemption on Page 10.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

You must begin withholding at the highest marginal rate of 6.99%, from each employee who claimed exempt status from Connecticut income tax withholding in the prior year and who did not provide a new Form CT-W4 on or before February 15 of the current year. See Employees Claiming Exemption on Page 10.