This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Estate Receipt And Release Form For Beneficiaries Distribution Of Funds

Description

How to fill out Connecticut Receipt And Release Of Guardian Of Estate?

There's no longer a reason to spend time searching for legal documents to meet your local state regulations. US Legal Forms has gathered them all in one location and made them easily accessible.

Our website provides over 85,000 templates for various business and personal legal matters categorized by state and area of application. All forms are properly drafted and validated, so you can trust in acquiring an up-to-date Estate Receipt And Release Form For Beneficiaries Distribution Of Funds.

If you are acquainted with our service and already possess an account, make sure your subscription is active before downloading any templates. Log In to your account, select the document, and click Download. You can also revisit all previously obtained documents whenever needed by accessing the My documents tab in your profile.

Print your form for manual completion or upload the template if you prefer to complete it in an online editor. Preparing official documents in accordance with federal and state laws and regulations is swift and uncomplicated with our library. Give US Legal Forms a try today to keep your documentation organized!

- If you have never utilized our service before, completing the process will require a few additional steps.

- Here's how new users can locate the Estate Receipt And Release Form For Beneficiaries Distribution Of Funds in our catalog.

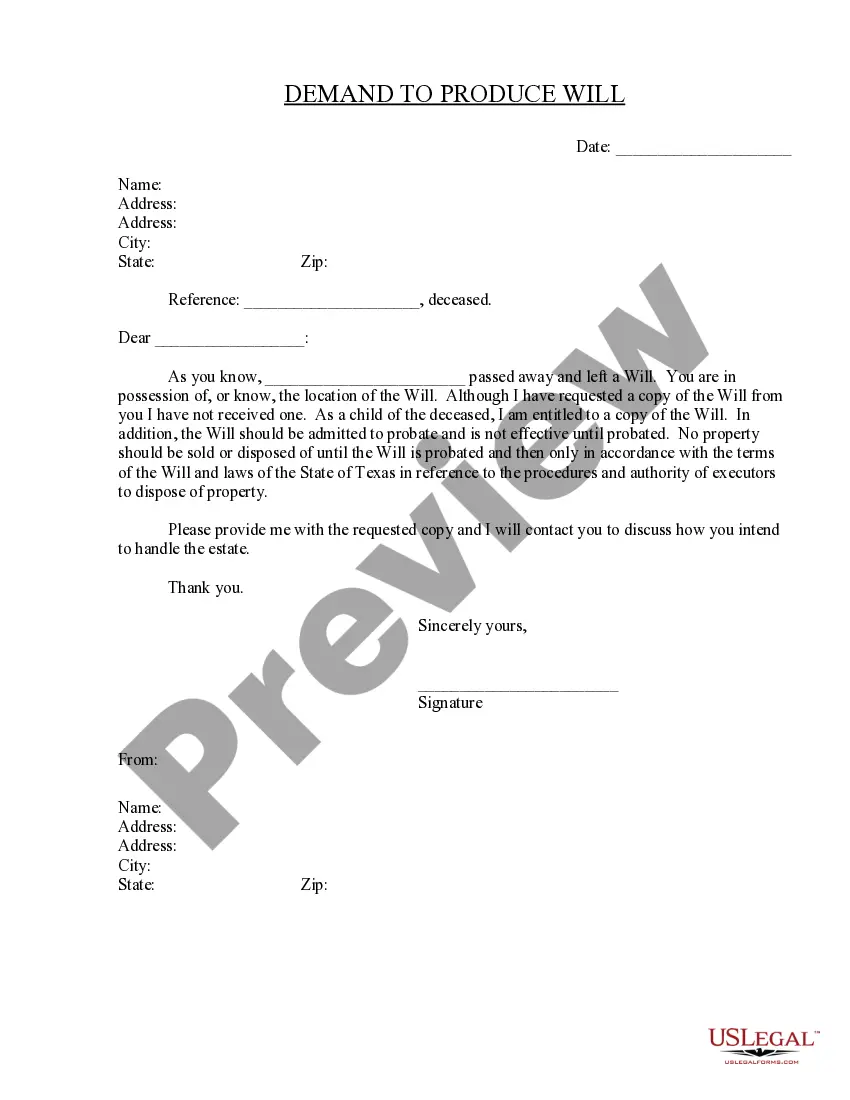

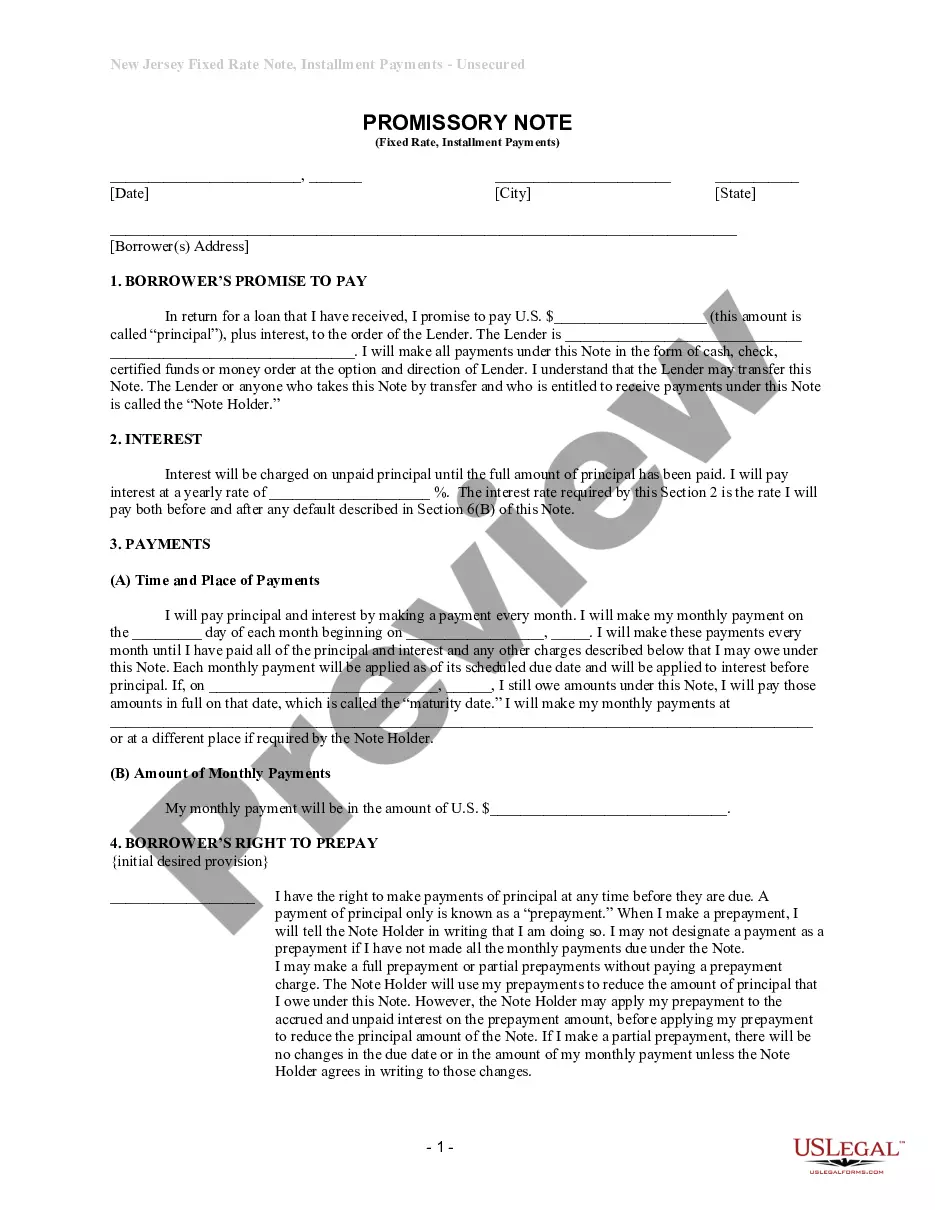

- Examine the page content closely to verify it contains the sample you require.

- To do so, utilize the form description and preview options if available.

- Utilize the Search field above to look for another sample if the current one does not meet your needs.

- Click Buy Now next to the template name once you identify the correct one.

- Choose the most appropriate pricing plan and either register for an account or Log In.

- Complete your payment using a credit card or PayPal to proceed.

- Select the file format for your Estate Receipt And Release Form For Beneficiaries Distribution Of Funds and download it to your device.

Form popularity

FAQ

Can an executor distribute money before probate? An executor should avoid distributing any cash from the estate before they fully understand the estates total worth and the total value of liabilities. It is highly advised not to distribute any assets to beneficiaries until, at the very least, probate has been granted.

To summarize, the executor does not automatically have to disclose accounting to beneficiaries. However, if the beneficiaries request this information from the executor, it is the executor's responsibility to provide it. In most cases, the executor will provide informal accounting to the beneficiaries.

If there's enough money in the estate account, an interim payment can be made to beneficiaries, with executors holding back some money to cover potential costs. These payments should be recorded by asking the beneficiaries to sign a written receipt.

Once the bank has all the necessary documents, typically, they will release the funds within two weeks. Many will release a sum of money before the grant to deal with essential expenses such as funeral costs. The executor should approach the relevant bank promptly to determine the approach they take.