Forma Trust

Description

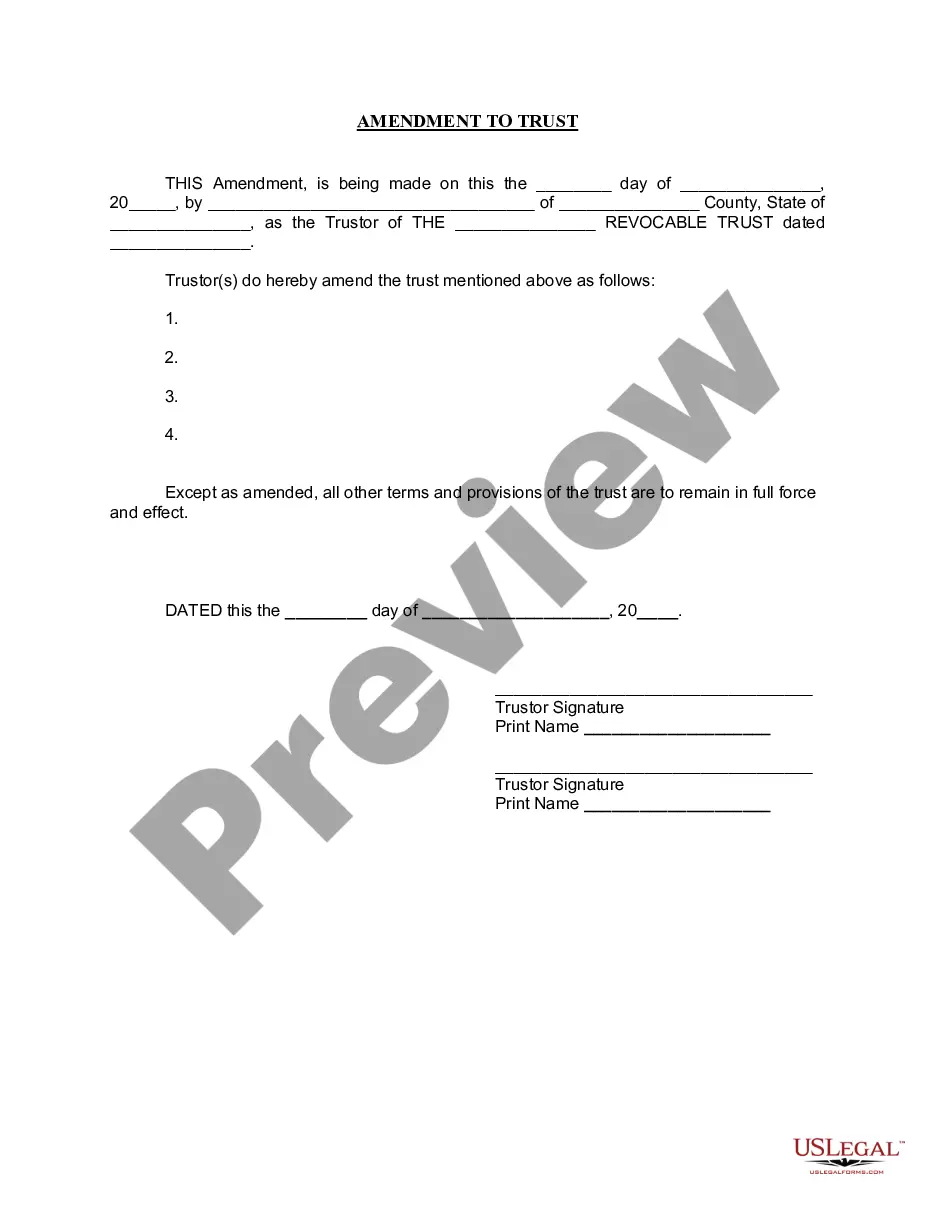

How to fill out Connecticut Amendment To Living Trust?

- Log in to your existing US Legal Forms account or create a new one if you're a first-time user.

- Explore the preview mode to review form descriptions, ensuring you select one that fits your requirements and complies with local jurisdiction laws.

- Utilize the search function to find alternative templates if the initial form seems inadequate.

- Purchase the selected document by clicking on the 'Buy Now' button and picking your preferred subscription plan.

- Make your payment using a credit card or PayPal account to finalize the subscription.

- Download your legal form and save it on your device for easy access, or find it later in the 'My Forms' section of your account.

In summary, US Legal Forms offers an exceptional, easily navigable platform to procure legal documentation, enhancing the advantages of Forma Trust. With a robust library of over 85,000 forms and expert assistance at your fingertips, preparing legal documents has never been easier.

Start your journey with US Legal Forms today and ensure that your legal needs are met efficiently and effectively!

Form popularity

FAQ

A trust becomes effective as soon as it is properly funded and all legal conditions are met. With a Forma trust, once the assets are transferred and the documents are executed, the trust functions immediately. This allows beneficiaries to start enjoying the benefits without unnecessary delays. Ensure all steps are completed efficiently to maximize the trust's efficiency quickly.

One significant mistake parents often make is not clearly communicating their intentions or appointing the right trustee. A Forma trust provides a framework, but clarity in outlining how the assets should be managed is vital. Lack of planning can lead to confusion among beneficiaries, resulting in disputes or mismanagement. Taking time to educate family members and selecting a capable trustee can prevent these issues.

The formation of a trust typically occurs once all legal documentation is in place. With a Forma trust, the timeline is often relatively short, especially if you engage with a trusted service like US Legal Forms. However, the actual enforcement of the trust can take longer, depending on asset transfer and legal procedures. It’s essential to plan accordingly to ensure smooth execution.

To establish a valid trust, you need to meet five key requirements. Firstly, you should have a clearly defined grantor or creator of the trust. Secondly, you must specify beneficiaries who will benefit from the trust. Third, you need to outline the trust's property or assets. Fourth, the trust must have a legal purpose. Lastly, a Forma trust requires a competent trustee to manage the assets effectively. Fulfilling these criteria ensures a solid foundation.

Setting up a trust can be a swift process, depending on specific requirements. With platforms like US Legal Forms, creating a Forma trust can take just a few hours, provided all documentation is readily available. Efficiency in preparation accelerates this process, ensuring that your assets are secured quickly. Thus, personal and financial peace of mind can be achieved in no time.

Building trust is not an overnight process. Typically, it takes time to foster relationships, whether personal or financial. By utilizing a Forma trust structure, individuals can create a strong foundation for their assets, which will inherently encourage confidence among beneficiaries. Patience and consistent communication are key elements when developing trust.

To report income from a forma trust, complete Form 1041 and include any relevant schedules that reflect the income earned. Provide detailed information for beneficiaries on Schedule K-1, which informs them of their share of the trust's income. Reporting accurately ensures compliance with IRS regulations and helps manage tax liabilities effectively.

Yes, trust income is required to be reported to the IRS through Form 1041 when applicable. The IRS expects transparency about all income generated from a forma trust. This ensures that taxes are assessed properly for both the trust and its beneficiaries. Fulfilling this obligation can prevent penalties or complications down the line.

Filing income from a forma trust requires submitting Form 1041, along with necessary schedules that reflect the generated income. Ensure you include each beneficiary's share of income on their corresponding Schedule K-1. It's advisable to consult tax professionals or use trusted resources to ensure accurate and timely filing.

Documenting income from a forma trust involves recording all sources of earnings accurately. This includes interest, dividends, and rental income generated by the trust assets. You'll also want to maintain detailed records for tax purposes. Utilizing a platform like uslegalforms can streamline this documentation process.