Ct Divorce Law For Retirement

Description

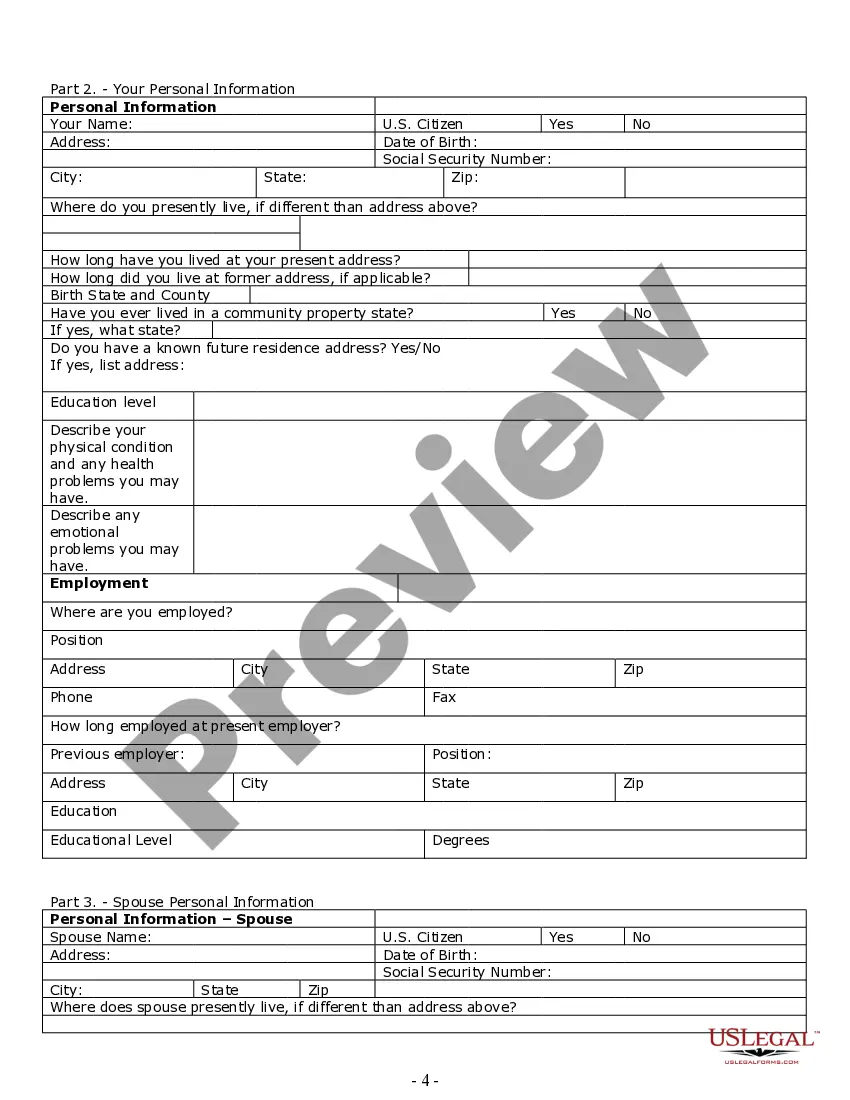

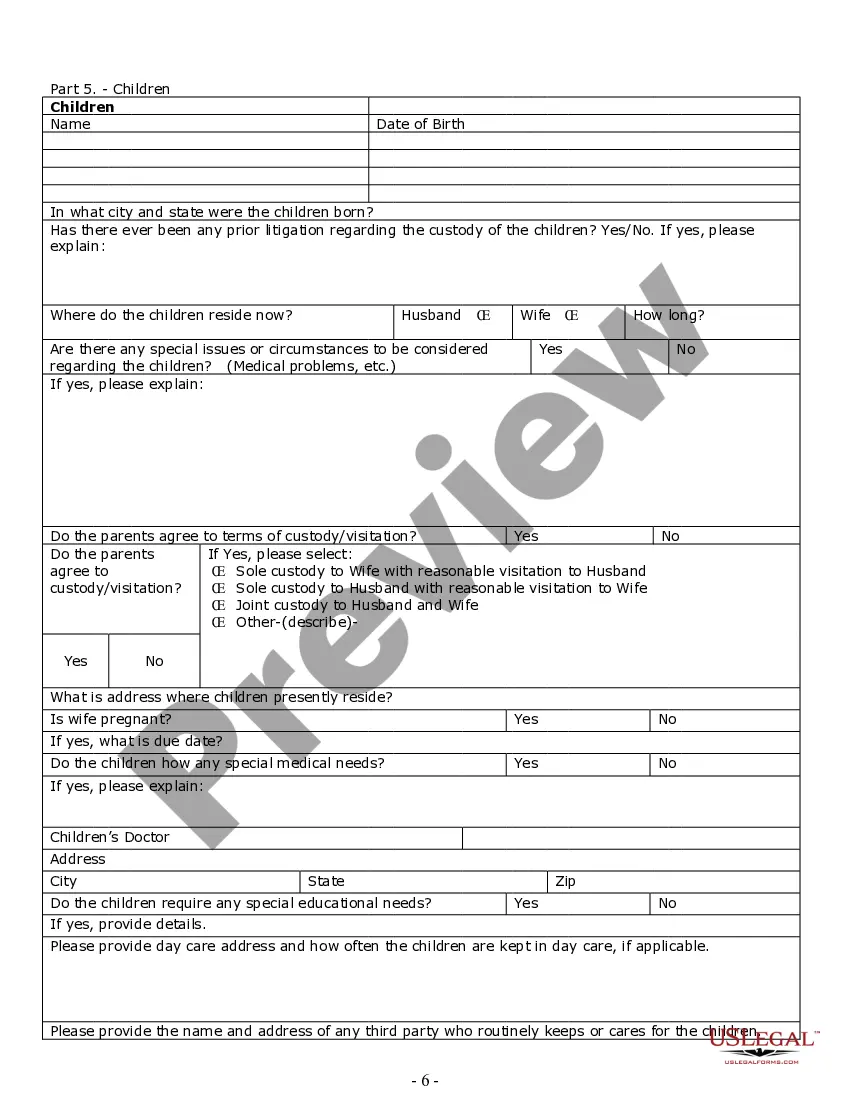

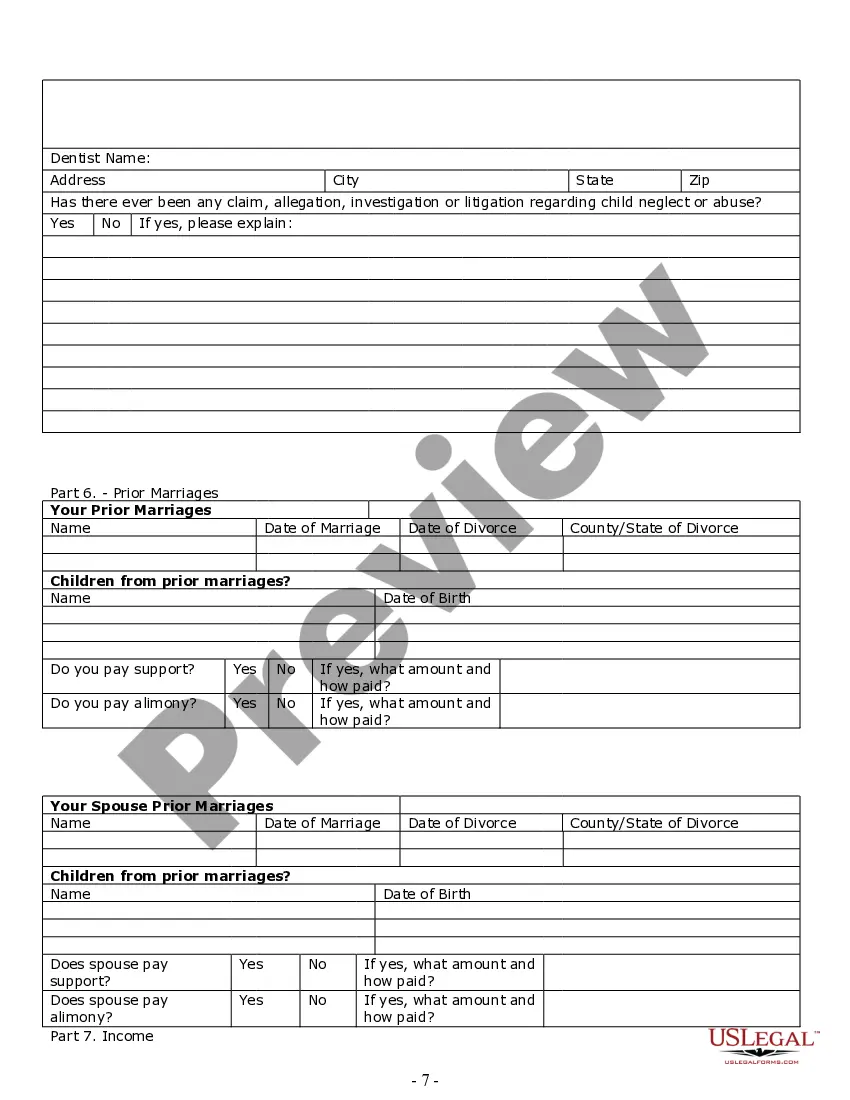

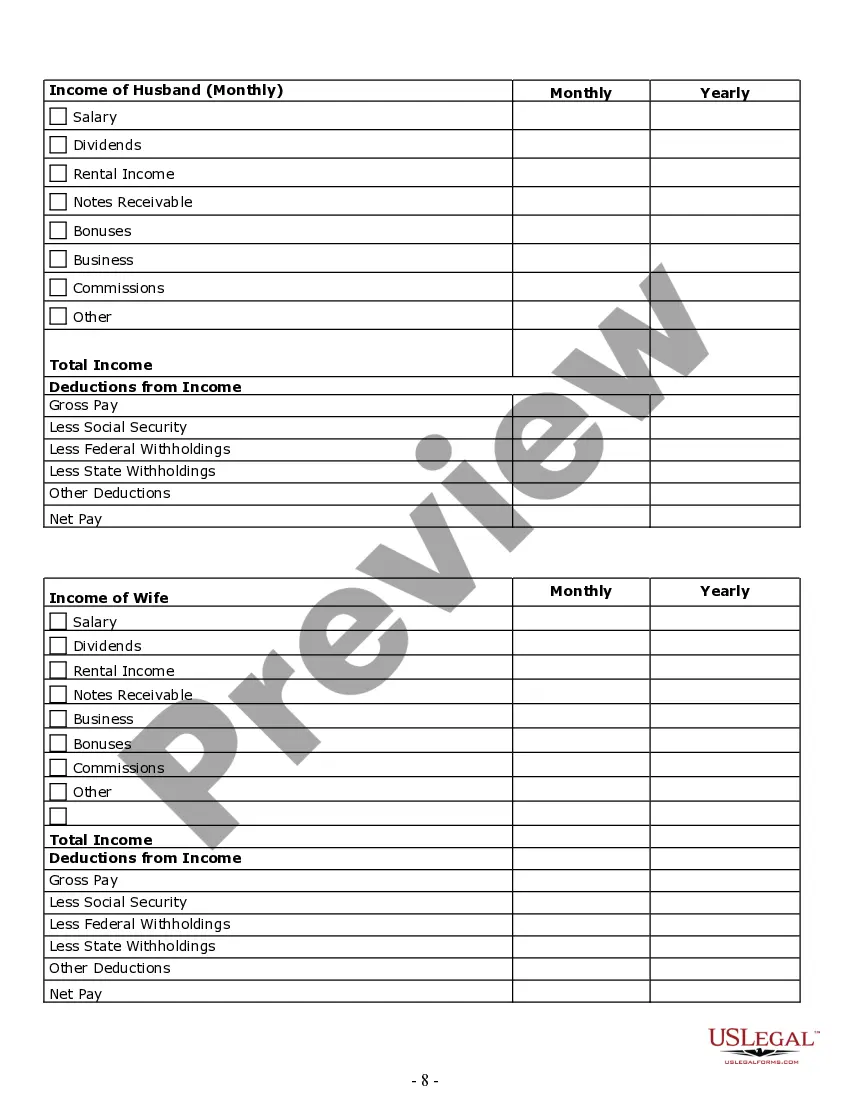

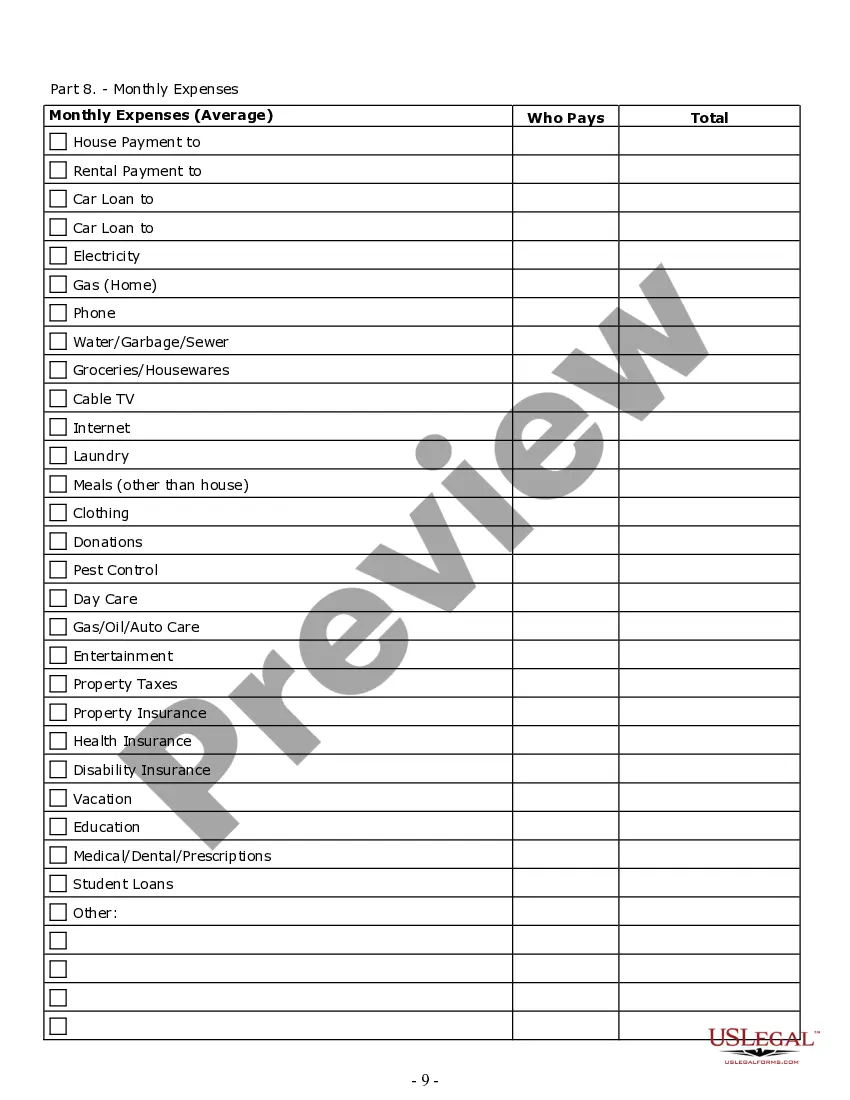

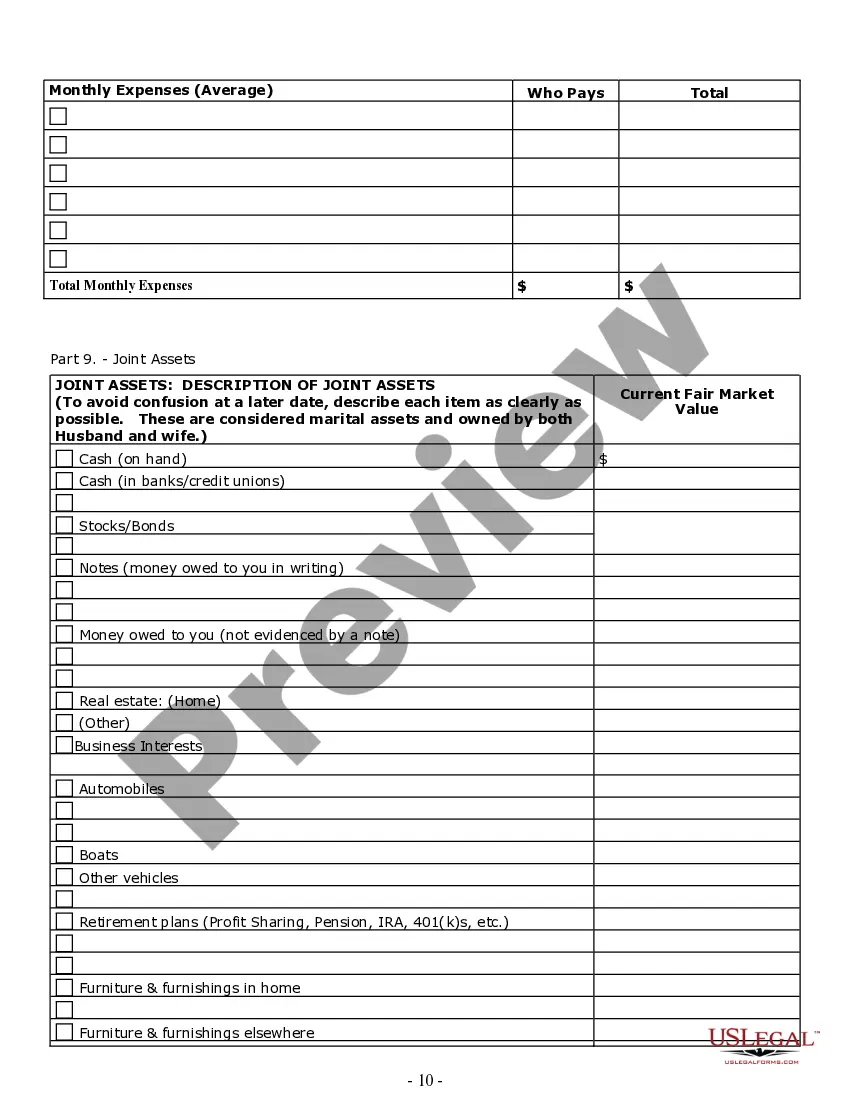

How to fill out Connecticut Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Identifying a preferred location to obtain the latest and suitable legal templates is part of the challenge of managing bureaucracy. Securing the correct legal documents demands precision and meticulousness, which is why it is crucial to acquire samples of Ct Divorce Law For Retirement solely from trustworthy sources, such as US Legal Forms. An incorrect template will squander your time and delay the matter at hand. With US Legal Forms, you have minimal concerns. You can access and review all the information regarding the document’s application and relevance for your situation and within your state or county.

Consider the outlined steps to complete your Ct Divorce Law For Retirement.

Eliminate the complications associated with your legal documentation. Explore the extensive US Legal Forms collection to discover legal samples, assess their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Review the form’s description to determine if it meets the criteria of your state and county.

- Check the form preview, if available, to confirm the template is indeed the one you require.

- Return to the search and find the correct document if the Ct Divorce Law For Retirement does not fulfill your needs.

- When you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Ct Divorce Law For Retirement.

- Once you have the form on your device, you can edit it with the editor or print it and complete it manually.

Form popularity

FAQ

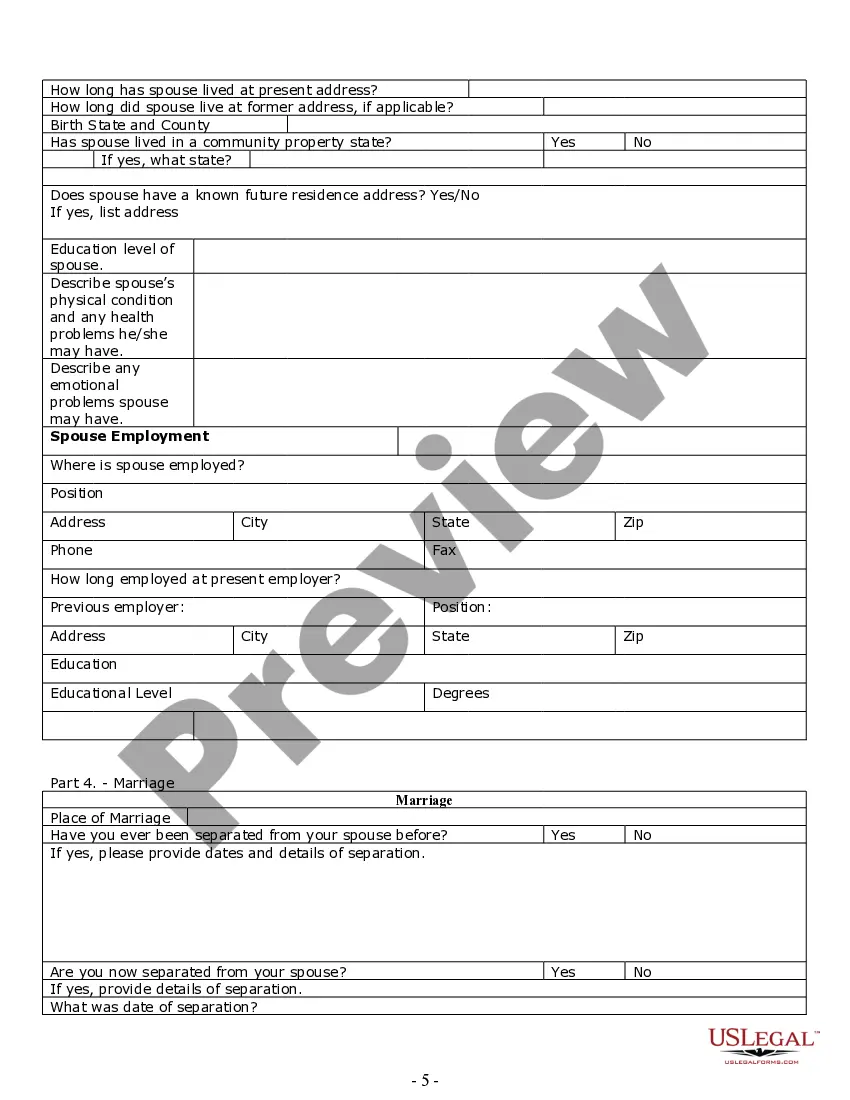

Contributions to retirement accounts made during the term of the marriage, as well as growth on those contributions, are considered marital assets. A division of individual retirement accounts (IRAs) can be ordered in a divorce decree or a property settlement agreement that's been recognized by the court.

In California, all types of retirement benefits are considered community property, which allows CalPERS benefits to be divided upon a dissolution of marriage or registered domestic partnership or legal separation.

Your ex-spouse may receive direct compensation from your pension through a qualified domestic relations order, or QDRO. A QDRO is a court order that allows one spouse's share of the other person's pension to be transferred into another account, such as an individual retirement account (IRA) or 401(k).

One way to protect your 401k in a divorce is through a Qualified Domestic Relations Order (QDRO). A QDRO is a legal order that allows for the division of retirement benefits between divorcing spouses.

Connecticut's equitable distribution system counts ?all property? owned by either spouse ? even retirement assets they owned before they got married. That means, when you get divorced in Connecticut, the court has jurisdiction to divide all your 401k, IRA, and pension accounts in any way it deems fair.